Aleksey Ivanov / Profile

- Information

|

7+ years

experience

|

32

products

|

141

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

👑 Theoretical physicist, programmer, trader with 15 years of experience.

----------------------------------------------------------------------------------------

💰 Presented products:

1) 🏆 Indicators with optimal filtering of market noises (for choosing points of opening and closing positions).

2) 🏆 Statistical indicators (to determine the global trend).

3) 🏆 Market research indicators (to clarify the microstructure of prices, build channels, identify differences between trend reversals and pullbacks).

----------------------------------------------------------------------------------------

☛ More information in the blog https://www.mql5.com/en/blogs/post/741637

----------------------------------------------------------------------------------------

💰 Presented products:

1) 🏆 Indicators with optimal filtering of market noises (for choosing points of opening and closing positions).

2) 🏆 Statistical indicators (to determine the global trend).

3) 🏆 Market research indicators (to clarify the microstructure of prices, build channels, identify differences between trend reversals and pullbacks).

----------------------------------------------------------------------------------------

☛ More information in the blog https://www.mql5.com/en/blogs/post/741637

Aleksey Ivanov

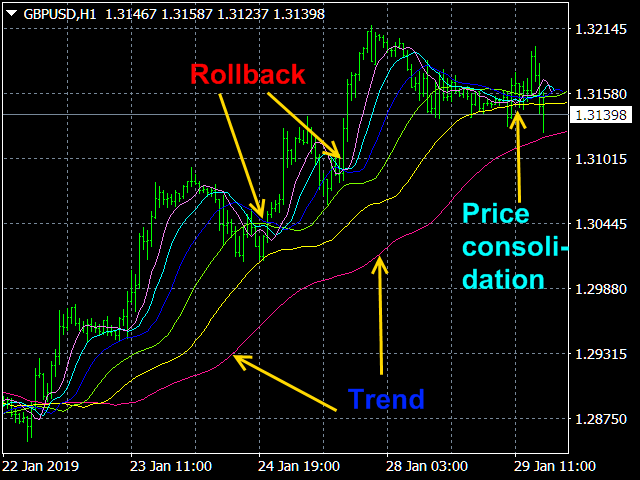

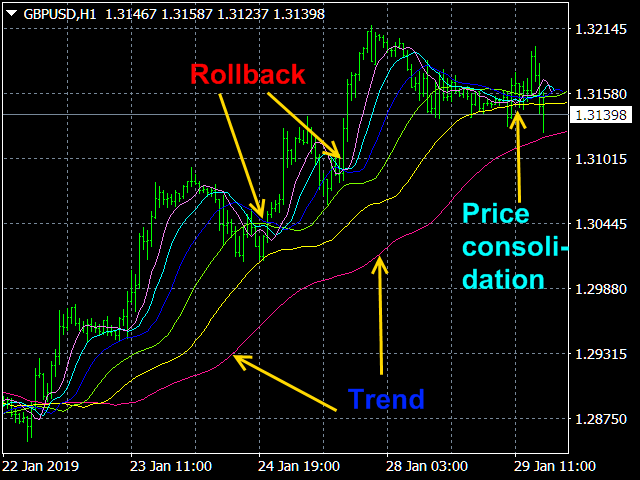

Cunning crocodile https://www.mql5.com/en/market/product/32028

✔️ One of the best indicators with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️ One of the best indicators with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

