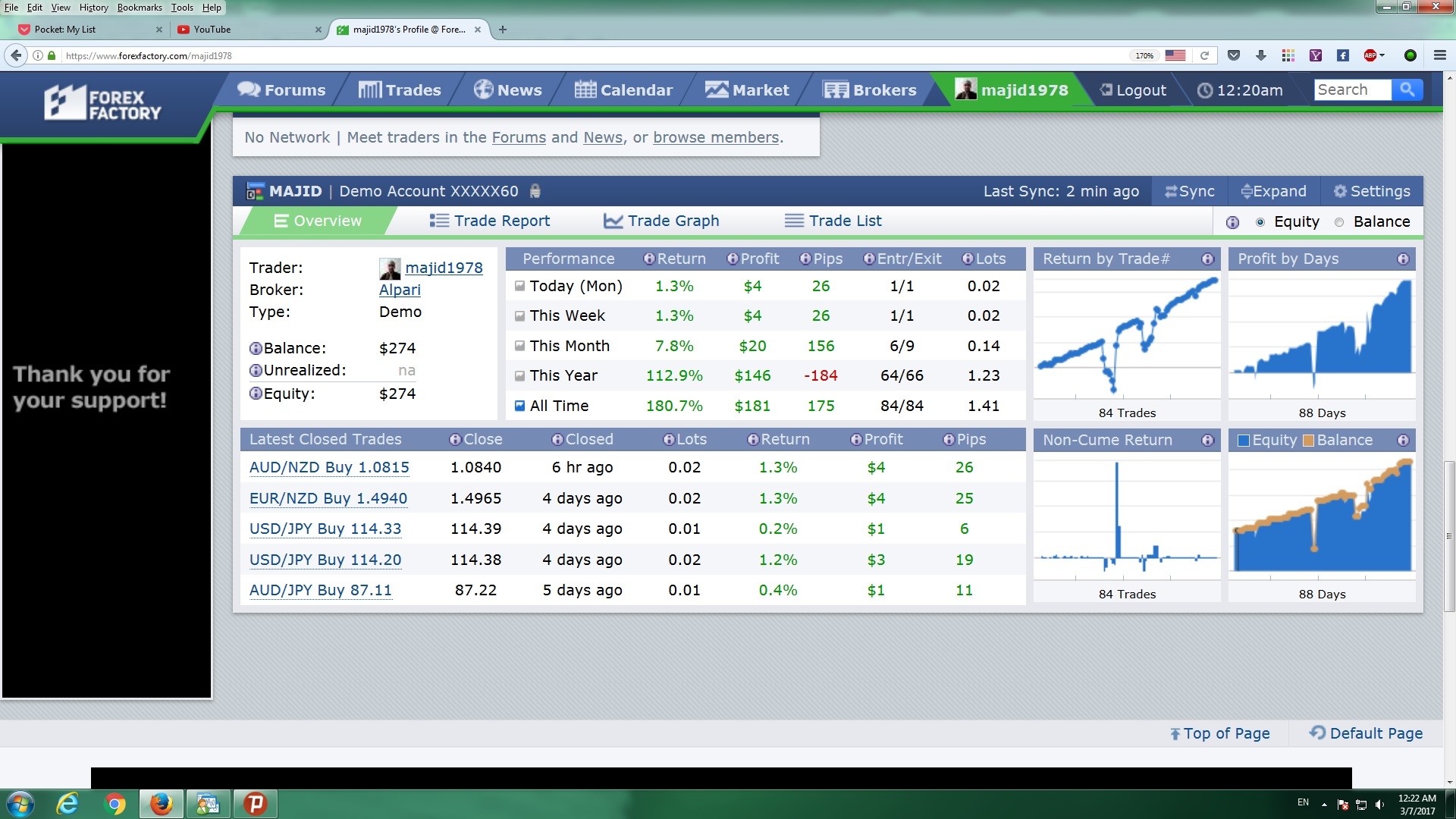

Seyedmajid Masharian / Profile

forex trader

at

home

Seyedmajid Masharian

Controlling Greed When Trading

https://www.dailyfx.com/forex/education/trading_tips/post_of_the_day/2012/08/06/Controlling_Greed_When_Trading..html

Below are two quotes from two different traders…

“Greed has cost me more than anything else.”

“How can I control greed??? Thathas been my number 1 problem.”

Human nature being what it is, quotes of this type have come from many traders over the years.

So, how does a trader go about controlling it?

First of all, if you personally can identify with these quotes, it means you are aware that greed is negatively influencing your trading. That recognition alone is a BIG step toward resolving the issue.

To keep this detrimental emotion in check, having a definite trading plan in mind…ideally written out…will help. Keep the plan nearby where you can reference it prior to placing any trade.

It will be a strategy that you have tested and one that has put pips into your account, live or demo, over time. By this I do not mean that the strategy puts positive pips in your account on each and every trade since every trade will not be a winner. But the trading plan/strategy you are using, overall, has been adding to your account size.

Then, only take trades that fit that trading plan exactly. If the trade does not measure up, don't take the trade. You only want to enter higher probability trades…trades based on your pre-determined plan. This will help prevent just randomly jumping into a trade because “it looks kind of OK”, or the “I just like to be in a trade” syndrome.

Next, never put more than 5% of your account at risk at any one time and always trade with at least a 1:2 Risk Reward Ratio in place. Rigidly adhering to both of these rules will prevent a trader from putting too much of their account at risk as well as exiting the trade at a desirable and predetermined level of profit. Overleveraging one’s account is one of the primary faults embraced by a trader influenced by greed.

Lastly, after the trade has executed with stops and limits in place, leave it alone!! Just let the trade play out according to the original parameters you put into place prior to being in the trade when emotions were non-existent.

Think about it…

When you were looking at the charts, checking trends, support and resistance levels, fundamentals and the like, you were totally without emotion. The plans that were put together while in that state of mind were based on facts alone. Once the trade is entered, however, emotions can shift into high gear. Making changes to a fact-oriented, unemotional trading plan based on moment to moment emotional shifts is not a prudent way to trade.

Managing and dealing with greed is not something that will be resolved over the next couple of trades over the next couple of days. However, by being conscious of how greed can negatively influence your trading and implementing the above points as part of your trading regimen, you will be taking positive steps toward the goal of “greed free” trading.

Lastly, tomorrow, August 7, 2012, I will be conducting a webinar on the Psychology of Trading. During that webinar (along with taking your questions)

I will be covering the former topics in greater detail.

You can access the webinar LIVE at 1 PM Eastern time by clicking on the link below…

https://plus.dailyfx.com/tnews/liveclassroom.do?liveclassroom=&ib=dailyfx

The webinar can also be viewed in the Course Archives area at the same link after its initial presentation.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

DISCLOSURES

https://www.dailyfx.com/forex/education/trading_tips/post_of_the_day/2012/08/06/Controlling_Greed_When_Trading..html

Below are two quotes from two different traders…

“Greed has cost me more than anything else.”

