AIS Hypergeometric Filter MT5

- Indicators

- Aleksej Poljakov

- Version: 2.0

- Updated: 24 May 2022

- Activations: 5

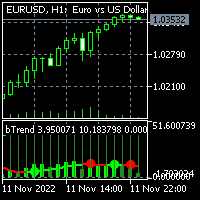

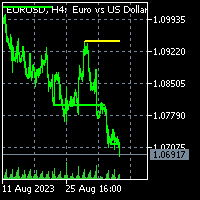

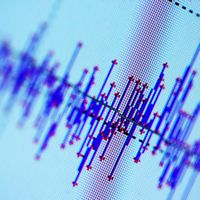

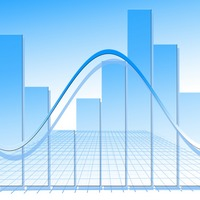

The hypergeometric series is used to calculate the weight coefficients of this filter. This approach allows you to get a rather interesting smoothing of the time series.

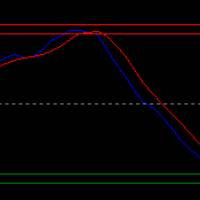

The hypergeometric filter weights do not decay as fast as exponential and linear weighted moving averages, but faster than smoothed moving averages. Due to this, the behavior of this filter is in many ways similar to the behavior of moving averages. However, it has several advantages. Its lag is much less than that of the moving average. But at the same time, it retains much more information than the exponential moving average. Due to this, the hypergeometric filter can better highlight the trend and cyclical components of financial time series. Thus, this indicator can be used in those trading strategies that use different types of moving averages.

The operation of the indicator depends on a single parameter:

- iPeriod - valid value of this parameter is 2 - 149.

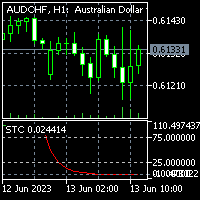

The smaller the value of this parameter, the stronger the indicator reacts to the latest price changes. A large value of this parameter allows you to highlight long-term trends. An example of the indicator operation with different iPeriod values is shown in the figures.