RSI Overbought Sniper PRO

- Experts

- Mustapha Lazar

- Version: 1.0

- Activations: 5

Description

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by looking for divergences and failure swings. RSI can also be used to identify the general trend.

How this EA works

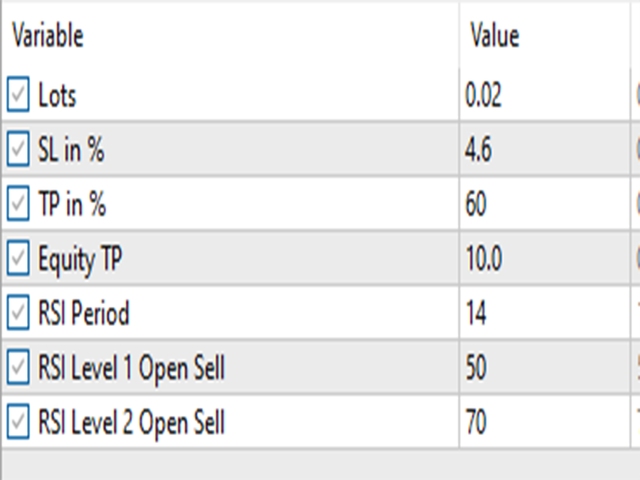

RSI is considered overbought when above 70 but the EA is using more than that to detect and validate whether it is an overbought that deserves to take an order for it.