OH Larry

- Experts

- STANTON ROUX

- Version: 1.2

- Updated: 18 November 2021

- Activations: 10

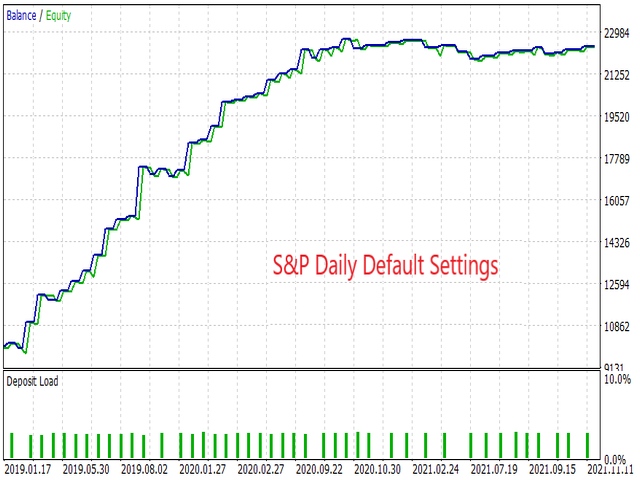

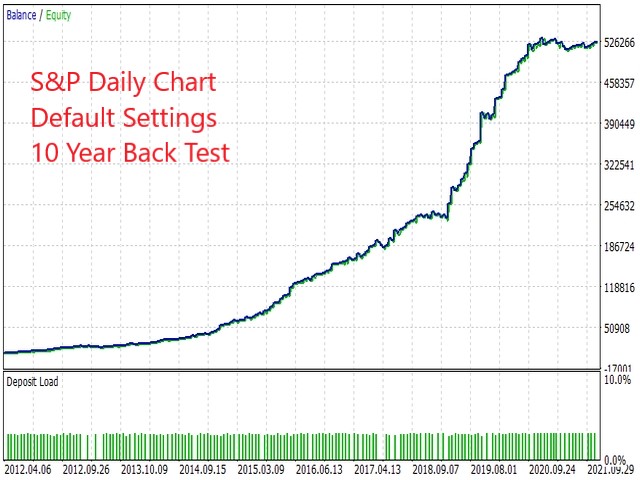

OH Larry is a collection of Larry Conners most popular mean reversion strategies rolled up into one EA.

Use them individually or combine the strategies.

Strategies Include:

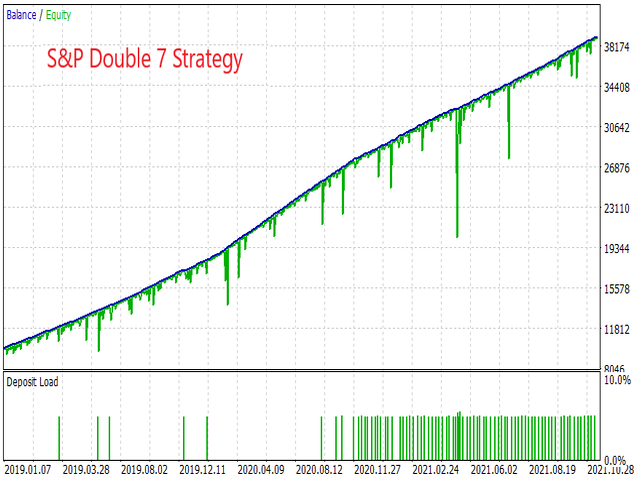

Larry Conners Double 7

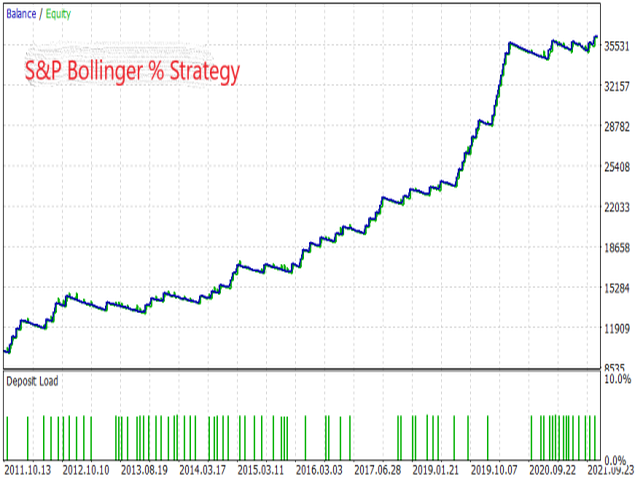

Larry Conners Bollinger %

Larry Conners RSI2

Larry Conners 2555

The strategies work best on higher timeframes H4 - D1 and on ETF's and Indices.

They can easily be configured to run on Forex as well.

Most of Larry Conners strategies don't include stop losses but I have added the functionality of adding a stop loss, take profit and trailing stops for better money management.

I have also included a exits section so you can combine exit strategies with different entry strategies.

Extra features Include:

Risk level or fixed lot money management

Entry days and times.

ORIGIONAL RULES

Double 7

- The close must be above the 200-day moving average.

- The close must be at a seven-day low.

- If 1 and 2 are true, then go long at the close.

- Sell when the close is at a seven-day high (sell at the close).

Bol%

- The close must be above the 200-day average.

- The %b must be below 0.2.

- If 1 and 2 are true, buy on the close.

- Exit when the %b closes above 0.8.

2555

- The close must be above the 200-day average.

- The 4-day RSI must be below 25.

- Exit when the 4-day RSI turns above 55.

RSI2

- The close must be above the 200-day moving average.

- The 2-day RSI is today below 10.

- If number 1 to 2 is true, then enter at today’s close.

- Exit on today’s close if the 2-day RSI is above 70.