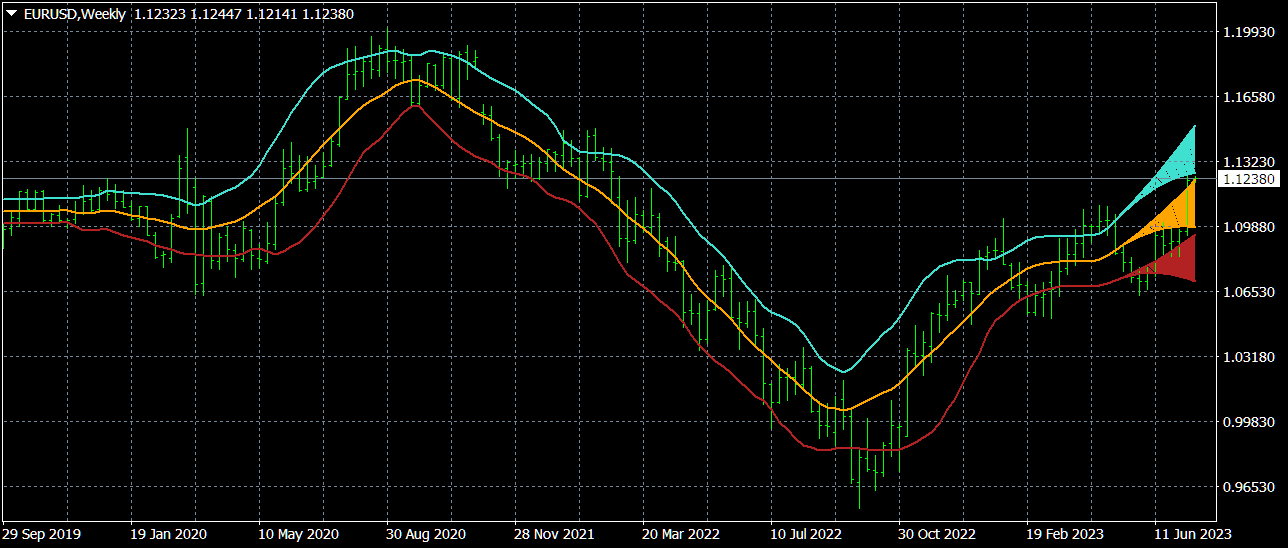

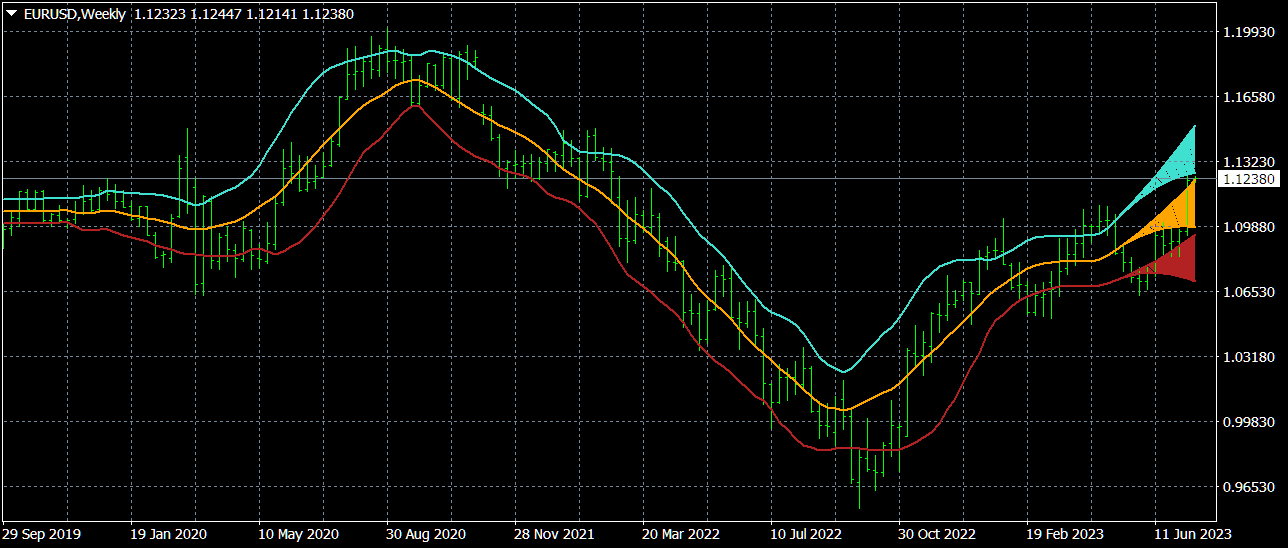

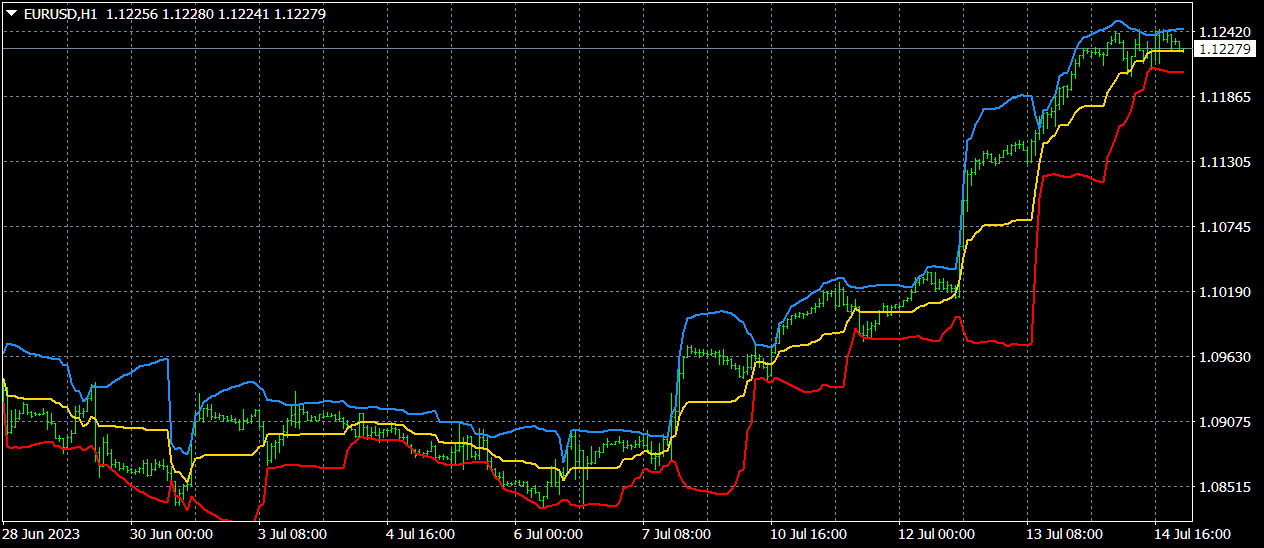

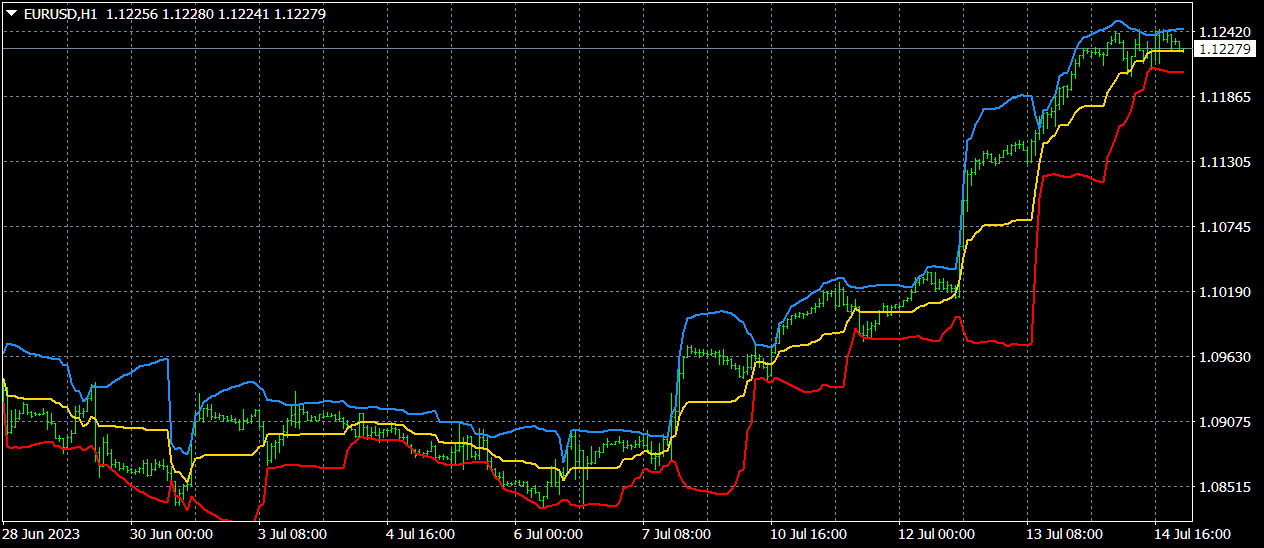

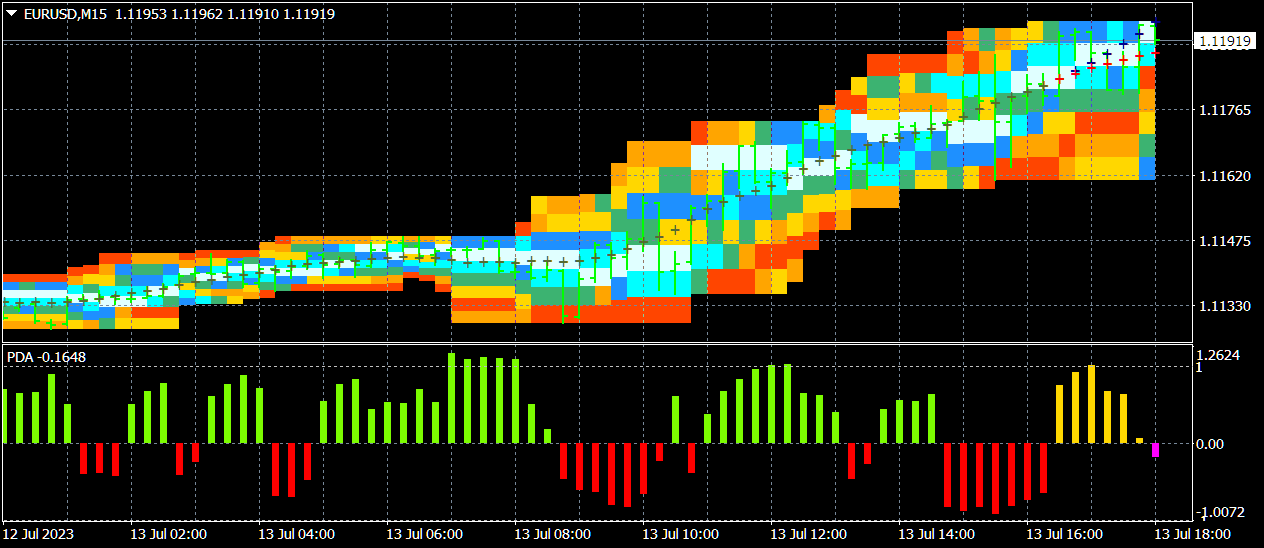

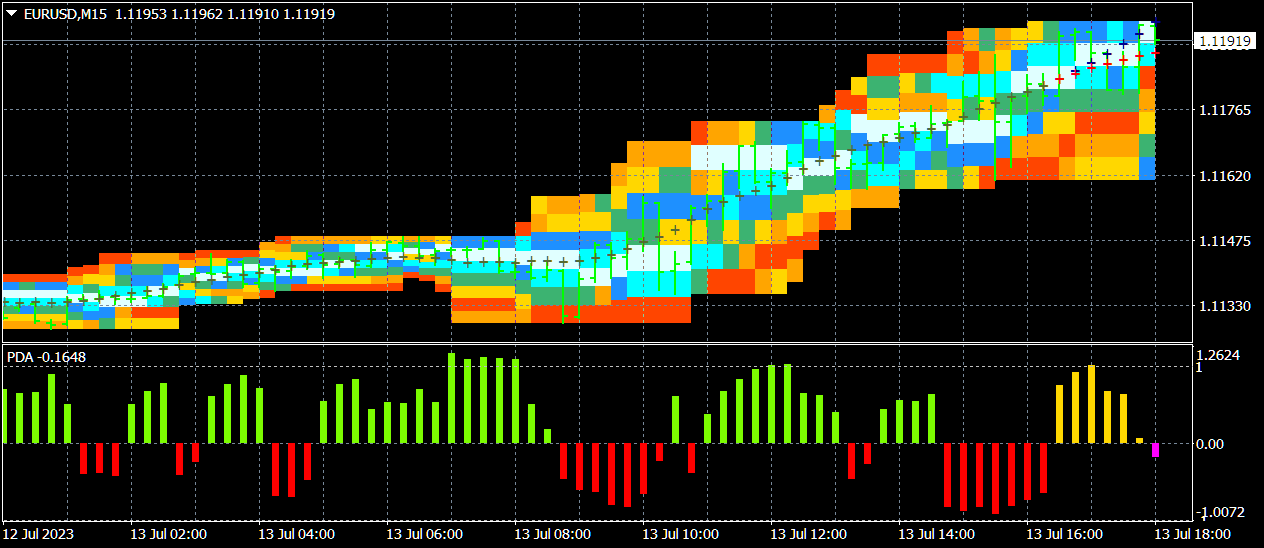

Scientific trade https://www.mql5.com/en/market/product/98467

An extremely convenient indicator that truly makes the process of making money on the exchange easy. It is based on the scientifically rigorous theory of the market developed by the author, the beginning of which is presented https://www.mql5.com/en/articles/10955 .

The indicator calculates the most probable price movement trajectory and displays it on the chart. Based on the predicted price movement trajectory, the indicator calculates the direction of the position and the position of the take profit. Based on the statistically calculated uncertainty of the trajectory of the predicted price movement, the selected risk level and the size of the deposit, the indicator also calculates the lot size and stop loss position. The averaging period of the indicator is selected based on the maximum probability of winning, which is presented for each period on the main chart of the trading terminal.

It is better to use M1-M15 timeframes in the indicator; at the same time, it is recommended to play according to the global trend, determined on H4, D1, i.e. if the indicator gives a SELL signal, then this position is opened when the global trend is down; if the indicator signal is BUY, then the position is opened when the global trend is up.

