Enrique Enguix / Profilo

- Informazioni

|

4 anni

esperienza

|

4

prodotti

|

3637

versioni demo

|

|

0

lavori

|

5

segnali

|

0

iscritti

|

Maker of Winners

al

Trading

I don't sell dreams, shortcuts, or nonsense. If you're still losing money in the market, the problem isn't the bots or the charts—it's you. But don't worry, we don't judge here; we fix.

📈 ALL OUR SIGNALS: https://www.mql5.com/en/signals/author/envex

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

⚠️ NEW MQL5 GROUP: https://www.mql5.com/en/messages/01c72081307dda01

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

If you feel that you don't know even the most basic things, start here: https://www.mql5.com/en/blogs/post/761104

📈 ALL OUR SIGNALS: https://www.mql5.com/en/signals/author/envex

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

⚠️ NEW MQL5 GROUP: https://www.mql5.com/en/messages/01c72081307dda01

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

If you feel that you don't know even the most basic things, start here: https://www.mql5.com/en/blogs/post/761104

Amici

3705

Richieste

In uscita

Enrique Enguix

They traded the office for the charts…

and now they’re slaves to their own freedom.

I’m not speaking abstractly.

Last Sunday, I helped a neighbor hang a shelf.

Coffee, screws that didn’t fit, a drill with no battery… and one of those chats that seem like nothing.

But in a moment, while I was holding the wood with my knee, he said this:

—“Sometimes I wonder if all of this… the house, the car, the job… I don’t know if I want it or if it was just the default path.”

There it is.

The sentence.

The one no one says out loud, but everyone feels.

Even you.

I know because I’ve seen it in dozens of traders:

People who didn’t come here just for the money.

They came for something harder to explain:

Control. Freedom. Life.

But they ended up glued to a screen.

From boss to chart.

From 9 to 5 to 24/7.

No schedule. No structure. No peace.

And that, my friend, is not freedom.

That’s building a shelf with parts that don’t fit.

Eventually, it crashes on you.

That’s why I built automated systems.

Not to sell the “make money while you sleep” story,

but to actually sleep, for fuck’s sake.

NODE is the first step.

Free.

Simple.

No magic.

But it comes with one promise: that you start regaining control without losing your mind.

You don’t trade. It trades.

And you reclaim your time.

Does it work? Try it.

And if it sparks your curiosity, your hunger, your drive for more…

then AXIS, LINK, and NEXUS will be waiting.

But it all starts here.

With that itch of doubt, even when everything seems “fine.”

And the decision not to stay where most people give up.

Download NODE.

And start breaking the fucking loop.

https://www.mql5.com/en/users/envex/seller

and now they’re slaves to their own freedom.

I’m not speaking abstractly.

Last Sunday, I helped a neighbor hang a shelf.

Coffee, screws that didn’t fit, a drill with no battery… and one of those chats that seem like nothing.

But in a moment, while I was holding the wood with my knee, he said this:

—“Sometimes I wonder if all of this… the house, the car, the job… I don’t know if I want it or if it was just the default path.”

There it is.

The sentence.

The one no one says out loud, but everyone feels.

Even you.

I know because I’ve seen it in dozens of traders:

People who didn’t come here just for the money.

They came for something harder to explain:

Control. Freedom. Life.

But they ended up glued to a screen.

From boss to chart.

From 9 to 5 to 24/7.

No schedule. No structure. No peace.

And that, my friend, is not freedom.

That’s building a shelf with parts that don’t fit.

Eventually, it crashes on you.

That’s why I built automated systems.

Not to sell the “make money while you sleep” story,

but to actually sleep, for fuck’s sake.

NODE is the first step.

Free.

Simple.

No magic.

But it comes with one promise: that you start regaining control without losing your mind.

You don’t trade. It trades.

And you reclaim your time.

Does it work? Try it.

And if it sparks your curiosity, your hunger, your drive for more…

then AXIS, LINK, and NEXUS will be waiting.

But it all starts here.

With that itch of doubt, even when everything seems “fine.”

And the decision not to stay where most people give up.

Download NODE.

And start breaking the fucking loop.

https://www.mql5.com/en/users/envex/seller

Enrique Enguix

There’s one thing that hits especially hard for men in their thirties:

seeing someone dumber, lazier, or clumsier than you... absolutely killing it.

You don’t envy them.

But it burns.

Because you’re grinding. Learning. Optimizing every detail.

And this other guy?

Sleepwalking his way to more money than you make in a quarter.

And you start asking yourself: What the hell am I doing wrong?

It’s not that you don’t know enough.

You’ve read. Backtested. Tweaked settings. Built systems.

But something invisible is blocking you.

You can feel it.

Like there’s a ceiling you just can’t crack.

Meanwhile, people you’d never trust to microwave popcorn...

are building accounts. Growing. Winning.

That’s when it hit me:

The problem isn’t your system.

The problem is that your system has no system.

Yes, it works.

But it has no structure. No spine. No direction.

You’re layering tools on top of tools without a core.

Executing without an engine.

And that’s why it doesn’t scale.

That’s why it feels fragile.

I’ve been there.

I had bots running.

Optimized inputs.

All the fancy tech.

And still... it felt like rolling dice.

Until I stopped asking what more can I add

and started asking what do I need to remove so this thing actually flows?

I’m not here to pitch you anything.

Just to drop this idea:

Sometimes, the guy winning isn’t smarter.

He just built something with bones.

A process.

A logic.

A method that doesn’t depend on being right — just on showing up with structure.

So next time you see some clown outperforming you,

don’t get angry.

Get curious.

Ask yourself:

What the hell did he figure out that I’m still missing?

https://www.mql5.com/en/users/envex/seller

seeing someone dumber, lazier, or clumsier than you... absolutely killing it.

You don’t envy them.

But it burns.

Because you’re grinding. Learning. Optimizing every detail.

And this other guy?

Sleepwalking his way to more money than you make in a quarter.

And you start asking yourself: What the hell am I doing wrong?

It’s not that you don’t know enough.

You’ve read. Backtested. Tweaked settings. Built systems.

But something invisible is blocking you.

You can feel it.

Like there’s a ceiling you just can’t crack.

Meanwhile, people you’d never trust to microwave popcorn...

are building accounts. Growing. Winning.

That’s when it hit me:

The problem isn’t your system.

The problem is that your system has no system.

Yes, it works.

But it has no structure. No spine. No direction.

You’re layering tools on top of tools without a core.

Executing without an engine.

And that’s why it doesn’t scale.

That’s why it feels fragile.

I’ve been there.

I had bots running.

