Bitcoin Scalp Pro MT5

- Experts

- Profalgo Limited

- Version: 1.8

- Updated: 22 July 2023

- Activations: 10

NEW PROMO:

- Only a few copies copies available at current price!

- Final price: 999$

- NEW: Choose 1 EA for free! (for 2 trade account numbers)

Bitcoin Scalp Pro is a unique trading system on the market.

It is fully focused on exploiting the volatility of the Bitcoin market by trading the breakouts of support and resistance levels.

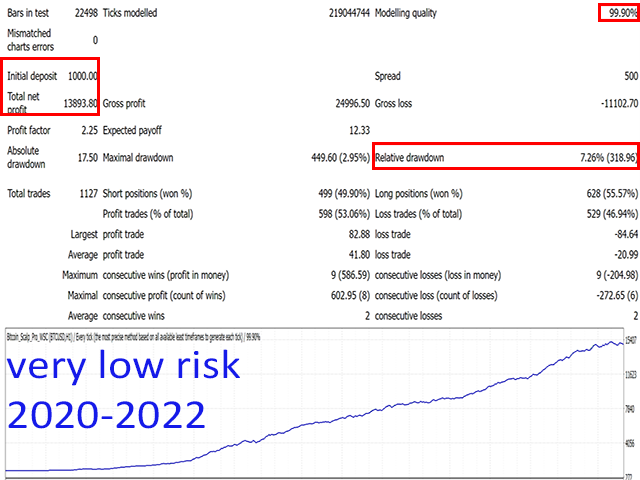

The focus of the EA lies on safety, which translates into extreme low drawdowns and a very good risk/reward ratio on the trades.

The EA uses a "smart adaptive parameter system" internally, which will calculate stoploss, takeprofit, trailingSL but also entries and lotsize based on the actual price of bitcoin.

That means that if bitcoin is trading at 6000 or at 30000 will have different values for all parameters.

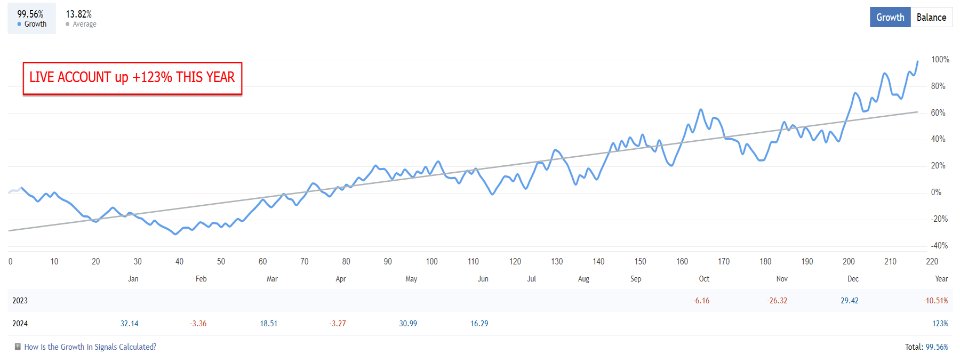

The EA has been forward tested on real live accounts since June 2022 and the results are very promising so far.

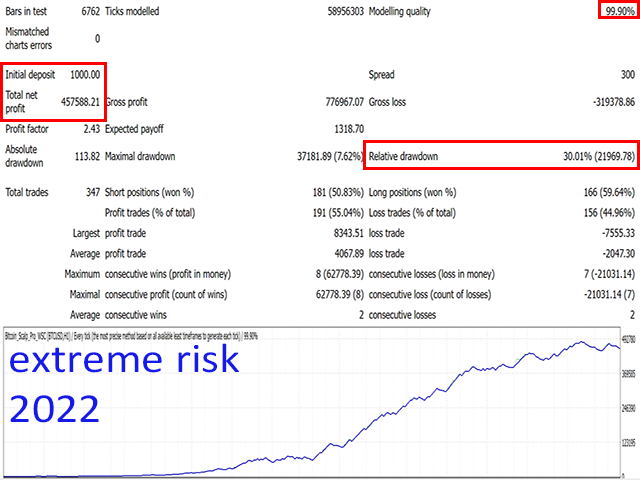

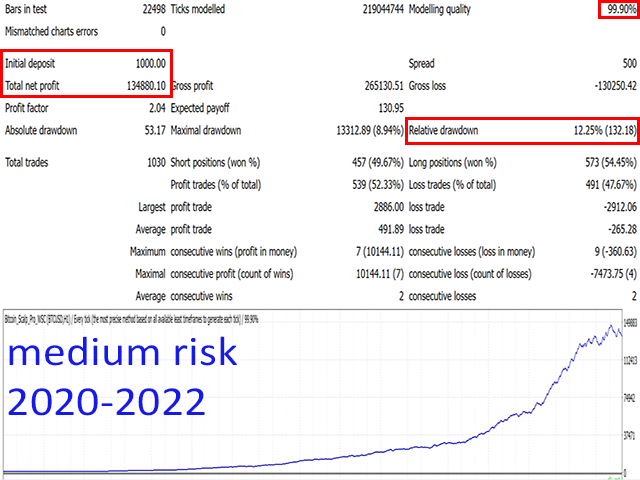

Backtests with 99.90% tickquality have also been done and show a very stable growth over the last years.

This EA requires a broker which offers low spreads on Bitcoin. Contact me in private message to get a list of recommended brokers.

Key features:

- Adaptive parameter system, adjust SL,TP etc to actual price of Bitcoin

- Very good risk/reward ratio of 2 to 1

- Verified live trading results

- Automatic lotsize calculation based on risk and price

- Safe trading, with SL and TrailingSL on all trades

- No grid, No Martingale or any other risky trade management system

- Minimum deposit: 200$

Setting up the EA:

Setup is very easy: simply open a H1 chart and run the EA on it. You can set the prefered risk in the "Lotsize Calculation Method" parameter.

The predefined risk settings go from 0.5% Risk Per Trade (very low risk) up to 10% Risk Per Trade (extreme risk).

It is recommended to start at a lower risk level, and increase risk when you feel comfortable with how the EA trades.

Parameters are self-explanatory, but feel free to contact me in case they are not clear

Backtesting the EA:

Choose a decent historical pricefeed, and make sure that it is one with low spreads, or set spread manually. Spreads should be lower than 1000 points on average.

If your backtesting results do not match mine, contact me in pm so I can help with the backtest-setup.

Running this EA for one day and already making profit. I already bought several EA's from Wim, and all of them were as expected and look very professional. Support is also excellent and very friendly.