Rsi Decoder MT5

- Indicators

- Philip Pankaj Suthagar

- Version: 1.10

- Updated: 10 February 2021

- Activations: 5

Inspired from,

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. -William Delbert Gann

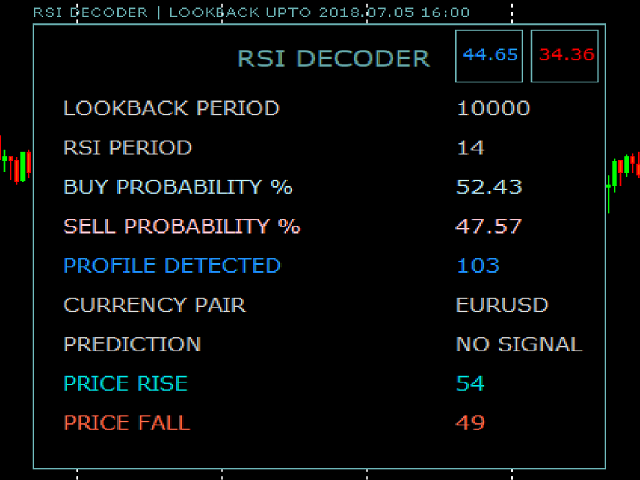

RSI DECODER is a Price Action/Price Pattern detection Indicator which uses historical data to validate a current pattern or profile to predict the probability of future price close based on forecast requirements given.

Fundamentally it forms a 3D(3 dimensional) box and contains all the taken data from history and cluster the buy and sell probability for near forecast given.Thus User gets well knowledgeable prediction to trade with.

Primary Objective:

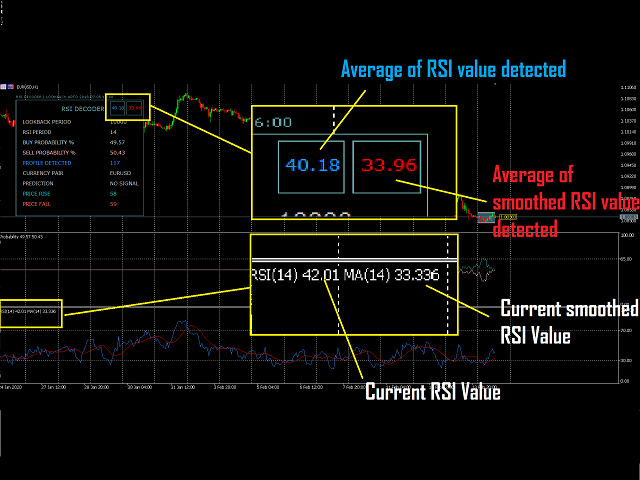

*RSI DECODER is built to decrypt the relationship between price(future price) and the RSI(Relative Strength Index) Indicator.

*Our Indicator will lookback throughtout the given historical period(Lookback period) and finds the exact and closest matches of RSI and Smoothed RSI indicator for given max.allowed errors.

*It forms BUY - SELL probability ratios for the selected patterns (Profile detected) based on forecast period(Custom Input).

Advantage of using RSI DECODER:

*Self Learning Algorithm.

*Faster and Superior than any other Machine Learning Models like Neural Networks,Regressions,SVM,Decision tree,Random Forest etc.

*Faster response rate on switching TimeFrame.

*Precision based Profile detection, Controls Noise allocation based on user requirements

*EA Integration

*Custom Precision Percentage (Max_Allowed_Change).

*Custom Email,Push Notification Alerts.

*User gets complete knowledge about current pattern(profile) and its future behaviour.

*When RSI is in overbought or oversold region,user can judge Potential Reversal or Trend Continuation with RSI DECODER.

*RSI DECODER works smoothly upto 20,000 lookback period.(Much faster than any conventional methods)

Recommended TimeFrame:

M30 and Above.

Major features considered in Profile detection are

*Relative Strength Index of the profile with respect to adjacent price.

*Smoothed Relative strength Index.

*Profile dimension.

*Correlation with Price.

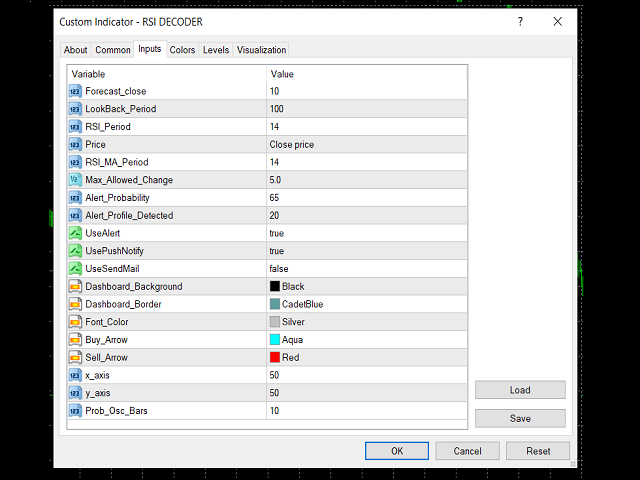

Details on Important Input Parameters:

*Forecast_close=Close price of specified bar in future for prediction.

*LookBack_Period = No. of Bars to look in historical memory for exact Profile.

Note:Download Required Historical Data as per LookBack Period.

*RSI_Period = No. of Bars to consider for calculating Relative strength index.

*RSI_MA_Period = No. of Bars to consider for calculating average of Relative strength index.

*Max_Allowed_Change= % of exact match of recent profile with respect to detected profiles.

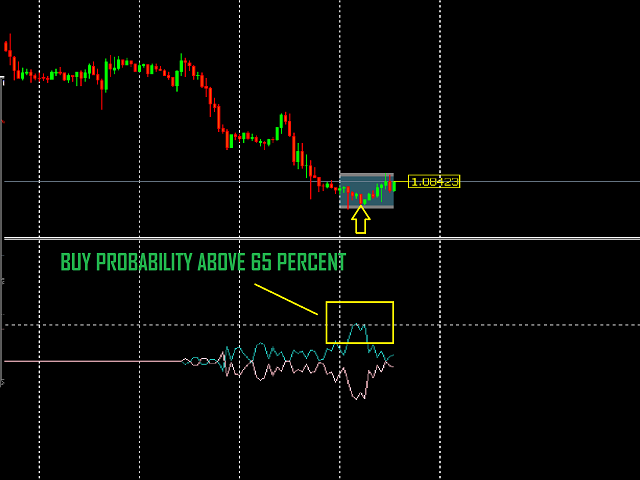

*Alert_Probability=Probability of getting Alert.

*Alert_Profile_Detected=Alert on exceeding No. Of profile detected.

*x_axis,y_axis = Positioning of Display Dashboard on Chart.

Probability Calculation:

Buy Probability = ( Price Rise / (Price Rise + Price Fall) *100.

Sell Probability = ( Price Fall / (Price Rise + Price Fall) *100.

Trade Setup:

Buy = Up Arrow Popup

Sell = Downl Arrow Popup

Thank you.!!