“How can I control greed??? Thathas been my number 1 problem.”

Human nature being what it is, quotes of this type have come from many traders over the years.

So, how does a trader go about controlling it?

First of all, if you personally can identify with these quotes, it means you are aware that greed is negatively influencing your trading. That recognition alone is a BIG step toward resolving the issue.

To keep this detrimental emotion in check, having a definite trading plan in mind…ideally written out…will help. Keep the plan nearby where you can reference it prior to placing any trade.

It will be a strategy that you have tested and one that has put pips into your account, live or demo, over time. By this I do not mean that the strategy puts positive pips in your account on each and every trade since every trade will not be a winner. But the trading plan/strategy you are using, overall, has been adding to your account size.

Then, only take trades that fit that trading plan exactly. If the trade does not measure up, don't take the trade. You only want to enter higher probability trades…trades based on your pre-determined plan. This will help prevent just randomly jumping into a trade because “it looks kind of OK”, or the “I just like to be in a trade” syndrome.

Next, never put more than 5% of your account at risk at any one time and always trade with at least a 1:2 Risk Reward Ratio in place. Rigidly adhering to both of these rules will prevent a trader from putting too much of their account at risk as well as exiting the trade at a desirable and predetermined level of profit. Overleveraging one’s account is one of the primary faults embraced by a trader influenced by greed.

Lastly, after the trade has executed with stops and limits in place, leave it alone!! Just let the trade play out according to the original parameters you put into place prior to being in the trade when emotions were non-existent.

Think about it…

When you were looking at the charts, checking trends, support and resistance levels, fundamentals and the like, you were totally without emotion. The plans that were put together while in that state of mind were based on facts alone. Once the trade is entered, however, emotions can shift into high gear. Making changes to a fact-oriented, unemotional trading plan based on moment to moment emotional shifts is not a prudent way to trade.

Managing and dealing with greed is not something that will be resolved over the next couple of trades over the next couple of days. However, by being conscious of how greed can negatively influence your trading and implementing the above points as part of your trading regimen, you will be taking positive steps toward the goal of “greed free” trading.

Lastly, tomorrow, August 7, 2012, I will be conducting a webinar on the Psychology of Trading. During that webinar (along with taking your questions)

I will be covering the former topics in greater detail.

You can access the webinar LIVE at 1 PM Eastern time by clicking on the link below…

https://plus.dailyfx.com/tnews/liveclassroom.do?liveclassroom=&ib=dailyfx

The webinar can also be viewed in the Course Archives area at the same link after its initial presentation.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

DISCLOSURES

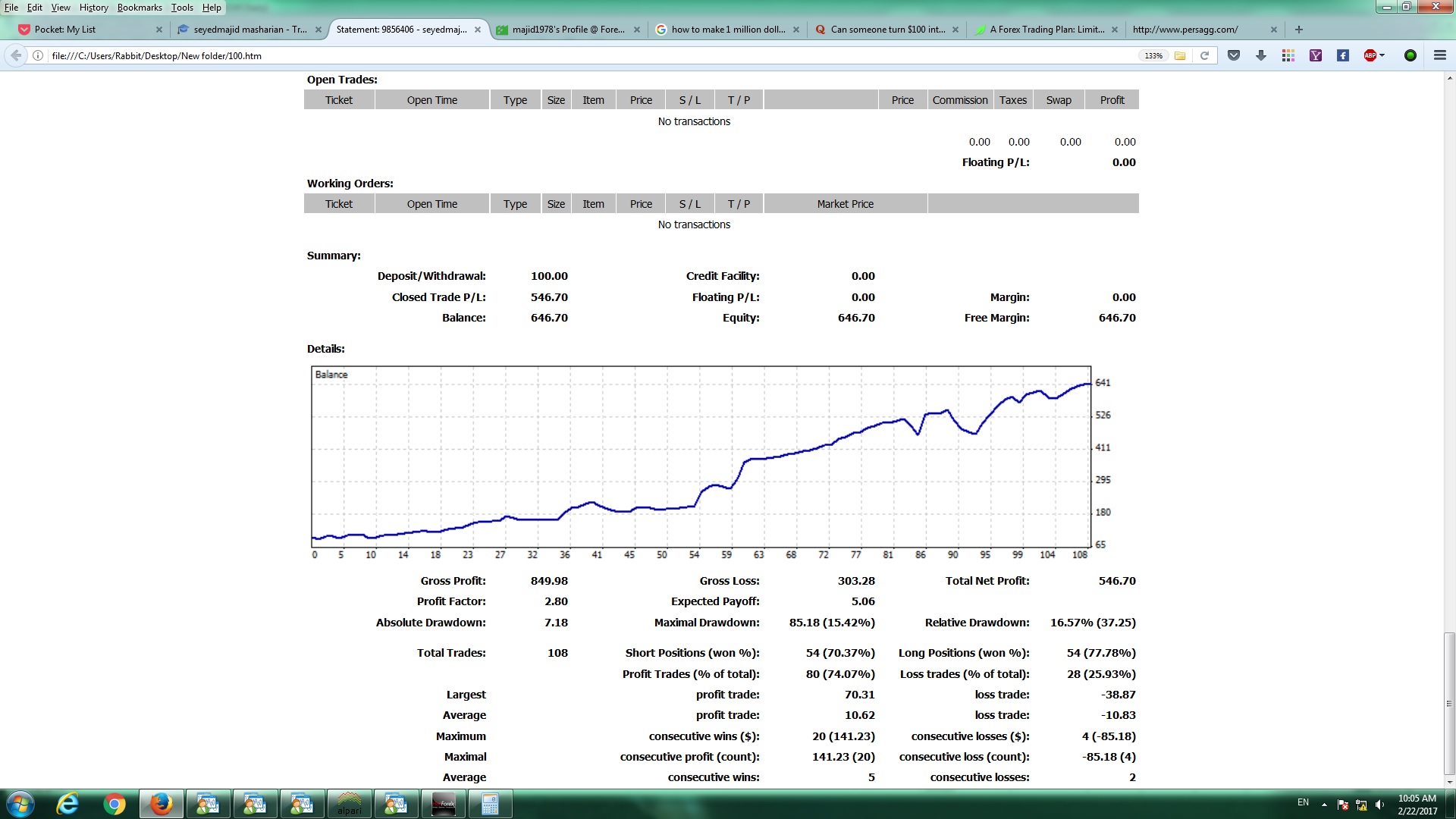

Seyedmajid Masharian

WATCH THIS INCREDIBLE VIDEO ABOUT INSTITUTIONAL TRADERS

MIND BLOWING TRUTH

https://www.youtube.com/watch?v=OgS52RyiO_M&t=468s

MIND BLOWING TRUTH

https://www.youtube.com/watch?v=OgS52RyiO_M&t=468s

Seyedmajid Masharian

A Wall Street performance coach who's consulted on Showtime's 'Billions' says too many people have the same misconception about success

For some of Denise Shull's clients, being in a slump might mean losing millions of dollars of other people's money.

