Cleverson Santos / Profile

- Information

|

6+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I've been looking for a perfect Forex market for 6 years, and I'm still studying your changes and seeking to refine my techniques!

I mainly work on EUR / USD, but I have thoroughly studied the crypto-derivatives market, I hope to have consistency equal to or close to what I have in my preferred currency pair.

It is always good to meet people with the same goals and ambitions and work together as a community ...

What is the Forex Market?

Forex - or FX, as it is also called - is an abbreviation for Foreign Exchange Market, which means foreign currency. The FX market was created in 1971 and moves large volumes of money daily, running 24 hours a day between 10 pm Sunday and 10 pm Friday.

What are the Risks of Investing in Forex Trading?

The forex market is the most aggressive in the world. The gains can be very high, but the risk is also very high. To speculate in this market you must have strong loss control, check that the broker is legally registered in your country of origin to operate, are fundamental precautions to keep it operating in the market.

Rules for Starting a Winning Journey in Forex!

1. Discipline.

Have a disciplined mind, do not be greedy in the market, for he will not be kind to you. Have a very strict Trader plan and do not get out of your rules!

2. Study.

You must study hard, especially in this risky market, knowing where you are investing your money can make the difference between profit and loss.

3. Broker.

The age of a good broker is more than 5 years and should work in the legal zone of countries like: USA, Grate Britain, Germany and Australia. Well Regulated to secure your investment in this broker! Your broker should also provide good support!

4. Strategy.

You must take the study and acquired knowledge over time to create a strategy and follow it and go improving, do not give up your strategies in the first mistakes and negatives, because if you stay trading all the time strategy will never have any and did not get to place no, Forex is an eternal learning, what works today, it may not work tomorrow, there is no revenue for earnings, there is a lot of hard work and dedication, learning and rigid discipline to have good profits ...

5. Emotional control.

This may be the main point, since emotional control can be the dividing line between a trader and a loser. It is amazing how adrenaline speaks loudly in this market, you see a winning position or a losing position makes you spend a million things in the head, so a strategy and a trader plan is important and disciplined more important, so you do not end a losing position that can become a winner, and also not close a winning position too early and end up failing to win what the market and its strategy had to offer.

Top Forex Rules

Negotiating is an art, not a science.

Never let a winner turn into a loser.

Victories in logic, impulsive deaths.

Never risk more than 2% per trade.

Always have a well-defined strategy and stick to your strategy.

Never be on impulse, do not let your emotional take care of you.

If you lose more than 3 positions in a row, stop and go do something, leave the market alone and go distracted!

If you win what your strategy defined, stop and go do something, tomorrow is another day, the market will still be there, profit writed accounts!

Use Fundamental and Technical Analysis.

Be cautious and responsible, the market will not be good to you.

For you to reflect!

It does not matter if my opinion is right or wrong, all that matters is if I make money - Brian Gelber

Most traders who fail have big egos and can not admit they are wrong - Brian Gelber

Losing trader can not plant and wait for the time to harvest - Tom Baldwin

When volatility and timing become insane, jump out - Michael Marcus

To operate is emotion. It's Mass Psychology, Greed and Fear - Michael Marcus

You have to agree to make mistakes regularly, there's nothing wrong with that - Bruce Kovner

The emotional wear and tear of operating is substantial. If you let yourself be influenced by losses, you can not operate - Bruce Kovner

Do not customize the market. The market is not a personal challenge. He is totally impersonal. He does not care if he makes money or not - Bruce Kovner

I mainly work on EUR / USD, but I have thoroughly studied the crypto-derivatives market, I hope to have consistency equal to or close to what I have in my preferred currency pair.

It is always good to meet people with the same goals and ambitions and work together as a community ...

What is the Forex Market?

Forex - or FX, as it is also called - is an abbreviation for Foreign Exchange Market, which means foreign currency. The FX market was created in 1971 and moves large volumes of money daily, running 24 hours a day between 10 pm Sunday and 10 pm Friday.

What are the Risks of Investing in Forex Trading?

The forex market is the most aggressive in the world. The gains can be very high, but the risk is also very high. To speculate in this market you must have strong loss control, check that the broker is legally registered in your country of origin to operate, are fundamental precautions to keep it operating in the market.

Rules for Starting a Winning Journey in Forex!

1. Discipline.

Have a disciplined mind, do not be greedy in the market, for he will not be kind to you. Have a very strict Trader plan and do not get out of your rules!

2. Study.

You must study hard, especially in this risky market, knowing where you are investing your money can make the difference between profit and loss.

3. Broker.

The age of a good broker is more than 5 years and should work in the legal zone of countries like: USA, Grate Britain, Germany and Australia. Well Regulated to secure your investment in this broker! Your broker should also provide good support!

4. Strategy.

You must take the study and acquired knowledge over time to create a strategy and follow it and go improving, do not give up your strategies in the first mistakes and negatives, because if you stay trading all the time strategy will never have any and did not get to place no, Forex is an eternal learning, what works today, it may not work tomorrow, there is no revenue for earnings, there is a lot of hard work and dedication, learning and rigid discipline to have good profits ...

5. Emotional control.

This may be the main point, since emotional control can be the dividing line between a trader and a loser. It is amazing how adrenaline speaks loudly in this market, you see a winning position or a losing position makes you spend a million things in the head, so a strategy and a trader plan is important and disciplined more important, so you do not end a losing position that can become a winner, and also not close a winning position too early and end up failing to win what the market and its strategy had to offer.

Top Forex Rules

Negotiating is an art, not a science.

Never let a winner turn into a loser.

Victories in logic, impulsive deaths.

Never risk more than 2% per trade.

Always have a well-defined strategy and stick to your strategy.

Never be on impulse, do not let your emotional take care of you.

If you lose more than 3 positions in a row, stop and go do something, leave the market alone and go distracted!

If you win what your strategy defined, stop and go do something, tomorrow is another day, the market will still be there, profit writed accounts!

Use Fundamental and Technical Analysis.

Be cautious and responsible, the market will not be good to you.

