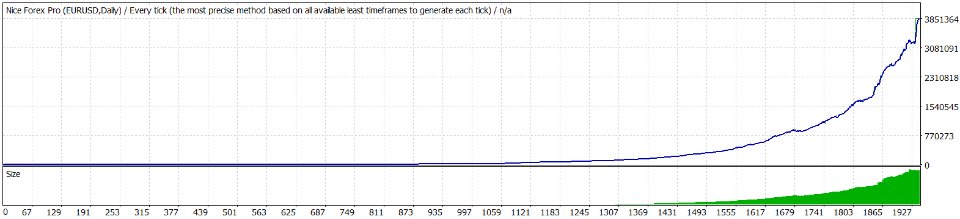

Nice Forex Pro

"Nice Forex Pro" is particularly effective for the EUR/USD currency pair, which is one of the most popular and liquid pairs in the Forex market. The EA can be optimized for this pair due to several reasons:

Why "Nice Forex Pro" is Best for EUR/USD:

-

High Liquidity:

- The EUR/USD pair is the most traded currency pair in the world, which means it offers high liquidity. This results in tighter spreads and less slippage, making it ideal for automated trading systems like Nice Forex Pro, which rely on accurate execution to maximize profits.

-

Stable Market Conditions:

- The EUR/USD pair tends to have more stable market conditions compared to more volatile pairs. This stability makes it easier for an EA like Nice Forex Pro to identify reliable entry and exit points, reducing the likelihood of false signals or erratic movements.

-

Available Economic Data:

- The EUR/USD pair is highly sensitive to major economic events and news from both the Eurozone and the United States. Nice Forex Pro can be programmed to take advantage of economic data releases, central bank decisions, and geopolitical events that impact the Euro and the Dollar.

-

Well-Defined Technical Indicators:

- The EUR/USD pair often moves in a more predictable pattern, making it easier for Nice Forex Pro to use technical analysis tools effectively. Popular indicators like Moving Averages, RSI (Relative Strength Index), MACD, and Bollinger Bands can provide reliable signals for EUR/USD trades, which the EA can automate for better accuracy.

-

Profit Potential in Various Market Conditions:

- Whether the market is trending or ranging, the EUR/USD pair offers opportunities. Nice Forex Pro can adapt to both market conditions by using different strategies—trend-following or mean-reversion strategies—based on the analysis of price action.

-

Risk Management:

- The EUR/USD pair is less prone to erratic price movements compared to exotic pairs, which allows Nice Forex Pro to implement precise risk management strategies. For example, it can set tighter stop-loss and take-profit levels to lock in profits and minimize losses.

How "Nice Forex Pro" Optimizes for EUR/USD:

- Customizable Strategy: The EA can be optimized specifically for EUR/USD by adjusting parameters like trading timeframes, risk settings, and indicators tailored to this pair's price behavior.

- Trade Frequency: Given the liquidity and price action of the EUR/USD, Nice Forex Pro can execute trades efficiently, identifying high-probability setups without overtrading.

- Trade Session Timing: The EUR/USD market is highly active during major trading sessions (like the London and New York sessions). The EA can be optimized to take advantage of the best trading hours for this currency pair.

"Nice Forex Pro" is ideally suited for trading EUR/USD because it can leverage the high liquidity, predictable price action, and responsiveness to economic events that characterize this pair. When properly optimized, it can offer significant profit potential, especially with its ability to automatically adjust strategies, manage risks, and execute trades intelligently.