MACD fit for low stagnation

- Experts

- Smarterbot Software

- Version: 221.19

- Updated: 20 October 2022

- Activations: 5

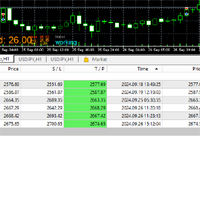

This expert trading tool utilizes the MACD signal as a trigger, with an optional moving average to confirm the signal. 8 custom fitness function optimization metrics are included to help traders find the best systems with low stagnation and high net profit for any asset. In addition to the optimization metrics, traders can select acceptance criteria such as a minimum number of trades and payoff of a trading system.

Expert advisor rules

Long entry:

- MACD line crosses the Signal line upward;

- [optional] The bar opens above Trend Moving Average;

Exit Long:

- [optional] MACD line crosses the Signal downwards;

- [optional] At Take profit or Stop Loss;

- [optional] At the end of the day;

Short entry:

- MACD line crosses the Signal line downward;

- [optional] The bar opens above Trend Moving Average;

Exit Short:

- [optional] MACD line crosses the Signal upwards;

- [optional] At Take profit or Stop Loss;

- [optional] At the end of the day;

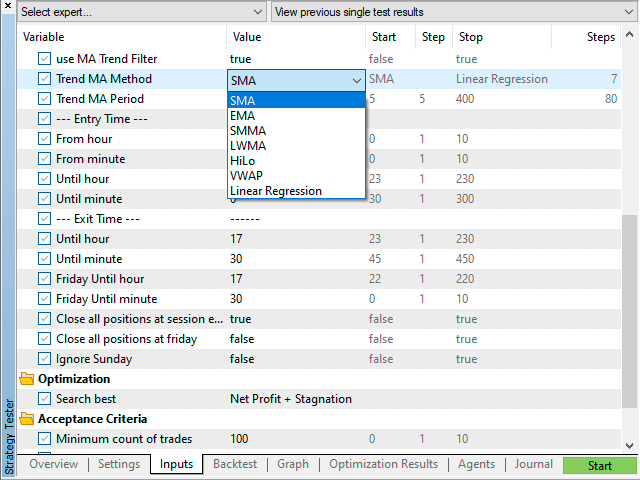

Other features include the ability to set Take Profit and Stop Loss as a percentage of price, which is suitable for stocks, cfd indexes, cryptocurrencies, and forex. It also allows for setting entry and closing times for added control over trades. With custom optimization metrics, traders can find systems with high CAGR and low drawdown, as well as low stagnation. Additionally, traders can select from 7 types of moving average as a trend filter, including SMA, EMA, SMMA, LWMA, HiLo, VWAP, and Linear Regression.

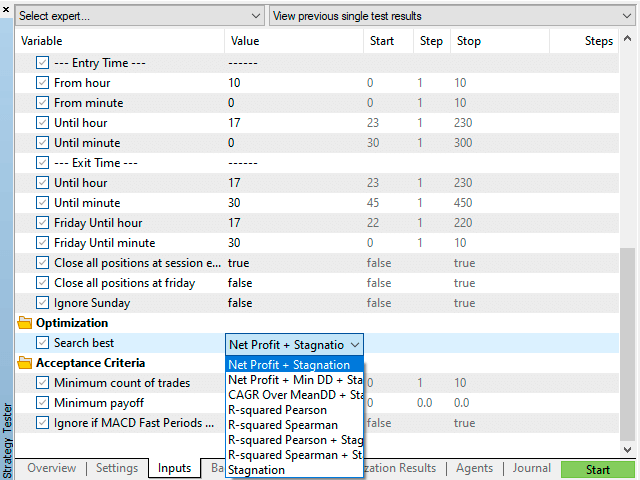

Traders can optimize the system by searching for the best net profit + stagnation, net profit + min DD + stagnation, CAGR over mean DD + stagnation, R-squared (Pearson), R-squared (Spearman), R-squared Pearson + stagnation, R-squared Spearman + stagnation and Stagnation.

Acceptance criteria include a minimum count of trades and minimum payoff.