For you to reflect!

It does not matter if my opinion is right or wrong, all that matters is if I make money - Brian Gelber

Most traders who fail have big egos and can not admit they are wrong - Brian Gelber

Losing trader can not plant and wait for the time to harvest - Tom Baldwin

When volatility and timing become insane, jump out - Michael Marcus

To operate is emotion. It's Mass Psychology, Greed and Fear - Michael Marcus

You have to agree to make mistakes regularly, there's nothing wrong with that - Bruce Kovner

The emotional wear and tear of operating is substantial. If you let yourself be influenced by losses, you can not operate - Bruce Kovner

Do not customize the market. The market is not a personal challenge. He is totally impersonal. He does not care if he makes money or not - Bruce Kovner

Friends

281

Requests

Outgoing

Cleverson Santos

Thiago Duarte

2020.04.17

Parabéns!

Cleverson Santos

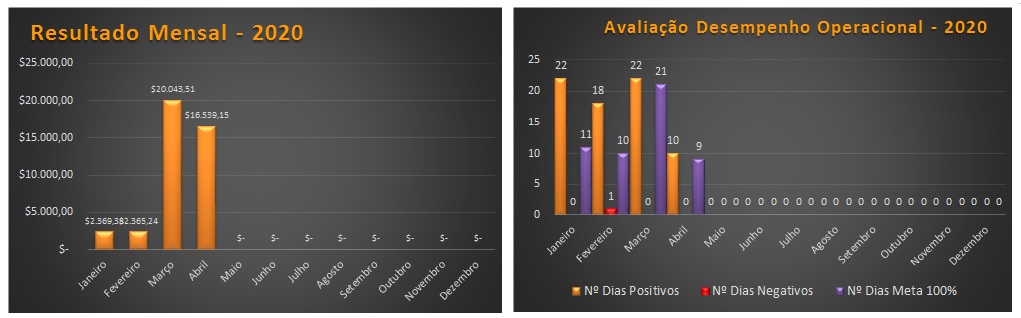

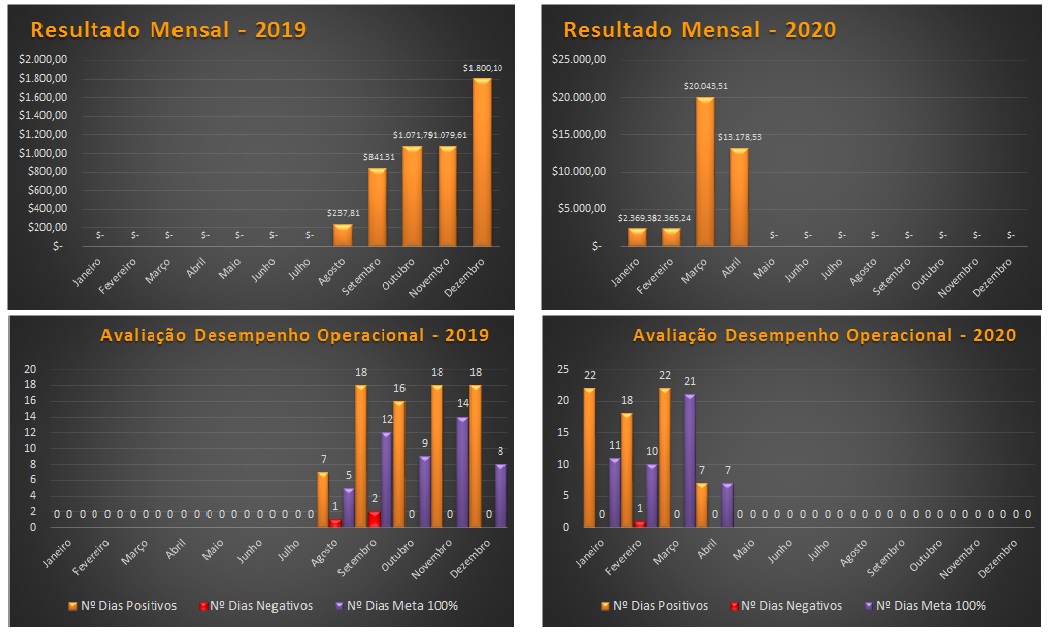

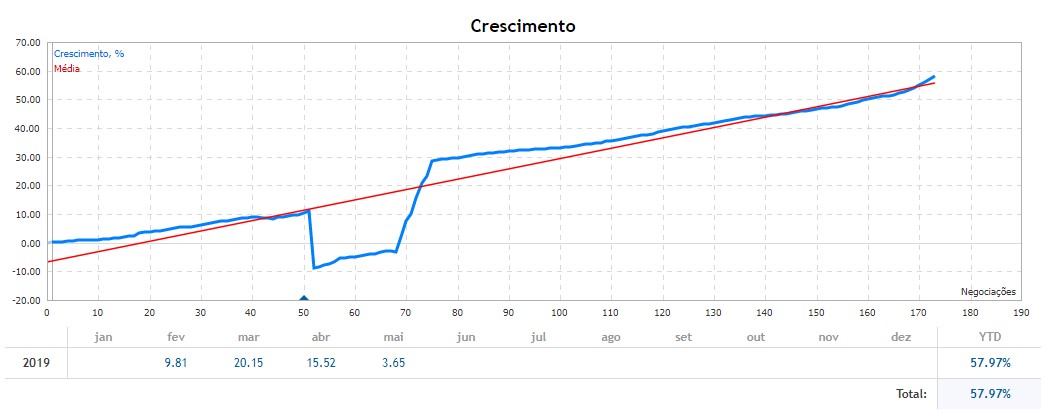

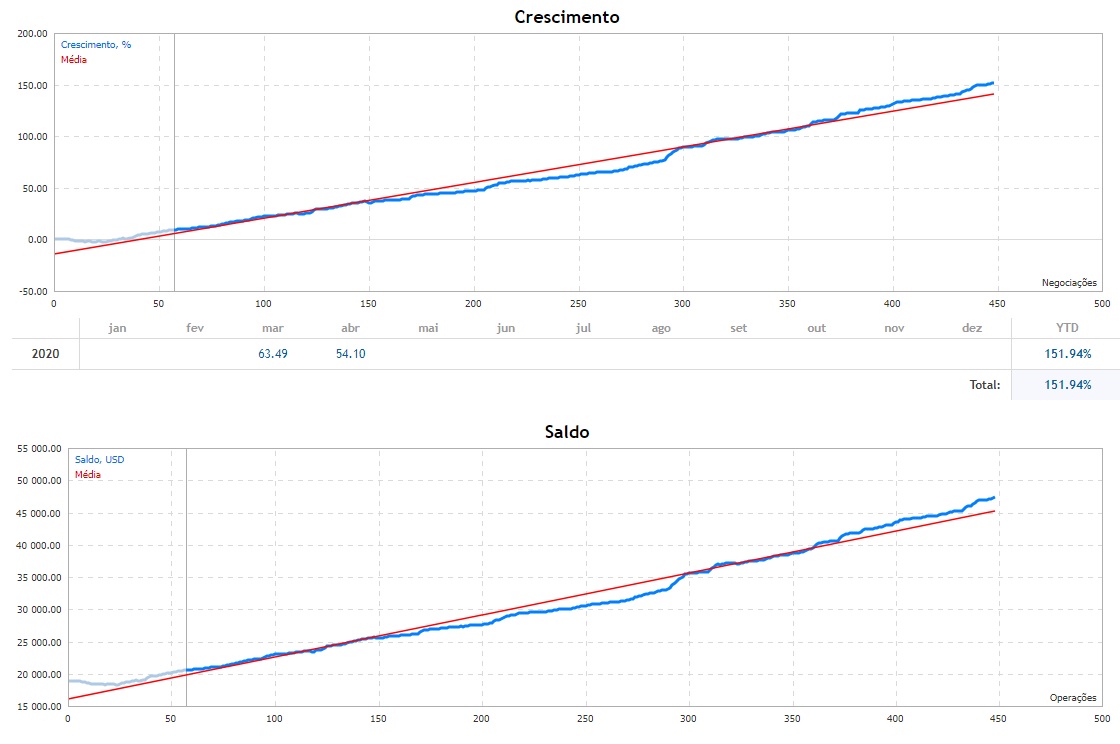

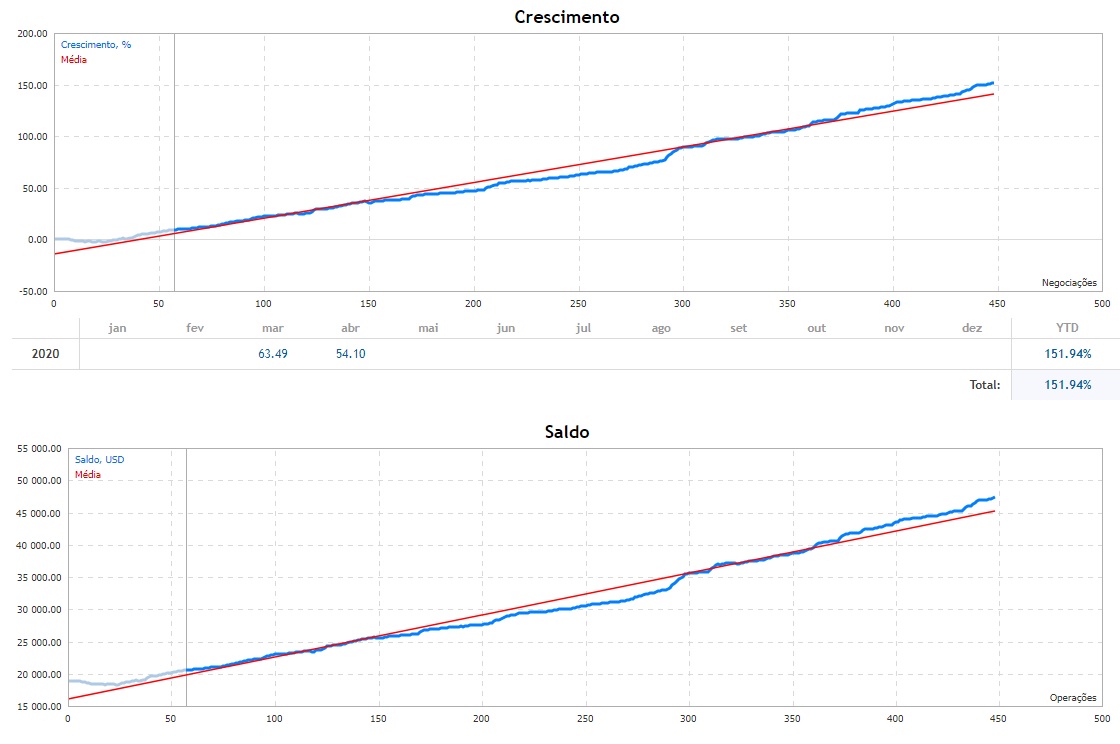

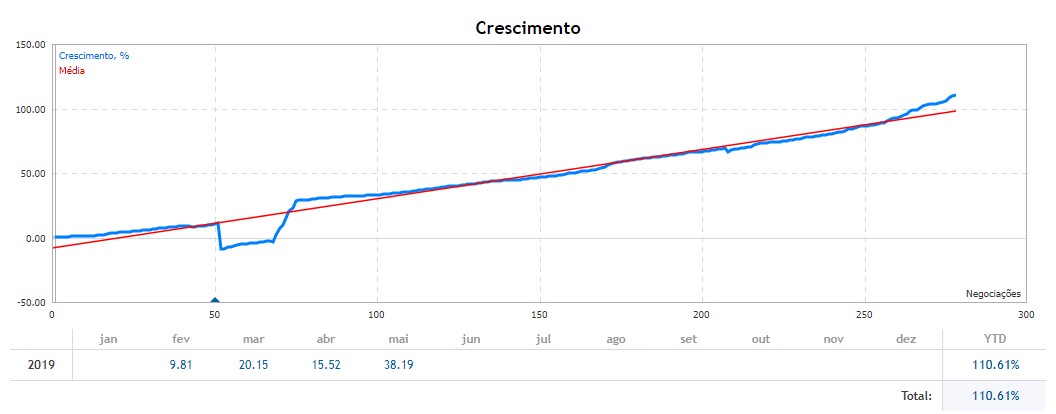

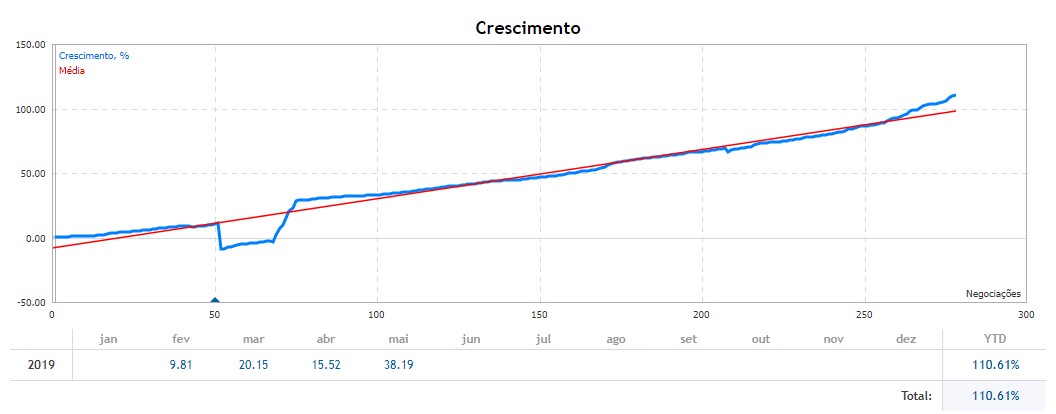

Seguindo Plano de Trading, risco calculado, rebaixamento calculado, técnica de trading em desenvolvimento e com sinas promissores de crescimento exponencial de capital!

Cleverson Santos

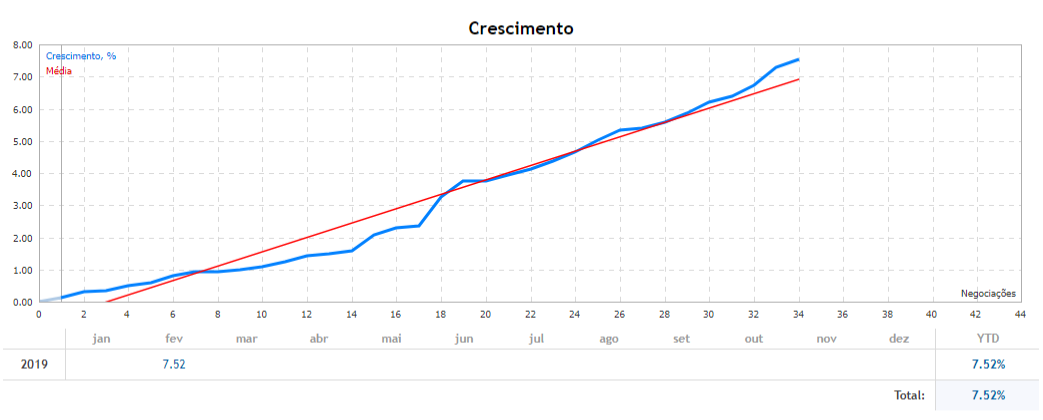

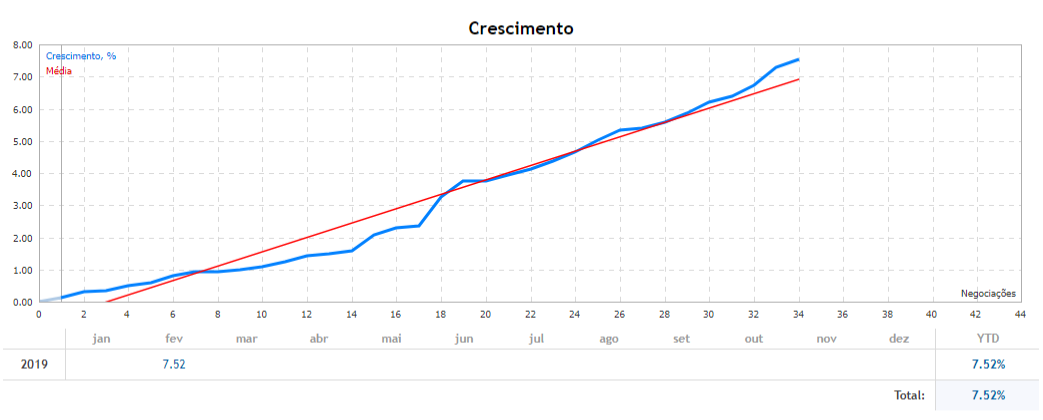

Conta para estudo de estrategias, ótimo desempenho, não copiar pois é uma conta para testar uma nova estratégia que estou desenvolvendo e tem demonstrado grande resultado!

Cleverson Santos

Mais um mês com crescimento consistente, aguardando movimentos de mercado para o mês de junho !! Atitude positiva sempre !!!

Falando sobre o mercado um pouco! Mês de Março tivemos uma grande continuação da principal tendência da Baixa, que nos ofereceu grandes oportunidades! Bem ... para o mês de junho, acho que a tendência continuará na Baixa, mas devemos ter cuidado com o mercado, com um olho na luta comercial EUA / China, e ficar de olho no que acontece na zona do euro !

-------------------------------------------------------------------------------------------------------------------------------------------

Another month with consistent growth, awaiting market movements for the month of June !! Positive attitude always !!!

Talking about the market a little! Month of March we had a great continuation of the main tendency of Baixa, which offered us great opportunities! Well ... for the month of June, I think the trend will continue in Baixa, but we must be careful with the market, with an eye to the US / China trade fight, and keep an eye on what happens in the EUR zone!

