Torg FMA

- Experts

- ANTON IVANOV

- Version: 1.5

- Updated: 10 January 2020

- Activations: 5

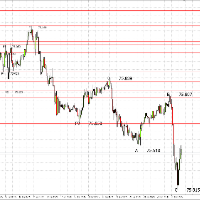

This EA is fully automatic, starting from MM and RM, ending with partial use as an auxiliary tool for manual trading, as it has the functions of opening by algorithm or closing by trawl for fractals. Works on all tools.

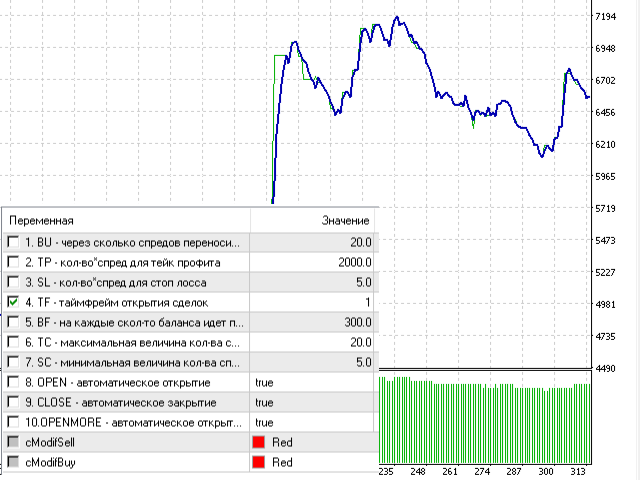

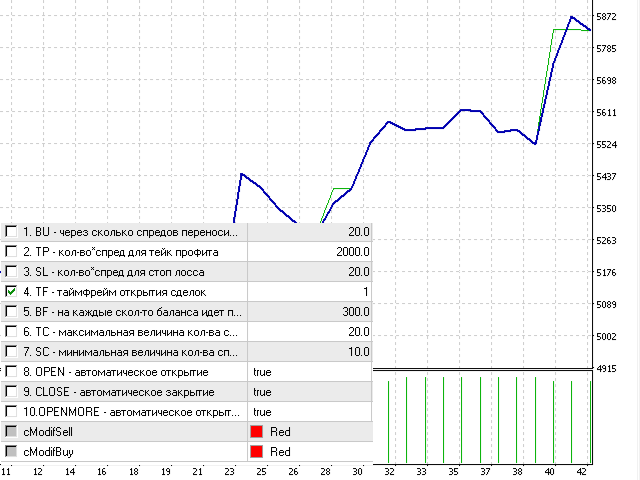

Recommended TF - M15, lowering or increasing TF, take into account the statistics of a market instrument.

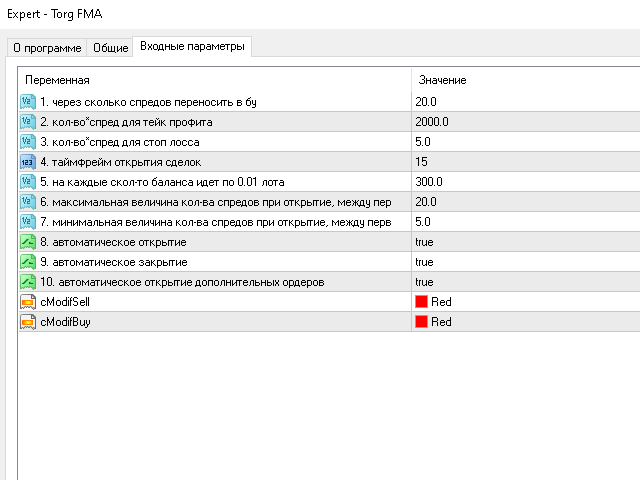

1. Translates transactions at a loss, regardless of the functions included, depending on the specified value calculated depending on the spread of the instrument.

2. Set take profit when opening a pending order according to the algorithm, calculation in the number of instrument spreads.

3. Places a stop loss on any open order, calculation in the number of instrument spreads.

4. Opening according to the algorithm of the current tool for the specified TF

5. Calculates the risk per trade for pending orders opened by the algorithm, BF - i.e. the balance amount is set and for each part of the amount there is a min lot (let's say a balance of $ 1000, BF 300, and the lot of the pending order will be 0.03, taking into account rounding)

6. Pending orders are opened according to the algorithm, and since it is not possible to set the trading time, volatility can be limited, for this there is a parameter for limiting the dimension between 1 and 2 candles before opening, it is also measured in the number of instrument spreads.

The maximum size.

7. Opening of pending orders is carried out according to the algorithm, and since it is not possible to set the trading time, you can limit volatility, for this there is a parameter for limiting the dimension between 1 and 2 candles before opening, it is also measured in the number of instrument spreads.

Minimum size.

8. Opening or not opening transactions with pending orders according to the algorithm, since it can be used partially as an assistant.

9. Closing or not closing deals, dragging a stop under a fractal.

10. Opening of additional orders by trend.

IMPORTANT!!!

The better you know the volatility statistics for a trading instrument, the better the

adviser will work, since it is advisable to use the statistics of an instrument

for each tool