Pierre Ksachikian / Profile

- Information

|

2 years

experience

|

34

products

|

15

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

https://www.mql5.com/en/market/product/94312

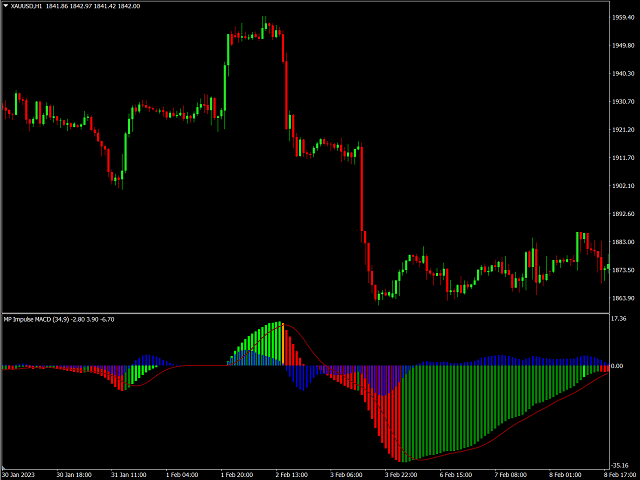

MACD (short for Moving Average Convergence/Divergence) is one of the most famous and oldest indicators ever created and is widely used among beginners . However, there is a newer version of the MACD that is named Impulse MACD which have less false signals than the standard MACD. Classic MACD helps us to identify potential trends by displaying crossovers between two lines. If MACD line crosses above the Signal line it shows us that the market is potentially up trending and that it would be

https://www.mql5.com/en/market/product/93920

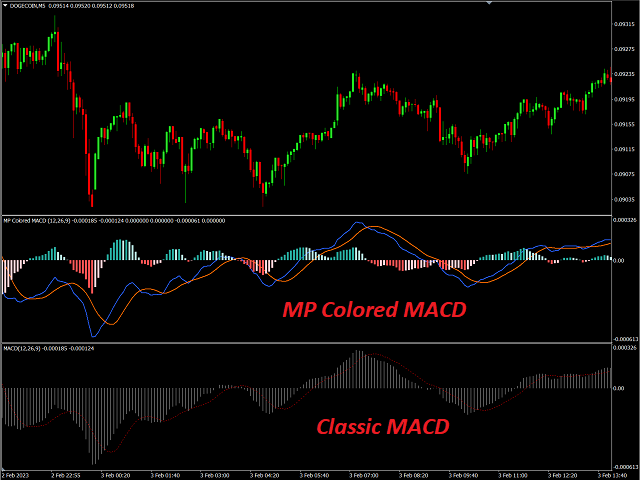

MACD (short for M oving A verage C onvergence/ D ivergence) is a popular trading indicator used in technical analysis of securities prices. It is designed to identify changes in the strength, direction, momentum, and duration of a trend in a security's price. History Gerald Appel created the MACD line in the late 1970s. Thomas Aspray added the histogram feature to Appel's MACD in 1986. The three major components and their formula 1. The MACD line: First, "PM Colored

https://www.mql5.com/en/market/product/93568

MACD (short for M oving A verage C onvergence/ D ivergence) is a popular trading indicator used in technical analysis of securities prices. It is designed to identify changes in the strength, direction, momentum, and duration of a trend in a security's price. History Gerald Appel created the MACD line in the late 1970s. Thomas Aspray added the histogram feature to Appel's MACD in 1986. The three major components and their formula 1. The MACD line: First, "PM Colored MACD" employs two

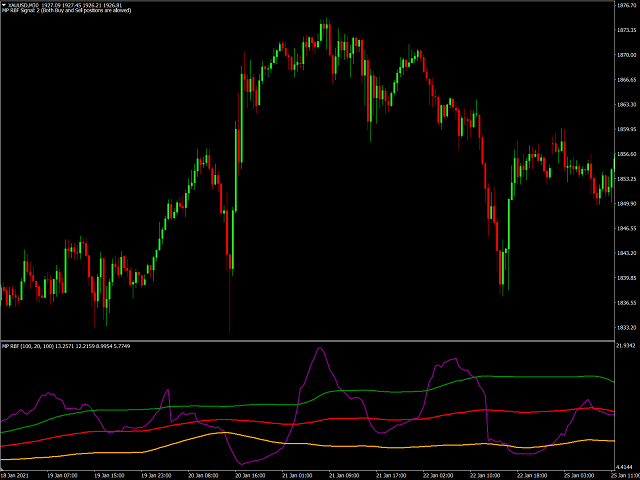

This easy to use technical indicator is created to be used to identify your trading zones based on volatility.

