John Davis / Profile

- Information

|

9+ years

experience

|

9

products

|

215

demo versions

|

|

3

jobs

|

0

signals

|

0

subscribers

|

With an unquenchable curiosity for financial markets and a knack for coding, John's daily routine revolves around dissecting market trends, analyzing historical data, and translating insights into algorithmic masterpieces on the MetaTrader platform. The MetaEditor is John's creative playground, where lines of code transform into powerful trading strategies.

As a self-employed professional, John is liberated from the constraints of a traditional work environment. This independence allows for a flexible lifestyle, with John seamlessly transitioning from a home-based workstation to a shared coworking space or even a bustling café, adapting to the ebb and flow of the markets from anywhere in the world.

John is a versatile coder, capable of designing algorithms for various trading styles. Whether it's developing high-frequency strategies to capture fleeting market movements or constructing robust swing trading systems, John's expertise extends across diverse market scenarios.

The morning routine for John involves a strategic blend of market research, coding, and fine-tuning algorithms. Every function and variable within the code serves a purpose, meticulously crafted to optimize performance and achieve the desired trading outcomes. Debugging is not just a technical challenge for John but a puzzle-solving exercise, refining algorithms to perfection.

Risk management is at the core of John's trading philosophy. Each algorithm is not just a code structure but a calculated financial decision-maker, equipped with comprehensive risk mitigation strategies. The MetaTrader environment becomes a canvas for John to weave together financial acumen and technological innovation.

Beyond the technical prowess, John's journey is a testament to the adaptability of self-employment. The flexibility of working for oneself allows John to find the ideal balance between work and life, creating a unique career path that aligns with personal goals and ambitions.

In the universe of self-employed algorithmic traders, John stands out as a skilled entrepreneur, navigating the complexities of financial markets with precision, ingenuity, and a commitment to continuous improvement.

This expert adviser works with EURUSD, AUDJPY, GBPJPY, NZDJPY, GBPJPY, NZDJPY, GBPCHF, GBPCAD, GBPAUD, and EURNZD. This EA utilizes similar mechanisms from the Swing Points indicator to generate Fibonacci levels. With these levels it picks the best time to enter and exit a trade. When trading with this system look forward to a daily bonus, because it detects and trades only in the direction of positive rollover. This bonus amount over time can be considerable and is not shown when back testing

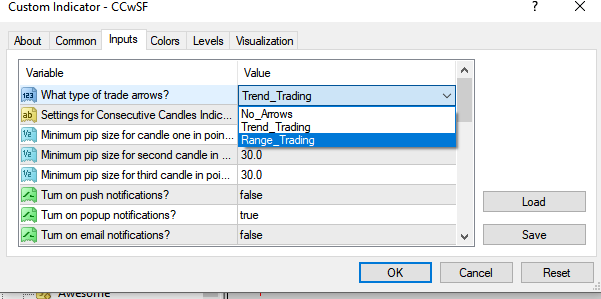

The Wolfalizer Indicator combines the functionality of the Engulfing Stochastic along with the ConsecutiveRSI and adds alerts along with more detailed output to the journal. This Indicator will alert you when RSI or Stochastics cross into oversold or overbought. You can set the oversold and overbought levels for RSI and Stochastics separately. You can pick if you want an engulfing candle to appear on the cross or set a number of consecutive candles you would like to see

The Wolfalizer Indicator combines the functionality of the Engulfing Stochastic along with the ConsecutiveRSI and adds alerts along with more detailed output to the journal. This Indicator will alert you when RSI or Stochastics cross into oversold or overbought. You can set the oversold and overbought levels for RSI and Stochastics separately. You can pick if you want an engulfing candle to appear on the cross or set a number of consecutive candles you would like to see. Interesting

Consecutive candles can give us an indication as to the strength of a trend. With this indicator, you can set the number of consecutive bull or bear candles you wish to be present before achieving a valid signal of RSI crossing into overbought or oversold. With this information, you can better judge if a continuation or reversal situation is about to present. RSI has two settable levels Interesting settings: Number of consecutive candles needed before a valid signal Overbought level of RSI

We have all seen a currency pair enter the overbought or oversold territory and stay there for long periods of time. What this indicator does is gives you the emphasis. So if you are looking for reversals then you may want to take notice when oversold territory is entered into with a bullish engulfing candle or if the trend is your thing then check for bearish engulfing candles while entering oversold. This indicator will show a downward arrow when it detects a bearish engulfing candle while

available for free at

https://www.mql5.com/en/code/19130

Swing Points are those places on the chart where price changes direction. This is an MT5 version of my MT4 Swing Points Indicator. Found on the code base at https://www.mql5.com/en/code/15616 and in the market at https://www.mql5.com/en/market/product/22918 The beginning input parameters allow you to configure your alerts. Turn on screen alerts allows you to turn on and off screen alerts. True is on, false is off. Turn on push to phone alerts allows you to turn on and off

please contact via whatsapp +27791298887 i want buy mt5 version

I have a little knowledge on the programming.

So is is based on the artificial intellegent concept?

Optimizes the value of overbought and oversold on each new bar. This expert strives to choose the best values for a simple strategy where it sells when the indicator crosses below an overbought level and executes a buy when it crosses above an oversold level. The best overbought and oversold level is calculated on each new bar according to how that value would have performed during the optimizing periods which can be specified. Inputs Unique number for this EA - can be any integer value

qualcosa?

-

44% (19)

-

33% (14)

-

23% (10)