Support Resistance Hi Low

- Indicators

- Andy Ismail

- Version: 208.19

- Updated: 26 August 2019

- Activations: 5

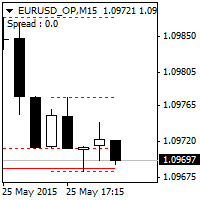

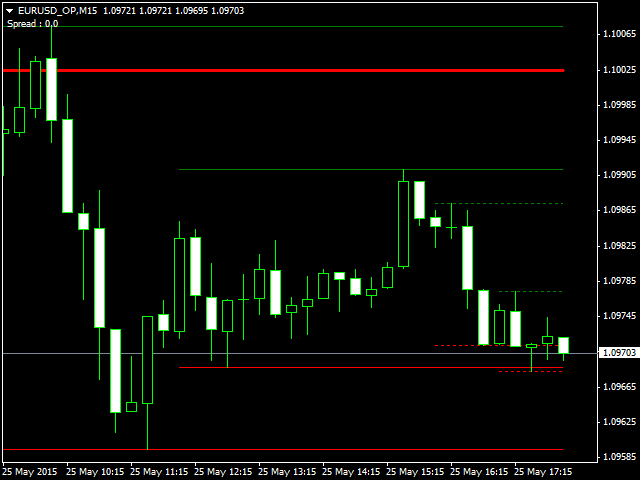

This indicator automatically draws Support and Resistance lines based on High and Low Candle at every timeframe.

Support and resistance have a recurring nature as a trader goes through the process of building a strategy. Because of its importance, it is often reasonable for a trader to build object patterns for incorporating these prices into a strategy. When strong support and resistance levels are found, this can enable traders to effectively plot their approach, manage trades, and adjust risk levels.

Considering Volume

Trading on the basis of support and resistance levels naturally must incorporate volume, because any security will only break through its level of support and resistence if sufficient volume is attached to it. Light volume may cause support or resistance trends only to pause while sufficient volume will cause such trends to reverse.

Indeed, the concepts of support and resistance are based on reversals, where a trend will reverse on its upper end when it reaches resistance; and the trend will reverse on its bottom when it hits its range of support.

The Psychology of Support and Resistance

Support and resistance levels exist only by virtue of traders' and investors' memories of their experiences with trading a given security at certain levels in the past. Investors will be more inclined to lend their support at the same level, at which a large crowd of investors once purchased the stock. Traders tend to have the expectation that a stock will rise again from the same level as it did in the past. Even if those traders did not hold the security in a previous session, they will still look to history to be their guide, examining prior examples of session bottoms and levels of support.

Which Element of Support and Resistance Works Best?

It depends on your strategy. None of the aforementioned support and resistance levels have any predictive behavior. Each is simply a probability that we will not be able to determine until the trade is over. But these levels can help traders build their approach to work with those probabilities looking to limit risk while maximizing gains. So the ‘meat’ of the strategy is still very much going to be based around the risk management because of the single unifying fact that you will never know what the next candle on a chart will be.

The Bottom Line

Support and resistance ranges are key concepts that will sharply refine your exit decisions to a fine point. At first glance, the imprecise nature of ranges may appear to be a detriment to precision, but your trailing stops will ensure some compensation for this potential problem. Always use trailing stops when exiting a position and always be sure to revise them according to the desired tightness or looseness of your exit strategy.

User didn't leave any comment to the rating