Optimized inputs.

All the fancy tech.

And still... it felt like rolling dice.

Until I stopped asking what more can I add

and started asking what do I need to remove so this thing actually flows?

I’m not here to pitch you anything.

Just to drop this idea:

Sometimes, the guy winning isn’t smarter.

He just built something with bones.

A process.

A logic.

A method that doesn’t depend on being right — just on showing up with structure.

So next time you see some clown outperforming you,

don’t get angry.

Get curious.

Ask yourself:

What the hell did he figure out that I’m still missing?

https://www.mql5.com/en/users/envex/seller

Enrique Enguix

Last week, I saw something in a coffee shop that stuck with me.

A guy ordered a coffee… and sent it back three times.

— “Could you make it a bit stronger?”

— “This one has too much foam.”

— “Sorry… could it be a little less hot?”

He sounded like he was ordering an algorithm, not a coffee.

I kept watching.

Not because of the coffee — but because of what was *behind* it.

The guy didn’t really want coffee. He wanted the exact experience he had in his head.

And if the real world didn’t match his vision… he got annoyed. He complained. He sent it back.

It reminded me of a lot of traders.

The ones who enter the market chasing “the perfect trade.”

A surgical entry. The perfectly timed take profit. The system that never fails.

But here’s an uncomfortable truth no one wants to hear:

The perfect coffee doesn’t exist. Neither does the perfect trade.

That guy didn’t even know what he wanted… until he *didn’t* get it.

And in trading, it’s the same.

Most people don’t really know what they’re looking for.

They just know they don’t want to lose.

But when a drawdown hits — or a trade doesn’t match their fantasy —

They send it back. They switch EAs. They tweak settings. “This strategy isn’t working anymore.”

And so, they never stick with anything. Just endless loops of frustration and tweaking.

I’ve been there too.

I spent years fine-tuning imaginary coffees.

Tinkering with settings every two weeks.

Chasing that “ideal setup” that would finally give me peace of mind.

Until I realized… this game isn’t about micromanaging every sip.

It’s about having a system that works over time — even if some days the taste isn’t great.

A logical EA. With clear rules. With data.

Not gut feelings or Monday-morning moods.

That’s why I built NODE.

No magic.

No unicorn-flavored espresso.

Just a free EA that filters noise with a neural network and manages risk for you.

Optimized for EUR/USD only. No crazy profit promises.

The best part?

It forces you to start thinking like a real trader from day one.

You can’t tinker with it every 5 minutes. It’s not a toy — it’s a system.

And if it works for you, there’s a whole ladder you can climb.

But first: learn to stop sending the coffee back.

That guy at the café eventually drank the third coffee reluctantly.

Was it good?

Who knows.

But he’d already turned a 10-minute break into a slow torture session.

Do yourself a favor:

Stop chasing perfect coffee. Start making decisions you can actually stick with.

NODE is here: https://www.mql5.com/en/users/envex/seller

And yeah… people still install it, see that it doesn’t perform miracles… and delete it in three days.

As if the barista was the problem.

A guy ordered a coffee… and sent it back three times.

— “Could you make it a bit stronger?”

— “This one has too much foam.”

— “Sorry… could it be a little less hot?”

He sounded like he was ordering an algorithm, not a coffee.

I kept watching.

Not because of the coffee — but because of what was *behind* it.

The guy didn’t really want coffee. He wanted the exact experience he had in his head.

And if the real world didn’t match his vision… he got annoyed. He complained. He sent it back.

It reminded me of a lot of traders.

The ones who enter the market chasing “the perfect trade.”

A surgical entry. The perfectly timed take profit. The system that never fails.

But here’s an uncomfortable truth no one wants to hear:

The perfect coffee doesn’t exist. Neither does the perfect trade.

That guy didn’t even know what he wanted… until he *didn’t* get it.

And in trading, it’s the same.

Most people don’t really know what they’re looking for.

They just know they don’t want to lose.

But when a drawdown hits — or a trade doesn’t match their fantasy —

They send it back. They switch EAs. They tweak settings. “This strategy isn’t working anymore.”

And so, they never stick with anything. Just endless loops of frustration and tweaking.

I’ve been there too.

I spent years fine-tuning imaginary coffees.

Tinkering with settings every two weeks.

Chasing that “ideal setup” that would finally give me peace of mind.

Until I realized… this game isn’t about micromanaging every sip.

It’s about having a system that works over time — even if some days the taste isn’t great.

A logical EA. With clear rules. With data.

Not gut feelings or Monday-morning moods.

That’s why I built NODE.

No magic.

No unicorn-flavored espresso.

Just a free EA that filters noise with a neural network and manages risk for you.

Optimized for EUR/USD only. No crazy profit promises.

The best part?

It forces you to start thinking like a real trader from day one.

You can’t tinker with it every 5 minutes. It’s not a toy — it’s a system.

And if it works for you, there’s a whole ladder you can climb.

But first: learn to stop sending the coffee back.

That guy at the café eventually drank the third coffee reluctantly.

Was it good?

Who knows.

But he’d already turned a 10-minute break into a slow torture session.

Do yourself a favor:

Stop chasing perfect coffee. Start making decisions you can actually stick with.

NODE is here: https://www.mql5.com/en/users/envex/seller

And yeah… people still install it, see that it doesn’t perform miracles… and delete it in three days.

As if the barista was the problem.

Enrique Enguix

My neighbor just got a 30-year mortgage… for a barbecue.

I swear.

He doesn’t care about the house. What he really wanted was a patch of fake grass, a shiny chrome grill, and a table where he could host Sunday BBQs with his friends.

I knew it the second he said:

“Man, I can already see myself there with a beer, watching those ribs cook…”

Not a word about the variable interest rate, notary fees, or the 300,000 euros he just signed for like it was pocket change.

And it got me thinking.

Because he’s not the only one.

Most people don’t buy homes. They buy the fantasy of what they think they’ll feel once they have it.

Like the guy who signs up for the gym because he imagines his six-pack… but never actually shows up.

Or the trader who enters the market dreaming of that epic winning trade… but panics the second things go south.

You know what they all have in common?

They’re not ready for what it *really* takes to get what they say they want.

And in trading, that’s deadly.

Because a lot of people get in for the idea of freedom, of “working from home,” of “being your own boss”…

But they can’t survive even a week when the system hits drawdown.

They start second-guessing. Tinkering. Overtrading. “Trying something I saw on YouTube.”

They become the guy with the barbecue dream… but no house. No plan. No structure. Just vibes and smoke.

I used to be that guy too.

