SL SOrders Basket

- Experts

- Vladimir Khlystov

- Version: 1.0

- Activations: 5

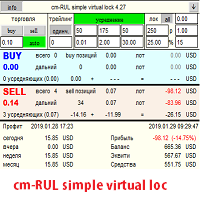

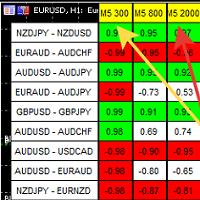

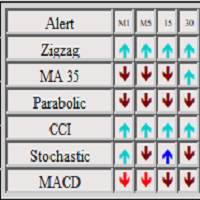

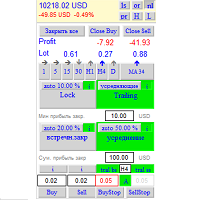

The EA is based on three very effective strategies. 1- trading on price consolidation, 2- breakdown of the price level and 3 distribution of trading volume. In addition to these three main strategies, the adviser also uses the tactics of closing long-distance positions at the expense of opposite profits, averaging volume and locking a false breakdown. It is almost impossible to describe the strategy consistently, since at every moment of time the adviser chooses his tactics and it can only be predicted by knowing the price in advance. The easiest way is to accept it as a black box making money. It is for this purpose that I have created parameters based on the average daily price movement. All parameters are based precisely on the average volatility of the ADR day over the past 2 weeks. Thus, the parameters are suitable for almost all major currencies. The examples show tests for different currencies with the same parameters.

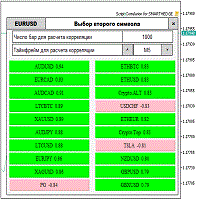

I suggest putting this adviser on 10-20 currencies at once, since its additional tactics provide for multicurrency. At the same time, you need to enable the equityADR parameter on one of the Expert Advisors, for example 0.5. This means that as soon as the equity increases by 0.5 ADR, all transactions will be closed and the system will continue trading from scratch.

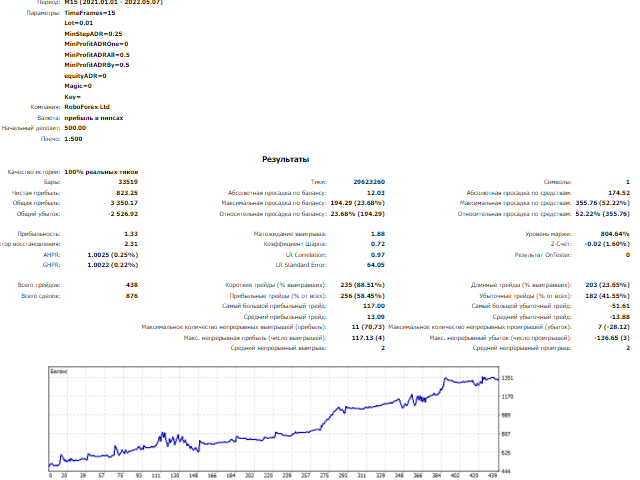

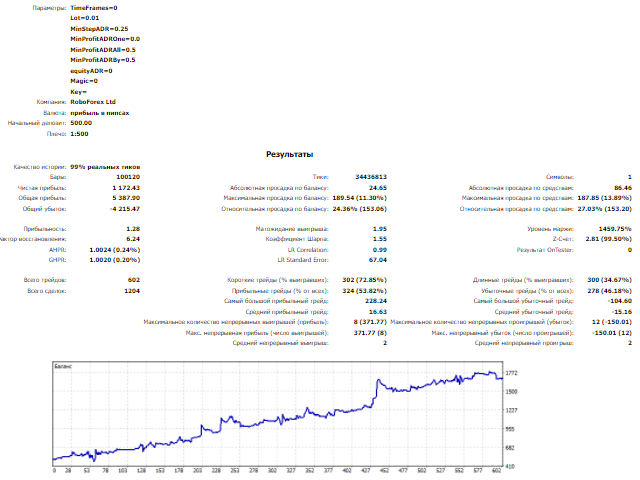

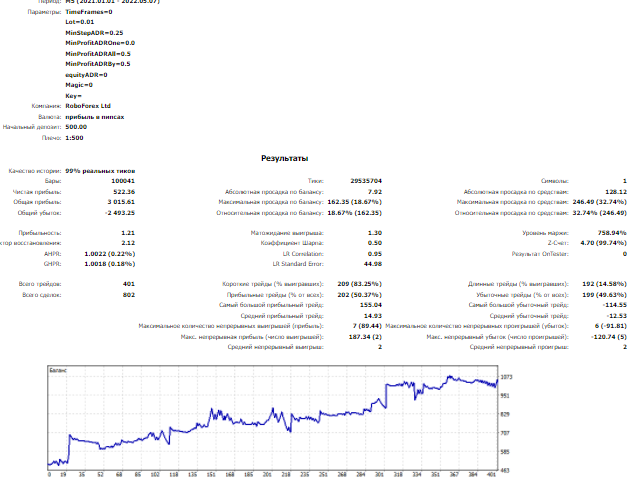

All the tests below are done with default parameters. Of course, you can improve them by performing your own optimization.

This is the first version of the Expert Advisor, then I plan to improve the way of determining consolidation and its breakdown. I hope for constructive suggestions and competent questions.

Parameters

MinStepADR = 0.25; - the minimum price step in this case is a quarter of the average daily price movement

MinProfitADROne = 0.0; - min profit of closing one direction (0- the function is disabled)

MinProfitADRAll = 0.5; - profit of closing all positions of the current instrument (0- the function is disabled)

MinProfitADRBy = 0.5; - the profit of the counter closing of the far due to the accumulation of opposite

equityADR = 0.0; - equity increase to close all positions of the entire account including orders of other advisors and manual..... (0- the function is disabled)