Shull is the founder of the ReThink Group, a performance coaching group that specializes in clients on Wall Street. She's also one of the inspirations for Wendy Rhoades, the in-house psychiatrist at the fictional hedge fund at the center of Showtime's hit show "Billions."

Shull studied the neuropsychology of unconscious thought at the University of Chicago and spent 15 years as an equities trader. They are two worlds she combined when she started ReThink in 2003, putting her own spin on the niche market of Wall Street performance coaching, a path paved by the late psychiatrist Ari Kiev, who was employed by Steve Cohen's hedge fund SAC Capital.

Perhaps the most defining characteristic of Shull's approach is that nearly all of us, regardless of what industry we are in, have a misconception about how the mind works and thus how we can recover from failure: We think we can will ourselves to success.

"The conventional wisdom on feelings and emotions is just wrong," she told Business Insider.

denise shullReThink Group founder Denise Shull.Courtesy of Denise Shull.

Shull thinks many people have assumptions based on an outdated theory of the "triune brain," which basically says emotions, thoughts, and basic functions are handled separately within the brain; the reality, she says, is that all three of these roles are related in brain mechanics.

Too many people, she said, think that "if we have a plan and that we're disciplined then we'll be able to do the things that we want. ... It doesn't work like that."

It's why Shull has clients in the first place, she explained. The clients know that they are underperforming and they see their mistakes. But no pep talk from a manager or colleague and no Stoic denial of feelings can get them back to their peak.

Instead, she recommends her clients — and anyone else struggling through a slump — identify and name the feelings they are attaching to the weaknesses causing them to fail, and dive right in. By embracing these feelings, her clients can come to understand them, strip them of power, and then replace them with desired emotions. The thoughts follow the feelings, she insists, counter to what people often think.

"Sometimes I feel like I'm just going to gag, if I have to read 'mental toughness' one more time," she said. "Like ugh, just being tough doesn't get you the result you want. It fails you at the worst possible moment. ... And then all those feelings come crashing in and cause you to be self destructive or not perform up to your potential."

http://www.businessinsider.com/wall-street-performance-coach-denise-shull-how-to-get-out-of-a-slump-2017-2

For some of Denise Shull's clients, being in a slump might mean losing millions of dollars of other people's money.

Shull is the founder of the ReThink Group, a performance coaching group that specializes in clients on Wall Street. She's also one of the inspirations for Wendy Rhoades, the in-house psychiatrist at the fictional hedge fund at the center of Showtime's hit show "Billions."

Shull studied the neuropsychology of unconscious thought at the University of Chicago and spent 15 years as an equities trader. They are two worlds she combined when she started ReThink in 2003, putting her own spin on the niche market of Wall Street performance coaching, a path paved by the late psychiatrist Ari Kiev, who was employed by Steve Cohen's hedge fund SAC Capital.

Perhaps the most defining characteristic of Shull's approach is that nearly all of us, regardless of what industry we are in, have a misconception about how the mind works and thus how we can recover from failure: We think we can will ourselves to success.

"The conventional wisdom on feelings and emotions is just wrong," she told Business Insider.

denise shullReThink Group founder Denise Shull.Courtesy of Denise Shull.

Shull thinks many people have assumptions based on an outdated theory of the "triune brain," which basically says emotions, thoughts, and basic functions are handled separately within the brain; the reality, she says, is that all three of these roles are related in brain mechanics.

Too many people, she said, think that "if we have a plan and that we're disciplined then we'll be able to do the things that we want. ... It doesn't work like that."

It's why Shull has clients in the first place, she explained. The clients know that they are underperforming and they see their mistakes. But no pep talk from a manager or colleague and no Stoic denial of feelings can get them back to their peak.

Instead, she recommends her clients — and anyone else struggling through a slump — identify and name the feelings they are attaching to the weaknesses causing them to fail, and dive right in. By embracing these feelings, her clients can come to understand them, strip them of power, and then replace them with desired emotions. The thoughts follow the feelings, she insists, counter to what people often think.

"Sometimes I feel like I'm just going to gag, if I have to read 'mental toughness' one more time," she said. "Like ugh, just being tough doesn't get you the result you want. It fails you at the worst possible moment. ... And then all those feelings come crashing in and cause you to be self destructive or not perform up to your potential."

http://www.businessinsider.com/wall-street-performance-coach-denise-shull-how-to-get-out-of-a-slump-2017-2

Seyedmajid Masharian

Muhammad Elbermawi

2017.02.22

I don't love it ... I just trade it ... emotions at Forex can destroy destroy you ... take care :)

Seyedmajid Masharian

2017.02.22

but you must love you job to become successful at it warren buffet says

Seyedmajid Masharian

Daily and 4hr Price Action Strategies

https://2ndskiesforex.com/trading-strategies/forex-strategies/daily-and-4hr-price-action-strategies/

https://2ndskiesforex.com/trading-strategies/forex-strategies/daily-and-4hr-price-action-strategies/

