Rosaline

- Experts

- Simone Peruggio

- Version: 1.0

- Activations: 5

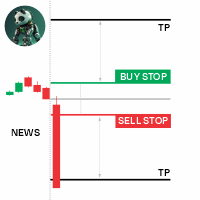

-Strategic approaches:

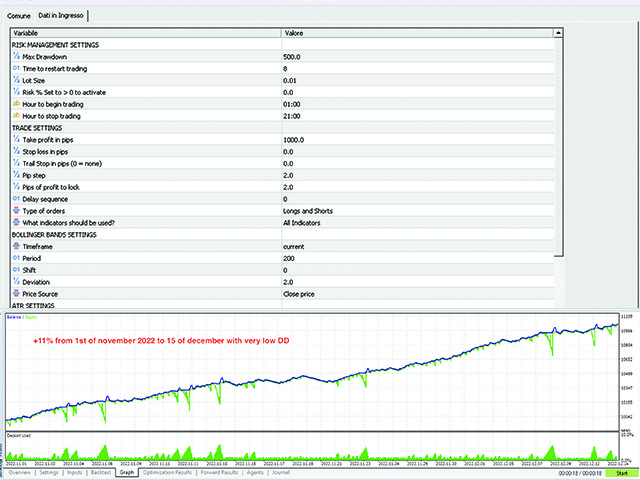

You can only trade with RSI or BB or both for double confirmation

What about the stop loss?

It can be fixed or open with multiple fixed or martingale positions (de gustibus)

You can stick to a single instrument such as gold or spread it over 3 or 4 instruments splitting the max risk of the equity protect

What is a 'VPS' and why is it necessary?

A VPS is like a kind of virtual computer that stays switched on 24 hours a day. An expert advisor (EA) should be installed on a metatrader account inside a VPS because this way it is as if you leave your computer switched on all the time. This way the EA works all the time, even at night.

What timeframe does it work on?

There is no predefined timeframe. You have to run a backtest and you can choose based on the results and average drawdowns which timeframe you think is best to trade on. I personally have accounts that trade in m1 and others in h1. I can have the RSI in m5 and bollinger bands in h4. These crosses are possible because of an EA. I have never believed in fixed stable EAs, the market is fluid and so we have to change too! I regularly launch optimisations to find the most suitable settings for the current market.

How many trades do you open per month?

It depends on many factors, you can also see this from the backtest. Some settings get you scalping and over 300 trades a month and others only about ten.

What is the average profit

It depends on what your risk exposure is. Personally in phase 1 of the challenges I play aggressive. Once funded or on my small real private accounts I am content to make between 1-3% per month.

What is the RR?

There is no real RR because it operates on a grid without a stop, but with an equity protect. Read below.

What STOP does it use?

It does not have a stop loss but an equity protect. It means that it opens "grid" positions with no martin gala (if you want you can activate it yourself, there is the option, but I don't use it). Example: on a 100k prop account (100k) the EP i.e. (the equity protect) I set it around 4000 (-4%) is risky, but it allows me to cushion drawdowns very well. This can also be backtested and optimised. Once funded or on personal accounts I keep a stop between 1 and 2.5% and lower the lottery so that I can have a wider carriage of positions.

Lots

It depends on the instrument and the prop. If I am on my own account every 1,000 euro is about 0.01. So there is no % lot size with this approach.

What are the concrete steps to try it out?

You rent it and try it out. With the quarterly you have access to extra material such as setfiles and video tutorials.

How do I do my first backtest?

Last 3 months, 1/3 forward, real tick and milliseconds matching the speed of your broker on your vps.

What should I test in input optimisation?

Everything. The more data you test the longer it takes to do it. Ideally: pip distance, indicators, indicator periods, max and min buy and sell levels, max drawdowns and lot sizes. You will find reference setfiles from quarterly subscriptions onwards.

What should I look at in the optimisation results?

The highest profit achieved between forward and back with low drawdown and good recovery rate and if you like, also sharp index. Run a single test and see if you come up with two nice steep curves without too many steps.

Only with subscriptions from quarterly onwards, by writing to me, I send access to setfiles that are constantly updated.

Write to me in private here after the rental/purchase.

Text me after you bought for setfiles templates

E' stata la prima EA che ho preso, ma prima di tutto ho avuto una splendida assistenza, ogni dubbio veniva chiarito. Il BOT fa il suo dovere, è semplice, rapido da configurare ma con gli strumenti messi a disposizione si possono già impostare diverse strategie interessanti. Il fatto di poterlo poi noleggiare ti da anche il modo di valutarlo bene prima di acquistarlo, soluzione sicuramente vantaggiosa alla fine soprattutto se lo si vuole usare per differenti conti e magari prop!