Multiday Overlay Strategy Low Risk

- Experts

- Fabio De Gaetano

- Version: 3.0

- Activations: 5

With the Multiday Overlay Strategy EA, you can trade in parallel all major/minor/cross pairs in Forex.

This EA is rather unique, as it is capable to "follow the market", this means:

- no optimization is needed;

- the same set of input parameters is good for all pairs;

- you do not need to change the input parameters even if market conditions change.

These three features mean that the EA is not "manually adapted" to a specific pair in a specific timeframe, as it normally happens when you optimize a pair with MetaTrader 4 in a past period with the Strategy Tester.

The EA is based on a complex theory, important to understand is the concept of Overlay in a specific Timeframe (e.g. 5, 10 or 15 days), that is an envelope of prices in the last days, and helps understanding where the value is and if the value is stable or not.

This EA has a very low risk, as it has the feature to adapt lot size to the Equity. In detail, the EA will keep lot size below 0.1 lot per each 4000 USD in equity. For instance, with 2000 USD in Equity, lot size will not exceed 0.1*2000/4000 = 0.05.

This feature means that the EA is rather conservative, with a very low risk. But as equity grows, also the lot will grow in proportion in order to enhance profit.

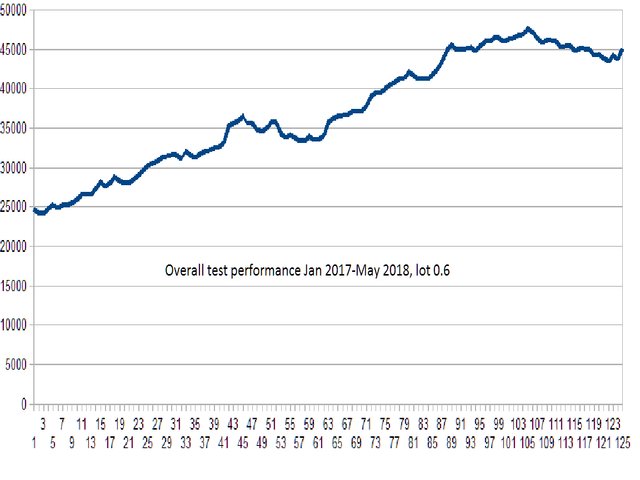

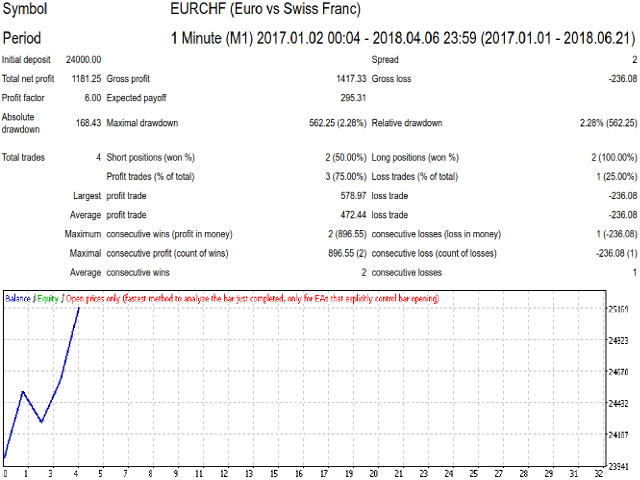

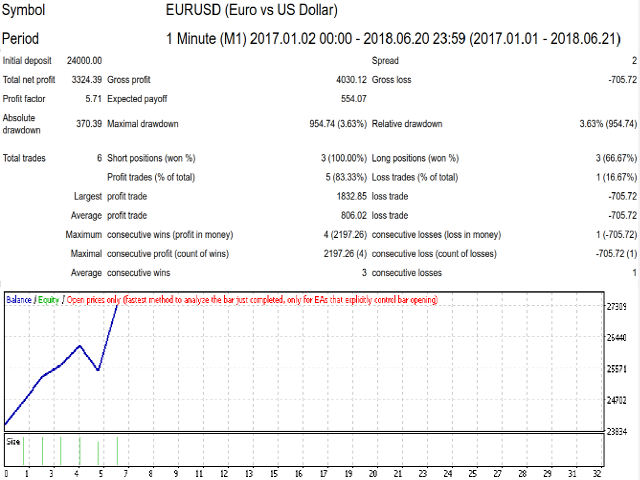

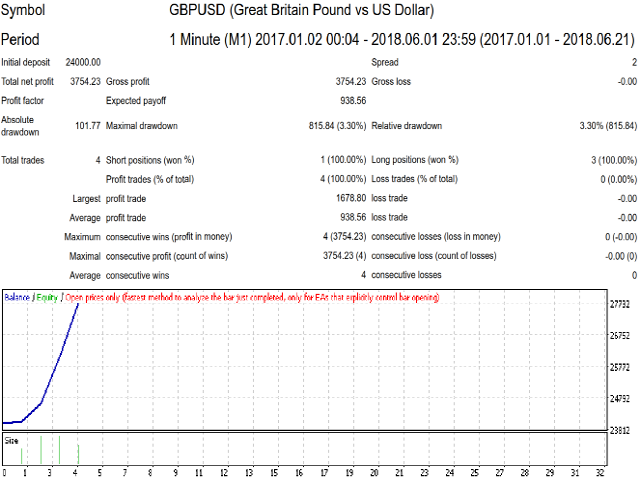

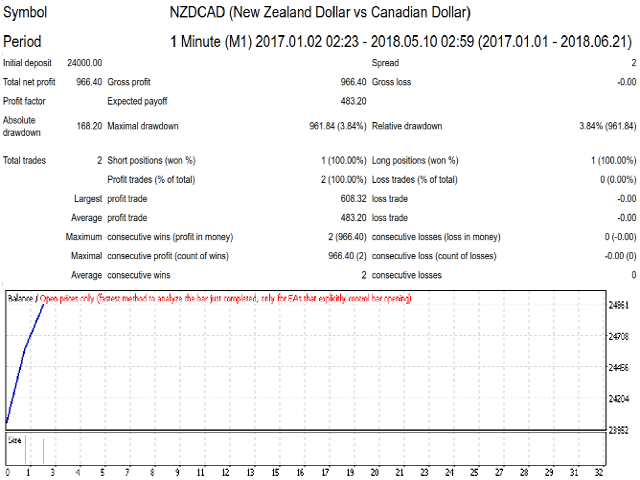

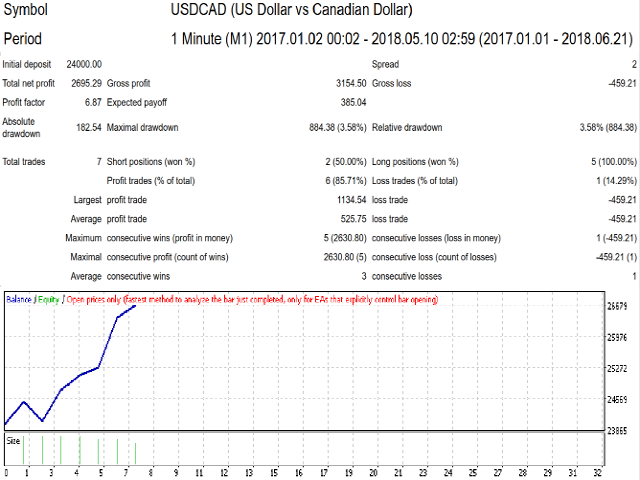

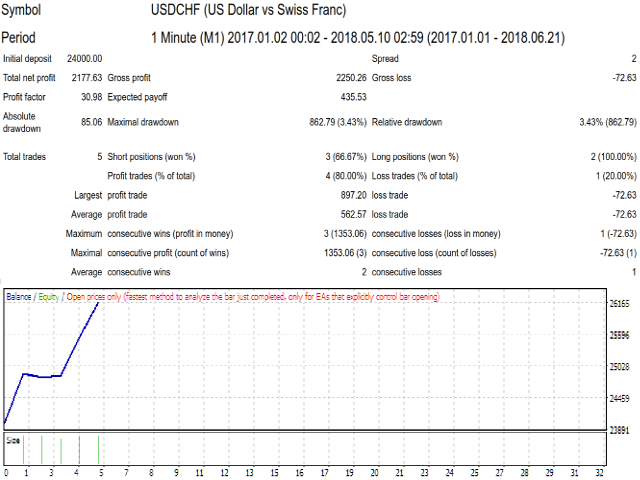

Testing on all pairs in 15 months with lot=0.6 the result is:

- profit 21k USD

- % win 75%

- DD below 5%

You can check general/detailed results in screenshots; normally positions are opened for many days.

Important: when backtesting, ONLY use M1 timeframe, it is mandatory. If the testing is too slow, you can use "open prices only". You need at least two years of data with M1 and M30 timeframes.

In order to run on a real or demo account, just attach to only one chart. You can adjust the refresh rate input parameter (recommended value=5), see below, and lot size.

Inputs

The EA has already default input parameters tested for good performance, you only need to adjust a lot size and data refresh rate.

- "bars M30 for base Overlay": defines a "shorter" Overlay; this is an integer number (1= 30 mins). For instance, 240 is a 5 days Overlay. A recommended value is between 240 and 330.

- "number of bars multiplicator for long Overlay": defines a "longer" Overlay, calcultated as the "shorter" Overlay length multiplied for this real number. A recommended value is between 2 and 3.

- "lot size": lot size. The value in input will be adapted in order to be less or equal to (Lot Size)*Equity/4000.

- "true to allow testing in no limit mode": if true, when testing the lot size will not be adapted to equity.

- "Magic": magic number.

- "minutes in wait after breakout": a virtual order becomes a real order only if price keeps higher than virtual order level for this number of minutes.

- "multiplies Stop Loss to obtain Take Profit": Take Profit level is equal to Stop loss level multiplied for this real number (Stop loss is calculated by the EA).

- "multiplies Take Profit to obtain Trailing Stop": Trailing Stop is equal to Take Profit level multiplied for this real number.

- "multiplies Trailing Stop to obtain Trailing Step": Trailing Step is equal to Trailing Stop level multiplied for this real number.

- "days in wait before cancelling a virtual order": a virtual order will be cancelled after this number of days (integer).

- "use Close as an exit condition": an order will be closed if price activity is above threshold and price is above Trailing level.

- "rate in minutes for data refresh": all internal data are recalculated every "rate" minutes. When testing, recommended 180 or higher, depending on machine resources, in real account can be lower (recommended: 5).

- "days in wait before closing an order": if an open order has a profit >0 but is lower than trailing level, after this number of days will be closed.