Higher Timeframe TDEV

- Indicators

- Tran Quoc Trung

- Version: 1.0

- Activations: 20

Aligning higher time frames for trading

One of the main concepts behind the beginner strategy is multiple time frame analysis – using a higher time frame to determine the overall market direction and executing trades on a lower time frame.

By determining the overall direction on a higher time frame and trading in that direction, you make sure that you trade in the direction of the overall trend – this increases your chances of profitable trades. In the beginner strategy, you use the 30 minute chart as the higher time frame, however, you can go a step further and also use the 4 hour time frame to assess an even larger picture.

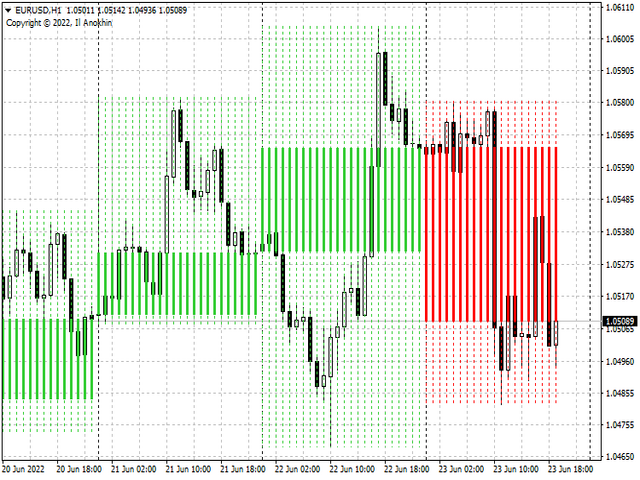

The following shows how to determine if the 4 hour chart and the 30 minute chart show the same market direction.

To align two higher time frames, you start at the highest time frame and then work down. So first switch to the 4 hour time frame and use the same rules as determining the market direction on the 30 minute chart.

You look for the last break of an up fractal and the last break of a down fractal. If the last fractal break was of an up fractal, then the direction is up on the 4 hour chart. Similarly, if the last break was of a down fractal, then the market direction is down on the 4 hour chart.

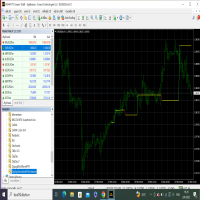

You can see this demonstrated on the chart below. The last break of a fractal was an up fractal and so the direction on the four hour chart is up.