AW Turtles Indicator MT5

- Indicators

- AW Trading Software Limited

- Version: 1.20

- Updated: 7 March 2024

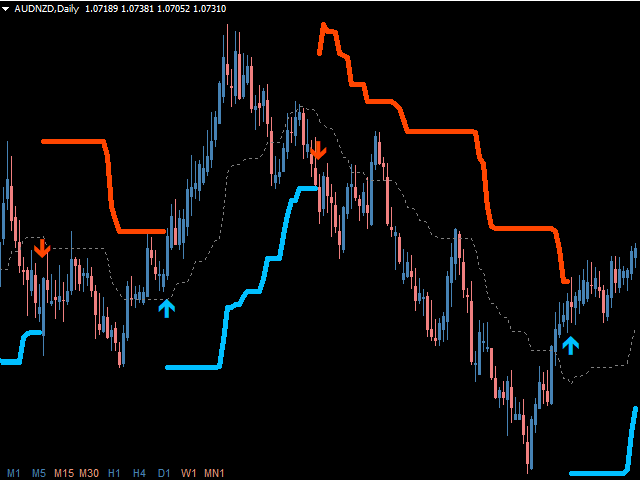

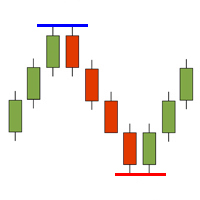

The indicator works according to the Turtle system and classically assumes a time interval of 20 and 55 candles. A trend is monitored over a given time interval. Entry is made at the moment of breakdown of the support or resistance level. The exit signal is a price breakout in the opposite direction of the trend of the same time interval.

Advantages:- Instruments: Currency pairs, stocks, commodities, indices, cryptocurrencies

- Timeframe: Classically D1, also suitable for working with any timeframes

- Trading hours: around the clock

- Money management strategy: Risk per transaction no more than 1%

- When using additional orders, the risk for each additional position is 0.25%

Entry rules:

1) Shorter entry:

The entry condition is a breakout of the 20-day high or low.The trade is skipped if the previous signal was successful.

Note! If the previous deal was closed with a profit, we skip the entry. If it suddenly turns out that the breakout is profitable, then later we enter it after breaking through the 55-day channel.

When the price breaks through this channel, we enter a trade.

2) Longer term entry (if the 20 day breakout was missed due to the reasons stated above):

The price breaks the 55-day high or low of the Donchian channel.Note! In approach number 2, the filter for the previous transaction is not used, we always enter.

Exit Strategies:

Stop Loss

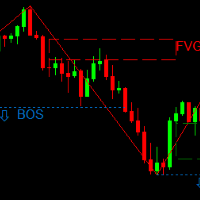

1) In the classic version there is a simplified form of calculation for turtles. It looks like this:

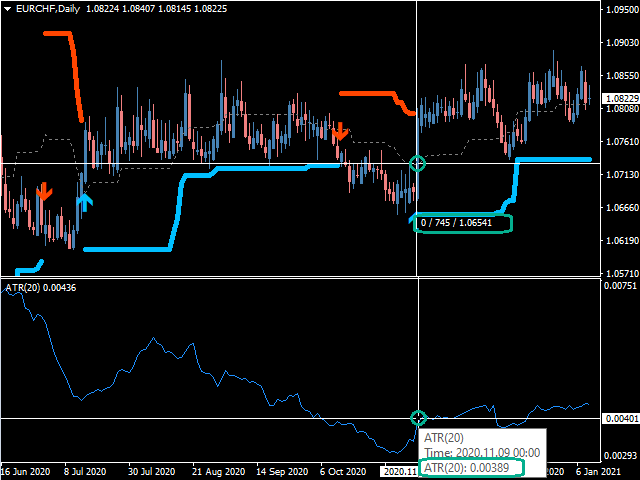

In order to work with the formula for calculating stop loss, it is worth adding the ATR indicator to the chart:

StopLoss = ATR (20) * 2

2) We offer an additional option for calculating Stop Loss. This is the exit along the middle line of the indicator.

The screenshot in the product description shows both StopLoss options:

The ATR indicator with a period of 20 is displayed at the bottom. Thus, in the first calculation, Stop Loss will be equal to 389 * 2 = 780 points.The upper part of the screenshot shows the estimated Stop Loss level according to the second strategy, that is, along the middle line. Second option Stop loss = 745 points.

As you can see, the StopLoss levels in the first and second cases are different, but have similar indicators. You can use any of the presented options in your trading.

Additional orders:

Installed at a distance of at least every 0.5 ATR from the entry point.

Input settings:Period_Donchian - Channel period. Based on the previous specified number of candles, from the lower to the upper price level. On channel breakouts, we receive signals about a trend reversal.

Maximum_bars_for_calculation - Number of bars for calculating the indicator

NOTIFICATIONS SETTINGS

Send_Push_Notifications - Use notifications about the appearance of new signals on the mobile version of the trader’s terminal

Send_PopUp_Alerts - Use pop-up notifications

Send_Email - Use sending letters about the occurrence of signals to the trader's email

GRAPHICS SETTINGS

Multitimeframe_dashboard - Dashboard display type, minimized or full

Font size_in_panel - Text size on the indicator panel

Y_offset - moving the multi-timeframe panel along the Y axis

X_offset - moving the multi-timeframe panel along the X axis

Color_Sell_Line - Color of the top line of the indicator

Color_Buy_Line - Color of the bottom line of the indicator

Color_Average_Line - Color of the average line of the indicator

Uptrend_Color_Panel - Color of the ascending direction in the panel

Downtrend_Color_Panel - Color of the downward direction in the panel

Up_Color_Main_Panel - Uptrend color in the panel

Down_Color_Main_Panel - Downtrend color in the panel

Support:

We are happy to provide our designs for free, but due to our limited time, all free products are provided without any support. Thanks for understanding.

buen trabajo