Maverick AI EA MT5

- Asesores Expertos

- Liudmyla Bochkarova

- Versión: 1.1

- Actualizado: 4 octubre 2023

- Activaciones: 11

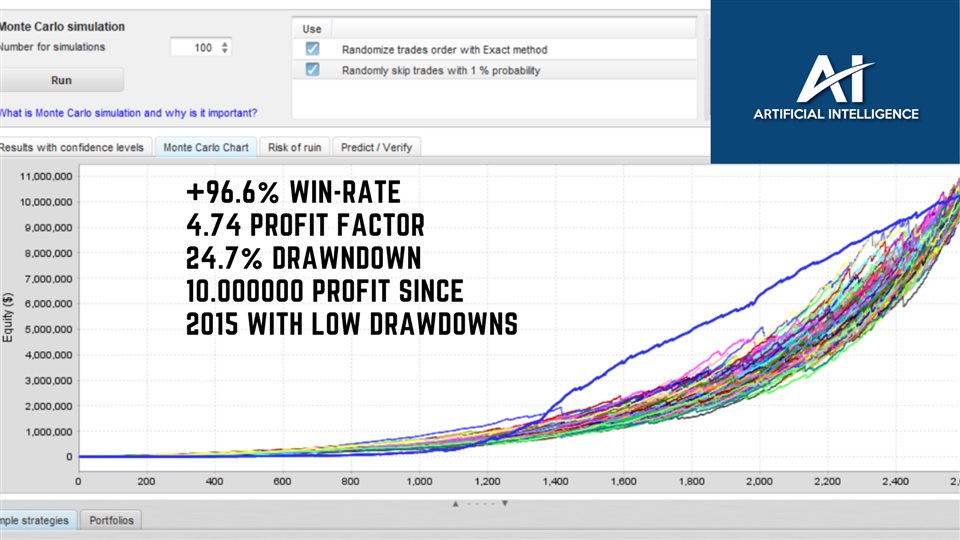

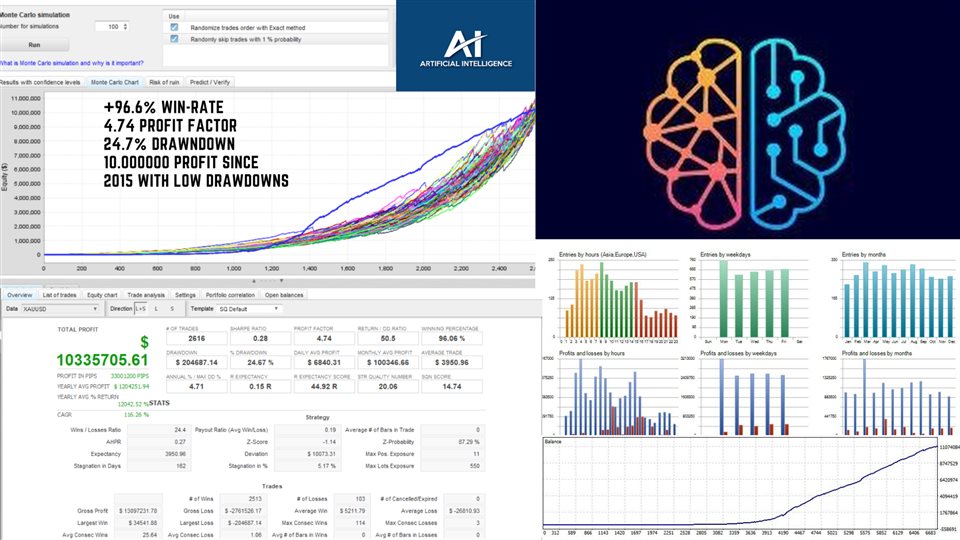

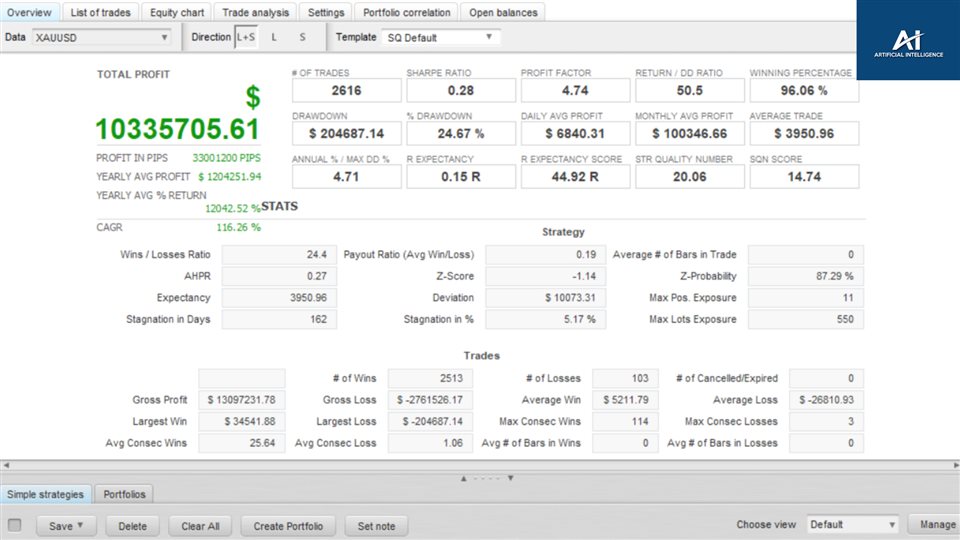

Maverick AI EA is a fully automated trading advisor designed exclusively for trading gold, in particular the XAUUSD pair. This EA has demonstrated stable performance from 2010 to 2020, showing high efficiency. It is distinguished by its commitment to safe and responsible risk management, eliminating risky methods such as martingale, grid trading or scalping. In addition, its adaptability to different broker conditions makes it a versatile tool for traders. The Maverick AI advisor is powered by advanced artificial intelligence using a multi-layer perceptron (MLP) neural network. MLP neural networks belong to the family of artificial neural networks with feedback (ANN). These neural networks consist of at least three layers of nodes: input, hidden and output nodes. Except for the input nodes, each node is a neuron using a nonlinear activation function.

The starting price of the EA for the first 10 copies is 499$ next price is 699$.

To maintain the Exclusivity of the advisor the price will constantly increase.

Information:

- No martingale

- FTMO, Prop Firm support.

- No Grid

- No averaging

- No dangerous methods of money management are used.

- Hard stop loss and take profit for each position.

- Not sensitive to broker conditions

- Easy to install.

| Symbol | XAUUSD (GOLD) |

| Type of account | Classic, ECN, PRO. Leverage 1:20 or higher |

| Timeframe | M15, M30, H1 |

| Settings | Default |

| Minimal/Recommended Deposit | 100$ |

| Can work with other EAs. | Yes |

Advantages of the Advisor:

The advisor utilizes advanced artificial intelligence capabilities, employing a multi-layer perceptron (MLP) neural network for intelligent decision-making. Thanks to the multi-layer neural network architecture, the advisor can process and analyze complex data patterns, even those that are not amenable to linear partitioning. Each node in the neural network employs non-linear activation functions to capture intricate data relationships. The expert employs supervised learning methods, including backpropagation, to continually refine and adjust its trading strategy based on historical data and performance. With this information, the expert can automatically assess risk levels, allocating them based on your settings and market conditions. Additionally, it can utilize various timeframes in trading, which, in turn, yield different results. These timeframes are determined by Artificial Intelligence within specific time ranges. This means that you can choose from the provided timeframes, each offering distinct trading styles ranging from aggressive to more conservative. The lower the timeframe, the more aggressive the trading, and vice versa."

Past results do not provide any guarantee of future profitability.