Enrique Enguix / Profile

- Information

|

5+ years

experience

|

2

products

|

8089

demo versions

|

|

0

jobs

|

2

signals

|

0

subscribers

|

I automate trading strategies in MetaTrader 5 (MQL5).

My job is to use algorithms to generate and validate approaches that are robust and profitable, but often not obvious to others.

| All our Expert Advisors: https://www.mql5.com/en/users/envex/seller

| New MQL5 Group: https://www.mql5.com/en/messages/01c72081307dda01

| Telegram Channel: https://t.me/+Jwdm825813I1Nzk0

| NEXUS HUB | Guide, Sets, FAQ & Support: https://www.mql5.com/en/blogs/post/764411

My job is to use algorithms to generate and validate approaches that are robust and profitable, but often not obvious to others.

| All our Expert Advisors: https://www.mql5.com/en/users/envex/seller

| New MQL5 Group: https://www.mql5.com/en/messages/01c72081307dda01

| Telegram Channel: https://t.me/+Jwdm825813I1Nzk0

| NEXUS HUB | Guide, Sets, FAQ & Support: https://www.mql5.com/en/blogs/post/764411

Friends

3850

Requests

Outgoing

Enrique Enguix

📢 NEW! NEXUS Trial Version Available on the HUB

A trial version of NEXUS is now available, designed for easy and risk-free testing.

👉 It comes pre-loaded with a set very similar to the classic version, ideal for testing how the system works without the need for advanced configurations.

🔹 Instrument: EURUSD (automatic prefix/suffix detection)

🔹 First order: fixed at 0.01 lots

🔹 Grid: normal configuration (no changes)

🔹 Valid until: December 31, 2025 (server time)

⚙️ You can download it directly from the HUB, in the downloads section. It's available now!

| NEXUS HUB | Guide, Sets, FAQ & Support: https://www.mql5.com/en/blogs/post/764411

A trial version of NEXUS is now available, designed for easy and risk-free testing.

👉 It comes pre-loaded with a set very similar to the classic version, ideal for testing how the system works without the need for advanced configurations.

🔹 Instrument: EURUSD (automatic prefix/suffix detection)

🔹 First order: fixed at 0.01 lots

🔹 Grid: normal configuration (no changes)

🔹 Valid until: December 31, 2025 (server time)

⚙️ You can download it directly from the HUB, in the downloads section. It's available now!

| NEXUS HUB | Guide, Sets, FAQ & Support: https://www.mql5.com/en/blogs/post/764411

Enrique Enguix

Nexus opened two trades, but no new ones are appearing even though the grid distance has been exceeded. That’s intentional. Nexus is not random — it uses controlled mechanisms, not roulette logic.

In this conservative set, the grid only activates after **four trades** have been opened by standard entry conditions (the base strategies). Until then, grid averaging is disabled.

Right now, either the price must rise, or additional valid entries must appear to complete the initial four trades. Only then will the grid logic engage to average profit.

It’s a conservative setup. I don’t mind if profits take a few days — what matters is preserving the account.

In this conservative set, the grid only activates after **four trades** have been opened by standard entry conditions (the base strategies). Until then, grid averaging is disabled.

Right now, either the price must rise, or additional valid entries must appear to complete the initial four trades. Only then will the grid logic engage to average profit.

It’s a conservative setup. I don’t mind if profits take a few days — what matters is preserving the account.