Falando sobre o mercado um pouco! Mês de Março tivemos uma grande continuação da principal tendência da Baixa, que nos ofereceu grandes oportunidades! Bem ... para o mês de junho, acho que a tendência continuará na Baixa, mas devemos ter cuidado com o mercado, com um olho na luta comercial EUA / China, e ficar de olho no que acontece na zona do euro !

-------------------------------------------------------------------------------------------------------------------------------------------

Another month with consistent growth, awaiting market movements for the month of June !! Positive attitude always !!!

Talking about the market a little! Month of March we had a great continuation of the main tendency of Baixa, which offered us great opportunities! Well ... for the month of June, I think the trend will continue in Baixa, but we must be careful with the market, with an eye to the US / China trade fight, and keep an eye on what happens in the EUR zone!

Cleverson Santos

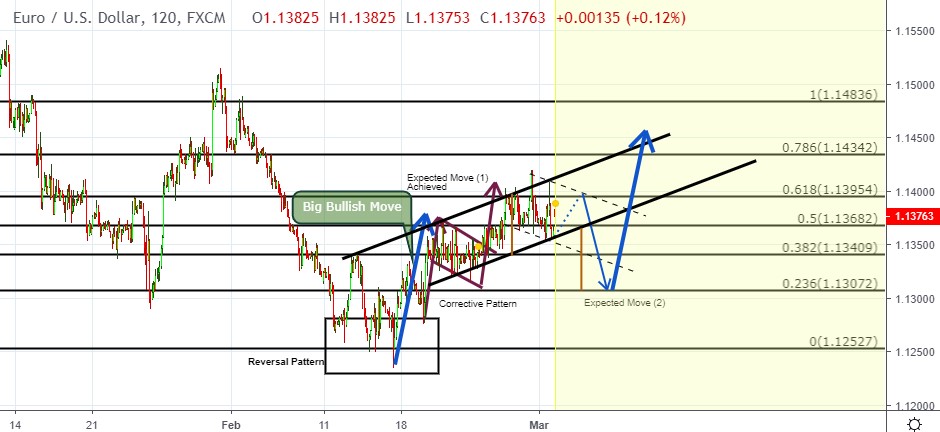

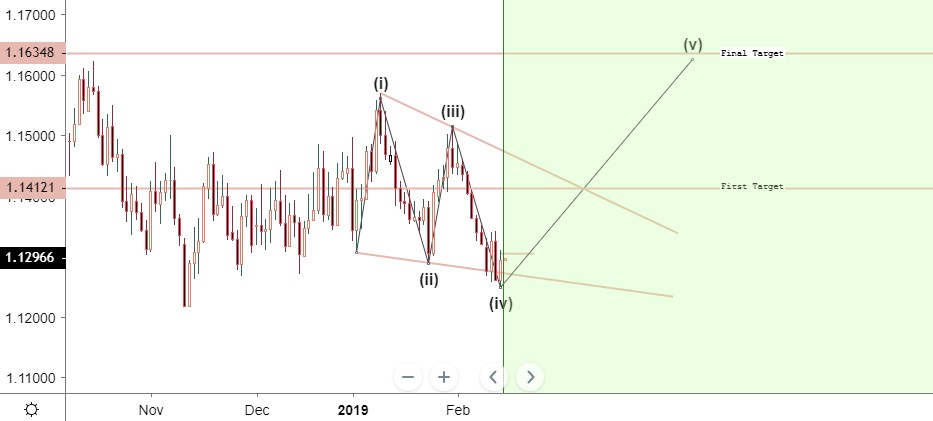

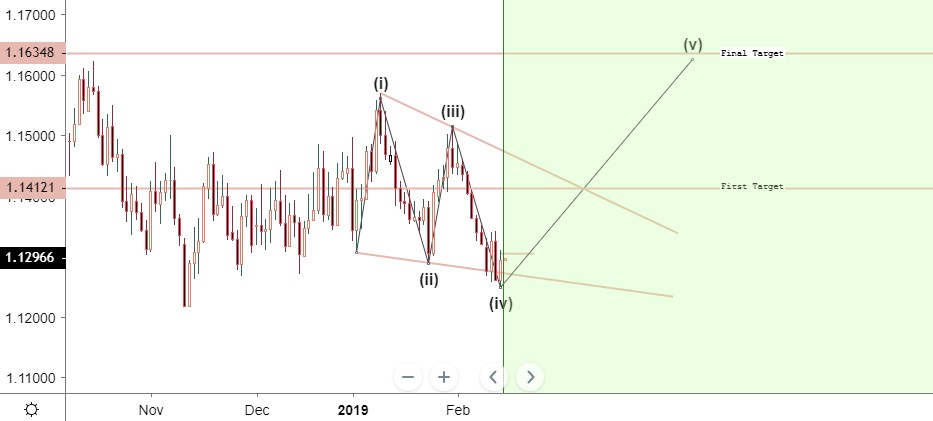

Price has fallen back into strong daily support between 1.29000 - 1.30000. On the above hourly time frame we can clearly see strong rejection to break below this level with perfect wick rejection which could, more or less, be market manipulation to stop hunt early long traders.

Look more clearly at this zone on the monthly time frame...potentially 6 strong wick rejections of this exact zone also coinciding with the previous broken lower high initiating a shift in the previous bearish trend in the long term.

Yes 1.14000 has previously been rejected as resistance but this only gives added fuel to my idea of a valid pullback to the downside to allow big players to obtain greater long entries.

The rest you will have to work out for yourselves... From here we have too potential long entry opportunities. Personally I would prefer price to retest 1.31000 before rallying to my first target of 1.136000 and then if successfully broken all the way up too 1.14000. However, price could also fail to retest 1.31000 and instead rally straight from here.

With all this in mind, it is important to take note of these two targets: 1.136000 & 1.14000.

Enjoy!

Look more clearly at this zone on the monthly time frame...potentially 6 strong wick rejections of this exact zone also coinciding with the previous broken lower high initiating a shift in the previous bearish trend in the long term.

