Average True Range Extended

- Indicators

- Kok Jye Yen

- Version: 1.0

- Activations: 5

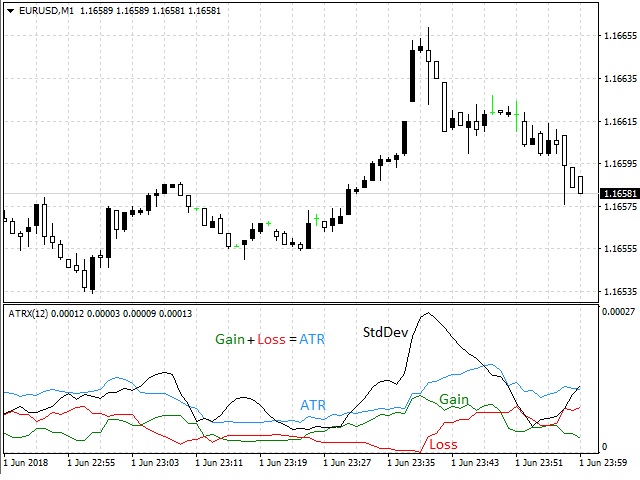

This is an extension of the Average True Range indicator with the breakdown of price gain, loss, and standard deviation; with the price break down into price gain and loss, this can now be used as an oscillator with standard deviation as the queue to time the entry and exit.

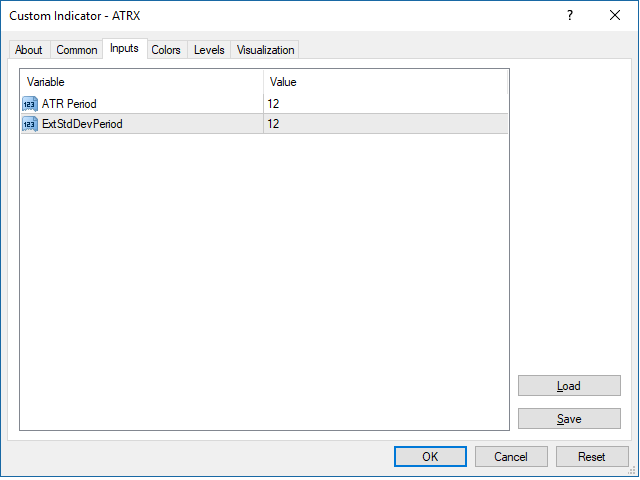

Settings

- ATR Period - Typically set at 12.

- ExtStdDev Period - This the period for the Standard Deviation and it typically follows the ATR Period.

How to use

Buy / Sell Direction - If the green (gain) is higher than the loss (red), means to buy and vice versa.

- Buy

- Entry - When the black line (standard deviation) cross over the green line and the green line is above the red line.

- Exit - When black line touches the green line OR green line (almost) touches the blue line (ATR) OR black line reaches the peak.

- Sell

- Entry - When the black (standard deviation) cross over the red line and the green line is above the green line.

- Exit - When the black line touches the red line OR red line (almost) touches the blue line (ATR) OR black line reaches the peak.