I fell in love with the idea. But I didn’t understand the cycles, the stats, the risk control… or the value of sticking to a system with logic, even when the weeks got tough.

It took time to get it.

Now I know: the ones who make it in this game aren’t the smartest. They’re the ones who can go through the process without betraying it every time it gets uncomfortable.

The ones who don’t need a barbecue fantasy to justify the investment.

That’s why I talk so much about systems that aren’t driven by emotion. That don’t bend every time the wind changes.

I don’t sell dreams.

I share what lets me show up every day without having a heart attack every time the market throws a tantrum.

Automated strategies that work with rules. With logic. With control.

No magic. No promises. Just *operational reality*.

Because if you’re going to mortgage your future for something, make damn sure it’s not just a fantasy.

My neighbor still hasn’t used the barbecue.

Not once.

But guess what… he’s already complaining about the mortgage.

Up to you what you invest in.

I swear.

He doesn’t care about the house. What he really wanted was a patch of fake grass, a shiny chrome grill, and a table where he could host Sunday BBQs with his friends.

I knew it the second he said:

“Man, I can already see myself there with a beer, watching those ribs cook…”

Not a word about the variable interest rate, notary fees, or the 300,000 euros he just signed for like it was pocket change.

And it got me thinking.

Because he’s not the only one.

Most people don’t buy homes. They buy the fantasy of what they think they’ll feel once they have it.

Like the guy who signs up for the gym because he imagines his six-pack… but never actually shows up.

Or the trader who enters the market dreaming of that epic winning trade… but panics the second things go south.

You know what they all have in common?

They’re not ready for what it *really* takes to get what they say they want.

And in trading, that’s deadly.

Because a lot of people get in for the idea of freedom, of “working from home,” of “being your own boss”…

But they can’t survive even a week when the system hits drawdown.

They start second-guessing. Tinkering. Overtrading. “Trying something I saw on YouTube.”

They become the guy with the barbecue dream… but no house. No plan. No structure. Just vibes and smoke.

I used to be that guy too.

I fell in love with the idea. But I didn’t understand the cycles, the stats, the risk control… or the value of sticking to a system with logic, even when the weeks got tough.

It took time to get it.

Now I know: the ones who make it in this game aren’t the smartest. They’re the ones who can go through the process without betraying it every time it gets uncomfortable.

The ones who don’t need a barbecue fantasy to justify the investment.

That’s why I talk so much about systems that aren’t driven by emotion. That don’t bend every time the wind changes.

I don’t sell dreams.

I share what lets me show up every day without having a heart attack every time the market throws a tantrum.

Automated strategies that work with rules. With logic. With control.

No magic. No promises. Just *operational reality*.

Because if you’re going to mortgage your future for something, make damn sure it’s not just a fantasy.

My neighbor still hasn’t used the barbecue.

Not once.

But guess what… he’s already complaining about the mortgage.

Up to you what you invest in.

Enrique Enguix

I once met a guy who tattooed his ex’s name... twice.

First on his forearm.

Then, right over the first one, to “fix it.”

He didn’t tell me like it was a drama.

He said it like someone talks about the weather:

“Yeah, I messed up… and then messed up again trying to fix it.”

And the worst part wasn’t the tattoo.

The worst part?

He still believed it was her fault.

---

Some people —and some traders too, while we’re at it— have this wild obsession with repeating the same mistakes, expecting things to magically work out.

First, they trade with no plan. Just vibes and little hearts on TradingView. They lose.

Then they try to “fix it” by watching a few YouTube videos or copying signals from some guy whose real name they don’t even know. They lose again.

And of course, it’s the market’s fault.

Or the EA.

Or the broker.

Or inflation.

Or Putin.

Never their own damn process.

Sound familiar?

---

That tattoo guy stuck in my head for days.

Because it’s the same thing I see every day in traders who won’t face one simple truth:

What’s not built with logic gets repeated with pain.

If you don’t have a system —a real one, tested, measurable, emotion-free—

you’ll keep tattooing the same mistakes on your trading account, again and again.

And the more it hurts, the more you’ll defend it.

Because admitting it failed means admitting you failed.

---

Been there.

Blew up accounts with “almost working” setups.

Wasted weeks tweaking indicators I barely understood.

Stared at trades like a cult member waiting for signs from the Fibonacci gods.

Until I’d had enough.

That’s when I started working with real data-driven systems.

No hunches. No hope. No bullshit.

First to stop being an idiot. Then to start trading like someone who means it.

---

That’s why I built NEXUS EA.

An algorithmic trading system with 9 integrated strategies, advanced filters, institutional-grade risk management, and 1-on-1 support.

It’s not for everyone.

And it’s not trying to be.

It’s for traders who’ve outgrown the training wheels and are ready to play this game for real.

NEXUS doesn’t do miracles.

It just does what you should be doing… without emotion.

---

I never saw the tattoo guy again.

I’d like to think he got it removed. Or that he learned something.

But knowing human nature… he’s probably getting ready to tattoo his new girlfriend’s name.

The difference between him and you is that you can choose not to keep marking yourself with the same old mistakes.

Think about that… while your account bleeds again tomorrow.

Or do what serious traders do: run with NEXUS.

And start taking this seriously.

https://www.mql5.com/en/market/product/90877

First on his forearm.

Then, right over the first one, to “fix it.”

He didn’t tell me like it was a drama.

He said it like someone talks about the weather:

“Yeah, I messed up… and then messed up again trying to fix it.”

And the worst part wasn’t the tattoo.

The worst part?

He still believed it was her fault.

---

Some people —and some traders too, while we’re at it— have this wild obsession with repeating the same mistakes, expecting things to magically work out.

First, they trade with no plan. Just vibes and little hearts on TradingView. They lose.

Then they try to “fix it” by watching a few YouTube videos or copying signals from some guy whose real name they don’t even know. They lose again.

And of course, it’s the market’s fault.

Or the EA.

Or the broker.

Or inflation.

Or Putin.

Never their own damn process.

Sound familiar?

---

That tattoo guy stuck in my head for days.

Because it’s the same thing I see every day in traders who won’t face one simple truth:

What’s not built with logic gets repeated with pain.

If you don’t have a system —a real one, tested, measurable, emotion-free—

you’ll keep tattooing the same mistakes on your trading account, again and again.

And the more it hurts, the more you’ll defend it.

Because admitting it failed means admitting you failed.

---

Been there.

Blew up accounts with “almost working” setups.

Wasted weeks tweaking indicators I barely understood.

Stared at trades like a cult member waiting for signs from the Fibonacci gods.

Until I’d had enough.