Yes 1.14000 has previously been rejected as resistance but this only gives added fuel to my idea of a valid pullback to the downside to allow big players to obtain greater long entries.

The rest you will have to work out for yourselves... From here we have too potential long entry opportunities. Personally I would prefer price to retest 1.31000 before rallying to my first target of 1.136000 and then if successfully broken all the way up too 1.14000. However, price could also fail to retest 1.31000 and instead rally straight from here.

With all this in mind, it is important to take note of these two targets: 1.136000 & 1.14000.

Enjoy!

Cleverson Santos

EUR/USD is trading below its main SMAs suggesting bearish momentum in the short-term.

1.1290 is a key support and if broken the next significant level becomes the 1.1240 level.

The intraday bear move might be over and bulls can target 1.1310, 1.1350 and 1.1400 figure which can be reached in the coming days.

Overview:

Today Last Price: 1.1296

Today Daily change: -46 pips

Today Daily change %: -0.41%

Today Daily Open: 1.1342

Trends:

Daily SMA20: 1.1339

Daily SMA50: 1.139

Daily SMA100: 1.1385

Daily SMA200: 1.1506

Levels:

Previous Daily High: 1.1388

Previous Daily Low: 1.1309

Previous Weekly High: 1.1422

Previous Weekly Low: 1.1328

Previous Monthly High: 1.1489

Previous Monthly Low: 1.1234

Daily Fibonacci 38.2%: 1.1339

Daily Fibonacci 61.8%: 1.1358

Daily Pivot Point S1: 1.1305

Daily Pivot Point S2: 1.1268

Daily Pivot Point S3: 1.1227

Daily Pivot Point R1: 1.1384

Daily Pivot Point R2: 1.1425

Daily Pivot Point R3: 1.1462

1.1290 is a key support and if broken the next significant level becomes the 1.1240 level.

The intraday bear move might be over and bulls can target 1.1310, 1.1350 and 1.1400 figure which can be reached in the coming days.

Overview:

Today Last Price: 1.1296

Today Daily change: -46 pips

Today Daily change %: -0.41%

Today Daily Open: 1.1342

Trends:

Daily SMA20: 1.1339

Daily SMA50: 1.139

Daily SMA100: 1.1385

Daily SMA200: 1.1506

Levels:

Previous Daily High: 1.1388

Previous Daily Low: 1.1309

Previous Weekly High: 1.1422

Previous Weekly Low: 1.1328

Previous Monthly High: 1.1489

Previous Monthly Low: 1.1234

Daily Fibonacci 38.2%: 1.1339

Daily Fibonacci 61.8%: 1.1358

Daily Pivot Point S1: 1.1305

Daily Pivot Point S2: 1.1268

Daily Pivot Point S3: 1.1227

Daily Pivot Point R1: 1.1384

Daily Pivot Point R2: 1.1425

Daily Pivot Point R3: 1.1462

Cleverson Santos

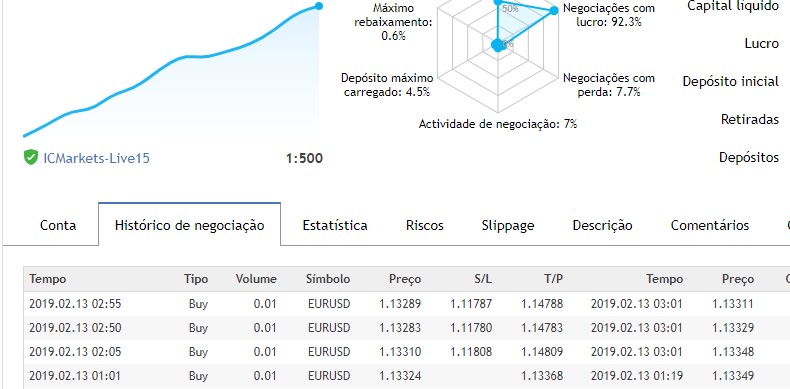

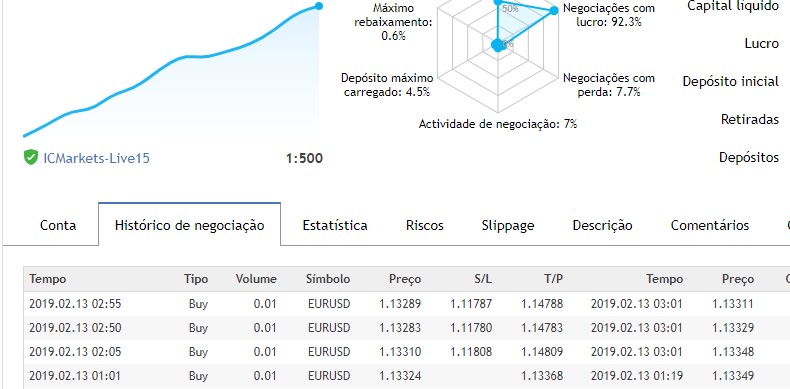

Adequado para todos os corretores de baixo spread com alavancagem de 1:30 a 1: 500

https://www.mql5.com/pt/signals/539166

https://www.mql5.com/pt/signals/539166

Cleverson Santos

EUR/USD finally getting some noticeable reaction from it's structural support.

Therefore, you can set target prices as shown in chart.

Take a look at the volume today coming off tarnished numbers from US data.

We are also witnessing price coming swiftly into value zone. Take caution taking the trade, as we are in overall down trend.

Comment: One big sign of buyers returning is that in past 4 days price attempted to break the same area but couldn't. This means that more and more buyers will come in and sellers will be wary of this area. If you're bear on EUR, I would wait close to 61.8% area of the whole down swing.

Therefore, you can set target prices as shown in chart.

Take a look at the volume today coming off tarnished numbers from US data.

We are also witnessing price coming swiftly into value zone. Take caution taking the trade, as we are in overall down trend.

Comment: One big sign of buyers returning is that in past 4 days price attempted to break the same area but couldn't. This means that more and more buyers will come in and sellers will be wary of this area. If you're bear on EUR, I would wait close to 61.8% area of the whole down swing.

John Brennan

2019.02.16

I think price hit a resistant level around 1.1.300 level. Let's hope this will broken to the upside next week.

Cleverson Santos

Novamente uma Terça Feira Abençoada com lucro constante, pequeno mas constante... objetivo de hj alcançado, estou fora do mercado ate amanha... abraço a todos!!!

Cleverson Santos

labeled in a impulse in Minor C (blue), with Minute I (green) and Minute II (green) complete.

Dollar should go from here, with a violent move on the up-side as the next interpretation.

maybe still test 1.13000 before the buying force enters the market

Dollar should go from here, with a violent move on the up-side as the next interpretation.

maybe still test 1.13000 before the buying force enters the market

Cleverson Santos

O euro está sendo negociado em alta na terça-feira pouco antes da abertura dos EUA, mas devolve cerca de metade de seus ganhos anteriores. O cenário de longo prazo é de baixa para a moeda única, devido ao enfraquecimento da economia da Zona do Euro, que está atrasando sua primeira alta de juros em anos.

No entanto, o euro está desfrutando de uma alta de curto prazo, porque a postura dovish da semana passada pelo presidente do Banco Central Europeu, Mario Draghi, estava totalmente precificada no mercado. Além disso, os comerciantes estão antecipando o Fed a ser dovish na quarta-feira, quando divulga sua decisão de taxa de juros e declaração de política monetária. Isso está ajudando a enfraquecer o dólar americano.

Às 1128 GMT, o EUR / USD está sendo negociado a 1,1432, subindo 0,0006 ou 0,05%.

Diariamente EUR / USD

Mais

Análise Técnica Diária

A tendência principal é baixa de acordo com o gráfico de oscilação diário. No entanto, o momentum está tendendo mais alto. A principal tendência muda para uma negociação em 1,1570. Um movimento em 1.1289 sinalizará uma retomada da tendência de baixa.

A tendência menor está em alta. Isso está controlando o momentum superior. O próximo alvo é o menor em 1.1490.

O intervalo principal é de 1,1570 a 1,1289. O EUR / USD está atualmente sendo negociado dentro de sua zona de retração em 1,1429 a 1,1463. Esta zona está controlando a direção de curto prazo do par de Forex.

No lado positivo, a maior resistência é um nível de 50% em 1,1516. No lado negativo, o suporte menor de 50% é 1.1370.

Previsão Técnica Diária

Com base na ação do preço inicial e no preço atual em 1,1432, a direção do EUR / USD no restante da sessão provavelmente será determinada pela reação do trader ao nível de 50% em 1,1429.

Cenário de alta

Um movimento sustentado sobre 1.1429 indicará a presença de compradores. O primeiro ângulo de objetivo vem em 1,1440. Superar este ângulo indicará que a compra está ficando mais forte. Isso poderia desencadear uma nova recuperação no nível de Fibonacci em 1,1463.

O ponto de partida para uma aceleração ascendente é de 1,1463. Tirar esse nível com convicção pode desencadear um aumento no topo menor em 1,1490, seguido por um ângulo Gann de tendência baixa em 1,1505.

Cenário bearish

A incapacidade de sustentar o início do rally acima de 1,1440 é o primeiro sinal de vendedores. Isso pode ser esperado porque a tendência principal está em baixa. Um movimento sustentado abaixo de 1.1429 poderia conduzir o EUR / USD para o ângulo de Gann de tendência ascendente em 1.1409.

Retirar 1.1409 pode desencadear uma aceleração para baixo com o próximo alvo 1.1370 e então um ângulo Gann de tendência ascendente em 1.1349.

However, the Euro is enjoying a short-term rally because last week’s dovish stance by European Central Bank President Mario Draghi was fully-priced into the market. Furthermore, traders are anticipating the Fed to be dovish on Wednesday when it releases its interest rate decision and monetary policy statement. This is helping to weaken the U.S. Dollar.

At 1128 GMT, the EUR/USD is trading 1.1432, up 0.0006 or +0.05%.

Daily EUR/USD

More

Daily Technical Analysis

The main trend is down according to the daily swing chart. However, momentum is trending higher. The main trend changes to up on a trade through 1.1570. A move through 1.1289 will signal a resumption of the downtrend.

The minor trend is up. This is controlling the upside momentum. The next target is the minor top at 1.1490.

The main range is 1.1570 to 1.1289. The EUR/USD is currently trading inside its retracement zone at 1.1429 to 1.1463. This zone is controlling the near-term direction of the Forex pair.

On the upside, the major resistance is a 50% level at 1.1516. On the downside, the minor 50% support is 1.1370.

Daily Technical Forecast

Based on the early price action and the current price at 1.1432, the direction of the EUR/USD the rest of the session is likely to be determined by trader reaction to the 50% level at 1.1429.

Bullish Scenario

A sustained move over 1.1429 will indicate the presence of buyers. The first target angle comes in at 1.1440. Overcoming this angle will indicate the buying is getting stronger. This could trigger a further rally into the Fibonacci level at 1.1463.

The trigger point for an acceleration to the upside is 1.1463. Taking out this level with conviction could trigger a surge into the minor top at 1.1490, followed by a downtrending Gann angle at 1.1505.

Bearish Scenario

The inability to sustain the early rally over 1.1440 is the first sign of sellers. This could be expected because the main trend is down. A sustained move under 1.1429 could drive the EUR/USD into the uptrending Gann angle at 1.1409.

Taking out 1.1409 could trigger an acceleration to the downside with the next target 1.1370 then an uptrending Gann angle at 1.1349.

No entanto, o euro está desfrutando de uma alta de curto prazo, porque a postura dovish da semana passada pelo presidente do Banco Central Europeu, Mario Draghi, estava totalmente precificada no mercado. Além disso, os comerciantes estão antecipando o Fed a ser dovish na quarta-feira, quando divulga sua decisão de taxa de juros e declaração de política monetária. Isso está ajudando a enfraquecer o dólar americano.

Às 1128 GMT, o EUR / USD está sendo negociado a 1,1432, subindo 0,0006 ou 0,05%.

Diariamente EUR / USD

Mais

Análise Técnica Diária

A tendência principal é baixa de acordo com o gráfico de oscilação diário. No entanto, o momentum está tendendo mais alto. A principal tendência muda para uma negociação em 1,1570. Um movimento em 1.1289 sinalizará uma retomada da tendência de baixa.

A tendência menor está em alta. Isso está controlando o momentum superior. O próximo alvo é o menor em 1.1490.

O intervalo principal é de 1,1570 a 1,1289. O EUR / USD está atualmente sendo negociado dentro de sua zona de retração em 1,1429 a 1,1463. Esta zona está controlando a direção de curto prazo do par de Forex.

No lado positivo, a maior resistência é um nível de 50% em 1,1516. No lado negativo, o suporte menor de 50% é 1.1370.

Previsão Técnica Diária

Com base na ação do preço inicial e no preço atual em 1,1432, a direção do EUR / USD no restante da sessão provavelmente será determinada pela reação do trader ao nível de 50% em 1,1429.

Cenário de alta

Um movimento sustentado sobre 1.1429 indicará a presença de compradores. O primeiro ângulo de objetivo vem em 1,1440. Superar este ângulo indicará que a compra está ficando mais forte. Isso poderia desencadear uma nova recuperação no nível de Fibonacci em 1,1463.

O ponto de partida para uma aceleração ascendente é de 1,1463. Tirar esse nível com convicção pode desencadear um aumento no topo menor em 1,1490, seguido por um ângulo Gann de tendência baixa em 1,1505.

Cenário bearish

A incapacidade de sustentar o início do rally acima de 1,1440 é o primeiro sinal de vendedores. Isso pode ser esperado porque a tendência principal está em baixa. Um movimento sustentado abaixo de 1.1429 poderia conduzir o EUR / USD para o ângulo de Gann de tendência ascendente em 1.1409.

Retirar 1.1409 pode desencadear uma aceleração para baixo com o próximo alvo 1.1370 e então um ângulo Gann de tendência ascendente em 1.1349.

However, the Euro is enjoying a short-term rally because last week’s dovish stance by European Central Bank President Mario Draghi was fully-priced into the market. Furthermore, traders are anticipating the Fed to be dovish on Wednesday when it releases its interest rate decision and monetary policy statement. This is helping to weaken the U.S. Dollar.

At 1128 GMT, the EUR/USD is trading 1.1432, up 0.0006 or +0.05%.

Daily EUR/USD

More

Daily Technical Analysis

The main trend is down according to the daily swing chart. However, momentum is trending higher. The main trend changes to up on a trade through 1.1570. A move through 1.1289 will signal a resumption of the downtrend.

The minor trend is up. This is controlling the upside momentum. The next target is the minor top at 1.1490.

The main range is 1.1570 to 1.1289. The EUR/USD is currently trading inside its retracement zone at 1.1429 to 1.1463. This zone is controlling the near-term direction of the Forex pair.

On the upside, the major resistance is a 50% level at 1.1516. On the downside, the minor 50% support is 1.1370.

Daily Technical Forecast

Based on the early price action and the current price at 1.1432, the direction of the EUR/USD the rest of the session is likely to be determined by trader reaction to the 50% level at 1.1429.

Bullish Scenario

A sustained move over 1.1429 will indicate the presence of buyers. The first target angle comes in at 1.1440. Overcoming this angle will indicate the buying is getting stronger. This could trigger a further rally into the Fibonacci level at 1.1463.

The trigger point for an acceleration to the upside is 1.1463. Taking out this level with conviction could trigger a surge into the minor top at 1.1490, followed by a downtrending Gann angle at 1.1505.

Bearish Scenario

The inability to sustain the early rally over 1.1440 is the first sign of sellers. This could be expected because the main trend is down. A sustained move under 1.1429 could drive the EUR/USD into the uptrending Gann angle at 1.1409.

Taking out 1.1409 could trigger an acceleration to the downside with the next target 1.1370 then an uptrending Gann angle at 1.1349.

Cleverson Santos

O EUR / USD pode ter surpreendido a maioria dos comerciantes pessimistas na sexta-feira, tendo realizado um impressionante rali superior a 120 pips, a partir de 1.1289. Ele ainda está sendo negociado confortavelmente acima da marca de 1,1400, mas recuos de curto prazo talvez devidos. O gráfico diário também produziu um padrão de velas da Engulfing Bullish , indicando uma possível mudança de direção a partir de agora. Observando a estrutura das ondas em um grau mais alto, o plano expandido ainda permanece intacto, com preços acima de 1.1218. Uma onda para níveis 1.1800 / 20 parece ser mais provável com a recente ação de preço desenvolvida na sexta-feira. No geral, o EURUSD permanece alta até que os preços permaneçam acima de 1.1289 níveis daqui em diante.

The EUR / USD may have surprised most pessimistic traders on Friday, having held an impressive rally above 120 pips, from 1.1289. It is still trading comfortably above the 1.1400 mark, but short-term setbacks maybe due. The daily chart also produced an Engulfing Bullish candle pattern, indicating a possible change of direction from now on. Observing the structure of the waves at a higher degree, the expanded plane still remains intact, with prices above 1.1218. A spike to levels 1.1800 / 20 appears to be more likely with the recent price action taken on Friday. Overall, the EURUSD remains high until prices remain above 1,1289 levels from now on.

The EUR / USD may have surprised most pessimistic traders on Friday, having held an impressive rally above 120 pips, from 1.1289. It is still trading comfortably above the 1.1400 mark, but short-term setbacks maybe due. The daily chart also produced an Engulfing Bullish candle pattern, indicating a possible change of direction from now on. Observing the structure of the waves at a higher degree, the expanded plane still remains intact, with prices above 1.1218. A spike to levels 1.1800 / 20 appears to be more likely with the recent price action taken on Friday. Overall, the EURUSD remains high until prices remain above 1,1289 levels from now on.

: