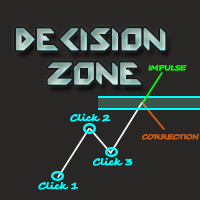

Decision Zone

- Indicators

- Flavio Alexandre Almeida Santos De Jesus

- Version: 1.20

- Updated: 21 October 2019

- Activations: 7

Decision Zone is an indicator that defines decision zones for previously selected pivots. In decision zones the user can more

safely decide whether the wave that has reached this zone is correction or impulse.

Zone levels were based on Fibonacci expansion along Elliot waves and case analysis.

Trading Strategy:

Basically, when the market wave reaches the decision zone at * Level 1.0 *, there is great potential for this wave to be an impulse or correction wave.

If it is impulse, the wave will break * Level 1.27 * with force. In the event of a correction the wave does not break * Level 1.27 * and a loss of

strength is noted, which reverses the direction of the market.

To select the pivot use the "A" key (if it is high pivot) or "B" key (if it is low pivot) and then click on three pivot peaks.

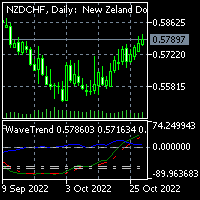

"A" key: Creates a high decision zone.

"B" key: Creates a bearish decision zone.

"R" key: Removes one decision zone at a time from the last created zone.

"L" key: Removes all decision zones.

"T" key: Activates all four levels of the decision zone.

"H" key: Activates the Opening price and the current Maximum and Minimum price lines.

Update - Version 1.20

- Added two more decision zone levels, now totaling 6 (six) levels.

- Bug fix that occurred when changing the time frame sometimes bugged and it was not possible to remove the last decision zone plotted using the 'R' shortcut.

- Added one more feature that plots the Open Trading price line and the latest Low and High price on the chart. To activate the functionality use the 'H' key and it is possible to remove using the 'L' key that clears every graph.

https://youtu.be/oKcufBatglE

Tags: decision zone, decision zone, impulse indicator, correction indicator, buy, sell, buy, stop or move, sell.