Porsaj Sentiment of Traders

- Utilities

- Jan Bungeroth

- Version: 8.7

- Updated: 6 February 2024

- Activations: 5

Note:

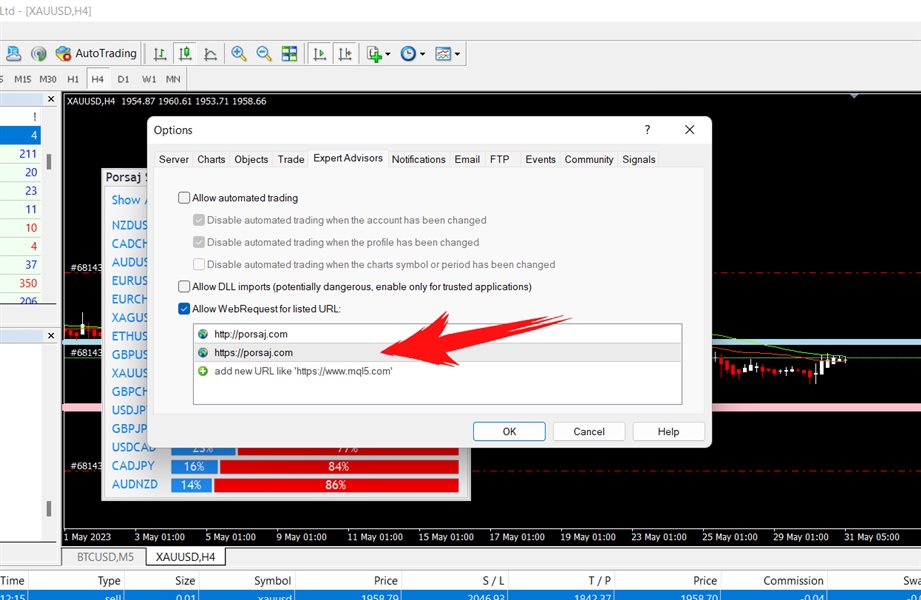

After installation, please go to Tools>Options>Expert Advisors and add https://porsaj.com to 'Allow WebRequest for listed URL'.

Still Problem?! Please check Internet connection!

Sentiment is a vital gauge that provides traders and investors with valuable insights into their perceptions of the market and the broader economy. It serves as a reflection of their collective outlook, emotions, and expectations regarding future price movements and economic conditions.

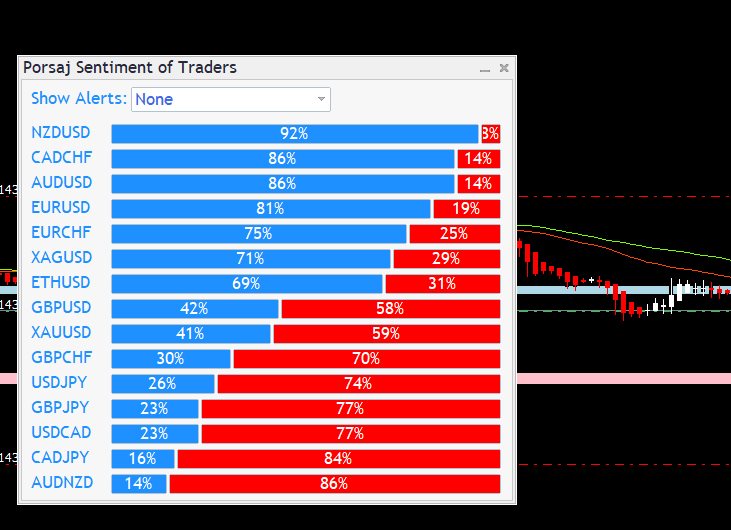

Porsaj is a powerful platform that offers traders a comprehensive view of market sentiment by providing valuable data on the percentage of long and short positions taken by traders. This information can be incredibly useful in assessing the overall sentiment of the market and making informed trading decisions.

By presenting the percentage of long positions, which represent traders betting on an asset's price to rise, and short positions, which indicate traders speculating on a price decline, Porsaj equips traders with a real-time snapshot of market sentiment. This data can serve as a valuable guide, giving traders insights into the prevailing market bias and potential shifts in sentiment.

The ability to access and analyze the sentiment of fellow traders can be instrumental in devising effective trading strategies. By understanding whether the majority of traders are bullish or bearish on a particular asset, traders can gain a clearer perspective on market dynamics and adjust their positions accordingly.

For instance, if the percentage of long positions on a specific currency pair is exceptionally high, it could indicate an overcrowded trade and a potential reversal in sentiment. In such cases, traders might consider taking a contrarian approach and exploring short positions as a means to capitalize on a potential price correction.

On the other hand, if the percentage of short positions outweighs long positions, it may suggest a prevailing bearish sentiment. Traders can use this information to confirm their own analysis and make informed decisions about potential entry or exit points.

By leveraging Porsaj's sentiment data, traders can stay ahead of market trends and align their strategies with prevailing sentiment. This can help them identify potential turning points, confirm their own analysis, and improve their overall trading performance.

In conclusion, Porsaj's provision of sentiment data, including the percentage of long and short positions, empowers traders with valuable insights into market sentiment. By integrating this information into their decision-making process, traders can enhance their ability to navigate the markets, identify opportunities, and potentially improve their trading outcomes.

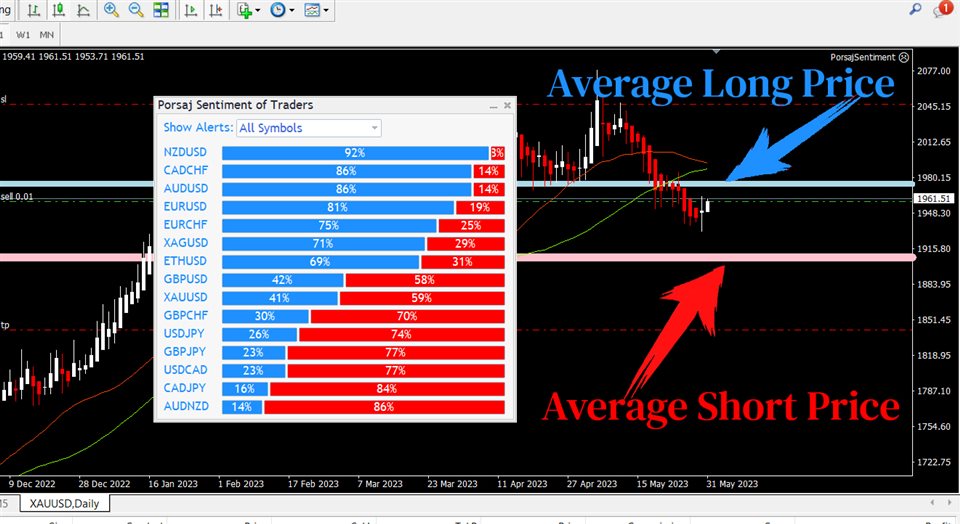

In addition to offering information on the percentage of long and short positions, Porsaj goes a step further by providing traders with the average long and short prices. This data is immensely valuable as it serves as a significant support or resistance level, offering insights into the overall sentiment and potential turning points in the market.

Support and resistance levels are crucial technical indicators used by traders to identify price levels at which an asset is likely to experience buying or selling pressure. They act as barriers that can influence market sentiment and trigger significant price movements.

By providing the average long and short prices, Porsaj enables traders to identify these key support and resistance levels more accurately. When the average long price aligns with a support level, it indicates that there is a considerable number of traders who have entered long positions around that price level. This can reinforce the support level and make it a robust area where buying pressure may emerge, potentially leading to a price bounce or reversal.

Conversely, when the average short price coincides with a resistance level, it suggests that there is a significant concentration of short positions at that price level. This strengthens the resistance level and signifies a zone where selling pressure may intensify, potentially causing a price rejection or reversal.

Being aware of these support and resistance levels based on the average long and short prices provided by Porsaj allows traders to make more informed decisions. They can use this information to identify potential entry or exit points, manage their risk more effectively, and align their trading strategies with the prevailing market sentiment.

Moreover, these support and resistance levels can also be useful for confirming other technical analysis tools or indicators. When multiple indicators align with key average long or short prices, it can enhance the traders' confidence in their analysis and potentially increase the likelihood of successful trades.

In summary, Porsaj's provision of average long and short prices adds an additional layer of support and resistance analysis, empowering traders with crucial information to navigate the market. By recognizing these significant levels, traders can make more informed trading decisions, capitalize on potential price reversals or bounces, and improve their overall trading performance.

Porsaj Sentiment of Traders supports:

AUDNZD,

AUDUSD,

BTCUSD,

CADCHF,

CADJPY,

ETHUSD,

EURCHF,

EURUSD,

GBPCHF,

GBPJPY,

GBPUSD,

NZDUSD,

USDCAD,

USDCHF,

USDJPY,

XAGUSD,

XAUUSD

Note: Please go to Tools>Options>Expert Advisors and add https://porsaj.com to 'Allow WebRequest for listed URL'.

We need you to connect Porsaj website to exchange of information.

User didn't leave any comment to the rating