CalculateScientificTradePeriod

- Utilities

- Aleksey Ivanov

- Version: 1.0

- Activations: 5

Firstly, the script estimates how many Mx bars of the chart (on which this script is applied) the future trend will most likely continue and what is its quality.

Secondly (and most importantly), the script is an auxiliary tool for the extremely mathematically advanced and extremely effective ScientificTrade indicator in trading.

The script calculates the optimal averaging period, which is also equal to Mx, of the ScientificTrade indicator, which gives the maximum profit according to the strategy of this indicator.

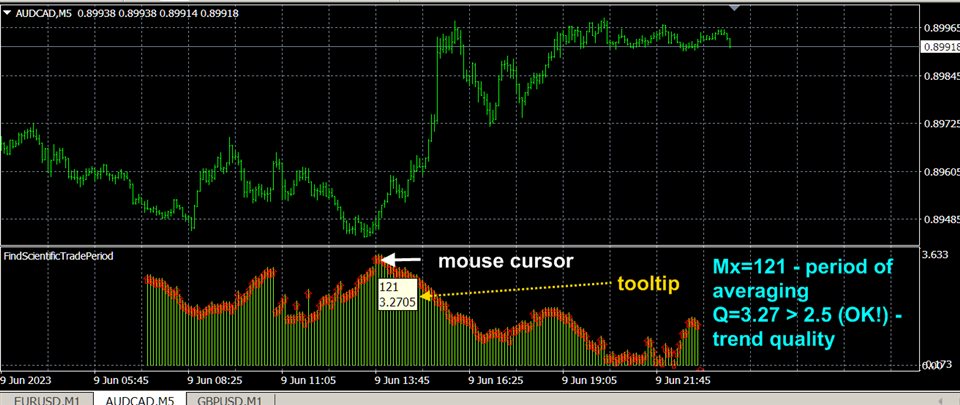

To display the data of the CalculateScientificTradePeriod script, you need to download the FindScientificTradePeriod indicator, on the scale of which these data are displayed.

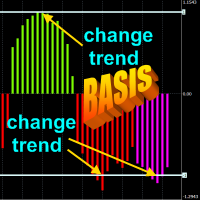

On the horizontal (time for conventional indicators) axis of the FindScientificTradePeriod indicator, the averaging period "M" is plotted, and on the vertical axis, the forecast values of certain parameters calculated by the CalculateScientificTradePeriod script are plotted. By default, the CalculateScientificTradePeriod script predicts the trend quality indicator Q (which is described by the Quality trend indicator in real time and on the price history) on a set of future time periods starting with a length of 10 bars from the current bar into the future and ending with a length of 200 bars from the current bar of the corresponding timeframe , which forms the function Q(M) of the quality of the trend future trend at different time intervals. The optimal period Mx corresponds to the maximum Mx=max Q(M) of the trend quality function, which (maximum) is located according to the chart displayed by the FindScientificTradePeriod indicator. To determine the optimal period to the maximum of the function (to the red bar), you need to move the mouse cursor and the value of this period and the value of this function will be displayed in the tooltip. At the same time, you need to look for a smoothly drawn maximum without random beats of the displayed parameter, which are mainly characteristic of small intervals. The desired maximum value should be greater than 2.5.

Script settings.

- Spectrum of computed values 10<M<200 The maximum calculated averaging period. Values: Any positive integer between 11 and 200. Default is 200.

- Estimated price fluctuation . Estimated price fluctuation in standard deviations. The default is 3.0. Should be the same as in the ScientificTrade indicator.

- Mode. Operating mode. Values: S(M)/M Profit growth rate, S(M) Profit, Q(M) Trend Quality (default), P(M) Probability of winning.