Chandelier Exits

- Indicators

- Muhammad Hassaan

- Version: 1.1

The Chandelier Exit Indicator is a popular technical analysis tool developed by Chuck LeBeau. It is designed to help traders identify potential exit points for their trades based on market volatility and the concept of trailing stops. The Chandelier Exit Indicator consists of three main components:

-

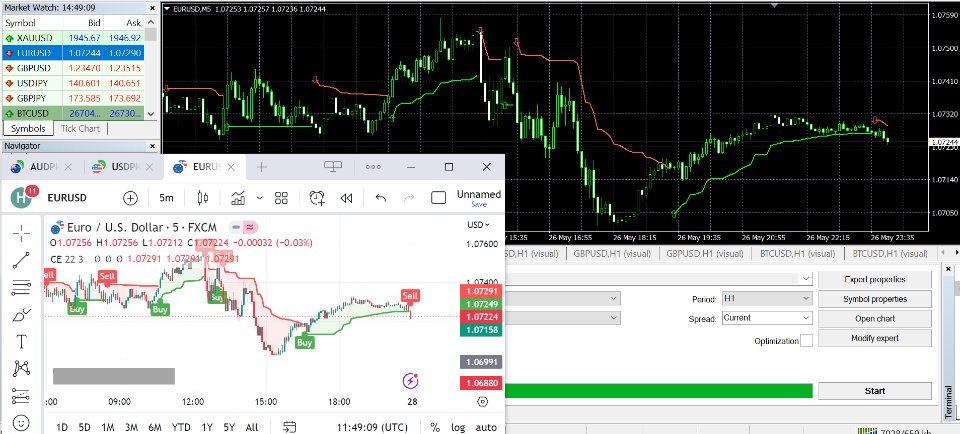

Average True Range (ATR): The indicator utilizes the Average True Range, which measures market volatility. The ATR calculates the average range between the high and low prices over a specified period. It helps determine the potential size of price swings and acts as a basis for setting trailing stop levels.

-

Trailing Stop Level: The Chandelier Exit Indicator plots a line that represents the trailing stop level. The stop level is derived by subtracting a multiple of the ATR from the highest high reached since entering the trade. The multiple used is typically a user-defined parameter, such as 2 or 3 times the ATR.

-

Exit Signal: The exit signal is generated when the price closes below the trailing stop level. This signals a potential trend reversal or a significant pullback, indicating it may be an appropriate time to exit the trade and protect profits.

The Chandelier Exit Indicator is commonly used by trend-following traders who aim to stay in a trade as long as the trend remains intact but want to exit when the trend shows signs of weakening or reversing. By dynamically adjusting the stop level based on market volatility, the indicator provides a trailing stop mechanism that moves closer to the price during volatile periods and provides more room during less volatile phases.

Traders can customize the Chandelier Exit Indicator by adjusting parameters such as the period for calculating the ATR and the multiple used to determine the trailing stop level. These customizations allow traders to adapt the indicator to different timeframes and trading strategies.