Seyedmajid Masharian

Warren Buffett’s 10 Ways to Get Rich

http://www.warrenbuffett.com/warren-buffett-10-ways-to-get-rich/

http://www.warrenbuffett.com/warren-buffett-10-ways-to-get-rich/

Seyedmajid Masharian

Why 3am is the best time to trade forex

https://www.etxcapital.com/blog/why-3am-is-the-best-time-to-trade-forex

https://www.etxcapital.com/blog/why-3am-is-the-best-time-to-trade-forex

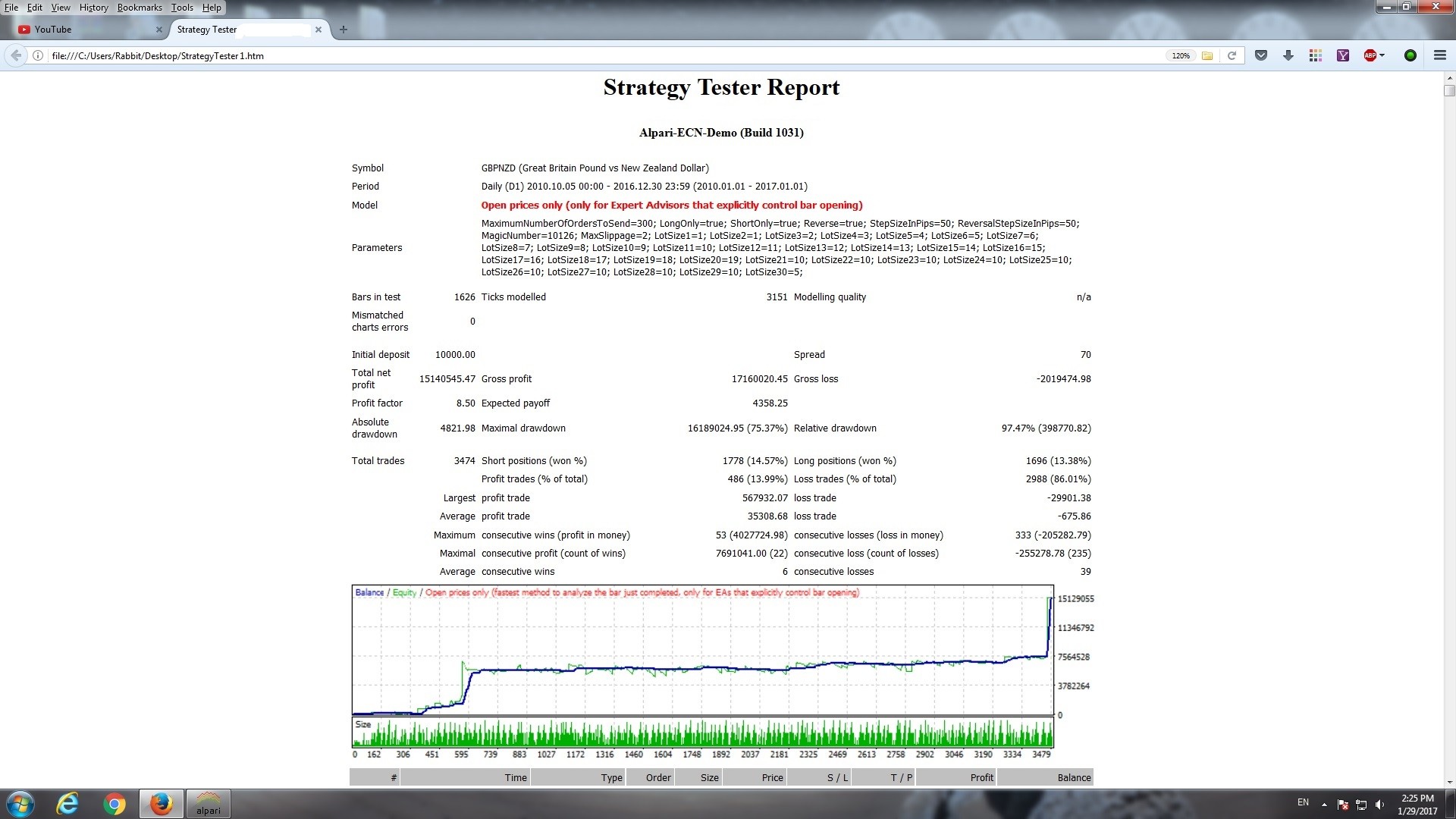

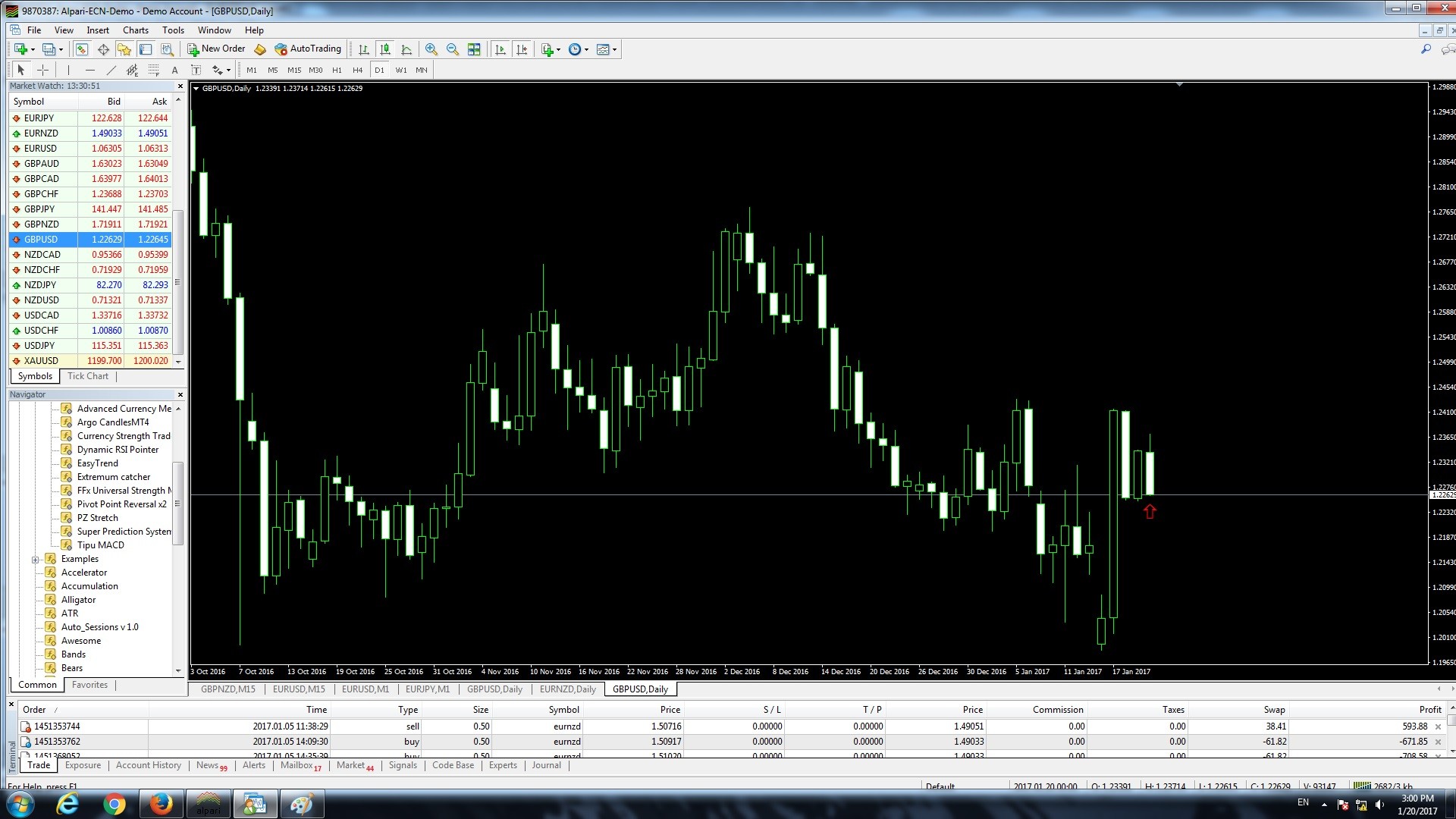

Seyedmajid Masharian

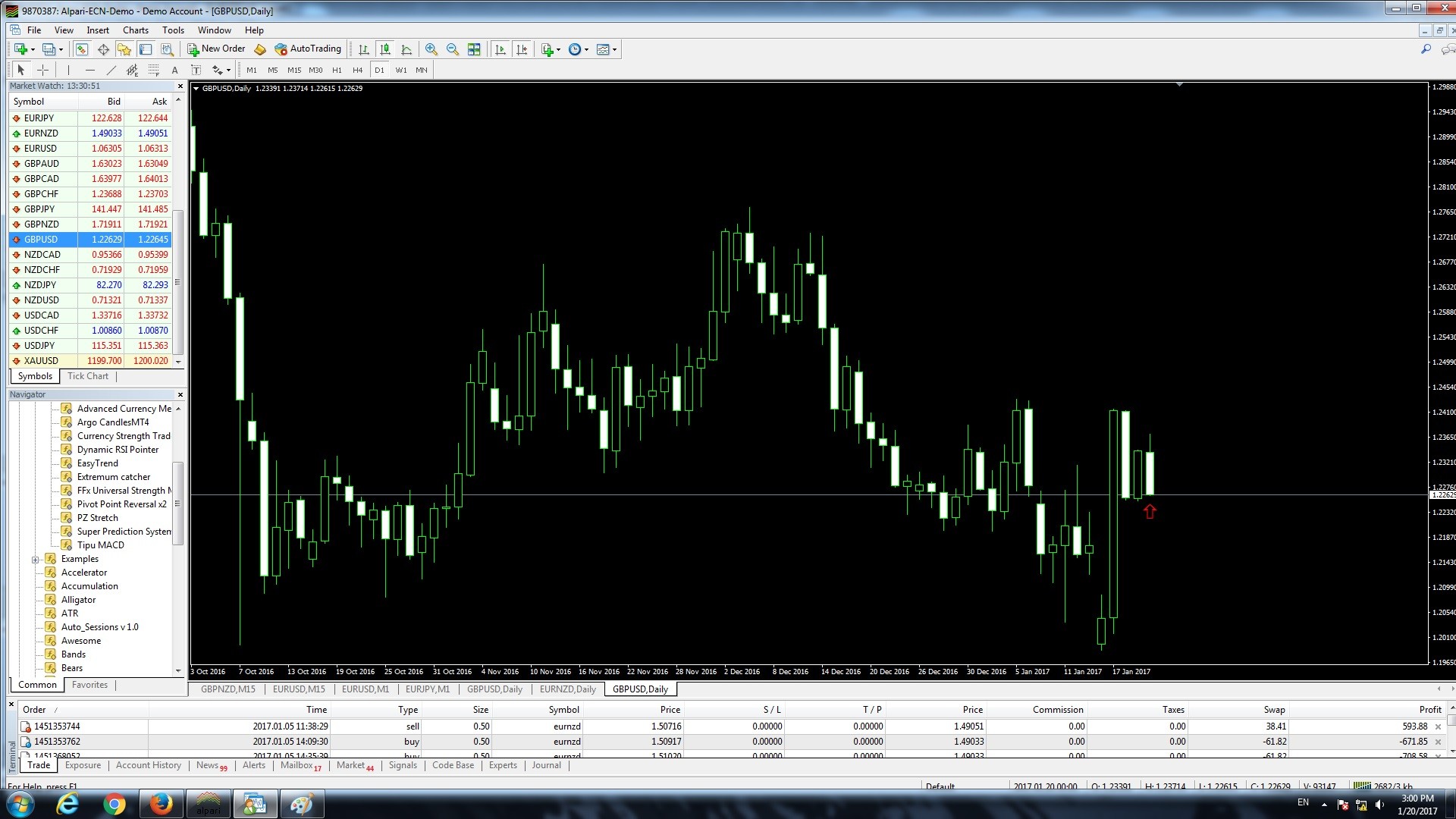

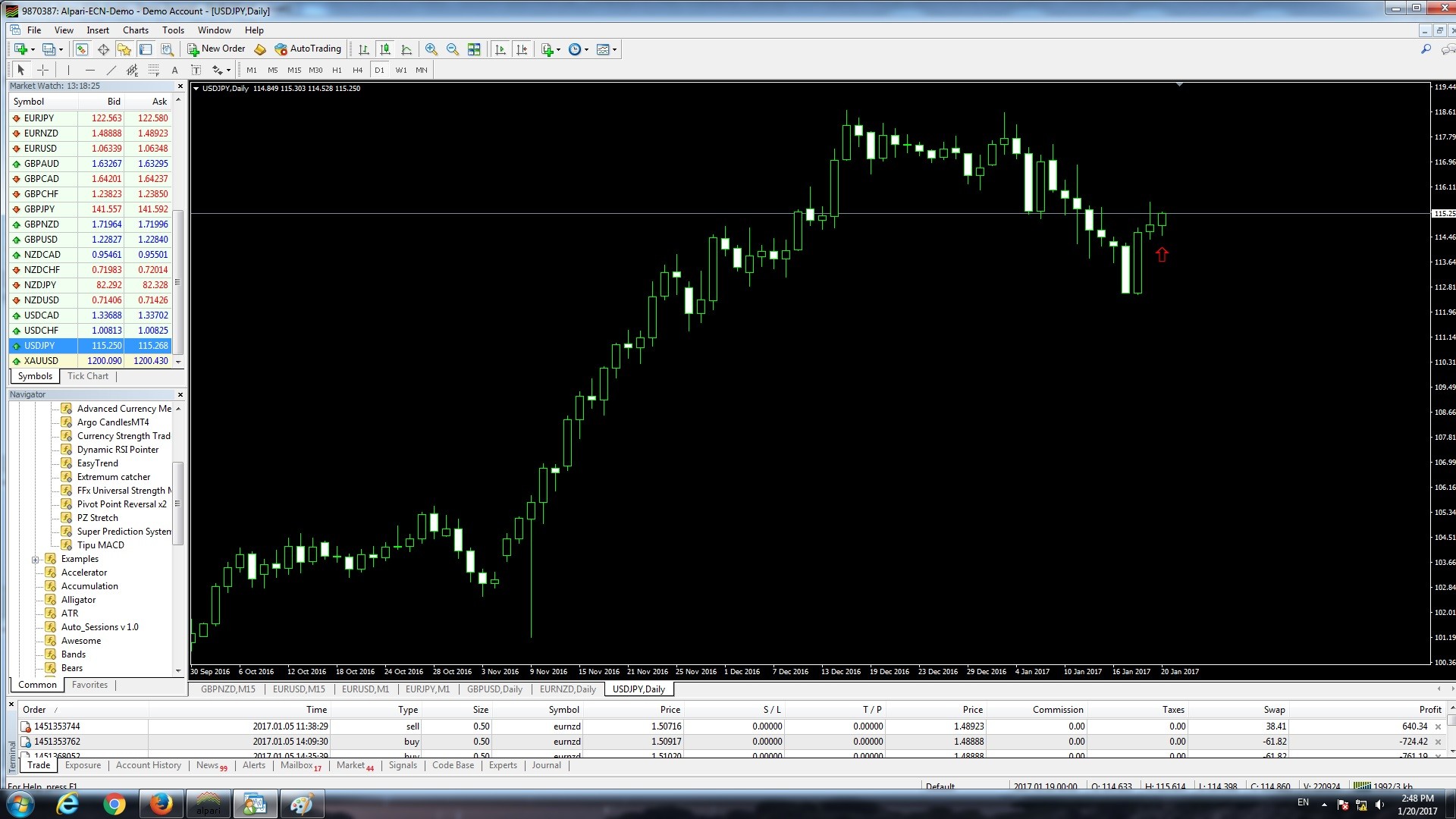

TRADING SIGNALS BASED ON DAILY PRICE ACTION

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

Seyedmajid Masharian

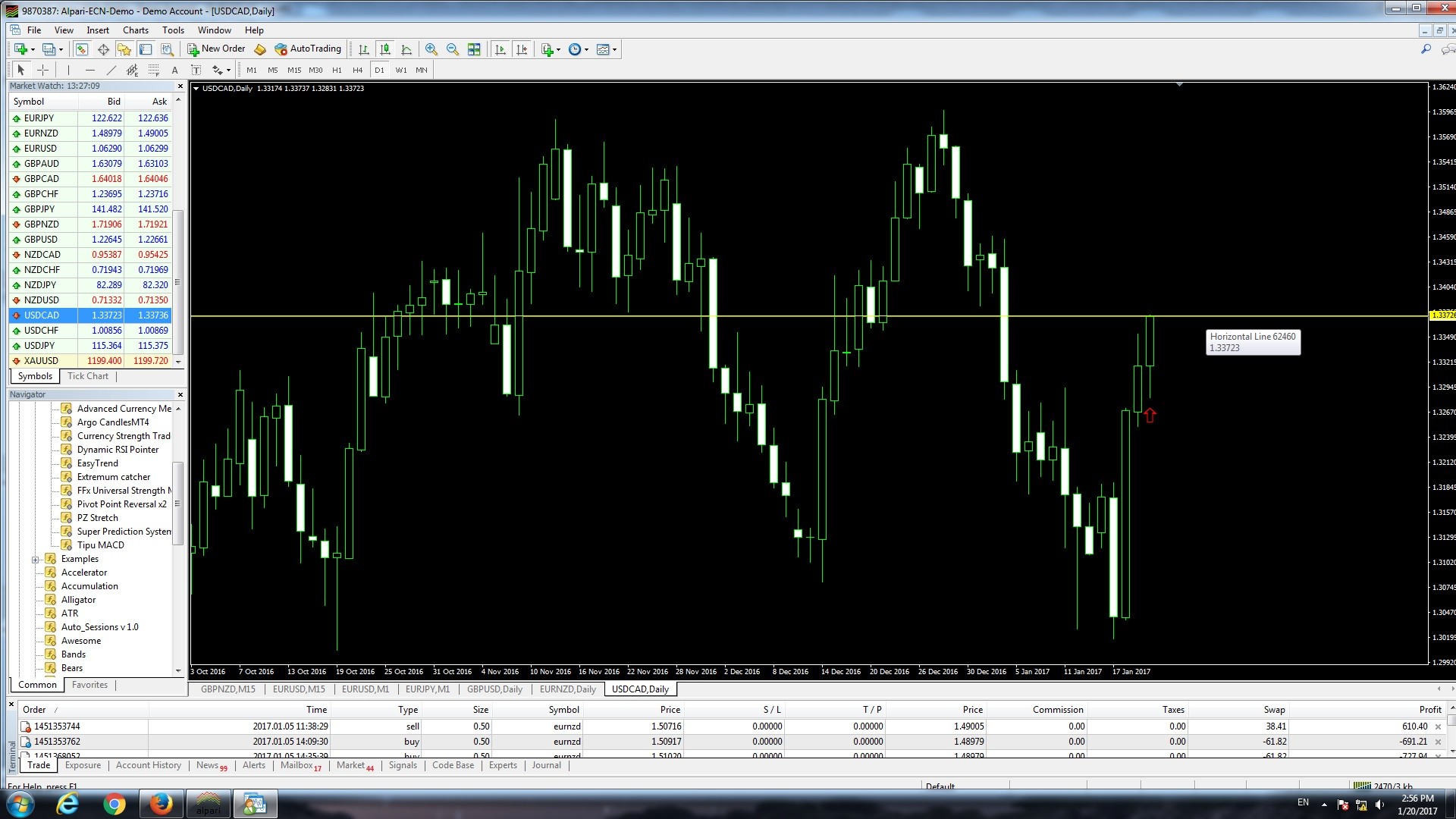

TRADING SIGNALS BASED ON DAILY PRICE ACTION

