Channel Edge MT5

- Experts

- Szymon Palczynski

- Version: 6.10

- Updated: 28 April 2024

- Activations: 5

The ATR indicator (Average True Range) is a tool used to measure market volatility. It can be used to develop a trading strategy that takes into account daily and weekly price volatility. Here are some key points about using ATR in a trading strategy:

Volatility Assessment: ATR helps understand how much the price of an asset has changed in a given period compared to previous periods. This is useful for assessing the likelihood of a trend reversal.

Order Setting: You can use ATR to set pending orders, which can help manage risk. It is always better to trade in an overbought and oversold market.

Channel Strategies: ATR is also used to assess the width of the trading range in channel strategies, which are based on breaking the channel boundaries or returning to the average price value.

An example strategy might involve opening a position opposite to the current trend when the ATR exceeds a certain percentage of its average value, which may indicate a potential trend reversal.

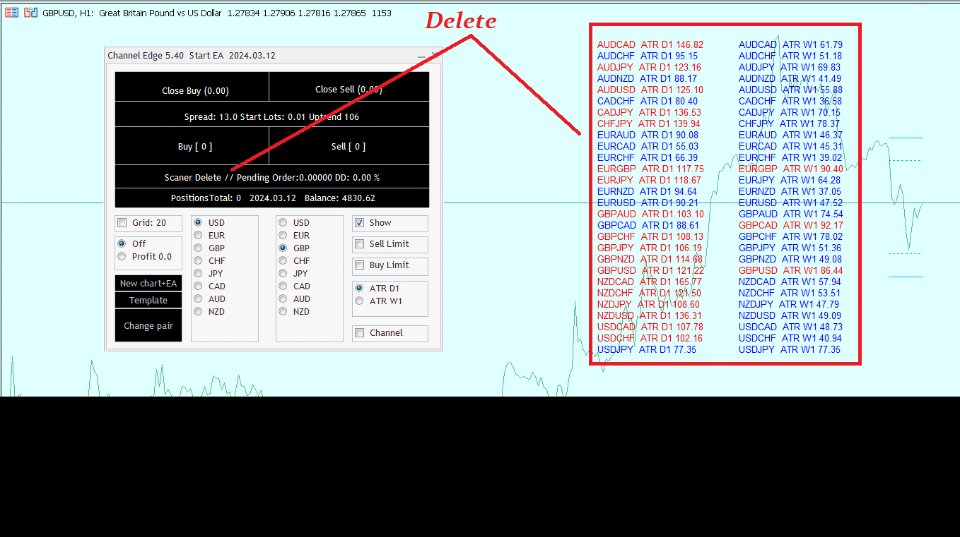

Before you open a position, it’s crucial to scan the market for opportunities. An installed scanner can help detect potential trades. This approach allows you to analyze market conditions and identify entry points that align with your trading strategy. By utilizing a market scanner, you can filter stocks or other assets based on specific criteria such as price movements which can significantly enhance your trading efficiency and decision-making process. Yes, a market scanner can be programmed to monitor price movements on both a daily and weekly level. This allows for the detection of trends and patterns that may not be visible over shorter time frames. Scanning daily movements can help identify short-term trading opportunities, while weekly analysis can provide information on long-term trends and potential market turning points. But to the point: Channel Edge is a powerful, semi-automatic trading tool that can also trade on its own.Using a scanner in this way can significantly increase the effectiveness of a trading strategy, allowing for better risk management and optimization of investment decisions.

When trading a selected currency pair, it’s indeed important to consider additional information that can impact your trading decisions. Here’s a breakdown of the factors:

-

Upcoming Events: Economic events, such as interest rate decisions, employment reports, and GDP releases, can cause significant market volatility. Keeping an eye on the economic calendar can help you anticipate such movements.

-

Swap: This is the interest paid or earned for holding a position overnight. A high swap cost can indeed reduce profits, especially when trading with leverage. It’s wise to be cautious with positions that have a large negative swap, as recommended by the expert system you mentioned.

-

Price movement in percentages and pips.

Incorporating these considerations into your trading strategy can help you make more informed decisions and manage risks more effectively. Always ensure that you’re aware of all the costs associated with holding positions and adjust your strategy accordingly to optimize your trading results.

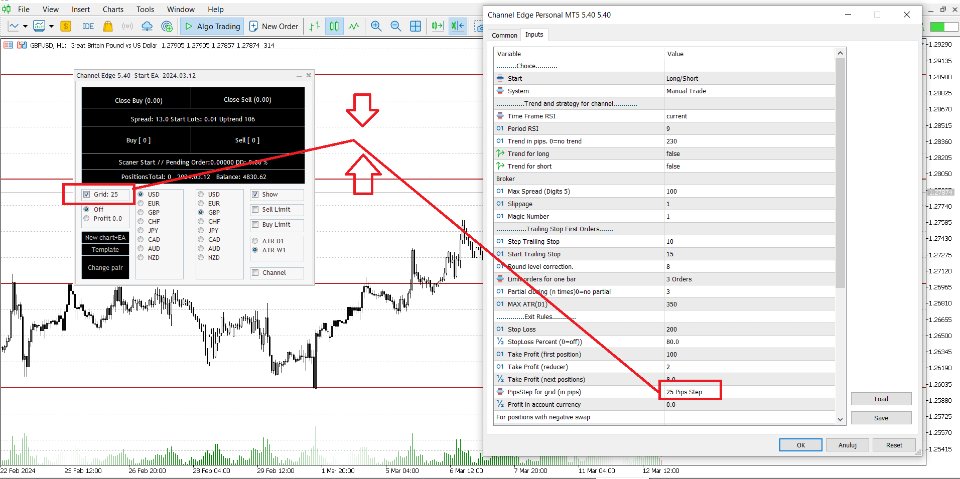

Combining manual and automated trading can offer a balanced approach to the financial markets. Here’s an overview of how this combination can be beneficial:

Manual Trading:

- Control: Traders have complete control over their trades, allowing for flexibility and personal judgment.

- Adaptability: Manual traders can quickly adapt to market news and changes that automated systems might not immediately recognize.

Automated Trading:

- Efficiency: Automated systems can process and execute trades much faster than a human can.

- Discipline: These systems strictly adhere to the set parameters, reducing the risk of emotional trading decisions.

Combining Both:

- Strategy Enhancement: Traders can use automated systems to monitor the markets and execute trades based on predefined criteria while retaining the option to intervene manually.

- Risk Management: By setting automated rules for exiting positions, traders can protect themselves against significant losses, especially during volatile market conditions.

By leveraging the strengths of both manual and automated trading, traders can aim for a more robust and diversified approach to their investment strategies. It’s important to note that while automated trading can handle repetitive tasks and maintain discipline, the human element of manual trading is invaluable for its strategic insight and decision-making capabilities.

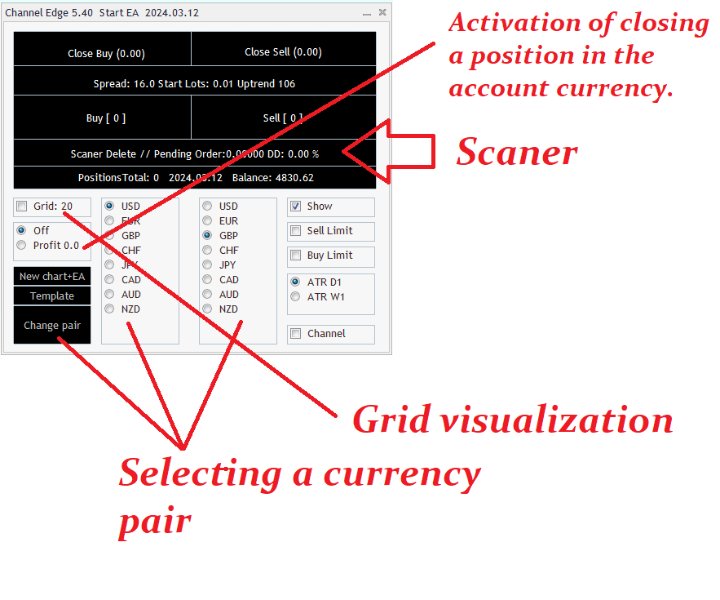

It appears you possess an extensive trading system equipped with multiple features tailored to effectively manage trades. Below is a concise summary of the components:

-

Closing Positions Based on the Entered Amount: This allows you to close trades based on a specific monetary value, providing precise control over your profit-taking and loss-cutting strategies.

-

Grid System Based on Circular Levels + Visualization on a Chart: A grid system that operates on predefined levels can help in identifying potential entry and exit points. The visualization aspect enhances the user experience by allowing traders to see these levels directly on the chart.

-

Partial Closing System with Trailing Stop: This feature enables you to secure profits by partially closing positions while letting the remaining portion run with a trailing stop, which adjusts the stop loss level as the price moves in your favor.

-

Loss Closure Based on Percentage: Setting a maximum loss limit as a percentage of your account balance is a prudent risk management strategy that can prevent significant drawdowns.

-

A System That Limits Orders to One Price Movement: This could refer to a system that places orders only when a certain price action criterion is met, avoiding overexposure to market fluctuations.

-

Template Saving Functions: The ability to save templates allows for quick setup of new charts, ensuring consistency and saving time.

-

Opening a New Chart and Adding an EA: This feature simplifies the process of starting a new analysis with the added functionality of an Expert Advisor (EA) for automated trading decisions.

-

Conveniently Change Currency Pairs Based on Radio Group: A user-friendly interface for switching between currency pairs can streamline the trading process, making it easier to respond to market conditions.

Each of these components plays a role in creating a structured approach to trading, which can be especially beneficial in volatile markets. Remember to regularly review and adjust your system as needed to align with changing market dynamics and your trading goals.

This is one of the best EA that e used, and I have tested more than 100, deserves 5 stars, I will use it in auto ATR mode, to learn to configure the trends and I hope to learn to use this system in manual or semi mode, but from what I have seen it has a lot of potential and I know that I will have very good results with it.