-

Telegram Channel: https://t.me/thekingadvisor

-

Mail: kingexpertadvisor@gmail.com

-

Ask your questions to author: https://www.mql5.com/en/users/guillem_boix

-

If you have any questions, please do not hesitate to contact us. We will be happy to help you!

INDEX:

1. Entrance

2. To begin with, who are we?

3. Introduction

4. Why The King Advisor?

5. How does The King Advisor work?

6. Two Risk Levels

7. How AI is revolutionizing trading?

8. How do neural networks work?

9. How do The King Advisor's neural networks work?

10. Our philosophy

11. Results

1.Entrance

Hello, if you are here, it is likely that our consultant has caught your attention. We welcome you to our blog. Although the content is extensive, we assure you that it is worth reading to gain a deeper understanding. Like everything in life, trading takes time and patience. So without further ado, let's get started!

2.To begin with, who are we?

We are a group of algorithmic traders with years of experience in the market. Throughout this time, we have developed and tested numerous trading robot prototypes through trial and error. Today, we are happy to present you our robot. Our goal is to offer a reliable and efficient tool that can be of great help to many investors who are looking for a functional robot. We believe that our robot can bring a lot to the table and will be of great help to many people.

We aspire to grow in this sector, so we are committed to offer a high quality tool that really makes a difference for our customers.

3.Introduction:

The King Advisor is an advanced expert advisor in the world of trading. This EA stands out for its advanced algorithm created by an experienced team, which makes it a very good tool for traders looking to automate their trading. It uses an algorithm that analyzes information to make decisions in the market. The King Advisor's neural network is designed to analyze data. This helps to improve the accuracy of your decisions.

What distinguishes this EA is its ability to learn and adapt to market changes. This is achieved through the use of neural networks, a component that allows the advisor to adjust its strategy. The King Advisor's learning capacity allows to keep up to date with different market situations. In addition to its adaptability, The King Advisor is distinguished by its precision in decision making.

The King Advisor also employs a self-learning mechanism, i.e. neural networks, which continuously improves its strategies as it collects and analyzes new data. One of the most outstanding features of The King Advisor is its ability to control the execution of trades. Before performing any trade, the robot evaluates the conditions for executing the trade. This minimizes slippage, ensuring that trades are executed under the best conditions.

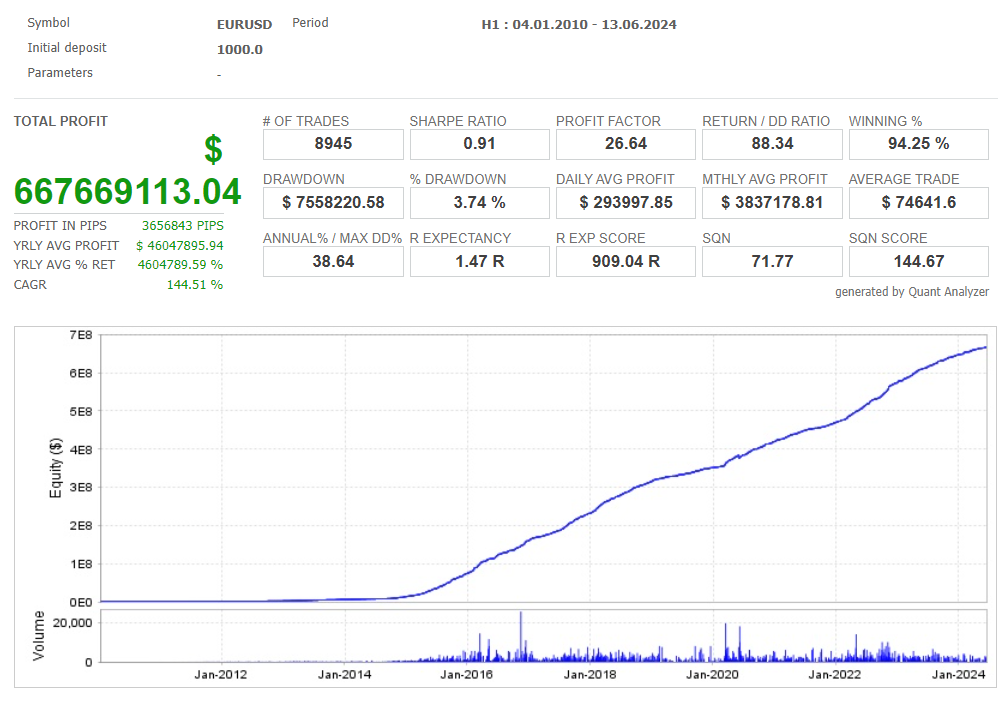

The King Advisor's adaptability to different market scenarios is another of its strengths. This algorithm has been tested in the worst market conditions, demonstrating its ability to maintain performance even in times of high volatility and economic uncertainty. The robustness has been validated through extensive backtests and tests simulating various market situations.

The development and optimization of The King Advisor has not been an easy task. The algorithm has been tested over a period of more than 20 years, using historical data with a modeling quality of 99.9% provided by Dukascopy. This testing and tuning process has allowed the strategies and algorithms to be fine-tuned.

In short, The King Advisor is a trading advisor that uses advanced neural networks and market strategies optimized for over 20 years. It is able to identify key market levels, execute trades accurately, manage risks effectively and adapt to different market conditions, making it a good tool for any investor.

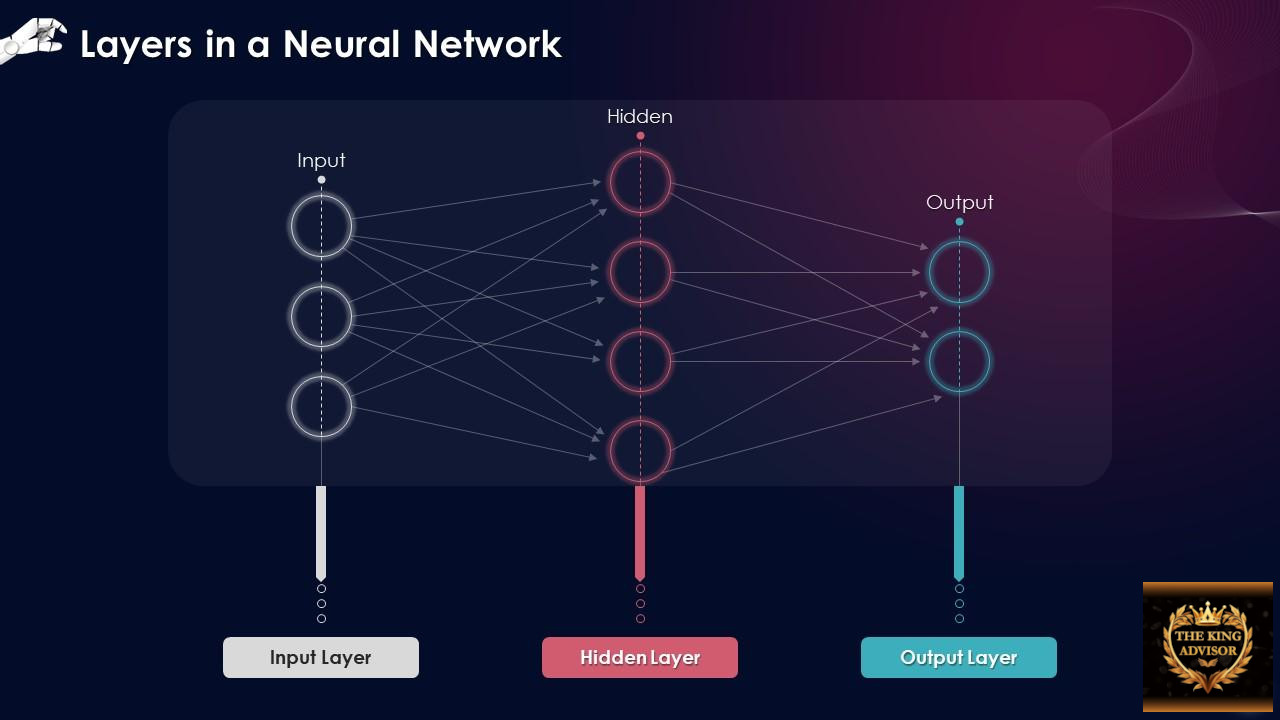

Here is a brief introduction to the operation of neural networks to understand and the robot graph:

4.Why The King Advisor

- ADAPTABILITY AI: The King Advisor is designed with artificial intelligence, which is why it is able to demonstrate remarkable adaptability to various market scenarios. Using machine learning algorithms and data analysis techniques, this robot can dynamically adjust to different market conditions, whether in periods of high volatility or in more stable markets.

- ADVANCED RISK MANAGEMENT: Advanced risk management is a feature of this robot, which allows you to constantly monitor the risk levels associated with each trade. For this reason, we have developed two types of risk levels intended for different trader profiles: the conservative risk level and the normal risk level (more on each later).

- CONTROL OVER EXECUTION: Control over the execution of operations is another area where this robot excels. Before executing any operation, the robot evaluates a number of factors, including trading volume, slippage, market volatility, etc. This analysis allows the robot to ensure that trades are executed in the best possible conditions, minimizing slippage and providing better entry points.

- MORE THAN 20 YEARS OF TESTING: The robustness and reliability of this robot has been tested and optimized over a period of more than 20 years using historical data provided by Dukascopy. This testing period has allowed us to refine the robot's strategies and algorithms, ensuring that they are effective in different market conditions. Dukascopy's data, known for its high quality, has been instrumental in validating the robot, providing 99.9% modeling. During this time, the robot has been subjected to backtesting.

5. How does The King Advisor work?

As investors and programmers, we consider it very important to maintain some confidentiality about our strategy to avoid the possibility of it being copied by others. Therefore, we can only share the following elements that underlie our strategy, but we also cannot go into too much detail:

- Support and resistance levels: We use support and resistance levels to identify areas where the price tends to bounce or break, which helps us make entry decisions.

- Trend lines: We use trend lines to predict the general direction of the price, identifying trading opportunities based on how the price interacts with these lines.

- AI Self-Learning System: We incorporate artificial intelligence to analyze data, as well as to adapt the strategy over time by automatically adapting the parameters in each new operation.

- Advanced trading system: We use sophisticated tools and algorithms that execute orders efficiently.

6. Two Risk Levels:

To ensure that our robot can adapt to different trading styles, we have developed two risk levels: normal and conservative.

- Normal Risk: This level uses a specific percentage of the account to close trades. It is designed for traders seeking a balance between risk and reward, allowing for greater profit opportunities, but with a proportionally higher risk.

- Conservative Risk: This level uses an average of all open positions to close trades. As more trades are opened, the risk is reduced proportionally. This type of risk is intended for traders who prefer a more cautious strategy, minimizing risk in each new operation.

With these risk levels, our robot effectively adapts to the individual preferences of each trader, optimizing performance according to their objectives and risk tolerance. Take the time to think about which strategy suits you, remember that like everything in life that which is thought out and done with time is much better.

7. How AI is revolutionizing trading?

Automated trading has evolved significantly in recent years, driven by technological advances and changes in the markets. Here are some of the most relevant developments and trends in this field:

Recents Innovations in Automated Trading:

- Artificial Intelligence (AI) and Machine Learning: Artificial intelligence and machine learning are transforming automated trading. Advanced algorithms can now analyze large volumes of data in real time to identify trends and make more accurate predictions. These models not only analyze data, but can also adapt and improve over time, offering a very good level of accuracy. For example, supervised learning models use data to train algorithms that can predict price movements. On the other hand, unsupervised learning models can identify price trends, which is useful for detecting trading opportunities.

- Predictive Algorithms and Forecasting Models: Predictive algorithms are at the heart of modern automated trading. Using machine learning techniques, these algorithms can make forecasts of price movements based on trends. These models can be supervised, using data to train the algorithm, or unsupervised, identifying trends without labeled data.

- Automated Trading Predictions and Future Trends: The adoption of artificial intelligence and machine learning is growing rapidly in the sector. This trend is likely to continue. For investors, this represents a significant opportunity. AI not only improves trading efficiency, but also provides advanced analytical tools that can empower investment decisions.

8.How do neural networks work?

Basically, neural networks in a trading robot work by using learning algorithms to analyze and predict market movements, although this may vary depending on the system.

- Neural Network Training: In order for a neural network to make predictions, it must be trained with market data. This process includes several stages.

- Neural Network Structure: Neural networks used in trading can vary in complexity and structure.

- Training Phase: In the training phase, the neural network learns from historical data using techniques such as backpropagation (error backpropagation).

- Validation and Tuning: During training, the network is periodically evaluated using the validation set to ensure that it is not overfitting to the training data. This involves adjusting hyperparameters such as learning rate, network architecture, etc.

- Implementation and Execution: Once the neural network has been trained and validated, it is implemented in the trading robot.

9. How do The King Advisor's neural networks work?

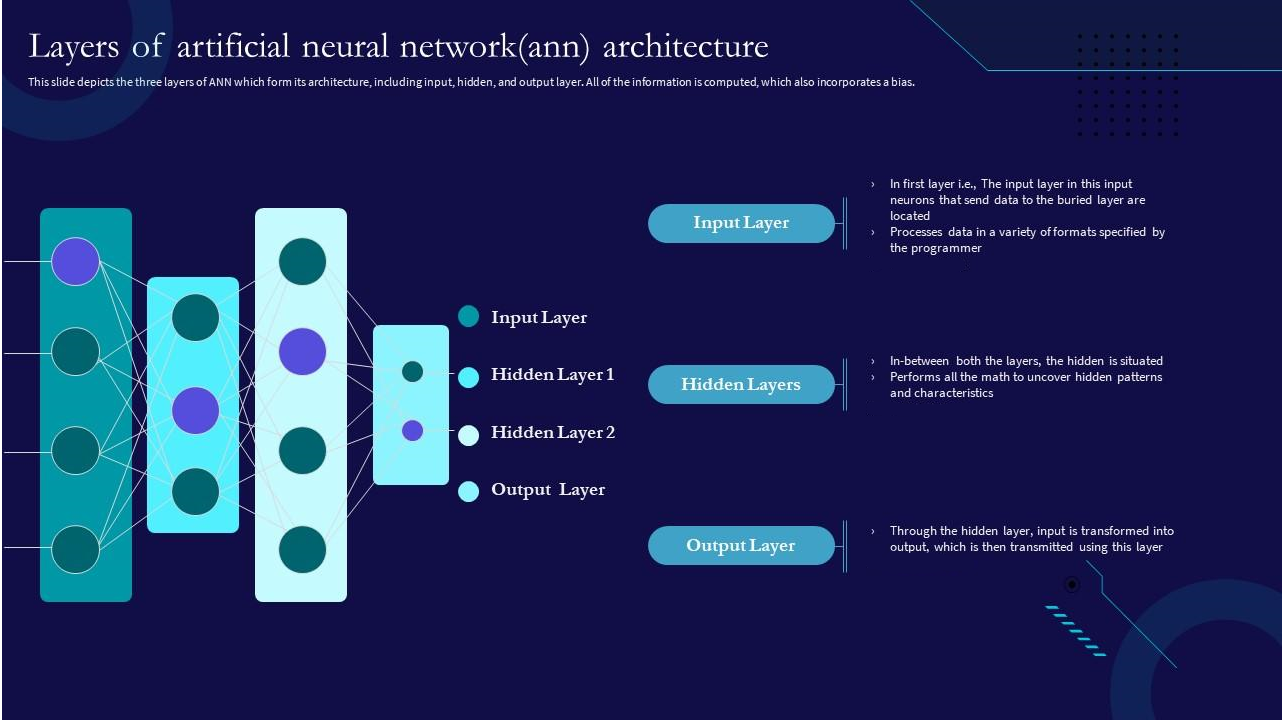

Neurons are organized in layers (input, hidden, and output), where each layer processes and filters the information to the next layer until a final result is generated. Depending on the complexity of the problem and the model created, multiple hidden layers can be used to solve more complex problems. The neural network is trained by algorithms such as supervised, unsupervised or reinforcement learning, adjusting the weights of the connections between neurons to minimize errors and improve the accuracy of the model.

These are data processing systems inspired by the human brain. They are composed of layers of interconnected nodes (or neurons). A typical neural network consists of an input layer, one or more hidden layers and an output layer.

- Input Layer: Receives the characteristics of the input data set. The input layer receives the data that will be used to make predictions. Each neuron in the input layer represents a feature of the input data. For example, if 5 historical prices and 3 technical indicators are used, the input layer would have 8 neurons.

- Hidden Layers: Process inputs by applying weights and activation functions to capture complex relationships in the data. Hidden layers perform data processing, extracting relevant features that are not directly visible in the input data. There can be one or more hidden layers, and the number of neurons in each layer can vary. This is adjusted during the training process.

- Output Layer: Provides the network output, which may be a price prediction, a buy/sell signal, etc. The output layer produces the final predictions neural network. The activation of the neurons in the output layer gives the final prediction.

Let's assume an example to see how a neural network works:

Input Layer: It could have 10 neurons to represent:

- 5 historical prices (opening, closing, high, low, volume).

- 5 technical indicators (such as moving average, RSI, etc.

- The first layer with 64 neurons and ReLU activation function.

- The second layer with 32 neurons and ReLU activation function.

Output Layer: It would have 2 neurons with a softmax activation function to predict the "up" and "down" probabilities.

Network training would involve adjusting the weights and biases in the hidden layers and the output layer to minimize the prediction error, using an optimization algorithm.

Training and Adjustment:

- During training, the neural network adjusts both weights and biases. This is done iteratively using techniques such as backpropagation, where the prediction error is propagated backwards through the network to adjust the parameters.

- The objective of training is to minimize the loss function (error) between the network predictions and the actual values observed in the training data.

Implementation and Operation:

- Once trained and validated, the neural network is implemented in a trading robot environment. Here, it processes real-time data and generates predictions that are used to make buy or sell decisions.

- The decisions made by the robot are based on the predictions of the neural network and are executed automatically.

Continuous Improvement:

- The neural network in The King Advisor continues to improve over time through constant feedback from your trades. This means that with each new trade, the robot automatically adjusts to current market conditions, thus improving adaptability.

10.Our philosophy:

We want to start by sharing our philosophy. As in any discipline in life, trading requires time and effort to achieve goals. To thrive in this industry, it is crucial to maintain a solid mindset and be consistent in your efforts.

We have put a lot of effort into creating a useful tool for everyone, regardless of their previous experience. In our opinion, success in trading depends not only on using a good EA, but also on knowing how to use it as a tool.

Success in trading requires perseverance and determination. Knowledge is not acquired overnight; it must be learned and improved continuously. Remember that the more you learn, the better you will perform in any discipline. Therefore, it is essential to seek improvement and learn every day. It is critical to understand that success in trading is not limited to luck, but rather improving statistics to reduce losses versus gains. It requires an ongoing commitment to continuous learning. In this sense, knowledge and skill are built gradually through experience and dedication.

In addition, it is necessary to be prepared to face the challenges that the market may present. This implies developing a strong mentality that allows you to adapt to different conditions and learn from each situation, whether favorable or unfavorable.

Has it ever happened to you that you were using a trading strategy and suddenly it stopped working? It may never have happened to you, but there is one very important issue that is rarely talked about: the market is changeable. Trading systems that used to work simply stop being effective over time. So how can we solve this problem? To do this, you can implement an artificial intelligence (AI) system that updates itself to the rhythm of the market from time to time.

Artificial intelligence is contributing significantly to the development of automated trading systems. In fact, in recent times, this topic has gained much relevance. This new technology is revolutionizing the markets, so having a good trading system is important.

The implementation of artificial intelligence in trading makes it possible to adapt to market changes and optimize strategies. AI systems analyze volumes of data, identify trends and forecast market movements with a precision superior to that of traditional trading systems. Moreover, AI can continuously learn and evolve through machine learning, adjusting its strategies autonomously to improve its effectiveness and reduce risks.

A very important point is to realize that financial markets are dynamic and are influenced by a multitude of factors, from economic and political changes to unexpected global events. For this reason, good risk management must be flexible enough to adapt to these changes.

The purpose of expert advisors or trading robots:

- The main objective of trading robots is clear: to make money. A second objective, applicable not only to trading robots, is to outperform the average return of stock indices. After all, what would be the point of buying an expert advisor that offers the same return or even less than an index? In that case, it would be better to invest directly in the index. Therefore, the task of us, i.e. the developers, is to create a good robot that can outperform this return as much as possible, as long as the risk is well managed. We could name many more objectives but we think that the main ones are these two.

Robot adaptability:

- A very important point that is sometimes lost sight of is the fact of thinking that a trading strategy or a trading robot will last forever, this is not so. In the same way that the markets evolve due to different factors, the strategy must also evolve. It is therefore important that the robot is kept up to date (ensuring updates from the developer) to ensure its future success.

Our task as programmers:

- As programmers, our duty is to keep the code up to date. This means keeping the code simple, clean and functional. In addition, we must ensure compatibility between MT5 and MT4.

Our task as investors:

- As investors, our task is to identify the current market situation in order to develop an effective strategy.

In summary, algorithmic trading presents a great advance but at the same time poses great challenges, the greatest of all as we have already mentioned, to generate money, the second objective, to exceed the returns of the indexes.

