AIS Trading Levels Intraday

- Indicators

- Aleksej Poljakov

- Version: 3.0

- Updated: 21 May 2023

- Activations: 5

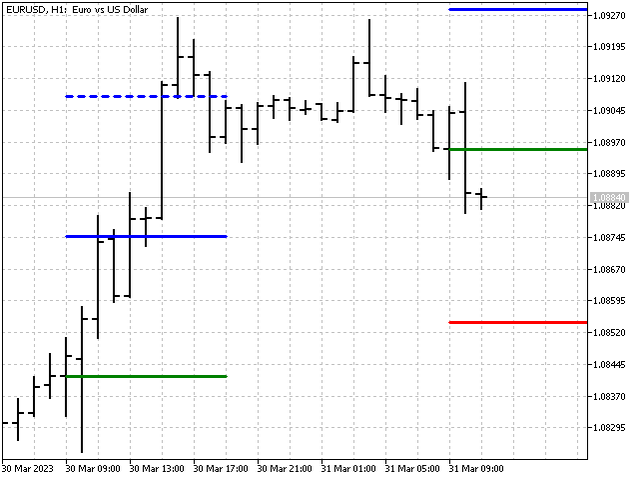

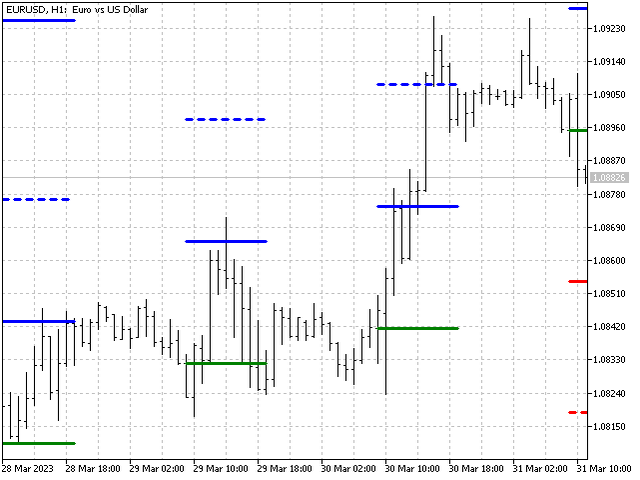

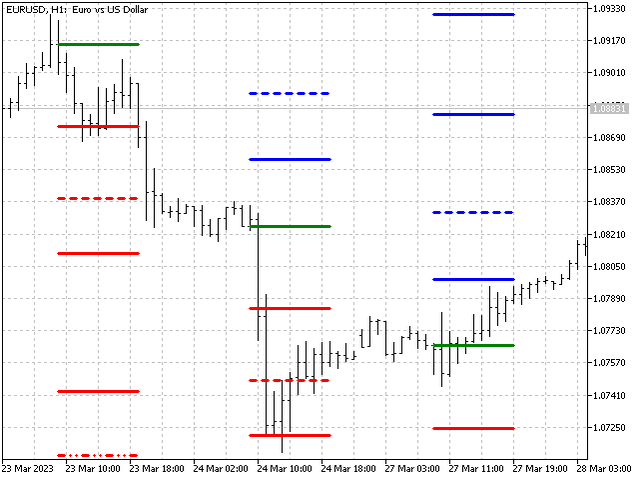

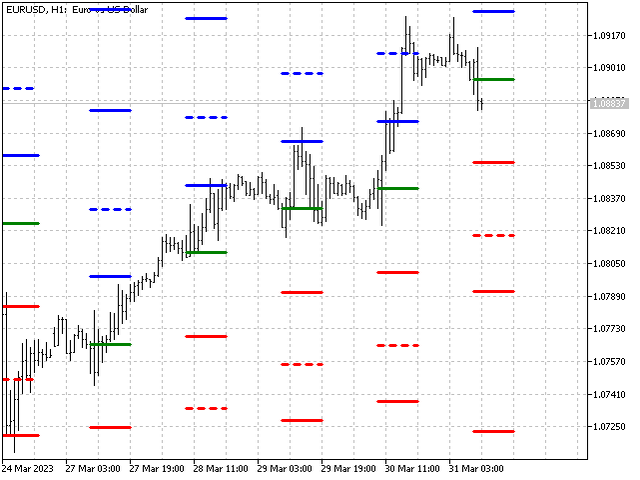

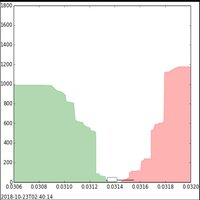

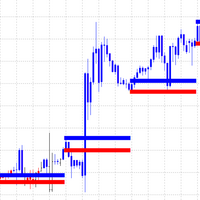

This indicator is designed to determine the time of the greatest trading activity within a day. After this calculation, the indicator builds the most significant trading levels. Comparing these levels with actual price action can provide information about the strength and direction of market trends.

Features of the indicator

Timeframe must be below D1. Recommended timeframes: M15, M30 and H1. Timeframes above H1 can give a very rough picture. And the use of timeframes below M15 can lead to short bursts of trading.

The indicator is sensitive to historical data. Therefore, I recommend setting at least 50 thousand bars in the chart window.

Indicator parameters

- Base - sets the base period for calculating trading activity.

day – trading activity is calculated taking into account the time of day.

week – trading activity is calculated taking into account the time of day and the day of the week.

- Width - line width.

- ClrMean, ClrUp and ClrDn are the colors of the middle, upper and lower trading levels.

- Style1 - Style5 – styles for displaying trading levels.

- AlertsOn - turns on the notification of the onset of trading sessions.

- MailOn - enables permission to send a message to e-mail.

- NotificationOn - allows sending messages to mobile terminals.