After choosing a timeframe, you sort through the averaging values like 20, 30, 40, …, 200 and look at the trading terminal at what value the maximum probability of winning is achieved. This is the value you should use. Since the averaging period of the indicator must be selected manually in the process of moving along the price history, the indicator readings in the tester cannot reflect the full effectiveness of its work and may be incorrect.

To automatically determine the optimal averaging period (which gives the maximum probability of winning), the CalculateScientificTradePeriod script has been developed. https://www.mql5.com/en/market/product/99909

The operation of the indicator is based on predicting the market's own trends, so it is not recommended to use it before and immediately after strong news, as well as in case of strong market volatility, especially if the volatility is the result of crisis processes. The indicator's forecast period, which is its averaging period, should not go beyond the future moment of strong news release.

Before opening a position, you should only assess the state of the market and take into account news factors.

Everything else - position direction, lot size and stop orders - will be automatically calculated by the indicator for you. After that, you open a position, and then turn off the computer and do things that are pleasant for you.

An extremely convenient indicator that truly makes the process of making money on the exchange easy. It is based on the scientifically rigorous theory of the market developed by the author, the beginning of which is presented https://www.mql5.com/en/articles/10955 .

The indicator calculates the most probable price movement trajectory and displays it on the chart. Based on the predicted price movement trajectory, the indicator calculates the direction of the position and the position of the take profit. Based on the statistically calculated uncertainty of the trajectory of the predicted price movement, the selected risk level and the size of the deposit, the indicator also calculates the lot size and stop loss position. The averaging period of the indicator is selected based on the maximum probability of winning, which is presented for each period on the main chart of the trading terminal.

It is better to use M1-M15 timeframes in the indicator; at the same time, it is recommended to play according to the global trend, determined on H4, D1, i.e. if the indicator gives a SELL signal, then this position is opened when the global trend is down; if the indicator signal is BUY, then the position is opened when the global trend is up.

After choosing a timeframe, you sort through the averaging values like 20, 30, 40, …, 200 and look at the trading terminal at what value the maximum probability of winning is achieved. This is the value you should use. Since the averaging period of the indicator must be selected manually in the process of moving along the price history, the indicator readings in the tester cannot reflect the full effectiveness of its work and may be incorrect.

To automatically determine the optimal averaging period (which gives the maximum probability of winning), the CalculateScientificTradePeriod script has been developed. https://www.mql5.com/en/market/product/99909

The operation of the indicator is based on predicting the market's own trends, so it is not recommended to use it before and immediately after strong news, as well as in case of strong market volatility, especially if the volatility is the result of crisis processes. The indicator's forecast period, which is its averaging period, should not go beyond the future moment of strong news release.

Before opening a position, you should only assess the state of the market and take into account news factors.

Everything else - position direction, lot size and stop orders - will be automatically calculated by the indicator for you. After that, you open a position, and then turn off the computer and do things that are pleasant for you.

Aleksey Ivanov

StatChannel https://www.mql5.com/en/market/product/37619

StatChannel is a bolinger bands indicator with no lag.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

StatChannel is a bolinger bands indicator with no lag.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Quality trend https://www.mql5.com/en/market/product/79505

The Quality trend indicator expresses the ratio of the strength of a trend or the speed of its growth (fall) to the degree of its noisiness or a certain norm of amplitudes of chaotic fluctuations of a growing (falling) price. The position of the indicator line above zero shows an increasing trend, below zero - a falling trend, the fluctuation of the indicator line near zero shows a flat.

If the indicator line begins to fluctuate rapidly around zero and approach it, then this indicates the imminent beginning of a trend movement. Quite often, an increase in the noise of even a rapidly growing trend or an increase in volatility indicates upcoming changes in the market, in particular, the end of the corresponding trend movement. Consequently, if the readings of an indicator with a high quality factor value suddenly start to decrease, then this indicates the imminent end of the corresponding trend movement. Therefore, the indicator readings are often leading and show the near end of a trend movement with a transition to a flat or even a change in the direction of the trend movement.

✔️The indicator does not lag behind and does not redraw

✔️The algorithms of this indicator are unique and developed by their author.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Quality trend indicator expresses the ratio of the strength of a trend or the speed of its growth (fall) to the degree of its noisiness or a certain norm of amplitudes of chaotic fluctuations of a growing (falling) price. The position of the indicator line above zero shows an increasing trend, below zero - a falling trend, the fluctuation of the indicator line near zero shows a flat.

If the indicator line begins to fluctuate rapidly around zero and approach it, then this indicates the imminent beginning of a trend movement. Quite often, an increase in the noise of even a rapidly growing trend or an increase in volatility indicates upcoming changes in the market, in particular, the end of the corresponding trend movement. Consequently, if the readings of an indicator with a high quality factor value suddenly start to decrease, then this indicates the imminent end of the corresponding trend movement. Therefore, the indicator readings are often leading and show the near end of a trend movement with a transition to a flat or even a change in the direction of the trend movement.

✔️The indicator does not lag behind and does not redraw

✔️The algorithms of this indicator are unique and developed by their author.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

StochasticExtrapolator https://www.mql5.com/en/market/product/80820

The indicator predicts the future values of the Stochastic indicator, which allows you to use this indicator much more efficiently.

The market has a very short memory; in any case, the information that formally describes it quickly becomes obsolete and loses its weight in the formation of the current price. Therefore, wavelet analysis is the most promising for predicting future market parameters. The author uses a number of wavelet functions (including the Morlet wavelet and a somewhat modified Gaussian function, which are shown in the last screenshot), the expansion by which, with a sufficient degree of reliability, allows extrapolating future values of oscillator indicators.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The indicator predicts the future values of the Stochastic indicator, which allows you to use this indicator much more efficiently.

The market has a very short memory; in any case, the information that formally describes it quickly becomes obsolete and loses its weight in the formation of the current price. Therefore, wavelet analysis is the most promising for predicting future market parameters. The author uses a number of wavelet functions (including the Morlet wavelet and a somewhat modified Gaussian function, which are shown in the last screenshot), the expansion by which, with a sufficient degree of reliability, allows extrapolating future values of oscillator indicators.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Channel Builder FREE https://www.mql5.com/en/market/product/34818

The Channel Builder (CB) or Ivanov Bands indicator is a broad generalization of the Bollinger Bands indicator. First, in CB, the mean line is calculated using various averaging algorithms. Secondly, the mean deviations calculated by Kolmogorov averaging are plotted on both sides of the middle line .

