Market Screener for MT4

- Utilities

- Sergey Batudayev

- Version: 1.28

- Activations: 5

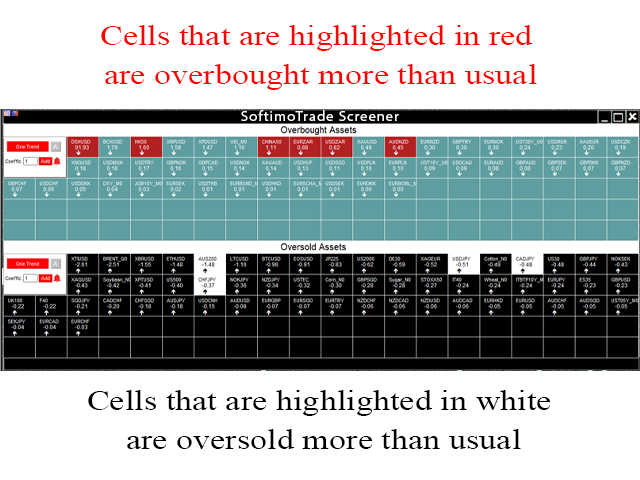

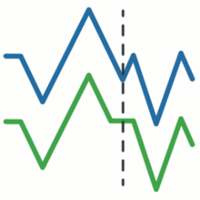

This is a screener that allows to identify assets that are more than usually overbought (% growth)or oversold (% fall) within a selected period of time (time frame).

The market is ruled by the law, buy cheaper, sell more expensive, but without an automatic scanner it is very difficult to identify assets overbought or oversold, say, within the current week, or the current hour, or month.

There can be dozens or hundreds of instruments, sometimes it is simply not possible to physically analyze everything manually, these problems can be easily solved using the Screener

What Screener can do

- the scanner can be used on any TF

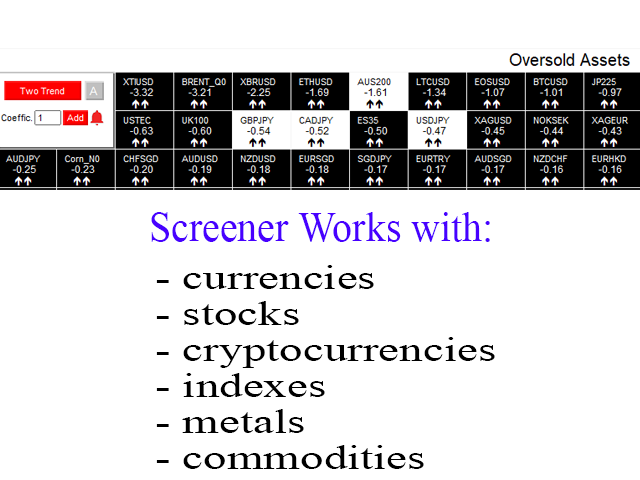

- the scanner works with currencies, stocks, cryptocurrencies, commodities, indices and other instruments

- the logic of identifying assets is universal since it is based on the fundamental laws of the market

- with the help of the screener, you can work according to different strategies, one of the most common will be Pump and Dump

PROMO BUY 1 GET 2 FREE -

Revealing the average value for each instrument – the screener SoftimoTrade Screener not only determines the overbought and oversold condition of the asset at the TF you have chosen, but also calculates the average price change for the selected time period for this instrument.

Further, all instruments whose current growth or decline rate is higher than usual are colored in the color of your choice, after which the selected instruments can be opened separately and proceed to a more detailed analysis.

A variant of the strategy using a screener

- for the Overbought Assets ↓ table, we are looking for assets whose current overbought index is higher than usual, go to the chart, analyze the asset in more detail, and if we see an interesting entry point, sell the asset along the trend.

- for an upward Oversold ↑, we look for assets whose current oversold index is higher than usual, go to the chart, analyze the asset in more detail, and if we see an interesting entry point, buy the asset following the trend.

We expose SL / TP within your trading system.

By a more detailed analysis, I mean consideration of levels, a trend on other timeframes, a fundamental picture for the selected instrument, etc.

V ariables

== Main settings ==

Pressing the “A” buttonin the overbought table sorts and displays only those instruments whose overbought value is greater than usual. These tools are interesting for finding sales.

The button “A” property is similar for a table with oversold assets.

Choosing a template indicator to open by click -select a template for opening a tool by click. Each cell has a link to open this chart, we recommend creating a new template with the iPump indicator, and give a name to the iPump indicator template, then when you click on the link you will see the indicator automatically load on the chart. Here is the instruction – https://c.mql5.com/6/896/27n_mb4y51ur.png

== Trend Calculation ==

Time frame of the main trend – the time frame of the main trend, when you select the “One Trend” button, then the tools are sorted by this TF

Secondary Trend Time Frame – the time frame of the secondary trend, when you select the “Two Trend” button, then the tools are sorted by the coincidence of the secondary trend with the main one.

== Average Calculation ==

Default multiplication coefficient of the average value – the default multiplication coefficient of the average value, the meaning of this setting is to multiply the average by the number specified in this setting, this allows you to find assets that are currently overbought or resold at 1.5 / 2, etc. time

Nice screener that sorts instruments by percentage changes rising and falling. Also clicking on the instruments opens the chart with templates.This provides are a better management of symbols and identify new opportunities with more ease.