Skynet Moving Average

- Indicators

- Roman Yablonskiy

- Version: 1.2

- Updated: 5 February 2019

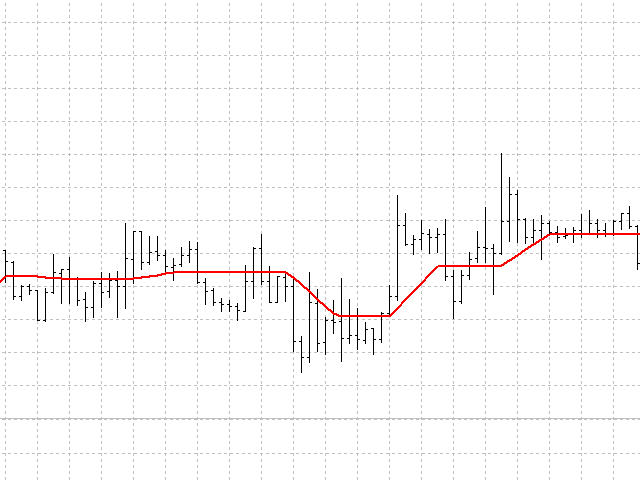

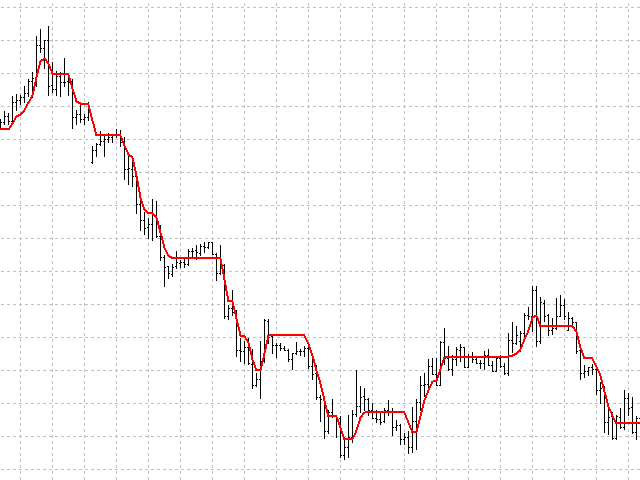

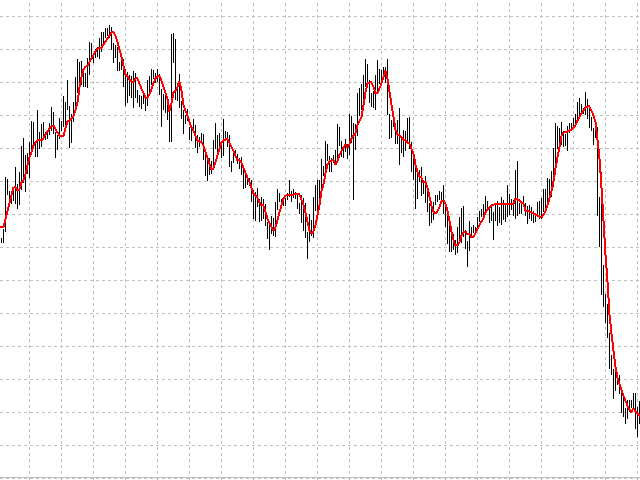

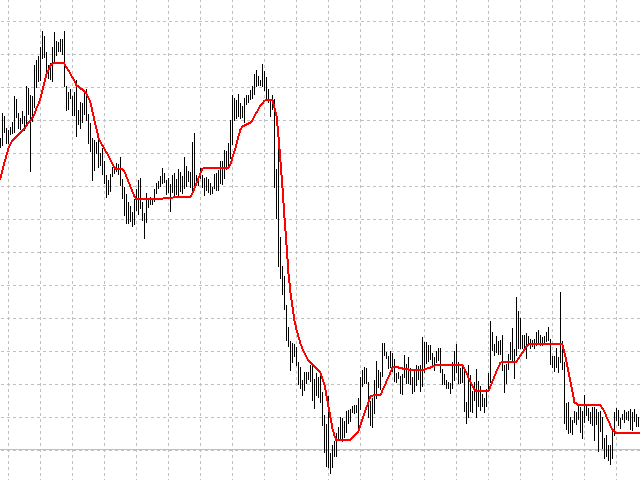

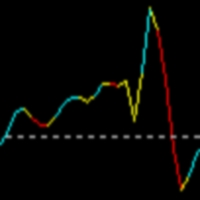

- Activations: 20

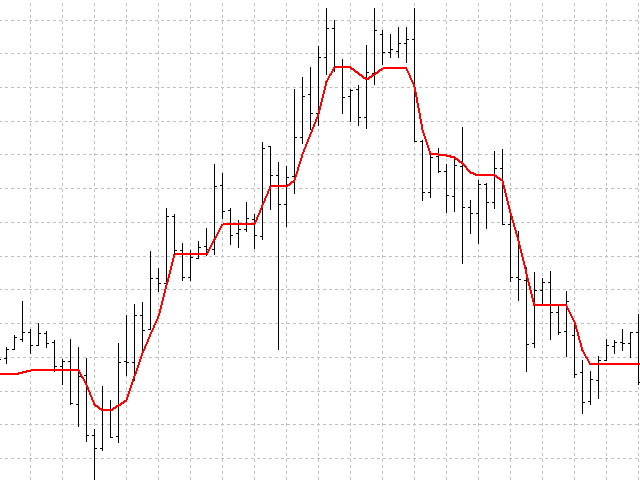

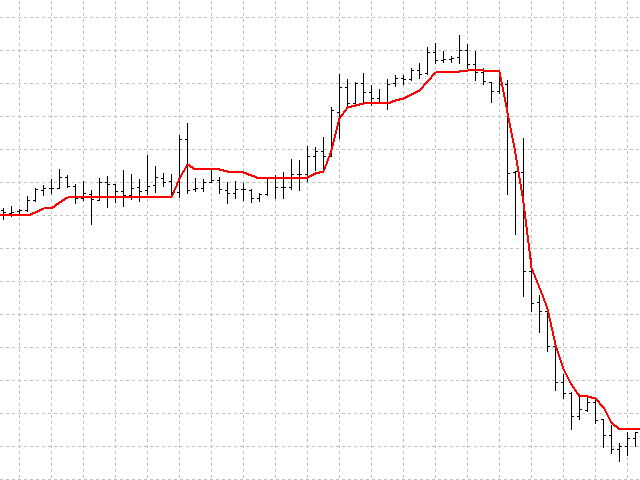

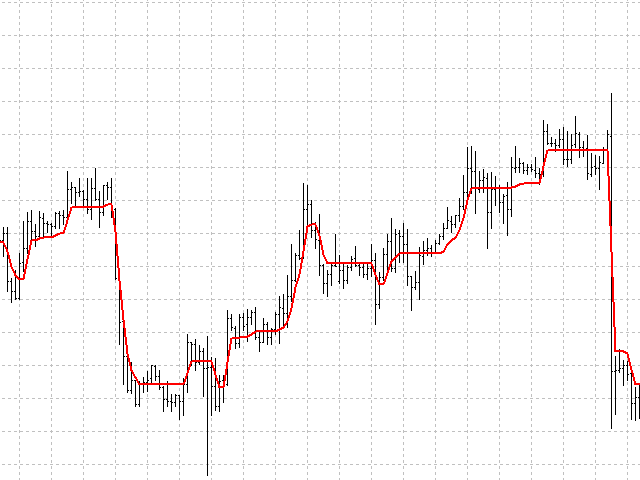

This indicator displays the trend direction, the averaged price value and flat areas. It is used to determine the averaged price value with little or no delay. During a flat, its line is often smooth, and it follows the trend during a descending or an ascending movement. The best charts for the indicator are the range\renko charts, which do not have rounded borders of price changes. Various types of moving averages and certain types of digital filters were used as a prototype. Compared to various moving averages based on the use of past price data, which eliminates the ability to quickly react to sudden changes, this indicator uses a fundamentally different method to calculate the average price value.

Advantages

- no delay, or a slight delay when using the 'smooth' parameter.

- customizable parameters for any price data and timeframes.

- it can be used for a wide range of strategies, both in flat and in trend, as a price noise filter or support/resistance line.

Parameters

- squeeze - oscillation transmission coefficient (the higher the value, the more price fluctuations are passed). The default value is 10;

- smooth - boundary smoothing coefficient. The default value is 4;

- pricetype - use Open or High\Low prices. The default value is 1;

Additional Information

The squeeze parameter is very sensitive, an incorrect value can distort the result. After changing the timeframe, the indicator takes some time to recalculate. Settings of the squeeze parameter for different timeframes: M1: 1-5, M5: 1-10, M15: 1-15; M30: 5-20; H1: 20-40; H4: 30-60; D1: 50-100.