Impuls Pro

- Experts

- Sergey Batudayev

- Version: 1.78

- Activations: 5

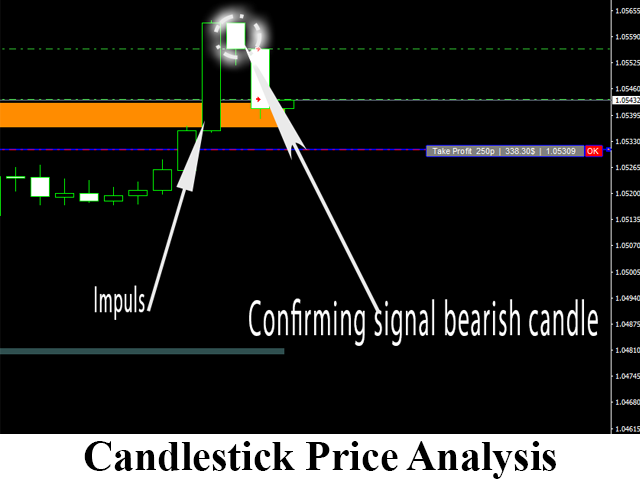

The EA’s strategy is based on Swing trading, with entries after sharp impulses calculated by the iPump indicator.

The advisor has the ability to open manual trades with automatic support

– for a downtrend ↓ we enter a trade after a corrective rise in the price, the asset falls into the overbought zone, we sell along the trend.

– for an uptrend ↑, we enter a trade after a corrective fall in the price, the asset falls into the oversold zone, we buy along the trend.

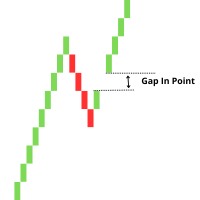

When trading on the selected asset, the advisor takes into account the trend and opens trades only according to the current trend, unprofitable trades can be closed both by stop and using averaging, the second option is certainly more profitable but also more risky

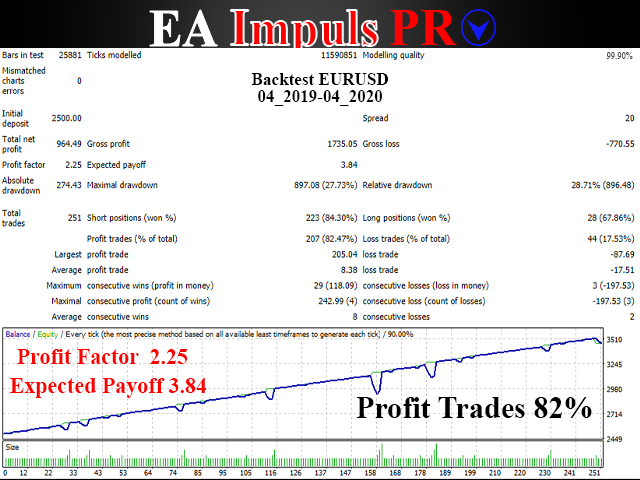

MyfxBook monitoring: myfxbook.com/members/SeniorTraderI

- built-in level indicator for analyzing levels for different TF

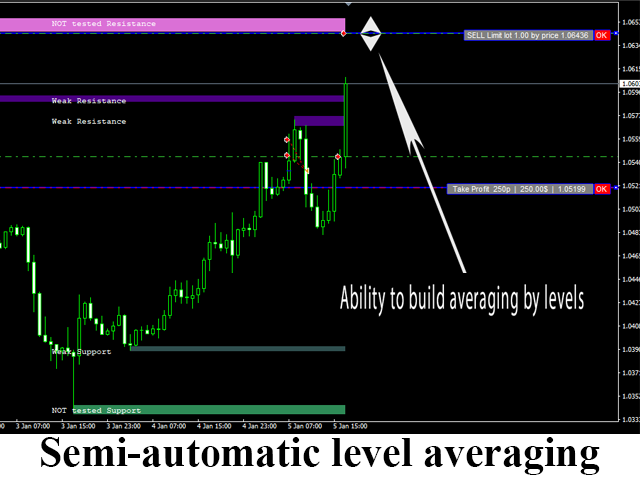

- the ability to select the level of averaging manually on the chart

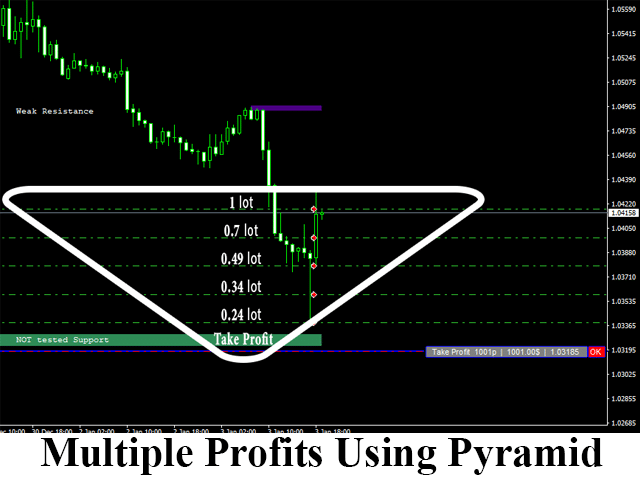

- the ability to multiply profits by opening many pyramiding orders (the number of orders can be controlled by yourself)

- more criteria for setting TP in%, based on the return signal of the iPump indicator

- ability to open a deal manually using the “Hand” mode

All trend strategies are based on simple and very correct logic, namely:

- opening a deal within the current trend

- opening a trade after price correction

- take into account trading levels

All three postulates are observed in this advisor.

Determining the trend for 2 timeframes, entering trades at the most favorable moment when the price is overbought / oversold more than usual, the correction levels SL and TP are visible on the charts.

Explaining the strategy

– for a downtrend ↓ we enter into a deal after a corrective price increase, the asset falls into the overbought zone, we sell along the trend;

- for an uptrend ↑ , we conclude a deal after a corrective fall in the price, the asset gets into the oversold zone, we buy along the trend.

Impuls Pro features

This Expert Advisor is aimed at those who have experience of independent trading, have worked with Expert Advisors who use averaging tactics.

- Choice of manual / automatic trading option

Trades can be opened by a signal from the iPump indicator or manually.

When you decide to open trades on iPump, you can control the desired direction of entry, for example, if you leave only the Trade Sell button red, the EA will only open short positions (you can use either the built-in trend panel or the iPump indicator to select a trend).

For manual opening, press the <iPump> button and the strategy will change to <Hand>.

Then, when you click on the “Trade Buy” or “Trade Sell” button, orders will be opened in the selected direction.

The “Close all Buy” and “Close all Sell” buttons are used to close orders.

- Possibility of choosing the level of price placement when averaging the position

This technique will allow you to choose the place at which price level to add a position before opening an order.

Even if you do not choose the desired level, the EA will place an order according to a predetermined distance.

The selection appears at a given distance controlled in the settings.

At the moment when the opportunity to adjust the averaging level opens, you will receive a notification from the advisor in the form of an e-mail / push-message or notification (alert) or even in the form of an SMS-message.

- Profit multiplication using pyramiding

- Entering a trade only after stopping the price movement

- The ability to visually control the risk for each trade

All of these settings will help you specify the exact level of risk for the current trade.

Thank you for everything, this is the best EA I have used in 10 years of Metatrade and you are the person who gave the best attention and service… thank you very much