Market Zones

- Indicators

- Expert Lims S.L

- Version: 1.2

- Updated: 24 November 2020

- Activations: 7

Market Zones

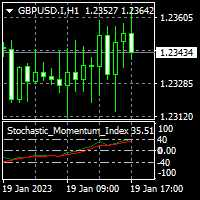

This indicator provides an easy way to get to trade based on Gaussian statistical levels similar to the Market Profile ® methodology.

Using an exclusive formula the indicator estimates dinamic zones where the market movements statistically remains most of the time (70%), this allows to see the market on a simplified way avoiding following non-relevant bar movements.

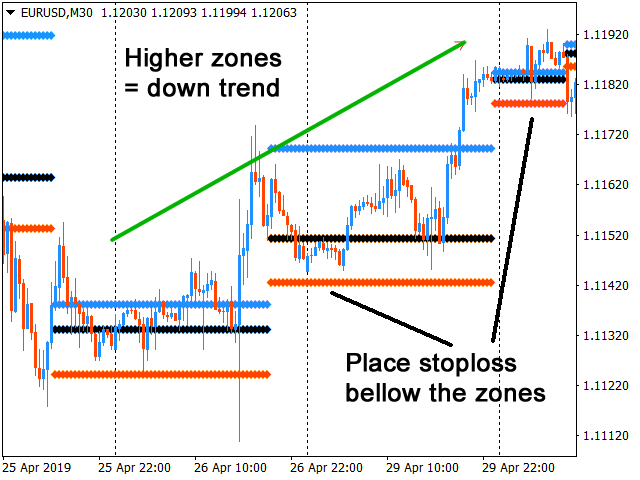

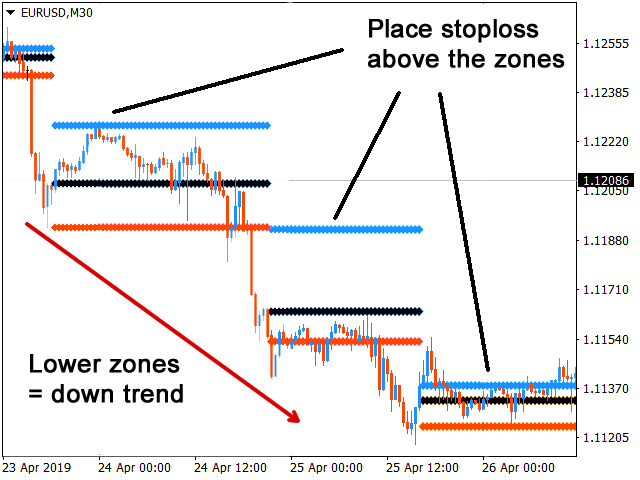

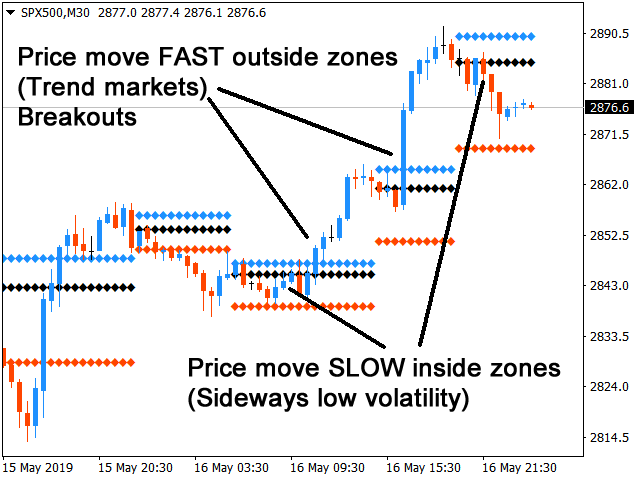

Prices stay calm inside market zones and tend to move faster outside the zones. This is crutial to identify best zones to trade breakouts, following-trend or sideways strategies.

Lines description

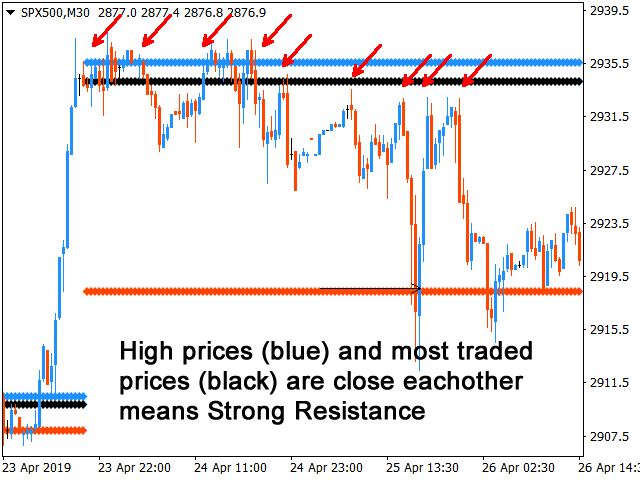

Each 3 lines together represents a RANGE where statistically price will remain moving inside the range.

- Blue color line represents top of the range / highest price.

- Black color line represents "most traded price" inside the range.

- Red color line represtens bottom of the range / lowest prices.

Zones shapes

Note that every zone is unique, depending on the market movements that generates them.

- Narrow zones represents "low volatility" market conditions.

- Wide zones represents "high volatility" market conditions.

- Long zones are indicative of sideways markets.

- Short zones are indicative of trending markets.

Parameters

1. Timeframe. The timeframe to use for the calculations. This allows to trade using multiple timeframes on the same chart.

2. Use Volume. Check true is you want broker volume to be used to calculate zones.

3. Back Bars. Number of bars on the current chart to show zones.

Examples of use

- When price cross above blue line there is high probability of a bullish breakout.

- When price bross bellow red line there is high probability of a bearish breakout.

- When trading short the stoploss are better situated above blue line.

- When trading long the stoploss are better situated bellow red line.