Hedgeuptodown

- Experts

- Hafis Mohamed Yacine

- Version: 1.0

- Activations: 5

What Is Hedging as It Relates to Forex Trading?

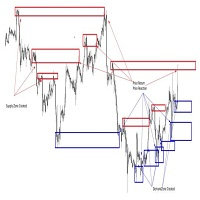

Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. It is typically a form of short-term protection when a trader is concerned about news or an event triggering volatility in currency markets. There are two related strategies when talking aboutHedge forex pairs in this way. One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options.

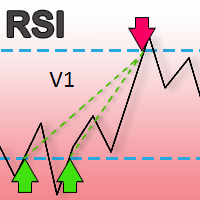

The strategy is profitable with volatility It bears repercussions and rallies Because she doesn't carry many deals with her It is a unit bargain and is protected by a stop As soon as 50 points bounce, a winner exits the market Fits the Eurodollar currency with the mentioned settings Because the euro range from 400 to 500 if you take a rally It needs to be corrected and it is mostly wobbly

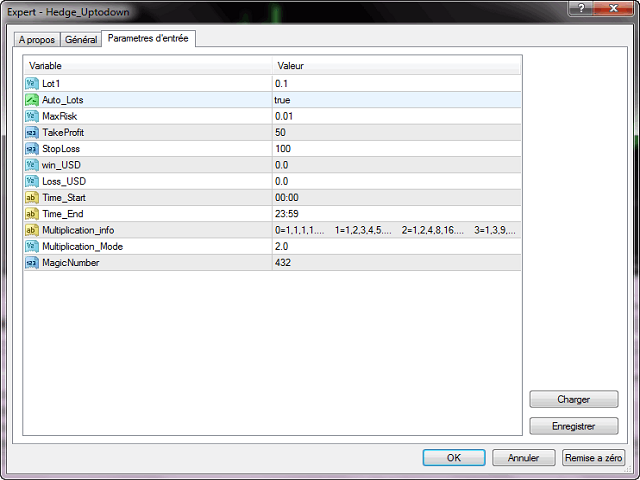

Parameters:

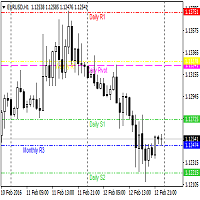

timeframe = 1m-5m

Lot1=0.01 for 500$

Auto_Lots= false

TakeProfit= 40

StopLoss=0

Multiplication_Mode = (0= low risk..= 1 medium risk ...=2 high risk)

Multiplication_info = "0=1,1,1,1.... 1=1,2,3,4,5.... 2=1,2,4,8,16.... 3=1,3,9,27...