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Channel Builder (CB) or Ivanov Bands indicator is a broad generalization of the Bollinger Bands indicator. First, in CB, the mean line is calculated using various averaging algorithms. Secondly, the mean deviations calculated by Kolmogorov averaging are plotted on both sides of the middle line .

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! I want to sincerely help you and dispel your illusions.

1) When you look in the market (or somewhere else, on some channel, etc.) at the description of any product (indicator or robot), you give priority (buy) to the product, the seller of which presented the most possible a long series of positive transactions based on the use of this product. And you think you made the right choice. But don't be so naive. The seller can choose from one hundred series of transactions, 99 series of which are losing, one winning series of transactions and present it in the description of his product. And this is what almost all salespeople do because they need to sell their product. I don't do that because my products are designed for the thinking consumer.

2) Optimization of the robot, which gives an exponential growth of the deposit, when billions are obtained from a hundred dollars, this is, in essence, just an adjustment to the previous history. When new data comes in that goes beyond the history of optimization (i.e. you start to actually trade), then such a robot with a 100% guarantee will bring losses. They buy such robots, in general, suckers. Friends, do not be suckers, i.e. do not lose your money neither on the purchase of such robots, nor when playing on the stock exchange with their help. Many sellers, in general, simply write bright clips, where the stories of allegedly positive transactions of their product and the frantic growth of the deposit are clearly unfolding in the drawn terminal. Some sellers do the same programmatically. If someone had such robots, then no one would sell them. This must be understood, and not wishful thinking.

3) I (a professional scientist, not some schoolboy) sell products with algorithms, which are my own original developments based on a scientific approach ( https://www.mql5.com/en/articles/10955 ,

https://www.mql5.com/en/articles/11158 ) to the study of the foreign exchange market and stock market, which, by the way, no one has done yet. All existing models of the foreign exchange market are not scientific, but simply "shamanic dances with tambourines." Trust me as a scientist. But people tend to buy products (at least robots, at least indicators) with popular algorithms “tested” by time, i.e. well-known strategies and calculation formulas. At the same time, they hope that the popularity of algorithms will provide them with a profit. This is also a naive fallacy. After all, if there were well-known formulas and algorithms that would bring profit in all market conditions, then everyone would become millionaires, which is not observed. On the contrary, in the reality hidden from suckers, all traders (using "time-tested" algorithms) either mark time in one place or lose money. Therefore, among the popular mathematical algorithms (even the most sophisticated ones, such as some kind of neural networks, etc.), there are no algorithms that consistently provide profit, and with a change in the state of the market, they begin to incur losses. Profitable algorithms should be looked for, just the opposite, among the original little-known developments, which are my products. https://www.mql5.com/en/blogs/post/741637

1) When you look in the market (or somewhere else, on some channel, etc.) at the description of any product (indicator or robot), you give priority (buy) to the product, the seller of which presented the most possible a long series of positive transactions based on the use of this product. And you think you made the right choice. But don't be so naive. The seller can choose from one hundred series of transactions, 99 series of which are losing, one winning series of transactions and present it in the description of his product. And this is what almost all salespeople do because they need to sell their product. I don't do that because my products are designed for the thinking consumer.

2) Optimization of the robot, which gives an exponential growth of the deposit, when billions are obtained from a hundred dollars, this is, in essence, just an adjustment to the previous history. When new data comes in that goes beyond the history of optimization (i.e. you start to actually trade), then such a robot with a 100% guarantee will bring losses. They buy such robots, in general, suckers. Friends, do not be suckers, i.e. do not lose your money neither on the purchase of such robots, nor when playing on the stock exchange with their help. Many sellers, in general, simply write bright clips, where the stories of allegedly positive transactions of their product and the frantic growth of the deposit are clearly unfolding in the drawn terminal. Some sellers do the same programmatically. If someone had such robots, then no one would sell them. This must be understood, and not wishful thinking.

3) I (a professional scientist, not some schoolboy) sell products with algorithms, which are my own original developments based on a scientific approach ( https://www.mql5.com/en/articles/10955 ,

https://www.mql5.com/en/articles/11158 ) to the study of the foreign exchange market and stock market, which, by the way, no one has done yet. All existing models of the foreign exchange market are not scientific, but simply "shamanic dances with tambourines." Trust me as a scientist. But people tend to buy products (at least robots, at least indicators) with popular algorithms “tested” by time, i.e. well-known strategies and calculation formulas. At the same time, they hope that the popularity of algorithms will provide them with a profit. This is also a naive fallacy. After all, if there were well-known formulas and algorithms that would bring profit in all market conditions, then everyone would become millionaires, which is not observed. On the contrary, in the reality hidden from suckers, all traders (using "time-tested" algorithms) either mark time in one place or lose money. Therefore, among the popular mathematical algorithms (even the most sophisticated ones, such as some kind of neural networks, etc.), there are no algorithms that consistently provide profit, and with a change in the state of the market, they begin to incur losses. Profitable algorithms should be looked for, just the opposite, among the original little-known developments, which are my products. https://www.mql5.com/en/blogs/post/741637

Aleksey Ivanov

Alligator Analysis FREE https://www.mql5.com/en/market/product/35227

The “Alligator Analysis” (AA) indicator allows you to build various (by averaging types and by scales) “Alligators” and their combinations, i.e. allows you to analyze the state of the market based on the correlation of this state with a whole range of different "Alligators". The classic "Alligator" by Bill Williams is based on moving averages and Fibonacci numbers, which makes it one of the best indicators now. The classic "Alligator" is based on Fibonacci numbers and is a combination of three smoothed moving averages (SМMA) with periods 5, 8 and 13, which are part of the Fibonacci sequence. In this case, the moving averages are shifted forwards by 3, 5, and 8 bars, respectively, which are numbers from the same sequence (preceding the corresponding period values).