Enrique Enguix

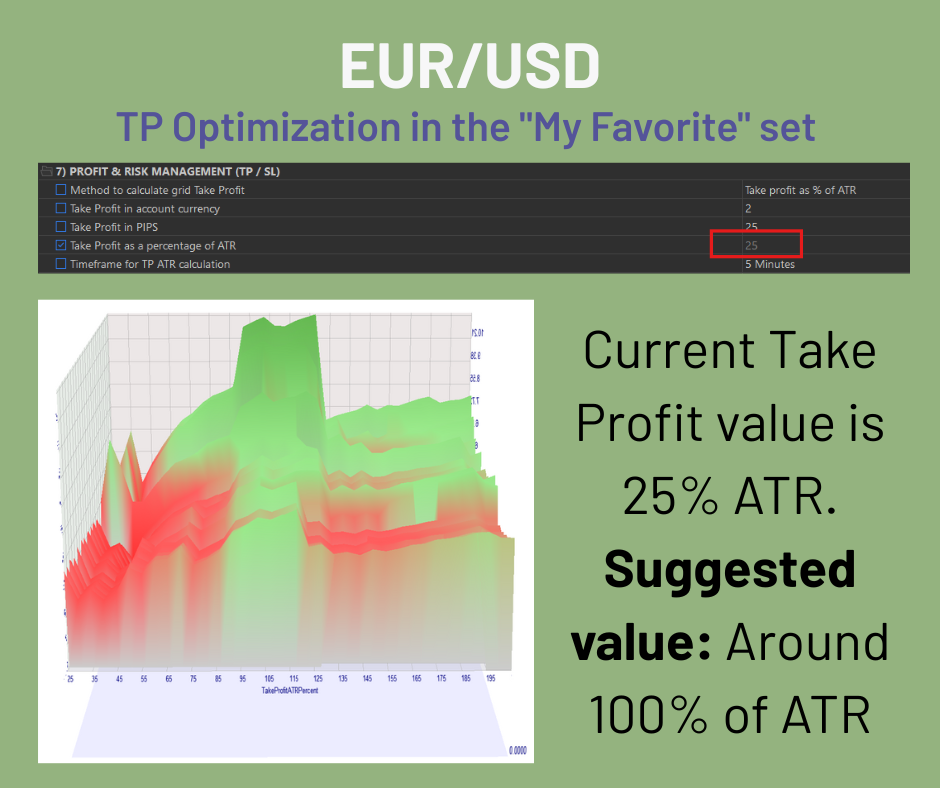

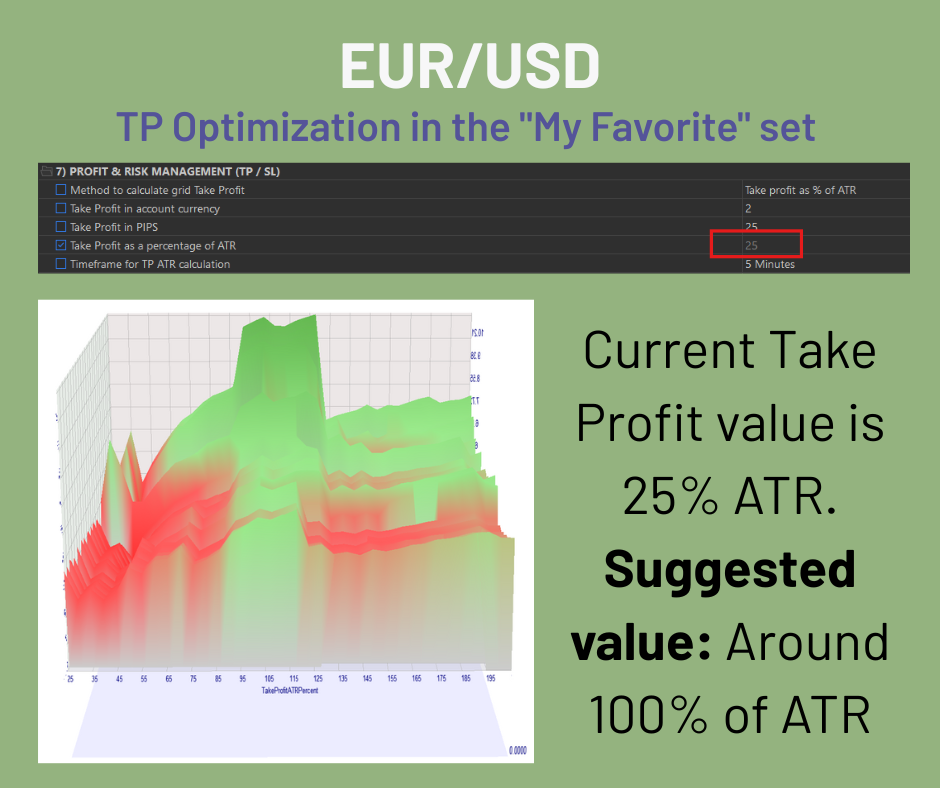

Following up on yesterday’s explanation, I ran an optimization of the “My Favourite” set — a process I’ll be applying to the other sets as well.

The original Take Profit was relatively low, and a significant portion of profit was being lost to swaps and commissions. It was set at 25% of the ATR. To refine it, I ran a 3D optimization (since 2D didn’t show the relationships clearly).

X-axis: Take Profit from 25% to 200% ATR.

Y-axis: backtest start delay from 0 to 2000 days, in 50-day increments (50 different start dates).

The most robust area emerged around 100% ATR. I’ll be testing this configuration to confirm its consistency.

Development is ongoing — every day brings small improvements. It will never be perfect, but the goal is to make it consistently good enough.

If this change turns out to be a real step forward, it will be uploaded

The original Take Profit was relatively low, and a significant portion of profit was being lost to swaps and commissions. It was set at 25% of the ATR. To refine it, I ran a 3D optimization (since 2D didn’t show the relationships clearly).

X-axis: Take Profit from 25% to 200% ATR.

Y-axis: backtest start delay from 0 to 2000 days, in 50-day increments (50 different start dates).

The most robust area emerged around 100% ATR. I’ll be testing this configuration to confirm its consistency.

Development is ongoing — every day brings small improvements. It will never be perfect, but the goal is to make it consistently good enough.

If this change turns out to be a real step forward, it will be uploaded

Enrique Enguix

“I won’t lie to you — I was expecting solid results.

But what’s happening with the Gold Set… it’s honestly blowing me away.”

When I built this setup for NEXUS, I spent hours fine-tuning every detail.

Backtests over several years.

Thousands of trades.

And the stats were clear:

91.37% win rate on shorts

93.13% on longs

Fast trades, low exposure, sniper-like entries.

So yeah, I knew it was strong.

But seeing real users report 100% winning trades week after week…

That still hit different.

What’s wild is: it’s not just one user.

It's happening across different accounts, brokers, setups — and the consistency is insane.

This isn’t magic.

It’s not a “holy grail.”

But it’s a system built to enter where it matters and exit before things go sideways.

Will it lose someday?

Of course.

This is trading — not a fairy tale.

But seeing the community validate it like this…

It reminds me why I built NEXUS in the first place:

To deliver a real tool for real traders.

Without hype. Without shortcuts. Without BS.

Just precision.

And results.

https://www.mql5.com/en/market/product/90877

But what’s happening with the Gold Set… it’s honestly blowing me away.”

When I built this setup for NEXUS, I spent hours fine-tuning every detail.

Backtests over several years.

Thousands of trades.

And the stats were clear:

91.37% win rate on shorts

93.13% on longs

Fast trades, low exposure, sniper-like entries.

So yeah, I knew it was strong.

But seeing real users report 100% winning trades week after week…

That still hit different.

What’s wild is: it’s not just one user.

It's happening across different accounts, brokers, setups — and the consistency is insane.

This isn’t magic.

It’s not a “holy grail.”

But it’s a system built to enter where it matters and exit before things go sideways.

Will it lose someday?

Of course.

This is trading — not a fairy tale.

But seeing the community validate it like this…

It reminds me why I built NEXUS in the first place:

To deliver a real tool for real traders.

Without hype. Without shortcuts. Without BS.

Just precision.

And results.

https://www.mql5.com/en/market/product/90877

: