Eagle Grid MT5

- Experts

- Luiz Felipe De Oliveira Caldas

- Version: 1.3

- Updated: 19 June 2023

- Activations: 20

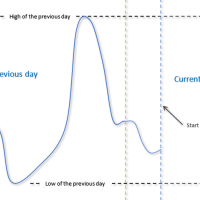

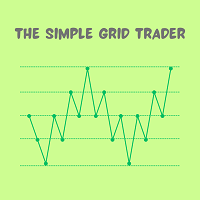

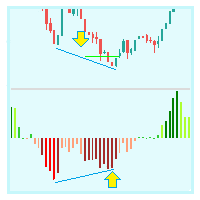

Grid trading is when orders are placed above and below a set price, creating an order grid with increasing and decreasing prices. Grid trading is most commonly associated with the foreign exchange market. In general, the technique seeks to capitalize on the normal volatility of an asset's price by placing buy and sell orders at certain regular intervals above and below a predefined base price.

For example, a forex trader can place buy orders every 15 pips above a set price, while also placing sell orders every 15 pips below that price. This takes advantage of trends. They can also place buy orders below a set price and sell orders above. This takes advantage of the varying conditions.