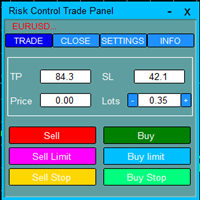

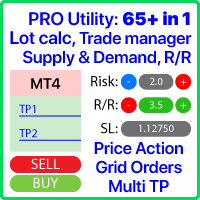

Risk Control Trade Panel

- Utilities

- Yupeng Xiao

- Version: 1.1

- Updated: 13 August 2019

- Activations: 5

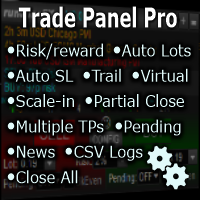

Risk Control Trade Panel is designed to assist in one-click trading. This tool can automatically calculate the trading lots based on the set risk money, the recommended StopLoss and the recommended TakeProfit. In the information menu, you can view indicators such as the weekly price range and the monthly price range.

Followings are highlight features

- Lotsize is automatically calculated based on the risk money set by the user.

- The recommended stoploss and recommended takeprofit are automatically calculated based on the ATR indicator.

- You can check the weekly price range and the monthly price range as a trading reference.

- You can view the original "Spread Costs and Swap Benefits" indicators.

1. For detailed explanations and statistical results of price range, see the article: STATISTICS OF WEEKLY PRICE RANGE OF MAJOR CURRENCY PAIRS

2. For detailed calculation methods and explanations of "Spread Costs and Swap Benefits", see the product: https://www.mql5.com/en/market/product/29322

Parameters

- Default Risk Money: set the default trading risk money, for example, the account currency is USD, and the setting of risk money is 200, then the loss money is ≤200USD when each trade triggers the default stoploss.

- Lots Step: minimal volume change step for clicking the "+" and "-" buttons in the TRADE tab.

- Magic Number: unique number to let the EA distinguish its own orders from the ones opened manually or by other EAs.

Panel content:

The panel has four tabs:

1. TRADE

- TP - Set the takeprofit (points), the default value is twice the default SL.

- SL - Set the stoploss (points), the default value is 1.5 times the value of ATR (4H).

- Price - Set the price of the pending order.

- Lots - Set the lots, the default value is calculated based on the risk money and default SL.

- “+”“-” - change lots according to the value of "Lots Step".

- Sell、Buy、Sell limit、Buy Limit、Sell Stop、Buy Stop - opening Buy,Sell or pending orders.

2. CLOSE

- Close Buy - Close all Buy orders.

- Close Sell - Close all Sell orders.

- Close All - Close all Buy and Sell orders.

- Delete All - Delete all pending orders.

3. Settings

- Risk Money - set the trading risk money, for example, the account currency is USD, and the setting of Risk Money is 200, then the loss money is ≤200USD when each trade triggers the default stoploss.

- Lots Step - minimal volume change step for clicking the "+" and "-" buttons in the TRADE tab.

4. INFO

- Weekly ATR - weekly ATR value.

- Weekly Range - the points of (highest price - lowest price) in this week.

- Weekly Range(%) - Weekly Range/Weekly ATR×100%.

- Monthly ATR - monthly ATR value.

- Monthly Range - the points of (highest price - lowest price) in this month.

- 4H ATR - 4 hour ATR value.

- Current Spread - current spread expressed in points.

- Spread Costs - current spread costs expressed in the account currency, the account currency is USD, EUR, etc.

- Swap Long - current swap benefits expressed in the account currency for long positions.

- Swap Short- current swap benefits expressed in the account currency for short positions.