https://www.mql5.com/en/market/product/92818

MP Relative Bandwidth Filter (RBF) is created to be used to identify your trading zones based on volatility. This easy to use technical indicator attempts to compare between Bandwidth of higher length and ATR of lower length to identify the areas of low and high volatility: Relative Bandwidth = Bandwidth / ATR The Bandwidth is based on Bollinger Band which its length ideally needs to be higher and ATR length needs to be ideally lower. After calculating Relative Bandwidth, the Bollinger

MT4:

https://www.mql5.com/en/market/product/88278

MT5:

https://www.mql5.com/en/market/product/89122

Also, new settings are added:

- Options to change position, distance and size of markers

- Option to count Inside Bars having equal level(s) with their Mother Bars

MT4:

https://www.mql5.com/en/market/product/88112

MT5:

https://www.mql5.com/en/market/product/89406

https://www.mql5.com/en/market/product/91337

https://www.mql5.com/en/market/product/92003

The purpose of using Smart money index (SMI) or smart money flow index is to find out investors sentiment. The index was constructed by Don Hays and measures the market action. The indicator is based on intra-day price patterns. The beginning of the trading day is supposed to represent the trading by retail traders. The majority of retail traders overreact at the beginning of the trading day because of the overnight news and economic data. There is also a lot of buying on market orders and

Perhaps we need a technical indicator...

https://www.mql5.com/en/market/product/91337

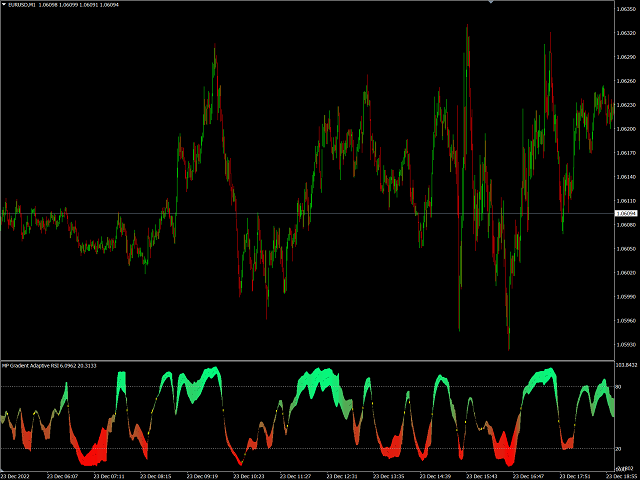

MP Gradient Adaptive RSI oscillator uses AMA with the basic RSI to cover the retracements with minimum lag. Trigger line crossing the oscillator will provide an entry point for trader. Settings: RSI period: period of the oscillator Sensitivity of the oscillator: controls the sensitivity of the oscillator to retracements, with higher values minimizing the sensitivity to retracements. RSI applied price: source input of the indicator Number of bars to draw: is used when the Fill Type option is not

For MT4:

https://www.mql5.com/en/market/product/91120

For MT5:

https://www.mql5.com/en/market/product/91255

The MP Andean Oscillator is used to estimate the direction and also the degree of variations of trends. It contains 3 components: Bull component, Bear component and Signal component. A rising Bull component indicates that the market is up-trending while a rising Bear component indicates the presence of down-trending market. Settings: Oscillator period: Specifies the importance of the trends degree of variations measured by the indicator. Signal line per: Moving average period of the Signal

The MP Andean Oscillator is used to estimate the direction and also the degree of variations of trends. It contains 3 components: Bull component, Bear component and Signal component. A rising Bull component indicates that the market is up-trending while a rising Bear component indicates the presence of down-trending market. Settings: Oscillator period: Specifies the importance of the trends degree of variations measured by the indicator. Signal line per: Moving average period of the Signal