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

Seyedmajid Masharian

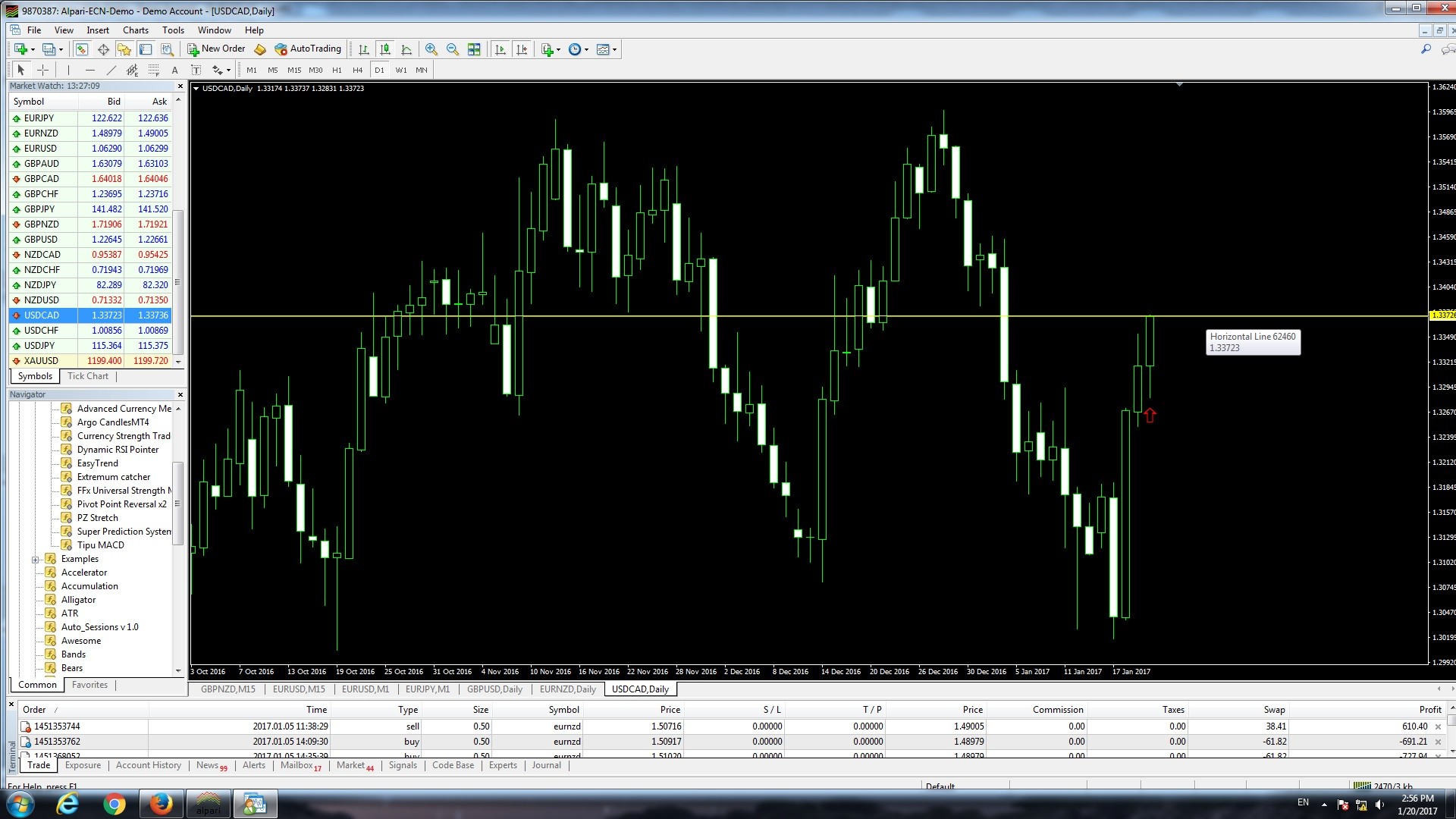

TRADING SIGNALS BASED ON DAILY PRICE ACTION

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

Seyedmajid Masharian

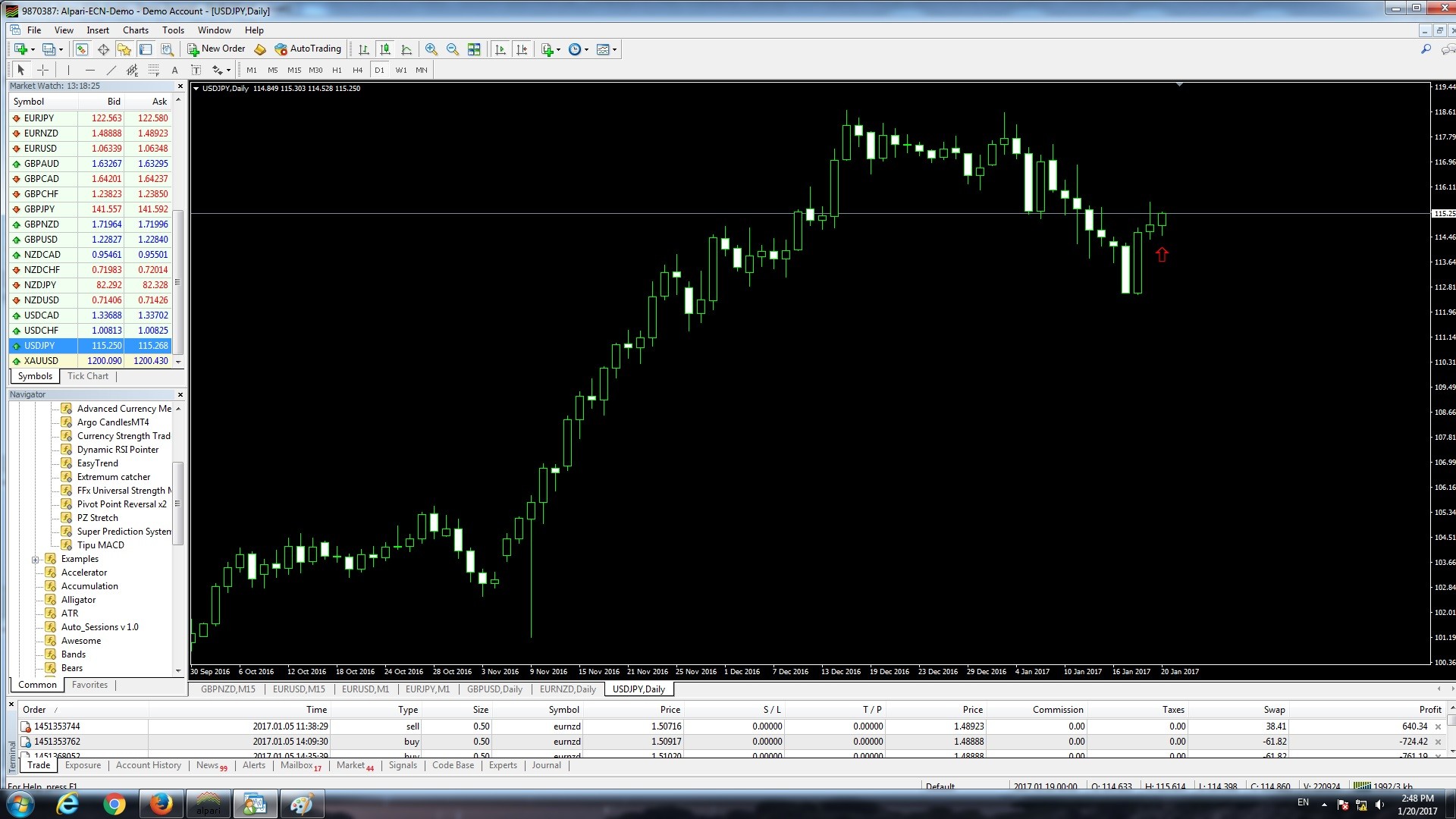

TRADING SIGNALS BASED ON DAILY PRICE ACTION

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