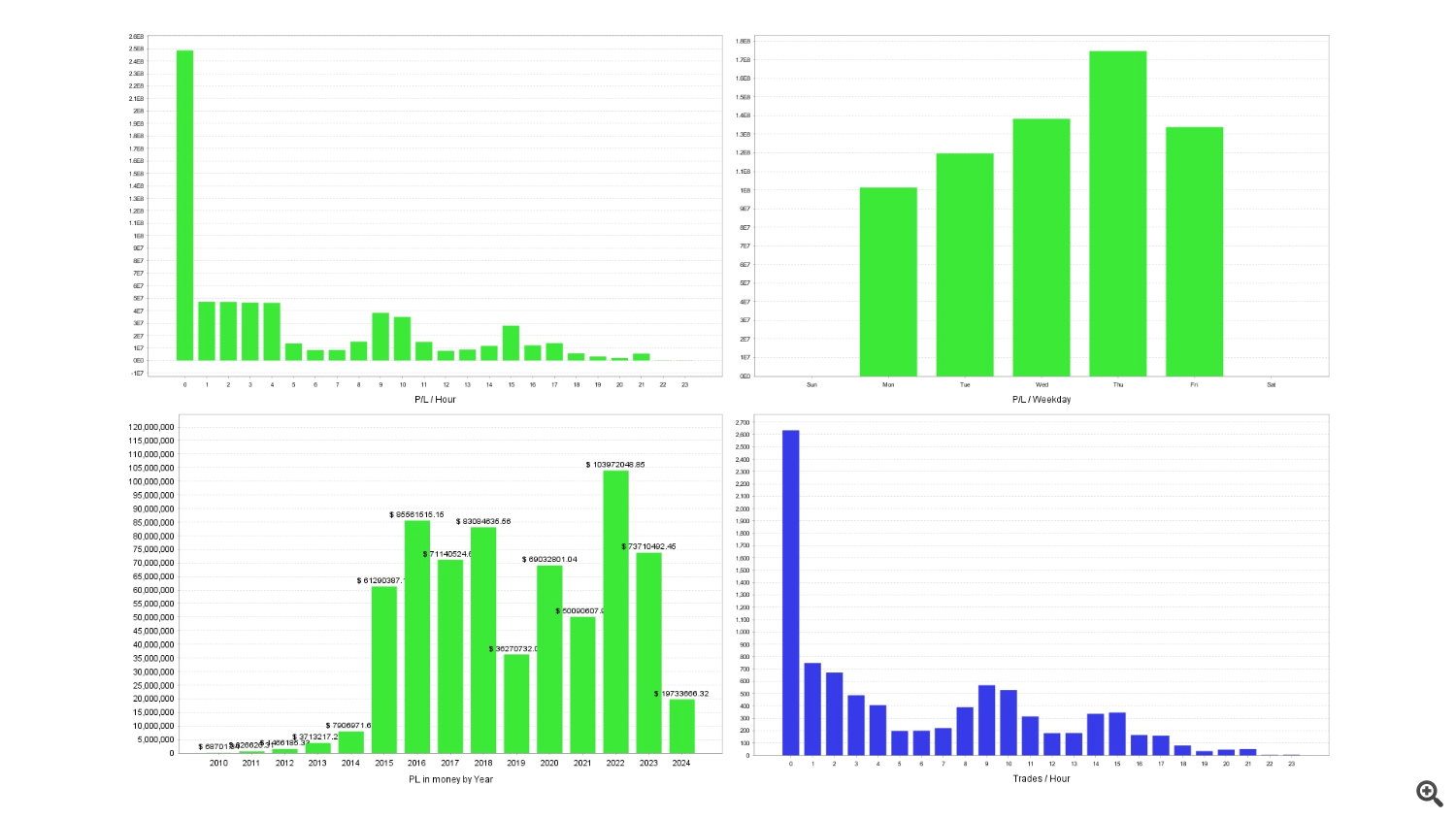

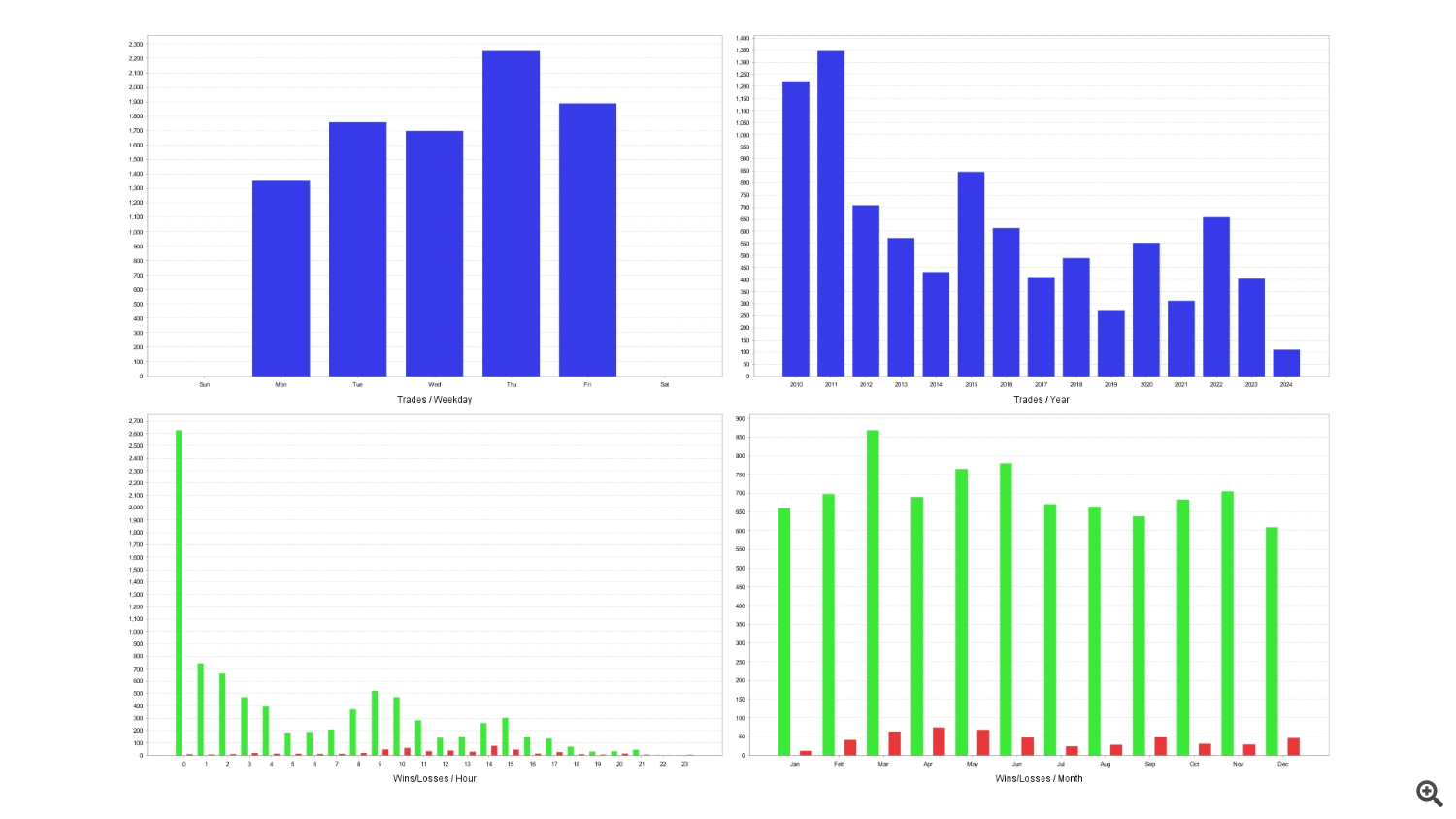

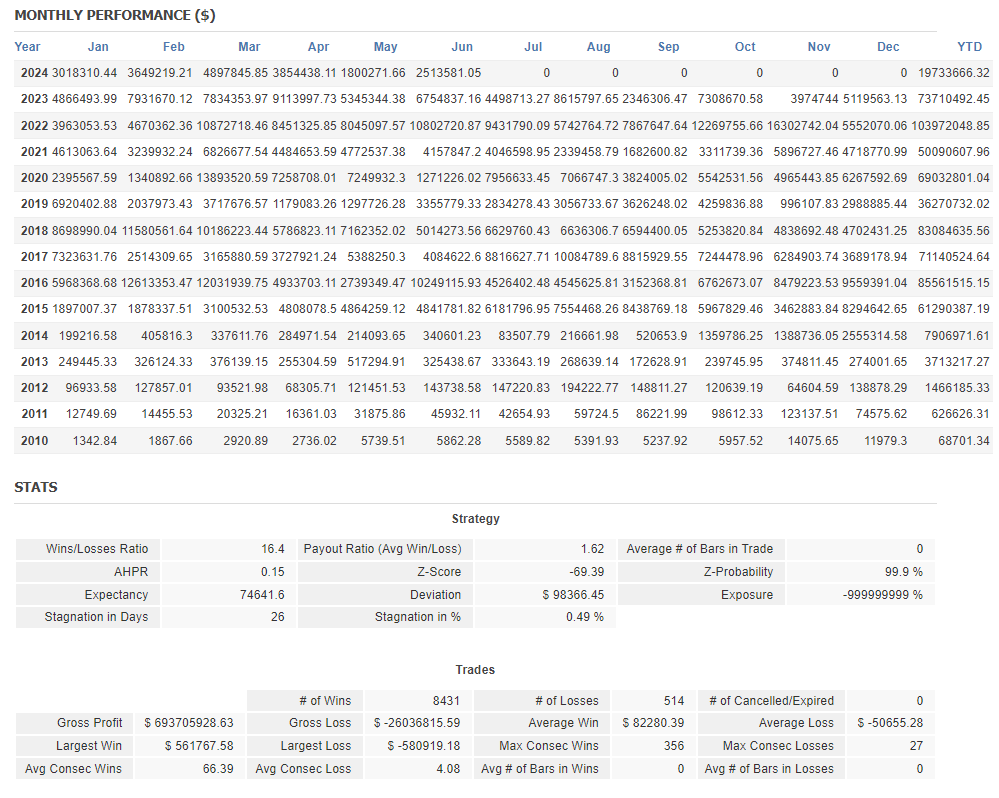

11.Results:

The results obtained by the robot during the period from 2010 to 2024 are presented below:

-

Telegram Channel: https://t.me/thekingadvisor

-

Mail: kingexpertadvisor@gmail.com

-

Ask your questions to author: https://www.mql5.com/en/users/guillem_boix

-

If you have any questions, please do not hesitate to contact us. We will be happy to help you!

-

HAPPY TRADING, AND MAY YOUR SUCCESS BE AS LIMITLESS AS YOUR AMBITION!