Multiple of 5 in jap GotoBi

- Experts

- Ryu-hei Sato-

- Version: 1.1

- Activations: 5

■About Multiple of 5 in jap Gotobi

A Gotobi is a day that has a 5 or 10 in it.

In other words, "the 5th, 10th, 15th, 20th, 25th, and 30th".

According to Japanese business custom, the demand for funds increases on Gotobi.

The middle rate is determined by banks at 9:55 a.m. on every business day (Japan Standard Time).

The exchange rate at which the bank settles the transaction on that day is the value of the exchange rate.

The higher the rate, the more profitable it is for the bank if the dollar appreciates or depreciates against the yen.

Therefore, it is said that the dollar tends to appreciate against the yen at 9:55 a.m. on the 5th, 10th, 15th, 20th, 25th, and 30th of each Gotobi, when the middle price of the day is determined.

■Days on which trading will not be performed

Entry will not be made on the following days.

When the 50th day falls on a Saturday or Sunday

・The year-end and New Year holidays (December 21 through January 4)

■Currency Pairs

USDJPY is recommended.

Other currencies will not offer any benefits.

■Time frame

Entry and settlement are made at predetermined times, so any time frame can be used.

Parameter Description

Initial lot

When the compound interest function is not used, entry is made with the number of lots set here.

When the compound interest function is used, entry is not made with a fixed initial lot, but with the formula (1) below.

Compound interest on/off

true→Compound interest function is turned "on".

The lot size is set based on the calculation in ① below.

false→Compound interest function is turned "OFF".

The initial lot is always entered, unaffected by the amount of margin.

Margin Step Amount

This amount is used in the calculation of ① below.

Lot calculation formula for compound interest

Balance ÷ Margin Step Amount × Initial Lot...①)

Example) Initial lot ...0.1

Margin step amount ...100,000

Balance is 100,000 → Lot is 0.1

Balance is 200,000 → Lot is 0.2

*The maximum number of lots depends on each firm.

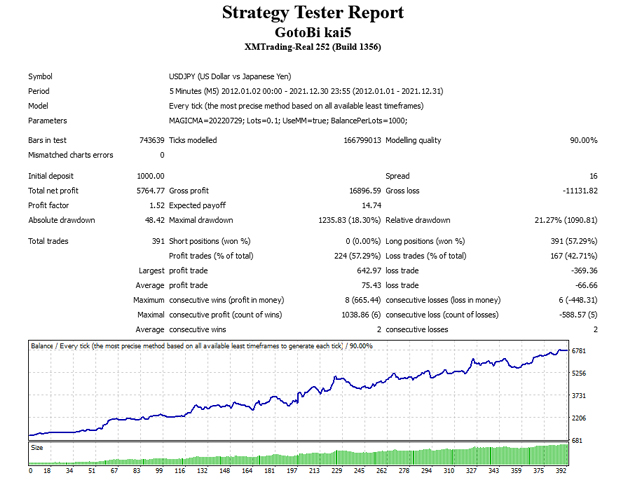

■Back-test results

The automated trading system is capable of continuously showing good performance.

The back-test results are shown with high leverage for reference.

Please keep in mind that the basic principle is to operate the system with low leverage.

Below are the single year results for 10 years.

Margin 1000$, Compound interest on, Initial lot 0.5 Margin, step amount 1000$, Spread 16 points

P/L Win PF

2012 +341% 64% 2.44

2013 +648% 59% 1.85

2014 +288% 59% 2.17

2015 +102% 50% 1.01

2016 +174% 55% 1.22

2017 +103% 53% 1.01

2018 +137% 58% 1.19

2019 +117% 59% 1.12

2020 +100% 54% 1.00

2021 +214% 61% 2.33

2012-2021 +52528% 57% 1.43

*Screenshot shows the following results.

(1) Margin 1000$, compounding on, initial lot 0.1, margin step 1000$, spread 16 points

(2) Margin 1000$, compounding on, initial lot 0.5, margin step 1000$, spread 16 points