AIS Discrete Hartley Transform

- Indicators

- Aleksej Poljakov

- Version: 1.0

- Activations: 15

This indicator is based on the discrete Hartley transform. Using this transformation allows you to apply different approaches when processing financial time series. A distinctive feature of this indicator is that its readings refer not to one point on the chart, but to all points of the indicator period.

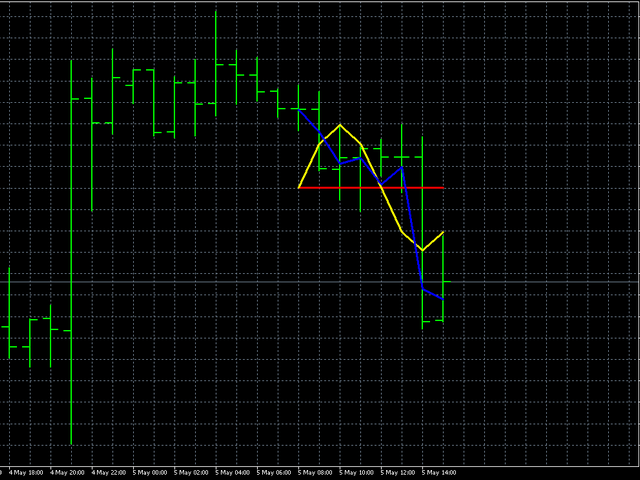

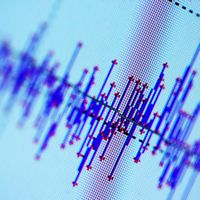

When processing a time series, the indicator allows you to select various elements of the time series. The first possibility of filtering is built on this approach - all unnecessary high-frequency components are simply discarded. The first figure shows the possibilities of this method, selecting the CutOff parameter, you can select the detail of the original time series (red line - only the main information is left CutOff = 0, yellow - the main and lowest frequency period CutOff = 1, blue - all the most high-frequency noises are discarded CutOff = 4 ). However, this is not the only possibility - noise components can be suppressed with additional filtering.

Both options are implemented in this indicator. Its parameters are:

- iPeriod - indicator period

- Shift - indicator shift relative to the current bar. By changing this parameter, you can evaluate the performance of the indicator in the past.

- NoiseReduction is a way to reduce noise. Possible values: none - noise is not suppressed (only the CutOff parameter works in this case), constant - noise is attenuated by a constant, linear - linear noise suppression, logarithmic - logarithmic attenuation, square - noise reduction occurs according to the square root law, quadratic - quadratic reduction noise, exponential - exponential noise attenuation.

- CutOff - noise cutting. The larger the value of this parameter, the more details are taken into account. Valid value of this parameter is 0 - iPeriod -1

- Constant - an additional constant that affects the amount of noise suppression. This setting is not used when NoiseReduction = none. Its valid value is 0 - 255.