EA Macd Indicator Strategy Cut Loss

- Asesores Expertos

- Zafar Iqbal Sheraslam

- Versión: 1.0

- Activaciones: 10

The Moving Average Convergence Divergence (MACD) is a popular technical analysis tool used by traders and analysts to identify trends and potential buy or sell signals in a financial instrument, such as a stock, currency pair, or commodity. It's essentially a combination of two moving averages, often referred to as the "fast" and "slow" moving averages.

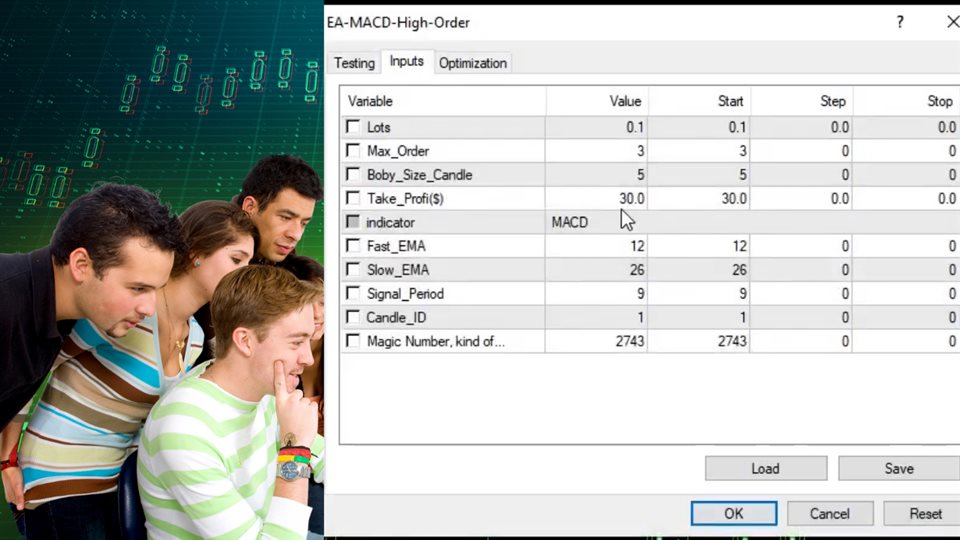

Here's how the MACD is calculated:

-

Fast Moving Average (12-period EMA): This is a 12-period Exponential Moving Average (EMA) of the asset's price. An EMA gives more weight to recent prices, making it more responsive to short-term price movements.

-

Slow Moving Average (26-period EMA): This is a 26-period Exponential Moving Average of the asset's price. It's a longer-term average that smooths out price fluctuations.

-

MACD Line: This is the difference between the fast EMA and the slow EMA (MACD Line = 12-period EMA - 26-period EMA).

-

Signal Line (9-period EMA of MACD Line): A 9-period EMA of the MACD Line is calculated. This signal line acts as a trigger for potential buy or sell signals.

-

MACD Histogram: This is the difference between the MACD Line and the Signal Line. It's plotted as a histogram and can help visualize the momentum of the price movement.

That all will work on fully automated in this MACD EA