Spread and Cost pips

- Indicators

- Alexander Shienkov

- Version: 2.1

- Updated: 4 January 2024

About the Spread

Spread is the difference between the Ask and the Bid price of an asset in the stock or currency exchange.

Let's refer to Central Banks and currency exchange in these banks, in order to understand why Spread is so important in currency trading. In Central Banks, we always see the difference between the buying and the selling price of a currency. This difference is what the bank buying and selling the currency earns. When trading in the Forex market via a broker, we can also se the difference, which is however much smaller than in currency exchange points.

For example, the quote "EUR 1.2030/1.2032" means that the broker is ready to buy Equro against the US dollar at 1.2030, and sell Euro at 1.2032. The difference between the buying and selling price is 2 points (0.0002).

Calculating the true spread size is difficult. The value depends on the broker's policy.

There are two types of Spread in the Forex market:

Fixed spread is constant regardless of changes in the market.

Floating spread is the most commonly used type. It fluctuates within a certain range depending on market conditions. Brokers normally indicate only the lower limit of this range. The floating spread value depends on the following:

- Liquidity of currencies

- Market sentiment

- Broker

How to take into account the spread when opening and closing trades in the Forex market.

When long (Buy) positions are opened, deals are executed at the Ask price, for short (Sell) positions deals are executed at the Bid price. The smaller the distance between the two prices, the faster your deal will go into a profit area provided that you correctly predict the price movement.

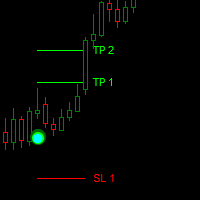

It is also important to consider spread when working with pending orders and when setting Take Profit (TP) and Stop Loss (SL).

About the Lot and the Point Value

Lot is the standard unit for measuring the volume of a currency transaction in the Forex market. One lot is equal to 100,000 of base currency units.

- A standard lot represents 100,000 units if the base currency, and its volume is equal to 1;

- Mini-lot represents 10,000 units of the base currency, and its volume is equal to 0.1 of the standard lot;

- Micro-lot represents 1,000 units of the base currency, and its volume is equal to 0.01 of the standard lot;

Most brokers provide calculators of lot value and information on the terms of service provided.

