LT Rsi

- Experts

- Sie Samuel Roland Youl

- Version: 1.55

- Updated: 23 October 2023

- Activations: 5

Introducing the RSI (Relative Strength Index) indicator, a powerhouse of technical analysis. This momentum oscillator assesses price movement strength and pinpoints potential overbought or oversold conditions in financial markets. Calculated using a mathematical formula based on gains and losses over 14 periods, the RSI comes with a value range of 0 to 100 and appears as a chart below the main price chart.

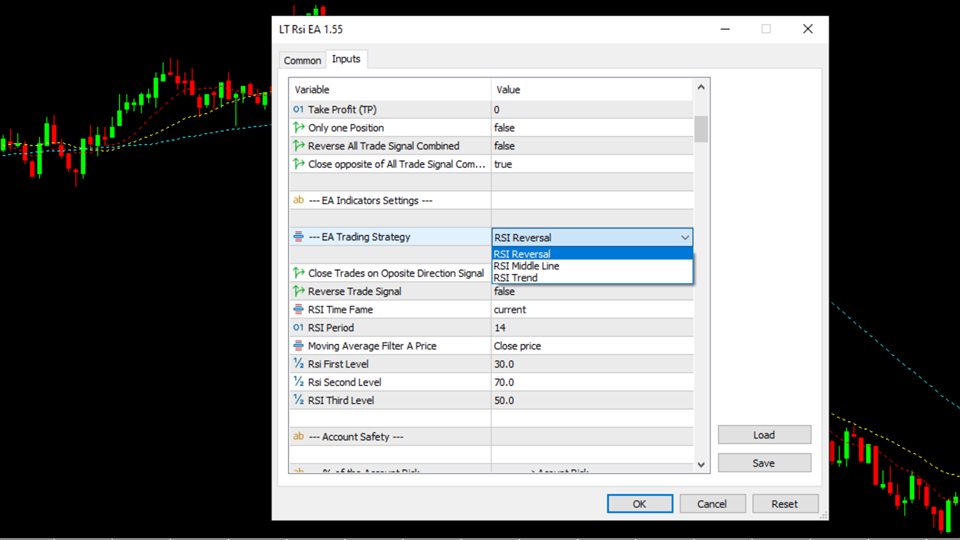

For traders employing the RSI Reversal strategy:

- First Level signals a buy opportunity.

- Second Level points to a sell opportunity.

For those following the RSI Trend strategy:

- First Level indicates a sell position.

- Second Level indicates a buy position.

And for traders adopting the RSI Middle Level strategy:

- The third level offers both Buy and Sell signals.

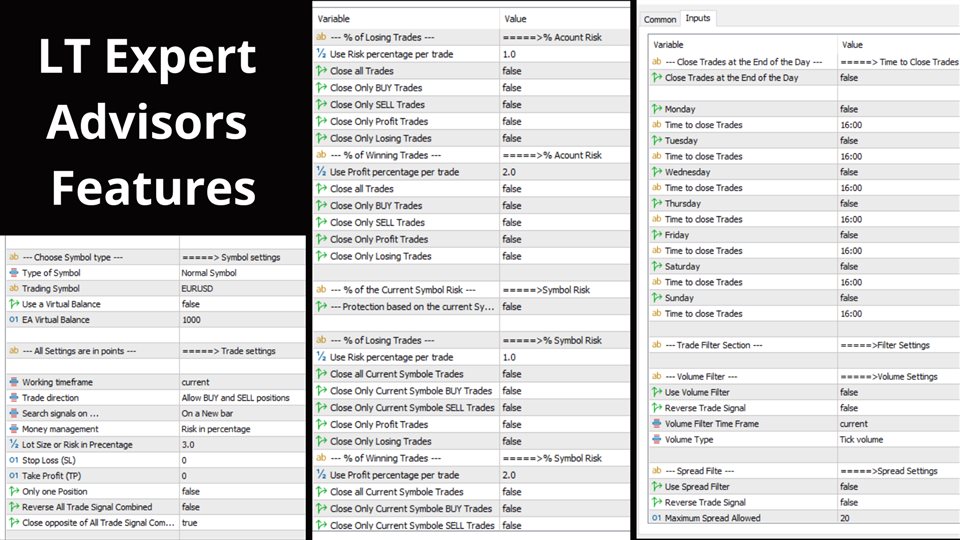

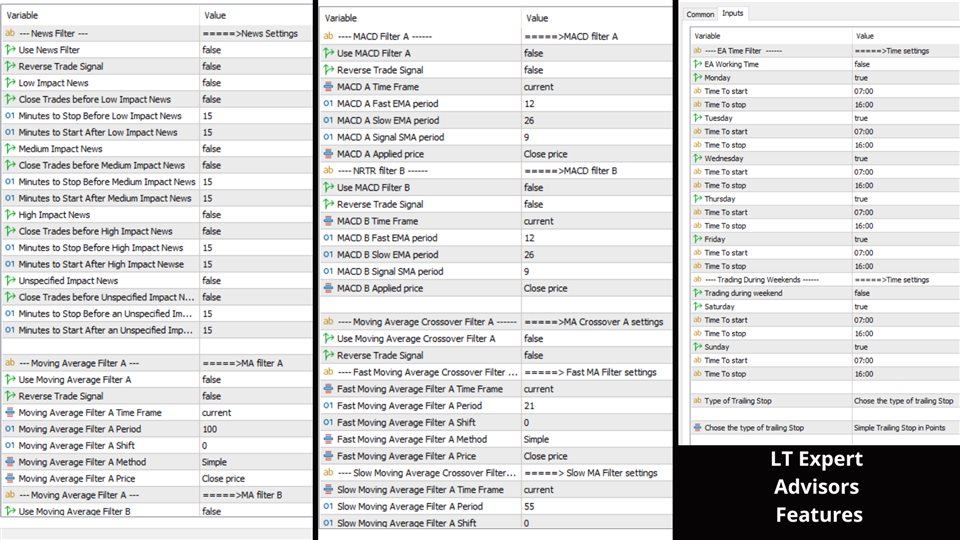

Our Expert Advisor (EA) equipped with the RSI offers remarkable flexibility. Here are some key features:

- Compatibility with multiple Time Frames.

- Freedom to choose your trade direction.

- Ability to set your preferred lot percentage for precise money management.

- Capability to manage multiple trades, closing on opposing signals, reversing trade signals, or closing trades based on account risk.

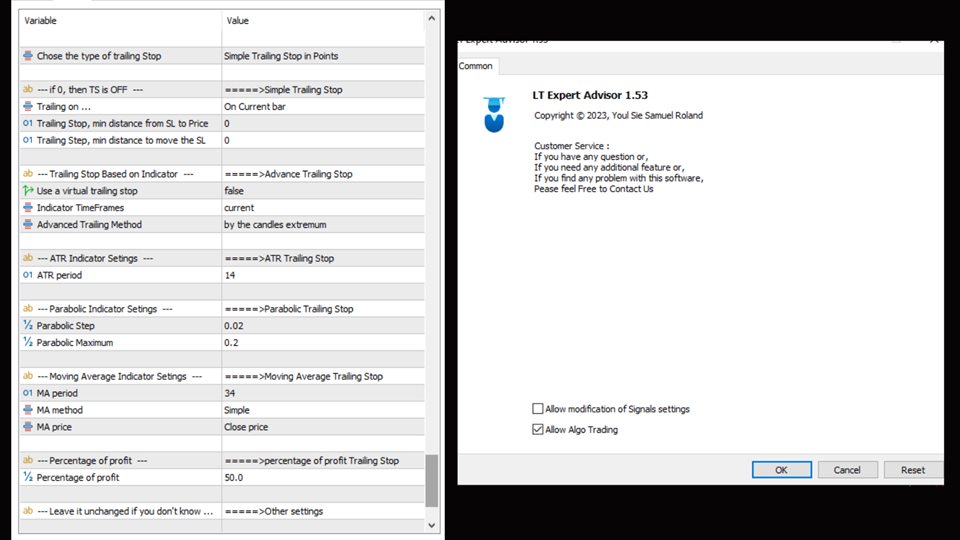

- Access to a wide selection of Trailing Stops bundled with the EA.

- Utilization of a trade filter option to enhance precision and reduce false signals, including filters such as volume, news, moving average, NRTR, Super Trend, and more.

Experience enhanced trading with our RSI-powered EA on the MQL5 marketplace!