Indicator Z Average Daily Reversal Times

- Indicators

- Clive Tyler

- Version: 2.30

- Activations: 5

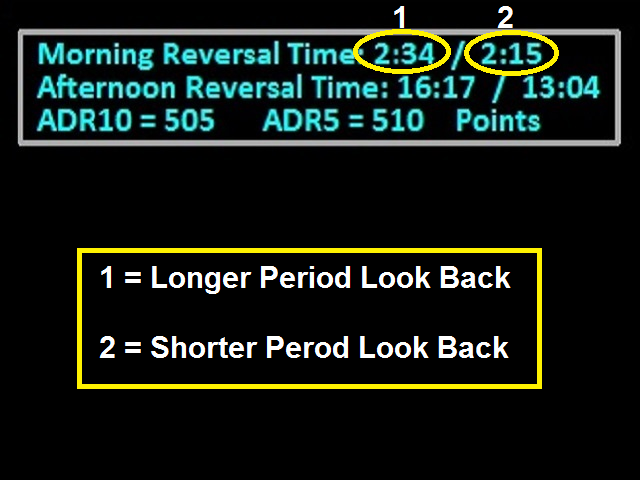

Gives the average times of the High of The Day and Low of The Day + the ADR over 2 different look back periods. Every day there is a High of the Day and a Low of the Day, and the distance between them is the ADR (Average Daily Range). If you are trading reversals at the first High/Low of the Day for high Reward:Risk trading, it’s useful to know the Morning Reversal time. If you are trading the End of Day Reversal back into the range after the ADR has been hit at the opposing High/Low of the Day, its useful to know the Afternoon Reversal time.

FINDING THE HIGH & LOW OF THE DAY

Different markets move at different times, and this indicator tells you the average daily reversal times over 2 look back periods for any market. You can compare a longer range average (e.g. 30 - 100 days) against a shorter range average (e.g. 10 - 15 days). The longer & shorter range averages are often remarkably similar, which shows just how regular and predictable the markets can be if you have the right tools to measure it.

A GREAT CONFIRMATION TOOL FOR TRADING REVERSALS AT THE HIGH or LOW OF THE DAY

Trade Daily Reversals at the High or Low of The Day if they occur within an acceptable proximity to the average reversal times.

CONFIRMATION FOR TREND TRADING

Avoid trend continuation trades if the Morning Reversal or Afternoon Reversal time is soon approaching.

However, if for example a trend continuation setup occurs 3 hours after the Morning Reversal time, you can be confident the current trend is likely to be the main directional move of the day, which allows you to remain in the trade until the ADR is hit, maximizing the profit from your trade.

HELPS PLAN YOUR TRADING DAY

The average reversal times for these 3 different markets using a 100 day look back period, show that these markets need to be traded at very different times to catch the big daily reversals that deliver maximum pips, and to avoid taking low volatility trades at the wrong times:

AUDUSD

· Morning High/Low of Day = 03.00 GMT / 21.00 EST

· Afternoon High/Low of Day = 14.45 GMT / 08.45 EST

EURUSD

· Morning High/Low = 09.15 GMT / 03.15 EST

· Afternoon High/Low = 18.10 GMT / 12.10 EST

WTI Oil

· Morning High/Low = 15.15 GMT / 09.15 EST

· Afternoon High/Low = 20.10 GMT / 14.10 EST

HELPS YOU PLAN YOUR EXITS

This indicator also helps you exit the daily trend with the majority of your profits intact.

In addition to the reversal times, it also includes ADR (Average Daily Range) information for 2 different look back periods, which tells you the total price movement in MT4 Points you can expect between the High and Low of the Day (we recommend using default ADR10 and ADR5 periods). Use this information to set your TP targets safely within the ADR, or set price and time alerts. Whichever occurs first (ADR hit or Afternoon Reversal time approaching), start watching the price action for signs of reversal, and be ready to exit your trade with maximum profits intact.

SPECIAL FEATURE – FILTER YOUR HISTORICAL SEARCH RANGES

You can also filter the time ranges used by the indicator to search for the historical reversal times. Historical reversal data that does not fall within the specified time ranges will not be included in the average calculation. This allows you to get a tighter search result that excludes irrelevant or unnecessary data that might skew the average times.

For example, the default settings exclude the first and last hour of each day to avoid including in the average results any days within the look back period that trended all day, yielding no trade-able reversals. If you are not trading during the first and last hour of the day, you don't need to include these extreme times in your average reversal times. Furthermore, once you know the approximate AM and PM reversal times for each market, you can filter the search ranges even further (e.g. AM Search Range = 01.00 - 13.00 / PM Search Range = 13.00 - 21.00)

| ALL TIMES ARE MT4 SERVER TIME |

|---|

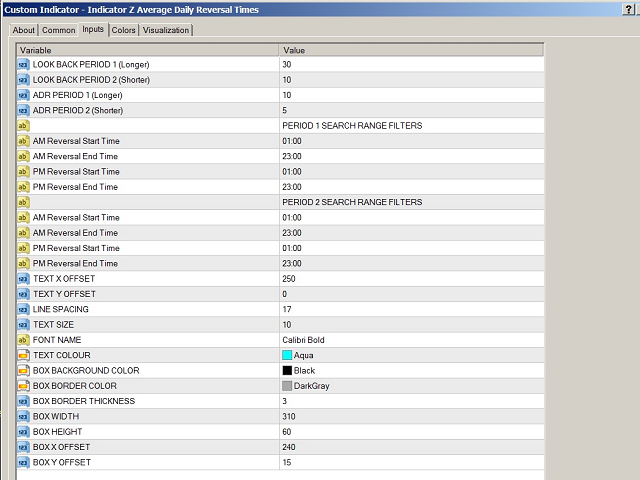

INPUT SETTINGS

- Look Back Period 1: The no. of days of historical data used to calculate the average reversal times

- Look Back Period 2: A second shorter look back period

- ADR Period 1: No. of days for the longer period ADR

- ADR Period 2: No. of days for the shorter period ADR

- Period 1 Search Range Filters: Filter AM and PM search ranges between 00.00 – 23.59

- Period 2 Search Range Filters: Filter AM and PM search ranges between 00.00 – 23.59