Straddle Scalper

- Experts

- Remi Passanello

- Version: 1.4

- Activations: 5

Overview:

Straddle scalper is an EA opening straddles at particular hours and /or days.

The Take Profit is dynamically generated using ATR ratio.

Requirements:

A hedging account is needed in order to open straddles.

A strict optimization (in open prices) is mandatory.

What is a straddle ?

A straddle is the action to open a Buy and a Sell at the same time.

How does this EA works ?

After being successfully optimized, the EA will open a straddle at each new bar (H1 Timeframe) designated by optimization.

The decision to open a new trade is taken according to a required minimum volatility (measured by ATR and statistically over the trading history)

A Take profit will be placed dynamically according to ATR ratio calculated by optimization.

There can only be 1 or 2 trades at the same time, closed by take profit or a new bar.

This EA does not use the following systems: Hedging, grid, martingale.

How to optimize ?

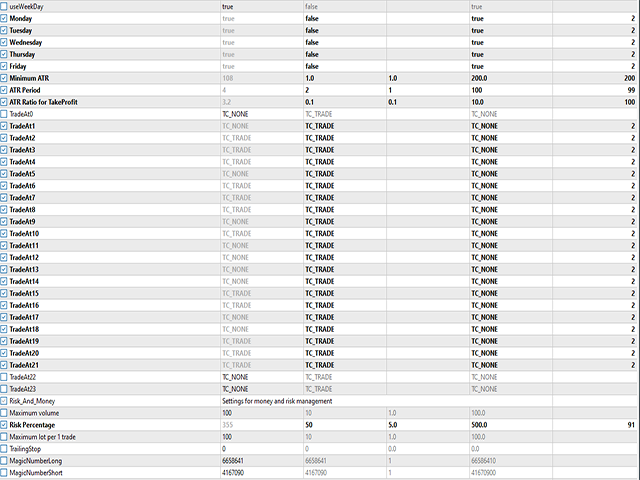

Take a look at the pictures, there is one showing the basic settings of the optimization set file.

Always optimize and use in H1, it will not work with any other Timeframe.

First, optimize in open price as the EA only set trades at new bars. (explicitly works in open prices)

Safe long term trading:

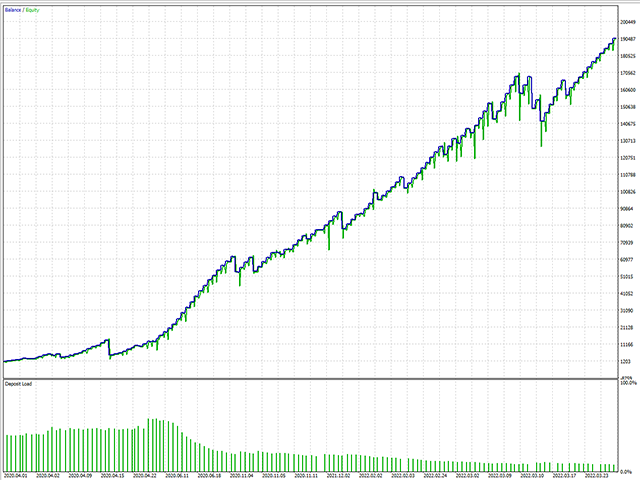

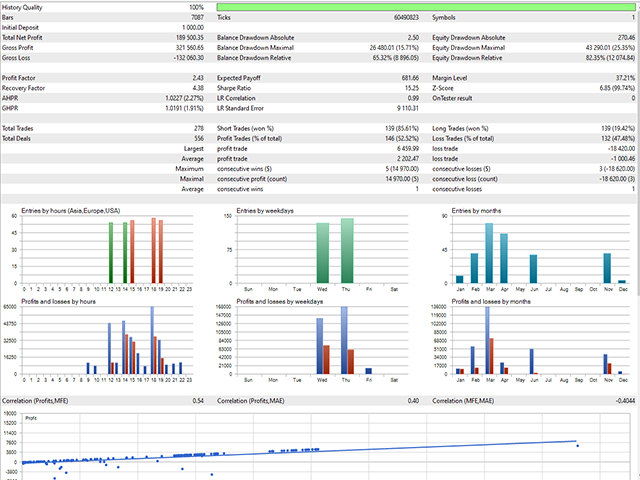

- If you want to be really safe, best is to optimize on a long term like several years.

- Try to find a results with many trades and the lowest drawdown.

- Watch the profit curve, it must show a trend up as steady as possible and especially at the end.

Risky trading for potential fast big rewards:

- Use a tiny start capital like 100 in order to avoid eventual big loss.

- Be sure that no particular planned news or events will interfere during your trading session (NFP, war or any country or economical diseases)

- Select a quite short period to optimize like some months or weeks.

- Also optimize the MaximumPercentageAtRisk in order to get a risky but proven set file.

- Use the most rewarding optimization result with the lowest drawdown and a good amount of trades (don't use ones with only some trades as it will not represent something reliable)

In any case, the best working instruments at the the most volatile with the lowest spread, trend is not a relevant factor for this specific strategy, only volatility and spread matters.

When your optimization is done, test it with real ticks, the result should be the same or a little bit better if the spread of your broker is not floating too much.

EA Inputs:

- useWeekDay: true/false : Uses or not the possibility to trade only during the selected days.

- Monday ... Friday:true / false : enables the selected day for trading if useWeekDay = true

- Minimum ATR: 1 - 200: Sets up the minimum ATR value to enable trading activity (volatility level)

- ATR Period: 1-100 or more: Sets period in bars for ATR

- ATR Ratio for Take Profit: 0.1 - 100: ATR is divided by this value to be used as Take Profit

- TradeAt0 ... TradeAt23: None/Trade: None will disable any trade at this time, Trade will enable straddle trading

- UseTakeProfit: true/false: Will use TP or not

- Maximum volume: 0.01 - 100: maximum volume for both trades (straddle)

- Risk Percentage: Trade at constant risk, 1 = 0.01 lot for 1000 of currency (€,$,AUD,CAD, aso...)

- Maximum lot par 1 trade: Sets the maximum volume for each trade *

- TrailingStop: Sets the trailing stop value in pips

- MagicNumberLong/Short: Magic number for long and short trades

*The EA checks if the asked volume is available in term of funds and leverage. If not, the minimum lot size will be used.

For better results, always use TakeProfit.