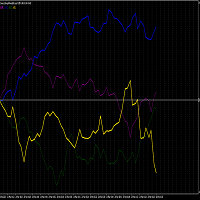

Volatility and Strength meter for ZAR

- Indicators

- Rajiv Ishwar

- Version: 2.0

- Activations: 5

PLEASE NOTE THAT LIKE MANY SUCH INDICATORS ON THIS MARKET, THIS INDICATOR WILL NOT WORK AS A DEMO DOWNLOAD FOR STRATEGY TESTER.

Therefore the 1 month option at the lowest cost allowed of $10 is available for you to test.

One of the better ways to trade is to analyse individual currencies rather than currency pairs. This is impossible with standard chart indicators on MT4.

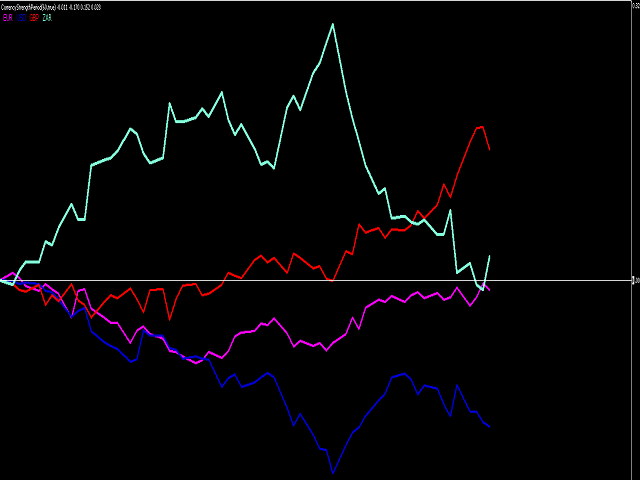

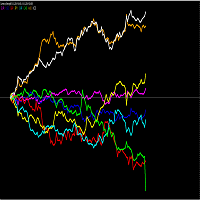

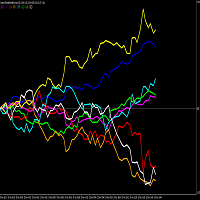

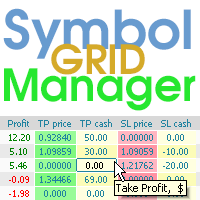

This currency strength meter allows one to trade the USDZAR, EURZAR, GBPZAR. Each currency (not pair) is measured constantly against the other 3 currencies to determine the gain on each pair. Those numbers are then shown cumulatively for each currency on the chart. PLEASE MAKE SURE YOUR BROKER OFFERS THESE PAIRS FOR THIS INDICATOR TO WORK OR OPEN AN ACCOUNT, EVEN DEMO, WITH ANOTHER BROKER THAT DOES.

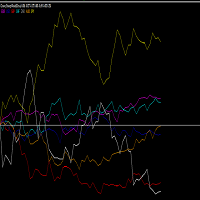

The look-back period can be set to whatever you want but the default is 60 periods. You many change the time-frame on your chart and the meter will adapt to that time-frame.

I recommend using a 1 minute and 5 minute chart with a look-back period of 60 for this indicator. The idea is to look at the last bit of the chart and match two currencies going in the opposite direction to each other. Matching a strong currency getting stronger and a weak currency getting weaker helps one stay out of false moves. Also if you trade a particular pair, you may use this meter to time your entries more accurately.

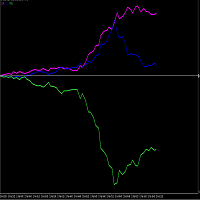

You may remove a currency line from the chart by setting that currency to "False" but it will remain in the calculation, and the scale will adapt to show only the currencies set as "True". This function may be used when one currency moves much more than the others, and skews the other 6 lines. This was seen often when Brexit announcements caused massive spikes on the GBP. The other lines then bunched up making it difficult to read for example, USDZAR

Set the zero line colour under "LEVELS". Also it is better to place the indicator on a new chart and expand it to fill almost the entire screen, rather than use it at the bottom of a trading chart.