Yan Xiong Xue / Seller

Published products

this is a trend following strategy, no grid,no m artingale Entry conditions: - If there is no position and the price breaks through the long-term period (55) Donchian channel upper and lower bands entry Addition conditions: 1,The interval ATR*AddCoef ficient is to increase the position once, and the stop loss is moved forward by 2*ATR. 2,The maximum position does not exceed MaxPositions Exit conditions: 1,defult stop loss:2*ATR stop loss after entering the market 2,trailing stop1:The price b

MT4 multi-variety multi-period signal monitoring system

Load to the indicators folder

Recommended loading chart: GBPUSD/XAUUSD/GBPJPY/USDJPY

Recommended loading period: M5/M15/H1/H4

Select all history by account history

- Statistics: Date, deposit, withdrawal, total number of transactions, number of transactions - long, number of transactions - short, total number of transactions, number of transactions - long, number of transactions - short, interest, commission, profit and loss, pro

MultipleSymbolsTurtleStrategy description this is a trend following strategy, no grid,no m artingale Entry conditions: 1,If there is no position and the previous breakthrough fails to exit, the price breaks through the short-term period (20) Donchian channel upper and lower bands entry 2, If there is no position and the price breaks through the long-term period (55) Donchian channel upper and lower bands entry Addition conditions: 1,The interval ATR*AddCoef ficient is to increase the position o

MT5 Trading Risk Control Panel 2.0 (Trading, Risk Control, Statistics)

1. Manual (fixed position, percentage stop loss position calculation, fixed amount loss position calculation)

2. Adaptive order placement

3. Track stop loss

4. Loss ratio alarm and strong balance of loss ratio

5. Account information, historical profit and loss ratios of various varieties (individual profit ratio, individual loss ratio, total profit ratio, total loss ratio)

6. Holding and historical statistics of

MT5TradePanel_V1 The panel supports market and pending orders Closing of positions by order type -trade -statistics - risk management - Trailing Stop -select the variant of risk calculation FIXED_LOTS, // fixed lots RISK_MONEY, // lots based on money RISK_RATIO // risk percent of account - percent of loss warning -percent od loss close all -show symbol info

TurtleLongTerm Strategy description this is a trend following strategy, no grid,no martingale Entry conditions: If there is no position and the price breaks through the long-term period (55) Donchian channel upper and lower bands entry Addition conditions:

1,The interval ATR*AddCoef ficient is to increase the position once, and the stop loss is moved forward by 2*ATR.

2,The maximum position does not exceed MaxPositions

Exit conditions:

1,defult stop loss:2*ATR stop loss after entering

Recommended symbols: XAUUSD, GBPUSD, EURUSD, USDJPY Parameter Description: - TimeFrame = PRIOD_ H1 ; // Chart cycle, recommended to load into H1 - MagicNumber = 60037 ; // Strategy identification code, set different numbers when multiple strategies trade the same variety - Fixed Lots (RiskPercentage=0) = 0.1 ;// When RiskPercentage is set to 0, enable fixed number of transactions, and pay attention to the minimum number of orders placed for specific transaction types - RiskPercentage = 0 ; //

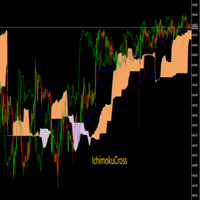

Strategy Introduction

Long entry conditions:

1. The price is above the cloud layer

2. chikouSpan_ MostRecent>MathMax (senkouSpanA, senkouSpanB)

3. kijunSen cross over tenkanSen

Long exit conditions:

1. TenkanSen corss down kijunSen

2. Price drops below cloud level tracking stop loss

Short Conditions reverse

Recommended symbol: USDJPY

Period: H1

Parameter Description

-Magic number=18857863182

-Order comment="Ichimoku"

-Lot mode=LOT_ MODE_ PCT_ ACC

-Lots/money/perc

Strategy introduction

Tanguan channel breakthrough approach, position according to the stop loss distance and variety point value adjustment, can also be fixed position trading, can set tracking stop loss,No Martin, no grid

Parameter description:

- Pairs List (comma separated) = "GBPUSD,GBPJPY,USDJPY,XAUUSD,XTIUSD"; // pairs list, divided by ",", other applicable varieties can be tested and optimized by themselves

- TimeFrame = PERIOD_H4;

- MagicNumber = 60037;

Intro to Range Breakout Strategy (pre-close clearance) Range = yesterday high - Yesterday low On track = opening price + range *k; Lower rail = Open price - range *K Stop-loss closing position: When the price breaks up the upper track or breaks down the lower track, it breaks the opening price of the day again

Parameters: Pairs List (comma separated) = "GBPUSD,GBPJPY,USDJPY,XAUUSD,XTIUSD,USTEC"; - TimeFrame = PERIOD_D1; - MagicNumber = 60037; - OrderComment = "RangeBre

Load EA to the active trading instrument chart, execute according to the tick of the loading chart. Please use it after multiple tests on the simulation disk and familiarize yourself with all functions to avoid unnecessary losses

1, close the current chart currency: this currency close, one click full close, annotation close, magic close, clear stop loss and profit, delete this chart currency order, only close this chart multiple single, only close this chart empty single, close this chart pr

AdvancedDualThrust Introduces the policy

HH: the highest price of the N-day high, and LC: the lowest price of the N-day close HC: the highest price of the N-day closing price, LL: the lowest price of the N-day low The formula for calculating the oscillation Range is range =Max(HH-LC,HC-LL). - UpLine=Open+k1 * Range;

DownLine=Open-k2 * Range;

Trading rules: 1, the price breaks through the upper and lower rail to open positions; 2, only trade once a day; 3, reverse break through the upper a

-Strategy description: Breakthrough system based on Bolling channel

-System elements :1, based on the closing price calculation of the Bolling channel; 2, based on the closing price calculation of the approach filter; 3, adaptive exit average

-Admission conditions :1, meet the filter conditions, and the price of the broken Bollinger channel on the track, open multiple single ;2, meet the filter conditions, and the price of the broken Bollinger channel under the track, open short orders

-E

Published signals

- Growth

- 156%

- Subscribers

- 0

- Weeks

- 209

- Trades

- 3325

- Win

- 92%

- Profit Factor

- 3.00

- Max DD

- 34%