That’s when I started working with real data-driven systems.

No hunches. No hope. No bullshit.

First to stop being an idiot. Then to start trading like someone who means it.

---

That’s why I built NEXUS EA.

An algorithmic trading system with 9 integrated strategies, advanced filters, institutional-grade risk management, and 1-on-1 support.

It’s not for everyone.

And it’s not trying to be.

It’s for traders who’ve outgrown the training wheels and are ready to play this game for real.

NEXUS doesn’t do miracles.

It just does what you should be doing… without emotion.

---

I never saw the tattoo guy again.

I’d like to think he got it removed. Or that he learned something.

But knowing human nature… he’s probably getting ready to tattoo his new girlfriend’s name.

The difference between him and you is that you can choose not to keep marking yourself with the same old mistakes.

Think about that… while your account bleeds again tomorrow.

Or do what serious traders do: run with NEXUS.

And start taking this seriously.

https://www.mql5.com/en/market/product/90877

Enrique Enguix

Today’s not about selling. It’s about saying what no one else seems to be saying.

We’ve just had two straight days where trillions of dollar vanished from global markets.

And no — this isn’t a “healthy correction”. It’s a serious shake-up.

Wall Street is crashing.

Europe is deep in the red.

Banks are down over 10%.

Oil’s dropped nearly 8%.

Nasdaq and S&P just logged their worst sessions since 2020.

And the scariest part? Most people are acting like nothing’s happening.

This isn’t just a headline.

It’s not an isolated event some EA can dodge with a news filter.

This is a slow-moving storm that goes way beyond charts and technicals.

This isn’t measured in pips.

It’s measured in fear. In uncertainty. In systemic risk.

Expert advisors like NEXUS or AXIS do their job.

They apply logic when the market loses it.

But even they have limits.

Because no code can fully shield you when the world decides calm is optional.

So today,

No talk of backtests. No sales pitch.

Just this, as a reminder:

What’s happening right now is serious.

And pretending it’s not… is still a choice.

We’ve just had two straight days where trillions of dollar vanished from global markets.

And no — this isn’t a “healthy correction”. It’s a serious shake-up.

Wall Street is crashing.

Europe is deep in the red.

Banks are down over 10%.

Oil’s dropped nearly 8%.

Nasdaq and S&P just logged their worst sessions since 2020.

And the scariest part? Most people are acting like nothing’s happening.

This isn’t just a headline.

It’s not an isolated event some EA can dodge with a news filter.

This is a slow-moving storm that goes way beyond charts and technicals.

This isn’t measured in pips.

It’s measured in fear. In uncertainty. In systemic risk.

Expert advisors like NEXUS or AXIS do their job.

They apply logic when the market loses it.

But even they have limits.

Because no code can fully shield you when the world decides calm is optional.

So today,

No talk of backtests. No sales pitch.

Just this, as a reminder:

What’s happening right now is serious.

And pretending it’s not… is still a choice.

Enrique Enguix

"This is the biggest shift in global trade in 100 years."

I didn't say that. George Saravelos, Head of FX at Deutsche Bank, did.

And you know what’s really crazy?

He's right.

Trump just flipped the entire economic gameboard with a move no one (not even Wall Street) saw coming:

Base tariffs of 10%, 54% on China, 46% on Vietnam, 24% on Japan… and the list goes on.

The result?

Dollar collapse, stock markets crashing, and gold hitting all-time highs.

But here’s what nobody’s saying — and what we should be talking about:

When global trade gets distorted like this, the FX market becomes the arena where real power is defined.

That’s where we come in.

Because while the world panics, traders who understand the logic behind the chaos... can ride waves we haven’t seen in decades.

But not with magic formulas.

With tools that read the market, adapt to volatility, and ride these storms like pros.

Does that make sense?

Do whatever you want with this info…

But remember: expert advisors don’t sleep. And in this new order, that matters more than ever.

I didn't say that. George Saravelos, Head of FX at Deutsche Bank, did.

And you know what’s really crazy?

He's right.

Trump just flipped the entire economic gameboard with a move no one (not even Wall Street) saw coming:

Base tariffs of 10%, 54% on China, 46% on Vietnam, 24% on Japan… and the list goes on.

The result?

Dollar collapse, stock markets crashing, and gold hitting all-time highs.

But here’s what nobody’s saying — and what we should be talking about:

When global trade gets distorted like this, the FX market becomes the arena where real power is defined.

That’s where we come in.

Because while the world panics, traders who understand the logic behind the chaos... can ride waves we haven’t seen in decades.

But not with magic formulas.

With tools that read the market, adapt to volatility, and ride these storms like pros.

Does that make sense?

Do whatever you want with this info…

But remember: expert advisors don’t sleep. And in this new order, that matters more than ever.

Enrique Enguix

# "Good Backtest = Winning Bot" — The Most Elegant Lie in Trading

Let’s get real for a second.

This is the *most elegant and dangerous lie* in automated trading.

And I’m going to break it down in less than 5 minutes.

---

A while ago, some guy messaged me—super hyped.

He’d tested an EA that, according to its backtest, would’ve made 380% in one year with almost no drawdown.

He was ready to quit his job, move to Bali, and trade on a beach with hotel Wi-Fi.

The problem?

In live trading, the bot didn’t last two weeks before bleeding out like an honest politician.

Sound familiar?

---

Backtesting is like a first date: everything looks perfect… until reality shows up.

And no, the EA might not even be bad (though many are).

The real issue? Most traders don’t understand what a backtest is actually for.

Let me break it down:

Backtesting isn’t for predicting the future.

It’s for catching bugs, spotting consistency, and refining the internal logic of your strategy.

That’s it.

If you treat it like a crystal ball…

You’re playing with fire.

---

Here’s what you should be looking for in a backtest:

- How many trades per month? If it takes 3 trades a month, forget it. You’ll go crazy waiting.

- How does it behave in different years? If it crushes 2019 but crashes in 2020, something’s off.

- What happens during major news events? A lot of bots die right there.

- Does the logic make sense or are the numbers just pretty?

(If you can’t explain it with market logic—it’s useless.)

---

Now for the real punchline:

An EA that performs well in backtest but fails live…

is not a good EA.

It’s an overfitting trap.

And yeah, I’m saying this even though I sell robots.

That’s why when we build our EAs (like NODE, AXIS or NEXUS), we don’t just run them through historical data.

We stress test them in demo and live environments—under real market pressure.

Because that’s where the truth comes out.

And trust me, most can’t handle the heat.

---

Makes sense?

Because if your plan depends on a backtest that “looks good,”

you’re building your strategy on a mirage.

Do what you want with this info…

But next time you see an EA with perfect backtest results, ask yourself:

Am I looking at a robot…

or a magician?

See you on the battlefield (or on the chart).

Let’s get real for a second.

This is the *most elegant and dangerous lie* in automated trading.

And I’m going to break it down in less than 5 minutes.

---

A while ago, some guy messaged me—super hyped.

He’d tested an EA that, according to its backtest, would’ve made 380% in one year with almost no drawdown.

He was ready to quit his job, move to Bali, and trade on a beach with hotel Wi-Fi.

The problem?

In live trading, the bot didn’t last two weeks before bleeding out like an honest politician.

Sound familiar?

---

Backtesting is like a first date: everything looks perfect… until reality shows up.

And no, the EA might not even be bad (though many are).

The real issue? Most traders don’t understand what a backtest is actually for.

Let me break it down:

Backtesting isn’t for predicting the future.

It’s for catching bugs, spotting consistency, and refining the internal logic of your strategy.

That’s it.

If you treat it like a crystal ball…

You’re playing with fire.

---

Here’s what you should be looking for in a backtest:

- How many trades per month? If it takes 3 trades a month, forget it. You’ll go crazy waiting.

- How does it behave in different years? If it crushes 2019 but crashes in 2020, something’s off.

- What happens during major news events? A lot of bots die right there.

- Does the logic make sense or are the numbers just pretty?

(If you can’t explain it with market logic—it’s useless.)

---

Now for the real punchline:

An EA that performs well in backtest but fails live…

is not a good EA.

It’s an overfitting trap.

And yeah, I’m saying this even though I sell robots.

That’s why when we build our EAs (like NODE, AXIS or NEXUS), we don’t just run them through historical data.

We stress test them in demo and live environments—under real market pressure.

Because that’s where the truth comes out.

And trust me, most can’t handle the heat.

---

Makes sense?

Because if your plan depends on a backtest that “looks good,”

you’re building your strategy on a mirage.

Do what you want with this info…

But next time you see an EA with perfect backtest results, ask yourself:

Am I looking at a robot…

or a magician?

See you on the battlefield (or on the chart).

Enrique Enguix

# Who would win in a fight: a raging bull or a machine programmed never to fail?

Look at this image.

It’s not just a cyborg punching a bull.

It’s NEXUS stepping into the dirtiest arena of the market… and not backing down for a second.

While others pray the trend doesn’t rip them apart, NEXUS shows up with nine built-in strategies, news filters locked in, and risk management so tight it would make a Swiss banker blush.

The bull? It’s everything you can’t control: emotions, impulses, fake signals, surprise news, and yeah… that magical “market sentiment” so many gurus sell like fairy dust.

But NEXUS doesn’t believe in fairy tales.

It believes in data. In logic. In crushing human error with surgical precision.

And while you sleep, it keeps fighting. No fear. No doubts. No excuses.

It’s not cheap—and it’s not trying to be.

But if you’re tired of getting gored by the market, and you want a weapon built to survive the bloodiest arena in the game…

Then you already know which side you want to be on.

Do what you want with this information tomorrow Nexus will return to its original price of $1999

https://www.mql5.com/en/market/product/90877

Look at this image.

It’s not just a cyborg punching a bull.

It’s NEXUS stepping into the dirtiest arena of the market… and not backing down for a second.

While others pray the trend doesn’t rip them apart, NEXUS shows up with nine built-in strategies, news filters locked in, and risk management so tight it would make a Swiss banker blush.

The bull? It’s everything you can’t control: emotions, impulses, fake signals, surprise news, and yeah… that magical “market sentiment” so many gurus sell like fairy dust.

But NEXUS doesn’t believe in fairy tales.

It believes in data. In logic. In crushing human error with surgical precision.

And while you sleep, it keeps fighting. No fear. No doubts. No excuses.

It’s not cheap—and it’s not trying to be.

But if you’re tired of getting gored by the market, and you want a weapon built to survive the bloodiest arena in the game…

Then you already know which side you want to be on.

Do what you want with this information tomorrow Nexus will return to its original price of $1999

https://www.mql5.com/en/market/product/90877

Enrique Enguix

Want to make more money in trading? Start by losing less.

Look, I’ll be straight with you…

I talk to dozens of traders every single day. Some are seasoned, others just getting started. But there’s one thing I see over and over again—more than affiliate links to “financial freedom” courses:

Insane lot sizes on tiny accounts.

I’m talking people running 20 to 30 times the recommended risk. It’s like trying to carry an elephant on a bicycle… and then wondering why the wheels snapped.

And the craziest part? Most of them *know* better. But they still do it. Because greed doesn’t come with a stop loss.

Honestly, I’ve tried everything—charts, jokes, even straight-up warnings. But at some point, you realize something:

The best risk management isn’t knowing how much you can make. It’s knowing how much you’re willing *not* to lose.

Sure, making money is sexy. But not blowing up your account? That’s kinda hot too.

Do whatever you want with this info... just remember: the market doesn’t care about your feelings.

Look, I’ll be straight with you…

I talk to dozens of traders every single day. Some are seasoned, others just getting started. But there’s one thing I see over and over again—more than affiliate links to “financial freedom” courses:

Insane lot sizes on tiny accounts.

I’m talking people running 20 to 30 times the recommended risk. It’s like trying to carry an elephant on a bicycle… and then wondering why the wheels snapped.

And the craziest part? Most of them *know* better. But they still do it. Because greed doesn’t come with a stop loss.

Honestly, I’ve tried everything—charts, jokes, even straight-up warnings. But at some point, you realize something:

The best risk management isn’t knowing how much you can make. It’s knowing how much you’re willing *not* to lose.

Sure, making money is sexy. But not blowing up your account? That’s kinda hot too.

Do whatever you want with this info... just remember: the market doesn’t care about your feelings.

Enrique Enguix

🎥 What am I doing in this 1-minute video?

Playing with fire. Well... with timeframes.

I'm testing different timeframes using AXIS.

How? With a quick (brutal, to be honest) optimization — like a steamroller:

- Capital: $10,000

- OHLC M1 data quality

- Period: 5 years

No fluff. Just trying to extract quick insights.

I’m testing timeframes from 1 minute to 1 day, and using the complex criteria (the one that doesn’t just chase profit but looks at multiple metrics).

Spoiler: I’m *not* going for the highest profit — and I usually don’t. But more on that later...

Optimization starts.

Here’s what we get:

- M30 comes out as the most balanced.

- But M5 smashes it in raw profit.

I run backtests on both.