Seyedmajid Masharian

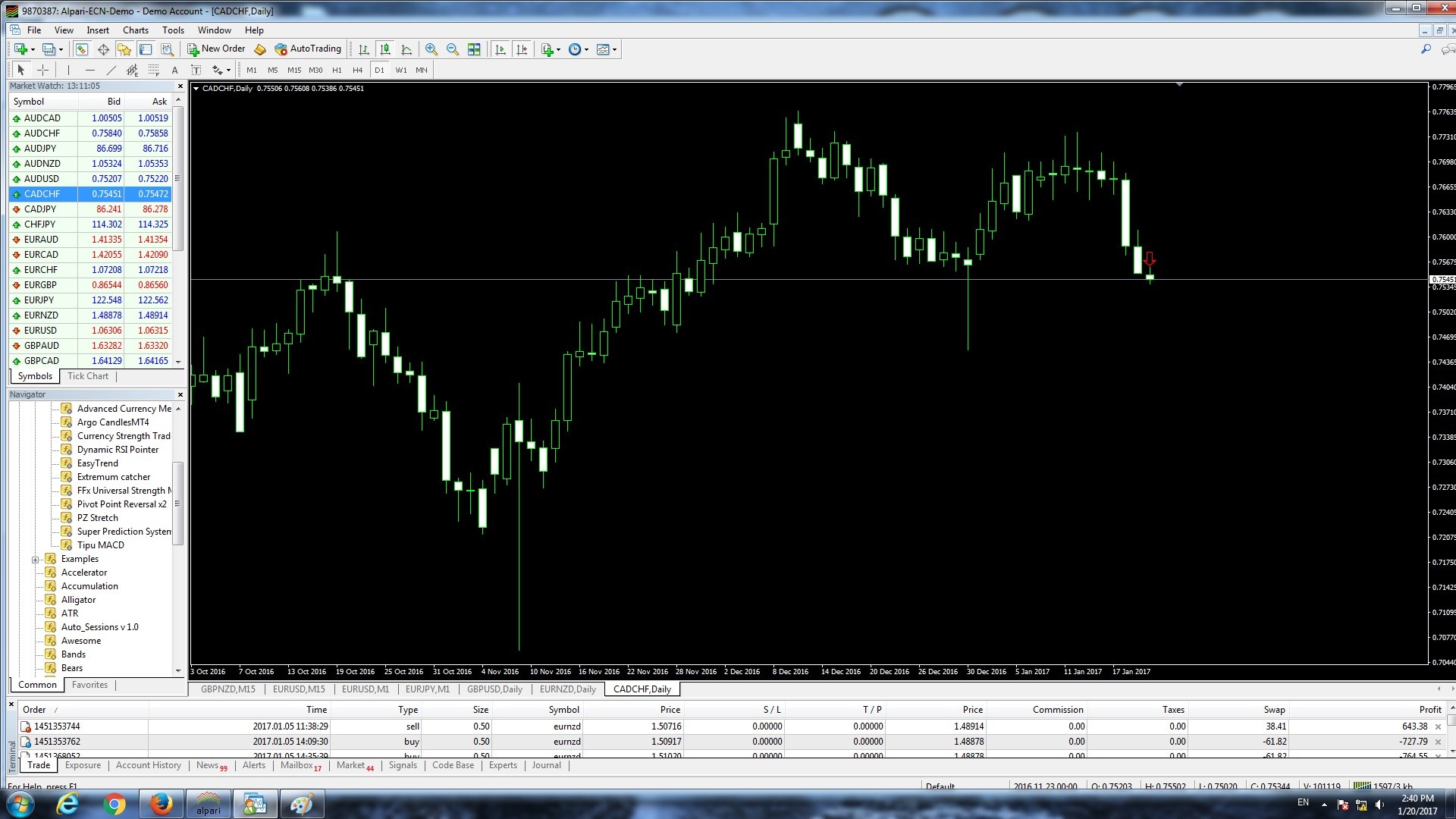

TRADING SIGNALS BASED ON DAILY PRICE ACTION

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES BELOW PREVIOUS CANDLE ON D1

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES BELOW PREVIOUS CANDLE ON D1

Seyedmajid Masharian

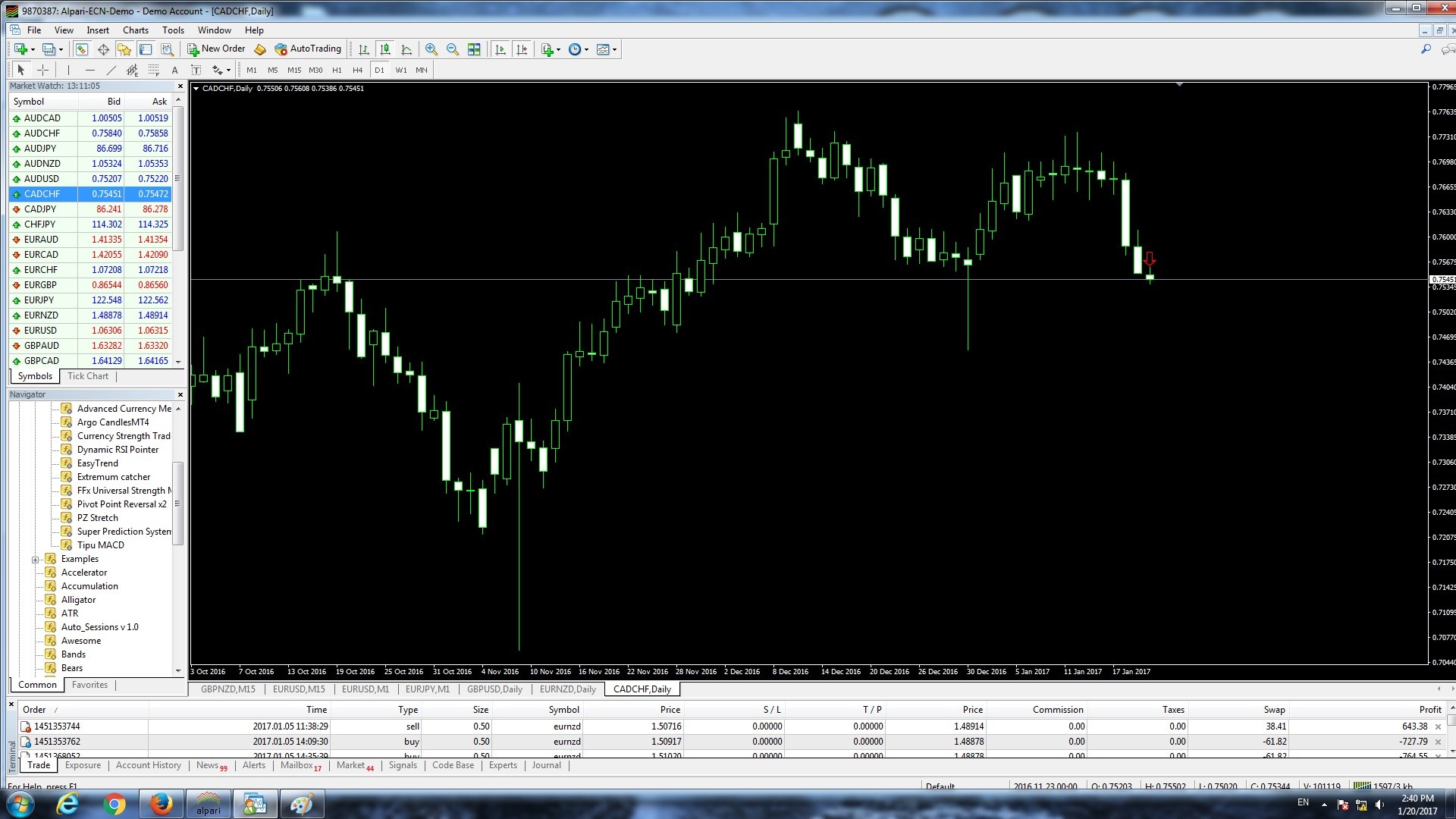

TRADING SIGNALS BASED ON DAILY PRICE ACTION

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES BELOW PREVIOUS CANDLE ON D1

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES BELOW PREVIOUS CANDLE ON D1

Seyedmajid Masharian

TRADING SIGNALS BASED ON DAILY PRICE ACTION

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

ENTER THE MARKET AND WAIT UNTIL BODY OF THE LAST CANDLE CLOSES ABOVE PREVIOUS CANDLE ON D1

: