Predetermination

- Utilities

- Abraham Correa

- Version: 1.1

- Updated: 16 August 2024

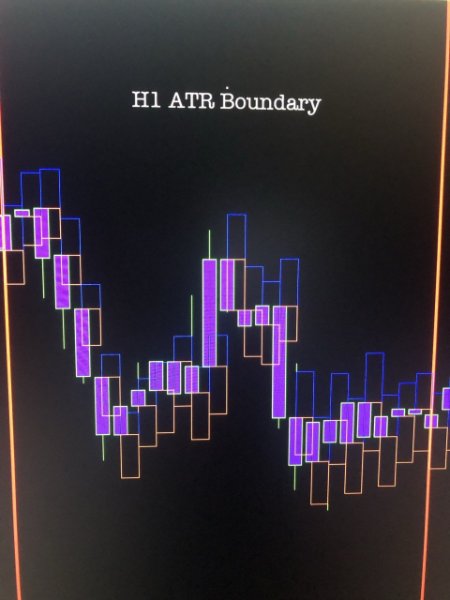

- Trail every trade position twice, automatically, in Average True Range! All manual trades are given a predetermined Risk-Reward closing point, ruled by a calculated motive that'll adjusts to volatility! The ATR, or average true range, is a technical indicator that measures the volatility, also known as "Volume," of a financial instrument by taking into account the price range over a specific period of time.

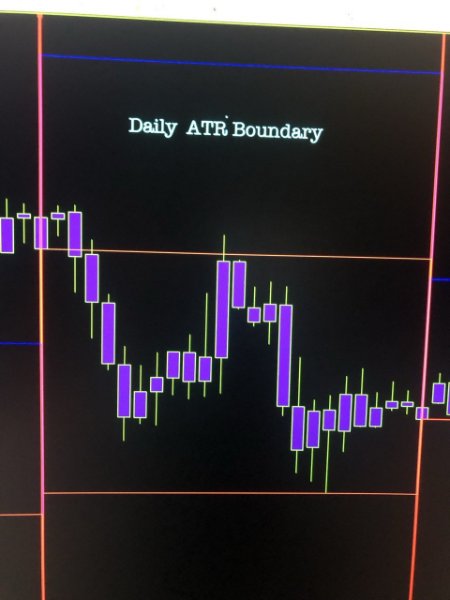

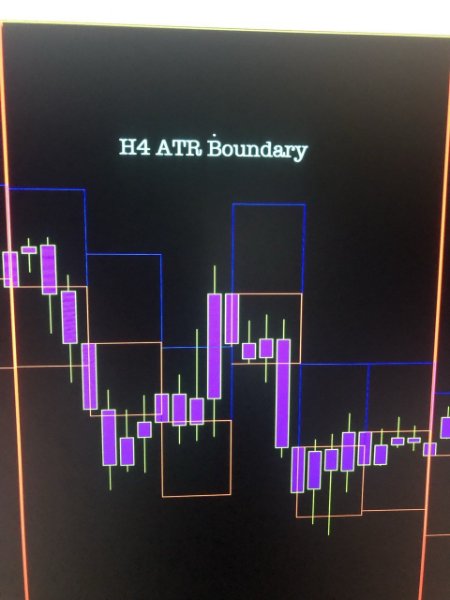

There is an inevitable change in the ATR value during price action. The Average True Range (ATR) indicator does not directly measure volume; rather, it assesses volatility in price movements. Predetermined adjustments are made regarding volatile conditions. The greater the current volume, the wider the entry and exit levels. Conversely, when there is less volume, the adjustments will be smaller. The ATR is commonly used to gauge the potential for price movement and to identify entry and exit levels within price action. Moreover, the number of participants in a trading chart allows the take profit and stop loss levels to adjust automatically in the system for you.

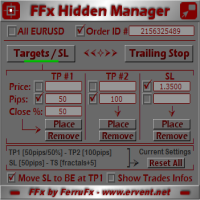

This expert advisor (EA) features a trailing capability that allows for adjustments of take profit levels based on three different time frames, inheriting three distinct true ranges. Adaptation to market chart activity means that each trade executed will have different pip distances. There is no complexity involved with "clicking panels or trading signals," as this is not a signal provider. This universal EA, utilitarian wise, creates three separate but interdependent take profits while maintaining a single stop loss for any open trade. You even have the option to forgo a stop loss if preferred! Each entry made is unique in pip distance, aligning with market chart activity.

This is an Expert Advisor.

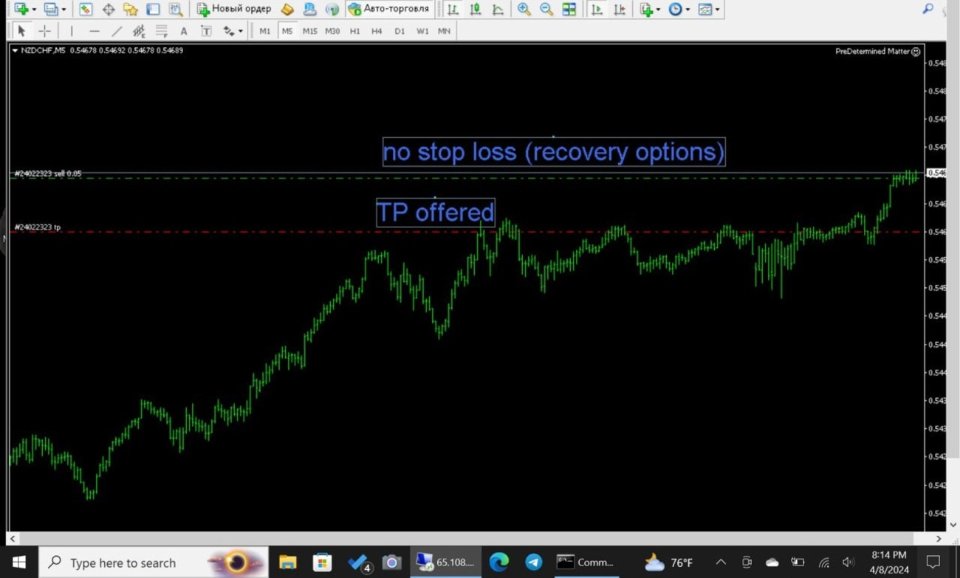

Mind over matter: Imagine having this on a Virtual Position Server (VPS)! It is possible to open a blank (no manual TP/SL) trade with your phone and receive Entry and Exit points for that trade! Your Meta trader account will get a notification of this, proving a reliable “TAKE PROFIT AND STOP LOSS”! Instantly make a trade while the utility handles the hardest decision. It is a calculated risk manager after all!

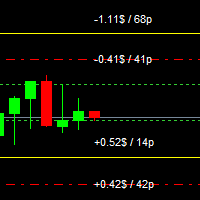

Example:

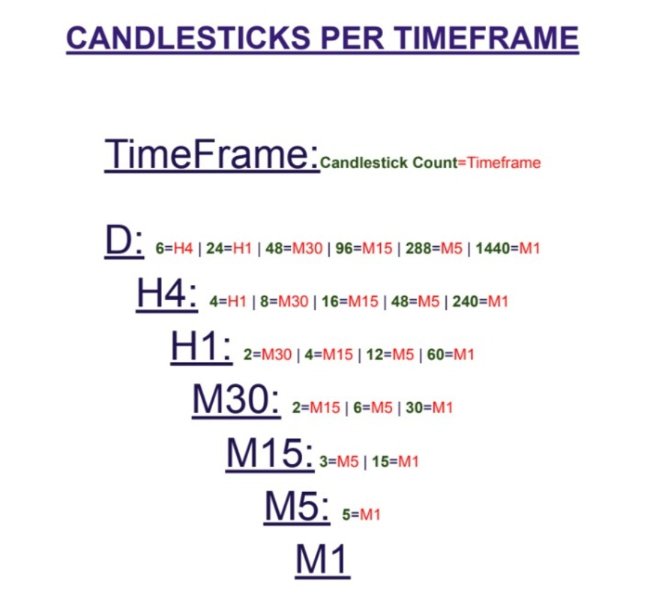

- Time period/days accounted for: 14 | Candlestick count in Timeframe: M30

- Time period/days accounted for: 14 | Candlestick count in Timeframe: H1

- Time period/days accounted for: 14 | Candlestick count in Timeframe: H4

^These are going to offer different Average True Ranges primarily because each Timeframe contain different number of Candlesticks; due to Time Variation! ^

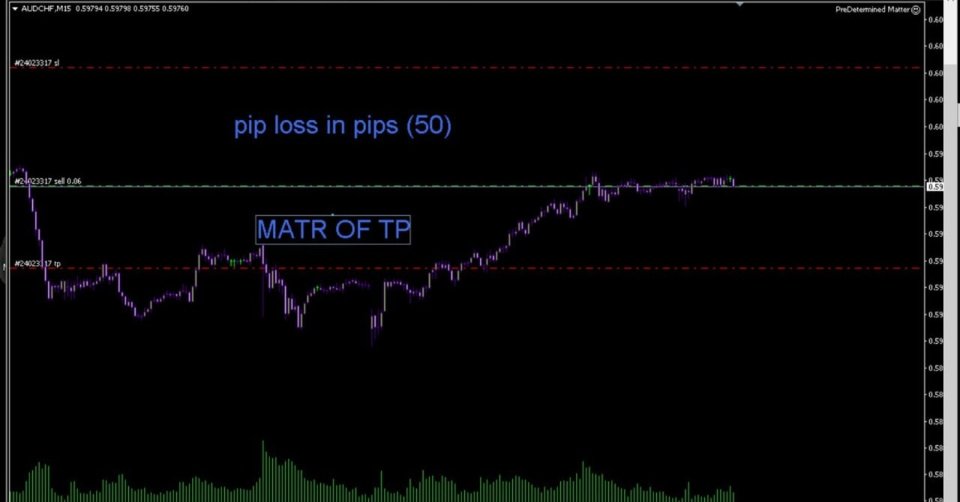

The metric of the 3 Take-Profit exit points:

A take profit point, per say, is defined by the ATR, Timeframe, and period of Days within that Timeframe. The aura of the ATR implementation is then multiplied in order to expand the pip range closure. By pip range closure, I mean the distance to where you’d prefer to have the exit point of your trade. If you believe you should scalp for a minimal number of pips, it will require a lesser value on the multiplier (<2.00). If you plan to see your trade trend in your favor, you may multiply the ATR aura (>2.00 via twice the size of the ATR origin).

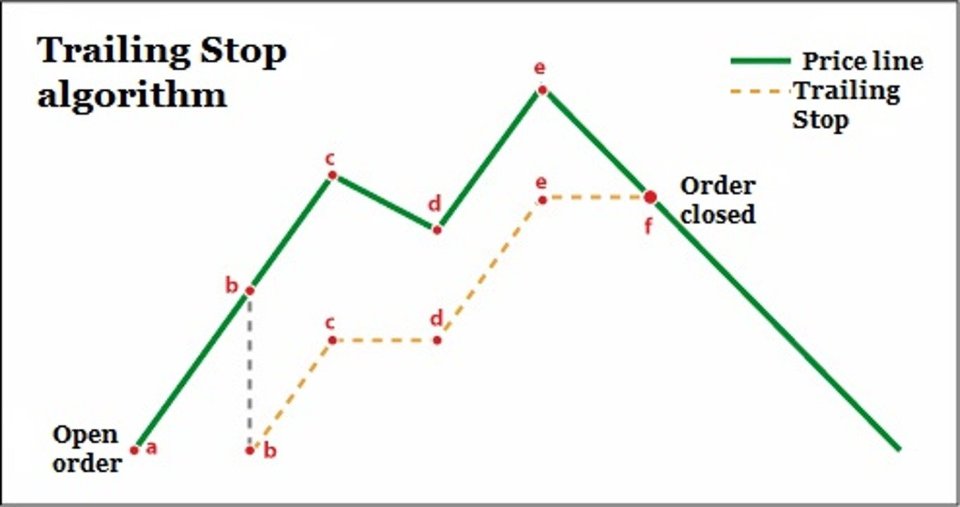

Now, notice how these 3 coexist. We can imagine it trailing from TP1 towards TP2. Ultimately the EA places the highest Timeframe's ATR|Timeframe and the trailing coded to be fairly hidden. If your hand made trade entered in your favor completely, you would see TP3 as the final closing point! That is what this EA implements on your account. Attain 3 ever changing Take Profits. This allows you to adjust your TP levels based on the current market conditions and help you make the most of your trades! #Trailing

Assure the TP / SL atmosphere remains greatest!

The metrics of the Stop Loss exit point choices available:

-

An average true range Stop Loss based on the multiplier value.

-

An optional Stop Loss set in PIP value.

-

Not wanting to allow a losing overall trade? Rescue and recover all trades by having *NO STOP LOSS* and attaching a completely separate recovery based EA.

Pros:

-

VPS usage

-

Adjusts with the market environment, allowing the pressure points to be atoned.

-

Manages entry and Exit points with profit in a calculated result based on True Range.

-

Journal notifications will show the activity taking place! Even the matter will prove it’s trailing!

-

Decision made in Advance, calculated instantly!

-

FAST BUY AND SELL TP/SL attachment

-

Trailing respects 3 different Time frames, inheriting 3 different True Ranges!

Cons:

-

Probably would close the trade sooner if there were ever a spiking move on the chart (but there’s an abundant amount of trading opportunity within the chart life).

-

THIS TOOL DOES NOT OFFER A TRADING POSITION SIZE, make your own wisely/cautiously.

---------------------------------------------------------------

Overall, this Expert Advisor for MetaTrader 4 is a powerful tool that can help you make informed decisions and achieve better results in your trading. With its advanced features and comprehensive trade management strategy, it is certainly worth considering for any trader looking to improve their performance.

The best