Conclusion? I only tweaked the timeframe. Nothing else. No fancy tricks.

And still — the results change a lot.

From other, deeper tests, we’ve seen that higher timeframes usually give more conservative systems:

Less profit, but also less risk.

👉 This isn’t rocket science. It’s quick to try.

And *totally* worth messing with.

Do whatever you want with this info...

But if you're serious about this,

you can’t keep trading blind with just one timeframe.

Playing with fire. Well... with timeframes.

I'm testing different timeframes using AXIS.

How? With a quick (brutal, to be honest) optimization — like a steamroller:

- Capital: $10,000

- OHLC M1 data quality

- Period: 5 years

No fluff. Just trying to extract quick insights.

I’m testing timeframes from 1 minute to 1 day, and using the complex criteria (the one that doesn’t just chase profit but looks at multiple metrics).

Spoiler: I’m *not* going for the highest profit — and I usually don’t. But more on that later...

Optimization starts.

Here’s what we get:

- M30 comes out as the most balanced.

- But M5 smashes it in raw profit.

I run backtests on both.

Conclusion? I only tweaked the timeframe. Nothing else. No fancy tricks.

And still — the results change a lot.

From other, deeper tests, we’ve seen that higher timeframes usually give more conservative systems:

Less profit, but also less risk.

👉 This isn’t rocket science. It’s quick to try.

And *totally* worth messing with.

Do whatever you want with this info...

But if you're serious about this,

you can’t keep trading blind with just one timeframe.

Enrique Enguix

"The market is not here to meet your expectations."

Everyone gets into trading thinking the market will behave the way they want.

If they prefer lots of fast trades, the market will give them that.

If they like trading only certain pairs, the market will magically align with them.

But the market doesn’t work like that. It never has. It never will.

And that’s the difference. Because we don’t design strategies to match your personal preferences.

We design strategies based on what we’ve proven works.

Not with gut feelings or lucky guesses, but with data — empirical tests, data mining, thousands of hours of backtesting and real-world analysis.

Because the market will do whatever it wants.

But we’ve already done the hard work to understand how it moves, why it moves, and how to take advantage of it.

Not to make it adjust to you — but to help you adjust to it.

The market will keep being the market. The question is: are you going to keep trying to make it dance to your tune, or are you ready to start playing by the rules that actually matter?

https://www.mql5.com/en/users/envex/seller

Everyone gets into trading thinking the market will behave the way they want.

If they prefer lots of fast trades, the market will give them that.

If they like trading only certain pairs, the market will magically align with them.

But the market doesn’t work like that. It never has. It never will.

And that’s the difference. Because we don’t design strategies to match your personal preferences.

We design strategies based on what we’ve proven works.

Not with gut feelings or lucky guesses, but with data — empirical tests, data mining, thousands of hours of backtesting and real-world analysis.

Because the market will do whatever it wants.

But we’ve already done the hard work to understand how it moves, why it moves, and how to take advantage of it.

Not to make it adjust to you — but to help you adjust to it.

The market will keep being the market. The question is: are you going to keep trying to make it dance to your tune, or are you ready to start playing by the rules that actually matter?

https://www.mql5.com/en/users/envex/seller

Enrique Enguix

"Losing weight fast" and "getting rich fast" are the same myth in disguise

Look… Have you noticed how everyone wants to lose 10 kilos in two weeks without giving up pizza and beer? Well, trading works the same way. People want to turn $100 into $10,000 overnight without understanding anything about risk management or strategy.

A serious dietitian will tell you the truth: losing weight quickly almost always means you’ll gain it back (with interest). Why? Because your body isn’t designed to burn fat at rocket speed without consequences. Trading is no different: making quick money usually means you’re taking on too much risk… and when things go south, you’ll lose faster than you made it.

But of course, people don’t want to hear that. They prefer the fantasy of "lose 10 pounds in 7 days" or "double your account in a week." And then come the tears.

You know what actually works? Consistency. Eating well every day, working out even when you don’t feel like it, and not obsessing over the scale. Trading is the same: using a solid strategy, managing risk, and letting time do its magic.

Because listen… losing half a kilo a week sounds boring, but after a year, that’s 25 kilos gone. And making 3% a month in trading sounds small… but after a year, if you reinvest, that’s a compounded 42%.

The question is: do you want fast results or real results?

Do what you want with this information… but remember that both your body and the market reward patience, not speed.

Look… Have you noticed how everyone wants to lose 10 kilos in two weeks without giving up pizza and beer? Well, trading works the same way. People want to turn $100 into $10,000 overnight without understanding anything about risk management or strategy.

A serious dietitian will tell you the truth: losing weight quickly almost always means you’ll gain it back (with interest). Why? Because your body isn’t designed to burn fat at rocket speed without consequences. Trading is no different: making quick money usually means you’re taking on too much risk… and when things go south, you’ll lose faster than you made it.

But of course, people don’t want to hear that. They prefer the fantasy of "lose 10 pounds in 7 days" or "double your account in a week." And then come the tears.

You know what actually works? Consistency. Eating well every day, working out even when you don’t feel like it, and not obsessing over the scale. Trading is the same: using a solid strategy, managing risk, and letting time do its magic.

Because listen… losing half a kilo a week sounds boring, but after a year, that’s 25 kilos gone. And making 3% a month in trading sounds small… but after a year, if you reinvest, that’s a compounded 42%.

The question is: do you want fast results or real results?

Do what you want with this information… but remember that both your body and the market reward patience, not speed.

Enrique Enguix

And there are still those who think that NEXUS doesn't have a Stop Loss...

https://www.mql5.com/en/market/product/90877

https://www.mql5.com/en/market/product/90877

Enrique Enguix

"Are you trading for yourself… or for them?"

Look, today is Father’s Day, so let me hit you with something you might not have considered: Are you trading just to make more money, or are you building something that truly matters?

Because let’s be honest — setting up an EA and letting it run isn’t exactly backbreaking work. The real effort isn’t in the trading itself — it’s in the decision to step up. To take control of your capital, not just to have more freedom, but to create it for your kids too.

It’s not about becoming some trading hero. It’s about showing your kids that you had the guts to build something real. That you weren’t just working to pay the bills — you were thinking long-term. You didn’t settle for a fixed paycheck because you knew there was another way.

Because at the end of the day, what you’re doing with automated trading isn’t just for you. It’s for them. So that when they look at you, they see someone who took control of their life. And trust me — that’s worth more than any monthly return.

So today, while you celebrate Father’s Day, ask yourself:

👉 Am I building something that will make their life easier… or just looking for some extra income?

Do what you want with this thought… but remember: the market goes up and down. Time with them doesn’t come back.

Look, today is Father’s Day, so let me hit you with something you might not have considered: Are you trading just to make more money, or are you building something that truly matters?

Because let’s be honest — setting up an EA and letting it run isn’t exactly backbreaking work. The real effort isn’t in the trading itself — it’s in the decision to step up. To take control of your capital, not just to have more freedom, but to create it for your kids too.

It’s not about becoming some trading hero. It’s about showing your kids that you had the guts to build something real. That you weren’t just working to pay the bills — you were thinking long-term. You didn’t settle for a fixed paycheck because you knew there was another way.

Because at the end of the day, what you’re doing with automated trading isn’t just for you. It’s for them. So that when they look at you, they see someone who took control of their life. And trust me — that’s worth more than any monthly return.

So today, while you celebrate Father’s Day, ask yourself:

👉 Am I building something that will make their life easier… or just looking for some extra income?

Do what you want with this thought… but remember: the market goes up and down. Time with them doesn’t come back.

Enrique Enguix

Look… There’s a widespread (and wrong) belief in the trading world: that the Stop Loss is the magic solution to avoid losses. But let me tell you something that most people prefer to ignore.

👉 Many grid systems work just because they are grids, without having any real statistical edge over the market. That’s like thinking you’ll always win at poker just because you’re wearing sunglasses. 🙃

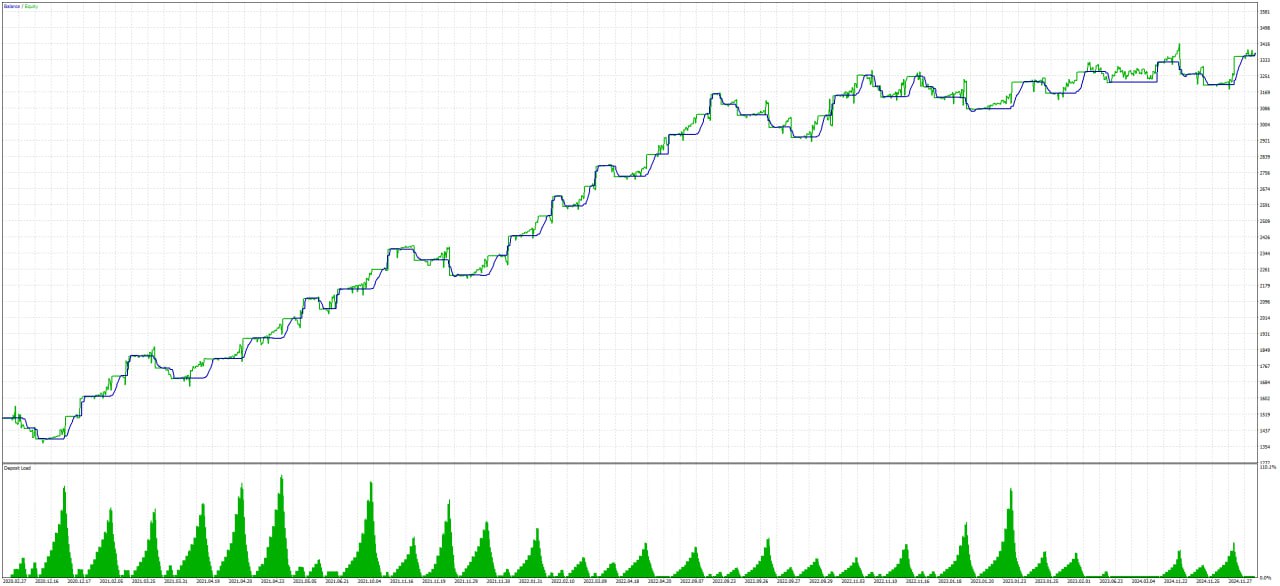

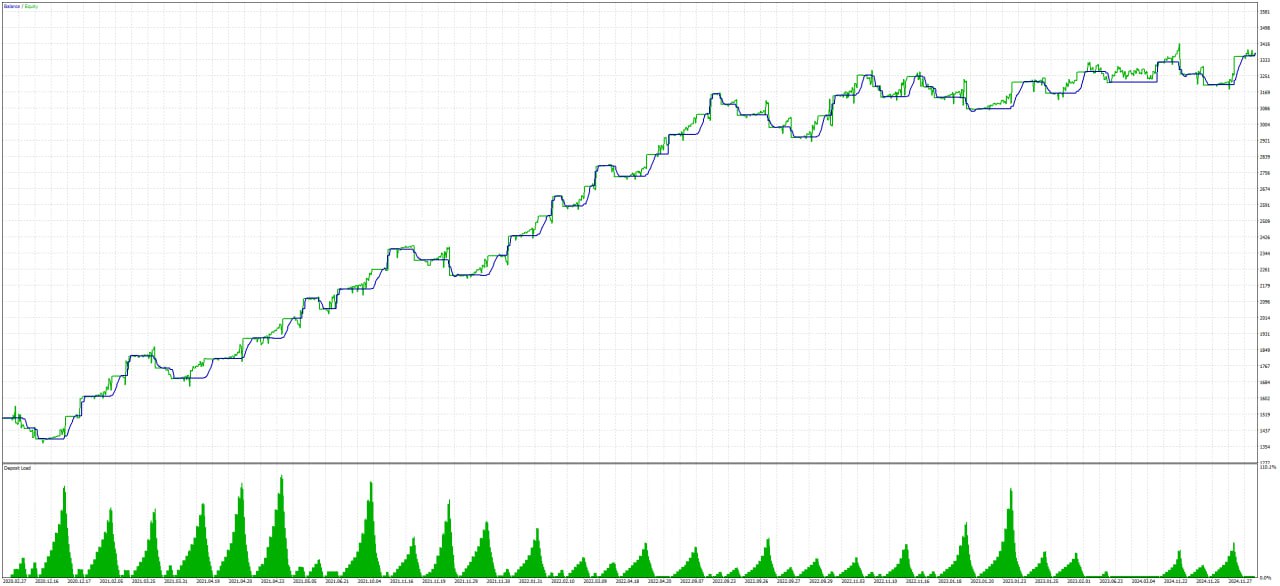

In the image (yes, take a good look), you can see a backtest of NEXUS using a stop loss of -$52 and a take profit of $102 — a 1:2 ratio. The key here is that in NEXUS, the grid isn’t used to "hide" a failing system. It’s a side-entry system, designed to take advantage of market movements with logic, not luck.

👉 Many grid systems work just because they are grids, without having any real statistical edge over the market. That’s like thinking you’ll always win at poker just because you’re wearing sunglasses. 🙃

In the image (yes, take a good look), you can see a backtest of NEXUS using a stop loss of -$52 and a take profit of $102 — a 1:2 ratio. The key here is that in NEXUS, the grid isn’t used to "hide" a failing system. It’s a side-entry system, designed to take advantage of market movements with logic, not luck.

Enrique Enguix

# Can You Trade with Your Eyes Closed?

No, seriously. Close your eyes for a second.

Now, try to open a trade.

What happens? Exactly — pure chaos.

Well, that’s exactly what you’re doing every time you trade without understanding the market rules.

Every time you enter a trade just because “it feels right.”

Every time you follow a Telegram signal without even checking the spread.

And the worst part? You’re surprised when you lose.

As if this were some rigged lottery and not a game of probabilities, risk, and control.

Listen, the market owes you nothing.

It doesn’t care if you woke up feeling motivated or if you watched a YouTube video about “the secret to getting rich with Forex.”

It’s not personal. It’s math. It’s statistics.

That’s why AXIS works.

Because it feels nothing.

Because it doesn’t panic when the market moves.

Because it follows the rules — even when you don’t want to.

The problem isn’t the market.

The problem is that you keep trading with your eyes closed, hoping luck will save you.

But hey… opening your eyes hurts.

Because then you realize the mistake was yours.

Now, do whatever you want with this info.

But if you’re going to keep trading blind, at least wear a helmet. 🔥

Almost 100 people have already bought it

https://www.mql5.com/en/market/product/126781

No, seriously. Close your eyes for a second.

Now, try to open a trade.

What happens? Exactly — pure chaos.

Well, that’s exactly what you’re doing every time you trade without understanding the market rules.

Every time you enter a trade just because “it feels right.”

Every time you follow a Telegram signal without even checking the spread.

And the worst part? You’re surprised when you lose.

As if this were some rigged lottery and not a game of probabilities, risk, and control.

Listen, the market owes you nothing.

It doesn’t care if you woke up feeling motivated or if you watched a YouTube video about “the secret to getting rich with Forex.”

It’s not personal. It’s math. It’s statistics.

That’s why AXIS works.

Because it feels nothing.

Because it doesn’t panic when the market moves.

Because it follows the rules — even when you don’t want to.

The problem isn’t the market.

The problem is that you keep trading with your eyes closed, hoping luck will save you.

But hey… opening your eyes hurts.

Because then you realize the mistake was yours.

Now, do whatever you want with this info.

But if you’re going to keep trading blind, at least wear a helmet. 🔥

Almost 100 people have already bought it

https://www.mql5.com/en/market/product/126781

Enrique Enguix

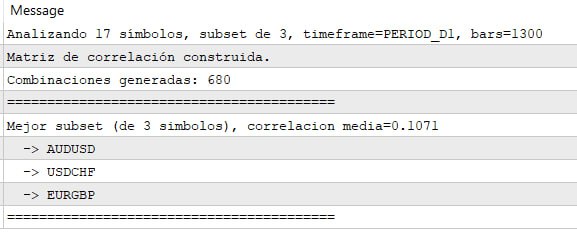

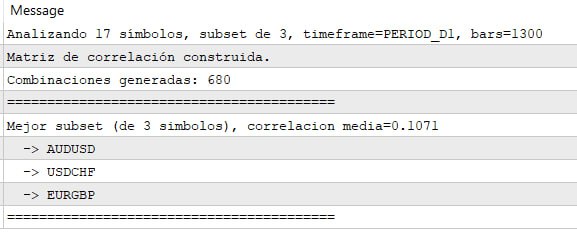

## Correlation Analysis of Currency Pairs for Multi-Symbol Strategy

A correlation analysis was conducted on 17 symbols to identify the combination of pairs with the lowest correlation, aiming to improve the strategy’s stability and diversification.

### Analysis Details:

- Symbol Subset: 3 pairs

- Timeframe: Daily (D1)

- Bars Analyzed: 1300 (approximately 5 years of data)

- Combinations Generated: 680

### Best Combination Found (with the lowest average correlation):

- AUDUSD

- USDCHF

- EURGBP

The average correlation between these pairs is 0.1071, indicating low correlation. This is essential for a multi-symbol strategy, as low correlation reduces the risk of simultaneous losses due to market-wide movements, enhancing overall stability and drawdown control.

This type of analysis is fundamental for building more robust and diversified trading systems.

A correlation analysis was conducted on 17 symbols to identify the combination of pairs with the lowest correlation, aiming to improve the strategy’s stability and diversification.

### Analysis Details:

- Symbol Subset: 3 pairs

- Timeframe: Daily (D1)

- Bars Analyzed: 1300 (approximately 5 years of data)

- Combinations Generated: 680

### Best Combination Found (with the lowest average correlation):

- AUDUSD

- USDCHF

- EURGBP

The average correlation between these pairs is 0.1071, indicating low correlation. This is essential for a multi-symbol strategy, as low correlation reduces the risk of simultaneous losses due to market-wide movements, enhancing overall stability and drawdown control.

This type of analysis is fundamental for building more robust and diversified trading systems.

Enrique Enguix

⚠️ When the market turns ugly, suddenly everyone remembers God.

"Please, let the price bounce."

"Let this trade avoid the stop loss."

"Let the trend reverse."

But when things go well, then it’s all:

"I know what I’m doing."

"It’s my strategy."

"It’s my discipline."

Funny, isn’t it?

The truth is, the market doesn’t work on miracles. It works on numbers, risk management, and a solid plan.

If every time you open a trade you need to pray that it doesn’t go against you… maybe you’re not managing risk—just gambling with faith.

And for that, there are casinos.

Do whatever you want, but the market doesn’t forgive those who trade with their fingers crossed.

If you want to avoid praying to God to fix your trading: https://www.mql5.com/en/users/envex/seller

"Please, let the price bounce."

"Let this trade avoid the stop loss."

"Let the trend reverse."

But when things go well, then it’s all:

"I know what I’m doing."

"It’s my strategy."

"It’s my discipline."

Funny, isn’t it?

The truth is, the market doesn’t work on miracles. It works on numbers, risk management, and a solid plan.

If every time you open a trade you need to pray that it doesn’t go against you… maybe you’re not managing risk—just gambling with faith.

And for that, there are casinos.

Do whatever you want, but the market doesn’t forgive those who trade with their fingers crossed.

If you want to avoid praying to God to fix your trading: https://www.mql5.com/en/users/envex/seller

: