Volatility Switching

- Experts

- Agus Santoso

- Version: 1.1

- Updated: 20 July 2024

- Activations: 5

MT4 : https://www.mql5.com/en/market/product/88159

MT5 : https://www.mql5.com/en/market/product/104672

"Volatility Switching" is an advanced Expert Advisor (EA) meticulously designed for traders seeking to optimize their positions in dynamic market environments. This EA operates on the principle of recognizing market volatility and dynamically adjusting its strategies to mitigate risk and enhance profitability. By employing the Open Position method with a keen eye on volatility and incorporating a sophisticated switching risk management system, "Volatility Switching" offers traders a comprehensive solution for navigating diverse market conditions with confidence.

Key Features:

Volatility Detection:

"Volatility Switching" is equipped with robust algorithms capable of accurately detecting changes in market volatility in real-time.

It constantly monitors various indicators such as price movements, volatility bands, and historical data to gauge the current market conditions.

Open Position Strategy:

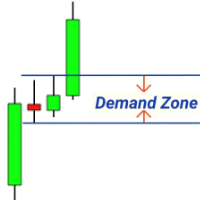

The EA initiates positions based on meticulously crafted entry criteria, taking into account both market volatility and prevailing trends.

It utilizes advanced technical analysis to identify optimal entry points, ensuring trades are executed with precision and timing.

Dynamic Risk Management:

"Volatility Switching" employs a dynamic risk management approach to adapt to evolving market conditions.

In instances where the market moves unfavorably, the EA swiftly adjusts position sizes or exits trades to limit potential losses.

Risk parameters are continuously optimized based on factors such as volatility levels, account size, and historical performance.

Switching Risk Management:

One of the standout features of "Volatility Switching" is its innovative switching risk management system.

When market conditions deviate from expected patterns or volatility exceeds predefined thresholds, the EA seamlessly switches between risk management modes.

This adaptive mechanism enables the EA to transition between conservative and aggressive risk profiles, optimizing risk-reward ratios based on the prevailing market environment.

Customizable Settings:

Traders have the flexibility to customize various parameters within the EA to align with their risk preferences and trading objectives.

Parameters such as stop-loss levels, take-profit targets, and volatility thresholds can be adjusted to suit individual trading styles.

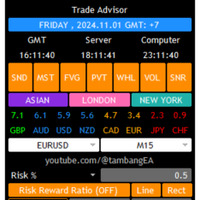

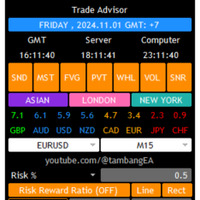

User-Friendly Interface:

"Volatility Switching" features an intuitive user interface, allowing traders of all experience levels to navigate and utilize its functionalities with ease.

Clear visual representations and comprehensive reporting enable traders to monitor performance and make informed decisions.

Benefits:

Enhanced Risk Management: By dynamically adjusting risk based on market volatility, "Volatility Switching" helps mitigate potential losses and preserve capital.

Optimized Profitability: The EA's ability to identify favorable trading opportunities while managing risk intelligently contributes to improved overall profitability.

Adaptability: "Volatility Switching" adapts to changing market conditions, ensuring it remains effective across diverse trading environments.

Time Efficiency: Automation of trading decisions saves time and allows traders to focus on strategy development and analysis rather than manual execution.

In summary, "Volatility Switching" represents a cutting-edge solution for traders seeking to navigate the complexities of today's financial markets. By integrating advanced volatility analysis with dynamic risk management capabilities, this expert advisor empowers traders to achieve their trading goals with confidence and efficiency.