Austin Currency Strength

- Indicators

- Augustine Kamatu

- Version: 1.1

- Updated: 15 October 2020

Check out other great products from https://www.mql5.com/en/users/augustinekamatu/seller

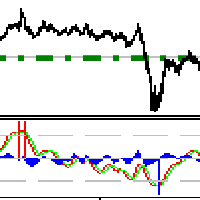

This indicator is the best so far at determining the currency strength of each pair.

It provides stable values and is highly adaptive to market changes. It is a great tool to add to your arsenal to make sure you are on the right side of the trend at all times.

No inputs required, it is simple plug and play.

A Winning Trading Strategy

This article describes the components and logic needed to develop a trading strategy that ensures that a profit is made regardless of what twists and turns the market throws at you.

Introduction

Time, experience and thousands of experiments have led me to conclude that the strength of a strategy is not in the accuracy of the indicator signals but in the management of open positions. In this article, I will describe the components and logic needed to develop a trading strategy that ensures that a profit is made regardless of what twists and turns the market throws at you.

Objective

First, we define the overall objective of our trading strategy. My objective is to achieve 0.5% per day for 20 trading days in a month for 12 months which translates to return of between 120% (if you use simple interest formula 0.5%x20x120) and 231% (if you use compound interest formula (1+0.5%)^(20*12)-1). This return by any standard is sufficient to provide steady income. The simple interest return is achieved by using a level lot size for all trades. Compound interest is achieved by increasing the lot size in proportion to the profits made so far.

Portfolio Diversification

There are two ways that we can achieve diversification, using different assets (currencies) and using different timeframes.

Asset diversification: For the success of the strategy, we need to create a very well diversified portfolio. This means we have to open a position in many different pairs. This way, if we get a false signal in 1 or 2 positions, the profits from the other positions will help to achieve the overall objective.

Time frame diversification: The indicator in use could show different signals depending on the time frame. It does not necessarily mean that one is wrong it may be that there is a retracement. Therefore diversifying on different time frames gives you an edge by earning short-term profits as we wait for price to follow the longer-term signal. This will bring us closer to achieve our objective.

Note that if the signal changes direction, the position will close so long as it is profit. If it is not in profit, the position will go under Position Management described below.

Position Management

In most cases the account will have achieved the target return but there are still open positions that are running at a loss and need to be managed without losing the profit already made. There are two tactics used to exit from these positions.

Tactic 1: We wait for another signal that supports the current position that has gone wrong. Then we open another position at a better price with a higher lot and put a take-profit at a price close to the average open price. We will repeat this process if we get more signals at better prices. This way the exit point moves closer to the current price and we will eventually exit with a small profit.

Tactic 2: Since we have already achieved our target for the day, we can redirect any additional profit to neutralize open positions with high running losses. We achieve this by finding the pair with the highest loss, then locate the oldest position in that pair and close it in full or in part in proportion to the extra profit earned.

Conclusion

With the application of this and many other algorithms my EA's can take any indicator and generate consistent profits while managing risks properly so that you don't wipe out your account. You can check out results of the strategy in my signals page https://www.mql5.com/en/signals/author/augustinekamatu

This is so useful