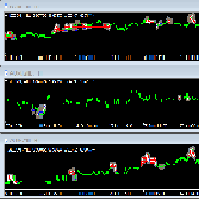

PZ Triangular Arbitrage EA MT4

- Utilities

- PZ TRADING SLU

- Version: 16.0

- Updated: 19 July 2024

- Activations: 20

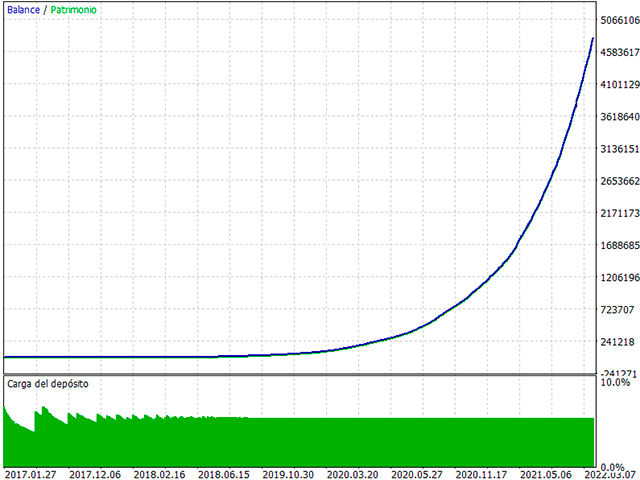

Exploit currency inefficiencies for risk-free trading

A triangular arbitrage strategy exploits inefficiencies between three related currency pairs, placing offsetting transactions which cancel each other for a net profit when the inefficiency is resolved. A deal involves three trades, exchanging the initial currency for a second, the second currency for a third, and the third currency for the initial. With the third trade, the arbitrageur locks in a zero-risk profit from the discrepancy that exists when the market cross exchange rate is not aligned with the implicit cross exchange rate.

[ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

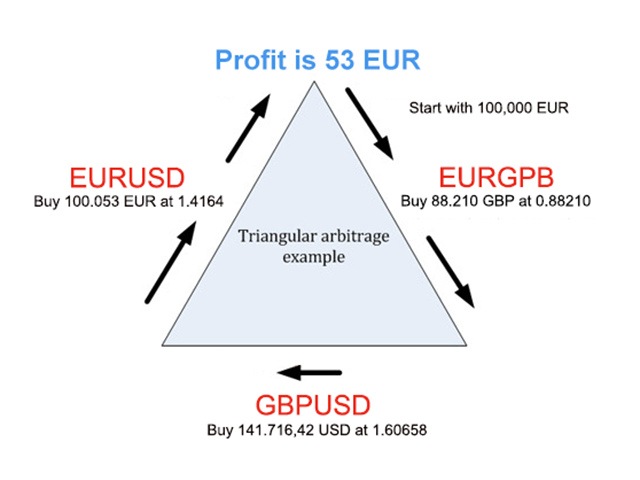

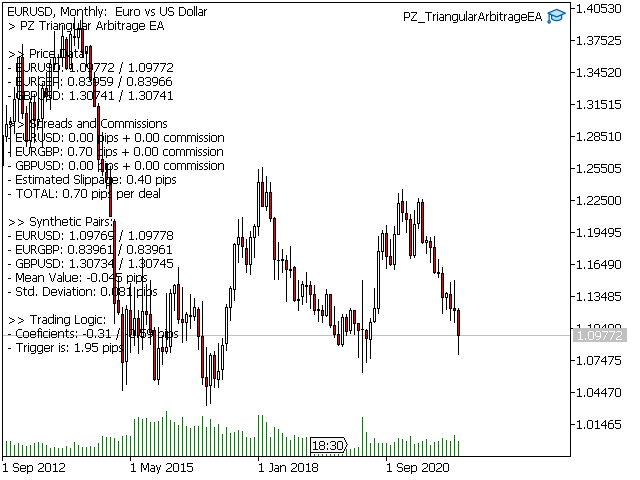

An example of a triangular arbitrage ring is USD, GBP and EUR. The currency pairs involved in such an arbitrage opportunity are EUR/USD, GBP/USD and EUR/GBP. These pairs can be thought of as an algebraic formula with a numerator and a denominator. The numerator in EUR/USD is the EUR, while the denominator in that pair is the USD. This equation works out to EUR divided by USD. These three currency pairs make up a tri arb ring that can be expressed as follows:

MEAN = EURUSD - EURGBP * GBPUSD

The mean roughly centers around zero but at times has serious excursions from this value. A mean below zero means that a profit is possible buying EURUSD, selling EURGBP and hedging with GBPUSD. Likewise, a mean above zero means that a profit is possible selling EURUSD, buying EURGBP and hedging with GBPUSD. If the combined transaction costs are smaller than the discrepancy, the deal can be taken and profits can be made. If slippage is too high placing the first two trades, the deal can still be profitable albeit unhedged.

Benefits of this EA

- Easy to set up and supervise

- Trade forex, crypto and metal pair rings

- Adapts to spread, commissions and slippage

- The strategy is time-frame independent

- It implements 25 built-in pair rings

- A theoretical zero risk strategy

- NFA/FIFO compliant

Features

- 25 built-in pair rings or...

- Enter your desired pair ring in inputs

- Possibility to hedge or not to hedge

- Customizable trading weekdays and hours

- Customizable Trade Trigger and Profit Target

- Customizable leverage and risk

The EA adapts its behavior to slippage. If the broker incurrs into considerable slippage when filling first two orders of the deal, the EA will refrain from hedging thus locking-in a loss in the ring. Instead, it will handle the deal as a mean reversion deal using only the first two pairs, which is still very likely to be profitable.

Usage Tips

- Trade with an "instant execution" broker

- Trade from a VPS or a good network point

- Backtest in M1 HLOC/Every Tick mode with and without random delays

- In netting accounts: don't trade rings with overlapping pairs simultaneously

- In hedging accounts: trade many rings at the same time without restrictions

- Changing the magic number from pair ring to pair ring is not necessary

Input Parameters

- Pair Ring: Select a built-in pair ring to trade or select "Manual Inputs".

- 1st Symbol: The first symbol of the pair ring. For example, EURUSD.

- 2nd Symbol: The second symbol of the pair ring. For example, EURGBP.

- Hedge Symbol: The hedge symbol of the pair ring. For example, GBPUSD.

- Trade Trigger: The minimum price discrepancy to trade in pips. A higher trigger will cause less trading frequency.

- Profit Target: The profit target for the deals in pips. A higher profit target will cause more variance in trading results.

- Hedge: Enable or disable hedging of the deals. Deals can also be profitable without hedging and transaction costs are smaller.

- Trading Weekdays: Enable or disable trading on any given weekday, from monday to sunday.

- Trading Hours: Set the trading hours for the EA. By default it trades from 00 to 21 hours.

- Leverage: Select the leverage the EA must use when trading the pair ring.

- Slippage: Maximum slippage on orders in points.

Built-in Pair Rings

- EURUSD/EURGBP/GBPUSD

- EURJPY/EURGBP/GBPJPY

- EURJPY/EURUSD/USDJPY

- EURCHF/EURUSD/USDCHF

- NZDCAD/NZDUSD/USDCAD

- NZDCHF/NZDUSD/USDCHF

- AUDJPY/AUDUSD/USDJPY

- And many more!

The EA can trade any pair ring of your choosing, for example BTCUSD/BTCEUR/EURUSD or XAUUSD/XAUEUR/EURUSD.

Author

Arturo Lopez Perez, private investor and speculator, software engineer and founder of PZ Trading Solutions.

Liar and differs not like the video nor is there fast and slow broker BAD AND note same in pictures