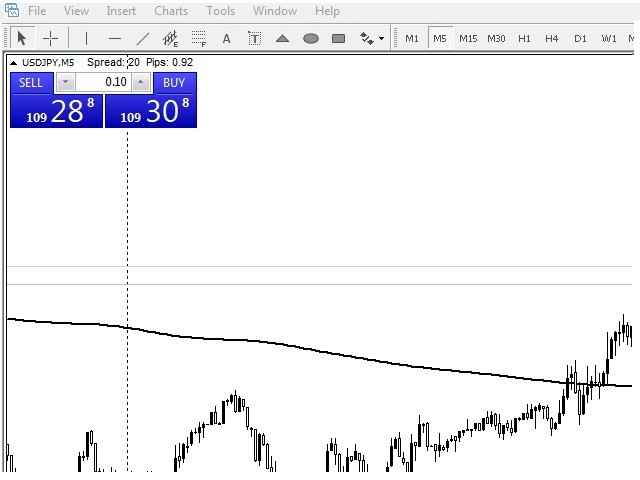

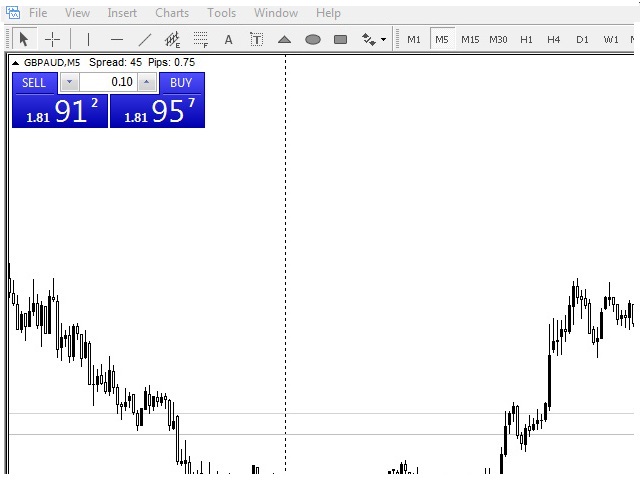

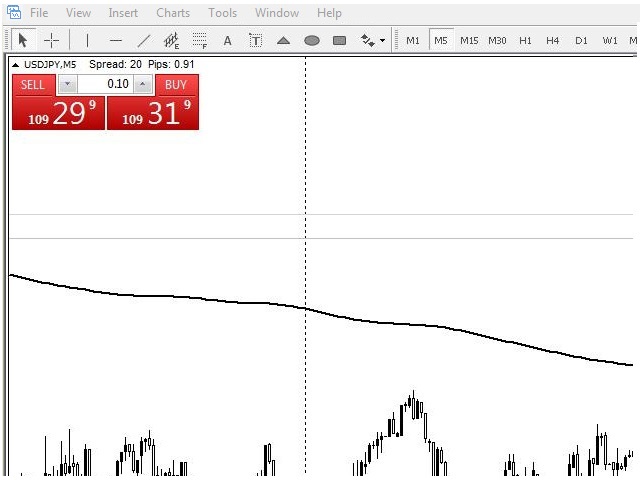

This indicator displays this information directly on a price chart. When you launch the indicator, it shows a text with the current spread value and the value of one point with the deal volume equal to mini lot, i.e. 0.10. This greatly simplifies the understanding of information about a trading instrument.

Note: the indicator can work with any broker, with any color of the chart background and is very convenient for analyzing the desired currency pair before opening a trade.

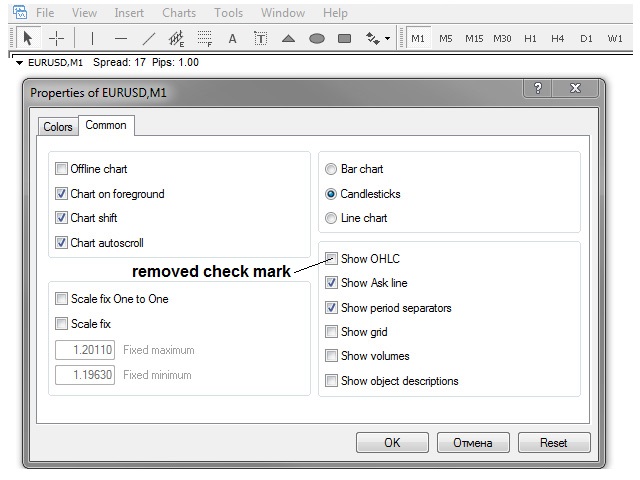

In order to avoid overlapping with the MetaTrader 4 text, before launching the indicator open Chart Settings -> Common and unselect "Show OHLC". By default, the indicator text is located directly above the Buy\Sell buttons where OHLC text is usually located. Thus, the exact spread value and the mini lot value are always shown on the screen.

OHLC - OPEN, HIGH, LOW and CLOSE — bar open price, the highest bar price, the lowest bar price, and bar close price, respectively.

If the "Show OHLC" option is important for you, you may change the location of the "Spread and cost pips" indicator.

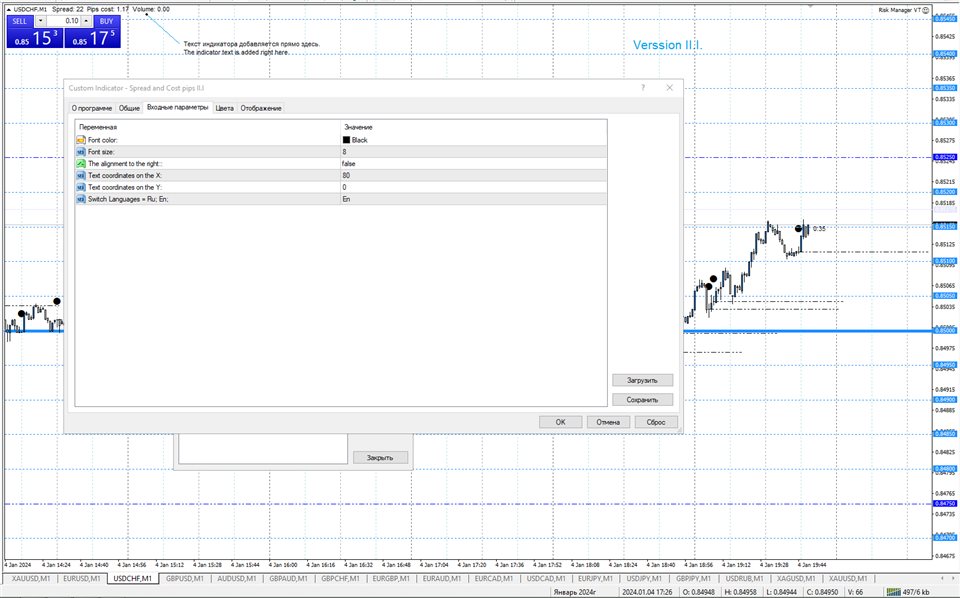

Color, size and language of the indicator text can be configured in input parameters.

Indicator inputs

- Font color - default is Black.

- Font size - default is 8.

- The alignment to the right - default is false.

- Text coordinates on the X - set location along the X axis.

- Text coordinates on the Y - set location along the Y axis.

- Switch Languages = Ru;En; - set the text language, default is En.

Brilliant indicator for what I was looking for