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The indicator AA uses 6 types of averaging, where the classical averaging SMA, EMA, SMMA, LMA are supplemented by averaging the moving average by the median and averaging weighted by volume.

Line shifts can be removed. The colors of the AA indicator lines are set according to the type of color spectrum: from violet for a small smoothing period to red - for the largest period.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The “Alligator Analysis” (AA) indicator allows you to build various (by averaging types and by scales) “Alligators” and their combinations, i.e. allows you to analyze the state of the market based on the correlation of this state with a whole range of different "Alligators". The classic "Alligator" by Bill Williams is based on moving averages and Fibonacci numbers, which makes it one of the best indicators now. The classic "Alligator" is based on Fibonacci numbers and is a combination of three smoothed moving averages (SМMA) with periods 5, 8 and 13, which are part of the Fibonacci sequence. In this case, the moving averages are shifted forwards by 3, 5, and 8 bars, respectively, which are numbers from the same sequence (preceding the corresponding period values).

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The indicator AA uses 6 types of averaging, where the classical averaging SMA, EMA, SMMA, LMA are supplemented by averaging the moving average by the median and averaging weighted by volume.

Line shifts can be removed. The colors of the AA indicator lines are set according to the type of color spectrum: from violet for a small smoothing period to red - for the largest period.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Estimation moving average without lag https://www.mql5.com/en/market/product/36945

A simple moving average (SMA) with an averaging period (2n + 1) of bars is always obtained lagging by n bars. If SMA or other types of moving averages are the basis for making trading decisions, then their strong delay does not allow to open positions in time and close positions, which leads to losses.

The Estimation moving average without lag indicator calculates an estimate of a non-lagging moving average and displays the corresponding confidence interval.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

A simple moving average (SMA) with an averaging period (2n + 1) of bars is always obtained lagging by n bars. If SMA or other types of moving averages are the basis for making trading decisions, then their strong delay does not allow to open positions in time and close positions, which leads to losses.

The Estimation moving average without lag indicator calculates an estimate of a non-lagging moving average and displays the corresponding confidence interval.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Iterative Moving Average https://www.mql5.com/en/market/product/31714

Iterative Moving Average – IMA. IMA is obtained by correcting the usual MA. The correction consists in addition to MA averaged difference between the time series (X) and its MA, i.e. IMA(X)=MA(X) + MA (Х-MA(X)). Correction is done in several iterations (and, exactly, 2 iterations in this indicator) and with a change in the averaging period.

As a result, the time-series points begin to cluster around (on all sides) of the getting IMA and with a smaller delay than around the usual MA. Therefore, IMA is a more effective tool for manual and automatic trading than all types of conventional MA (SMA, EMA, SSMA, LMA).

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Iterative Moving Average – IMA. IMA is obtained by correcting the usual MA. The correction consists in addition to MA averaged difference between the time series (X) and its MA, i.e. IMA(X)=MA(X) + MA (Х-MA(X)). Correction is done in several iterations (and, exactly, 2 iterations in this indicator) and with a change in the averaging period.

As a result, the time-series points begin to cluster around (on all sides) of the getting IMA and with a smaller delay than around the usual MA. Therefore, IMA is a more effective tool for manual and automatic trading than all types of conventional MA (SMA, EMA, SSMA, LMA).

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Signal Bands https://www.mql5.com/en/market/product/29171

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

✔️The indicator has all types of alerts.

✔️The indicator does not redraw.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

✔️The indicator has all types of alerts.

✔️The indicator does not redraw.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Robust filter https://www.mql5.com/en/market/product/52668

The Robust filter indicator is based on the robust filtering algorithm developed by the author using the multi-period averaged moving median.

The indicator calculates and shows:

✔️1. The direction of the trend;

✔️2. Entry and exit points of positions;

✔️3. StopLoss lines calculated from current price probability distributions and selected probability of closing an order by StopLoss before the trend reversal;

✔️4. Lot sizes based on the accepted risk level, deposit size and StopLoss position.

============================================================

✔️The indicator has all kinds of alerts.

✔️The indicator does not redraw.

✔️The indicator can be used both for trading scalper strategies and for long-term trading strategies.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Robust filter indicator is based on the robust filtering algorithm developed by the author using the multi-period averaged moving median.

The indicator calculates and shows:

✔️1. The direction of the trend;

✔️2. Entry and exit points of positions;

✔️3. StopLoss lines calculated from current price probability distributions and selected probability of closing an order by StopLoss before the trend reversal;

✔️4. Lot sizes based on the accepted risk level, deposit size and StopLoss position.

============================================================

✔️The indicator has all kinds of alerts.

✔️The indicator does not redraw.

✔️The indicator can be used both for trading scalper strategies and for long-term trading strategies.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Probabilities distribution of price https://www.mql5.com/en/market/product/27070

Indicator is used for:

1. defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2. defining the channel change moment.

✔️The algorithms of this indicator are unique and developed by their author

✔️ It has built-in management

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Indicator is used for:

1. defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2. defining the channel change moment.

✔️The algorithms of this indicator are unique and developed by their author

✔️ It has built-in management

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Prof MACD (MT5) https://www.mql5.com/en/market/product/65276

✔️ One of my most profitable indicators with optimal filtering.

✔️The algorithms of this indicator are unique and developed by their author

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️ One of my most profitable indicators with optimal filtering.

✔️The algorithms of this indicator are unique and developed by their author

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Asummetry https://www.mql5.com/en/market/product/40005

The Asummetry indicator allows you to predict the beginning of a change in the direction of trends, long before their visual appearance on the price chart.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Asummetry indicator allows you to predict the beginning of a change in the direction of trends, long before their visual appearance on the price chart.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Strong Trend Flat Signal https://www.mql5.com/en/market/product/37203

The Strong Trend Flat Signal indicator is the intersection of two, developed by the author, non-lagging moving averages with averaging periods 21 and 63.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Strong Trend Flat Signal indicator is the intersection of two, developed by the author, non-lagging moving averages with averaging periods 21 and 63.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Friends! What we see on the price charts as a trend is often not a trend, but arises as a result of the imposition of a large number of unidirectional price jumps, i.e. is a purely random occurrence. Such pseudo-trends especially often occur on small timeframes, where the level of noise is very high against the background of a weak regular price movement. And you can win on such random false trends only by chance. Therefore, following such false trends, as a rule, leads to losses. My indicators were designed to filter out such noise, which is not an easy task. For more information about this phenomenon and how to identify it, see the blog «True and illusory currency market trends” https://www.mql5.com/en/blogs/post/740838

Aleksey Ivanov

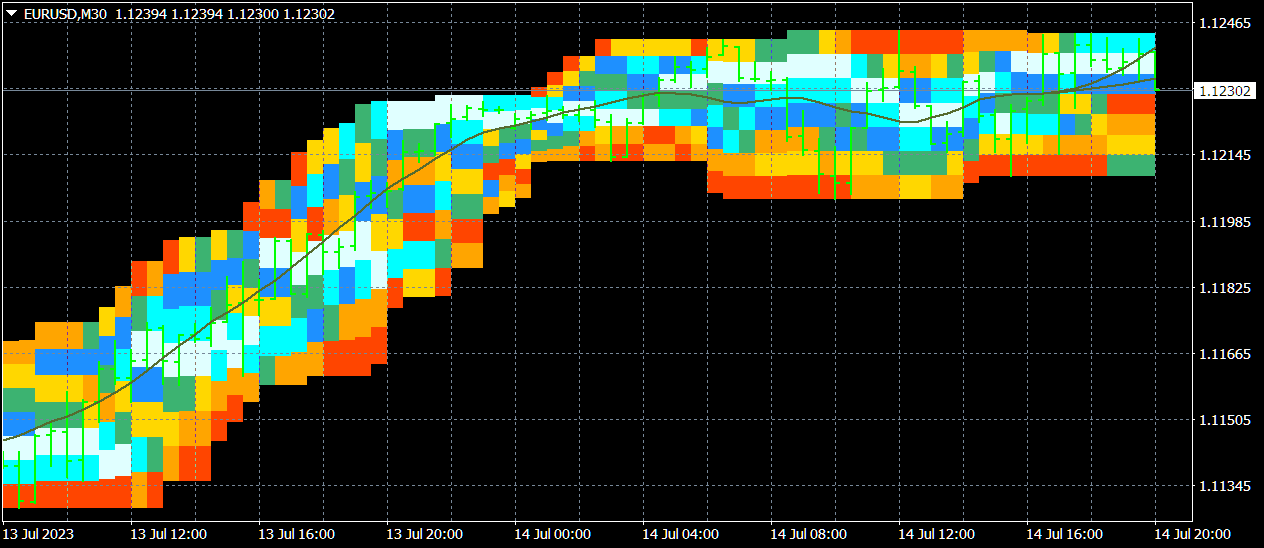

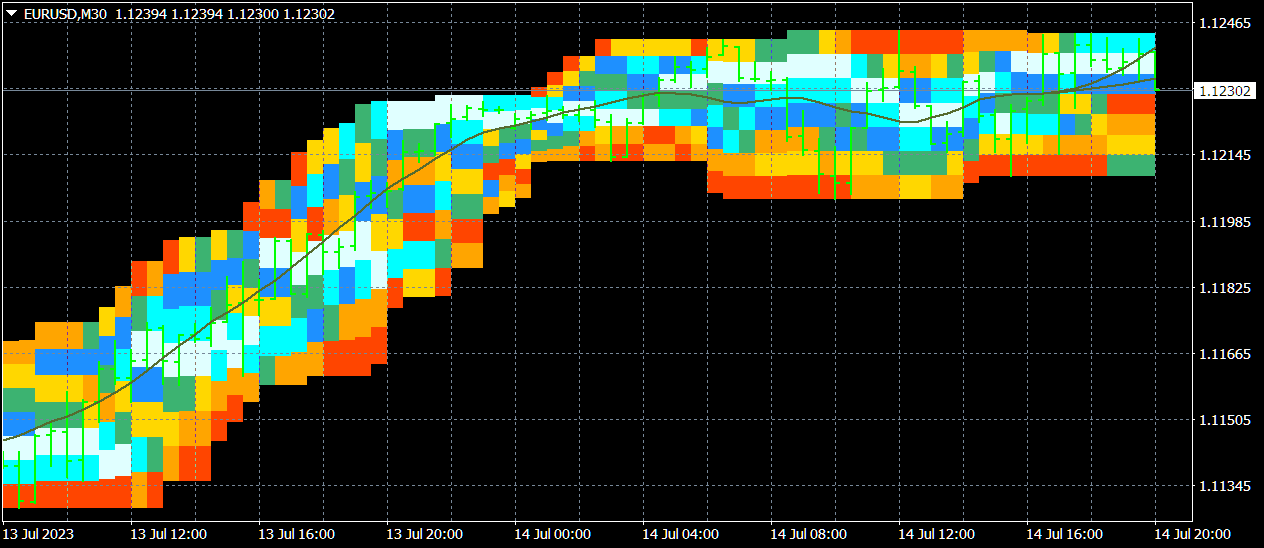

Probability distribution PRO https://www.mql5.com/en/market/product/41174

Indicator is used for:

1. defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2. defining the channel change moment.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Indicator is used for:

1. defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2. defining the channel change moment.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

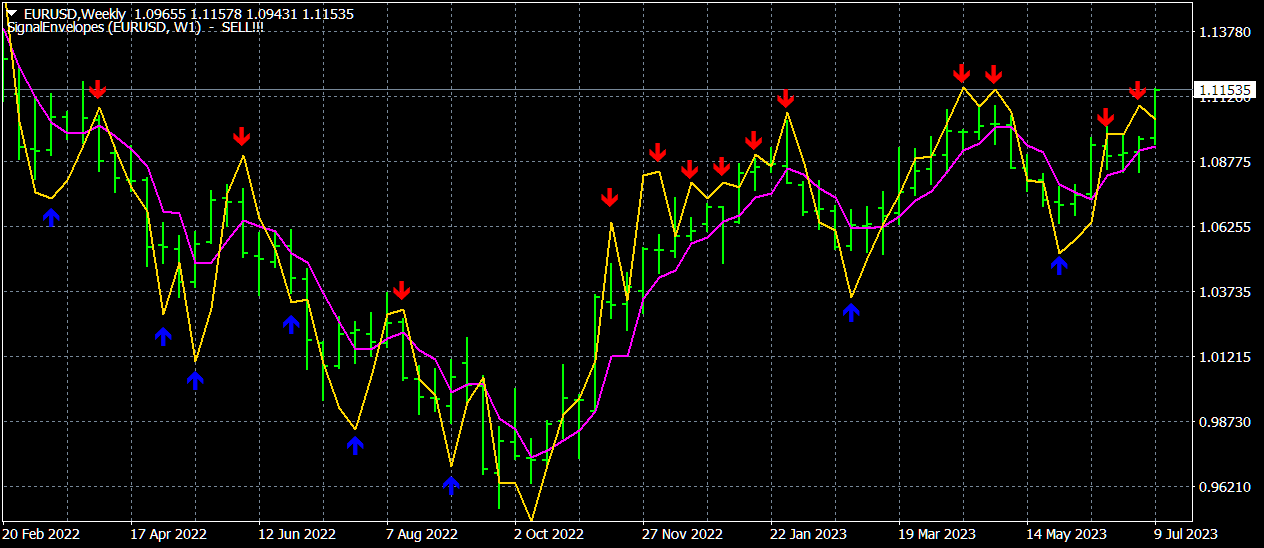

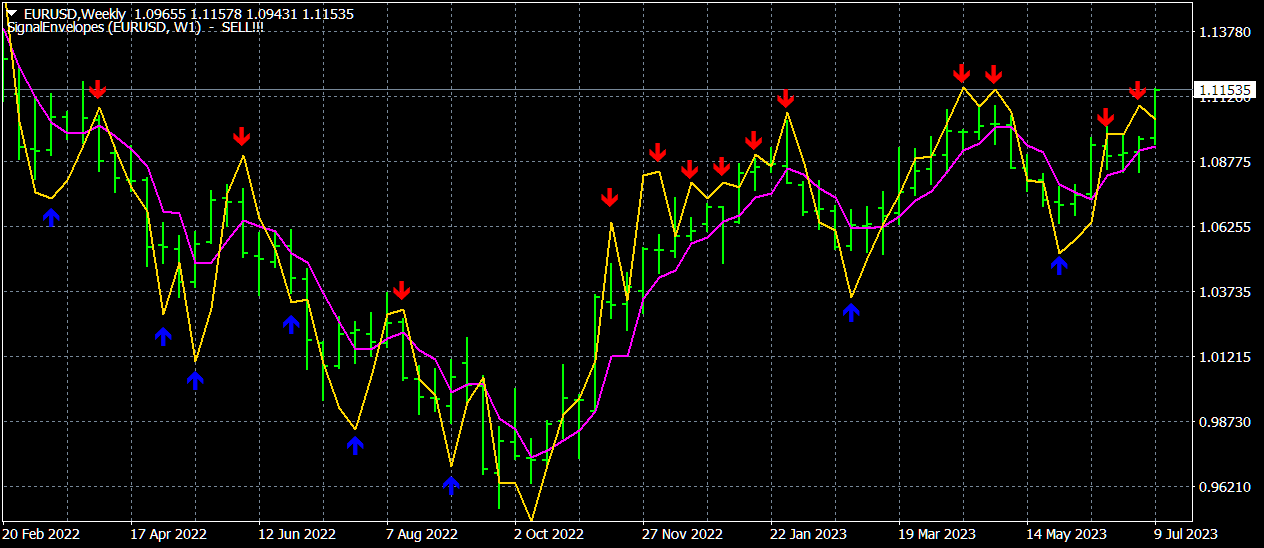

Signal Envelopes https://www.mql5.com/en/market/product/46593

The Signal Envelopes indicator uses the robust filtering method based on: (1) the moving median Buff0 = < Median> = (Max {x} + Min {x}) / 2 and (2) the averaging algorithm developed by the author Buff1 = <( ) ^ (- 3)> * ( ) ^ 4 based on the moving median. The Signal Envelopes indicator allows you to most accurately and with the minimum possible delay set the beginning of a new trend. The Signal Envelopes indicator can be used both for trading according to scalper strategies, and when using long-term trading strategies.

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Signal Envelopes indicator uses the robust filtering method based on: (1) the moving median Buff0 = < Median> = (Max {x} + Min {x}) / 2 and (2) the averaging algorithm developed by the author Buff1 = <( ) ^ (- 3)> * ( ) ^ 4 based on the moving median. The Signal Envelopes indicator allows you to most accurately and with the minimum possible delay set the beginning of a new trend. The Signal Envelopes indicator can be used both for trading according to scalper strategies, and when using long-term trading strategies.

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

RVI Extrapolator https://www.mql5.com/en/market/product/81184

The indicator predicts the future values of the Relative Vigor Index indicator, which allows you to use this indicator much more efficiently.

The market has a very short memory; in any case, the information that formally describes it quickly becomes obsolete and loses its weight in the formation of the current price. Therefore, wavelet analysis is the most promising for predicting future market parameters. The author uses a number of wavelet functions (including the Morlet wavelet and a somewhat modified Gaussian function, which are shown in the last screenshot), the expansion by which, with a sufficient degree of reliability, allows extrapolating future values of oscillator indicators.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The indicator predicts the future values of the Relative Vigor Index indicator, which allows you to use this indicator much more efficiently.

The market has a very short memory; in any case, the information that formally describes it quickly becomes obsolete and loses its weight in the formation of the current price. Therefore, wavelet analysis is the most promising for predicting future market parameters. The author uses a number of wavelet functions (including the Morlet wavelet and a somewhat modified Gaussian function, which are shown in the last screenshot), the expansion by which, with a sufficient degree of reliability, allows extrapolating future values of oscillator indicators.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

: